BDSwiss Review

Overall BDSwiss is considered low-risk, with an overall Trust Score of 83 out of 100. They are licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). The broker offers Indonesian traders four retail trading accounts: Cent, Classic, VIP, and Zero Spread.

- Louis Schoeman

Updated : April 18, 2024

Jump to:

Overview

Regulation and Safety of Funds

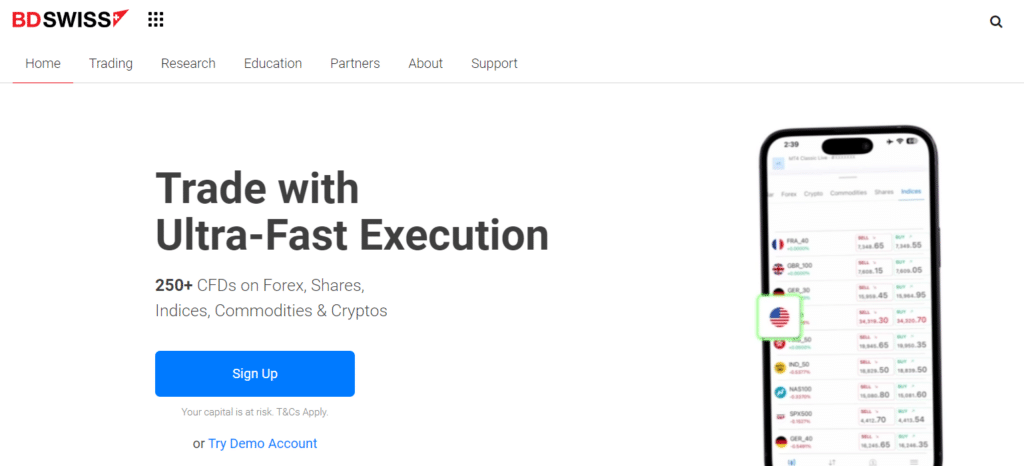

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

10 USD / 157,151 IDR

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, BDSwiss Mobile App, BDSwiss Webtrader

Crypto

Total Pairs

83

Islamic Account

Trading Fees

Account Activation

Overview

BDSwiss, a global financial services company, is the preferred choice for reliable and diversified trading options Indonesian traders seek. They offer investment alternatives like forex, cryptocurrencies, commodities, and indices to match investors’ diverse preferences.

Its multilingual interface, which includes Indonesian features, makes it accessible for Indonesian traders with ease.

Indonesian traders can benefit greatly from the educational offerings provided by the broker. The company provides various resources, including seminars, courses, and market analysis for novice and experienced traders.

Such education empowers Indonesian investors with knowledge to make informed decisions, which is vital in navigating the complexities accompanying trading activities today, thereby enhancing their capacity to trade successfully.

Moreover, the broker adheres to stringent international standards for regulatory conformity. Indonesian traders require dependable and transparent platforms to conduct their transactions with confidence.

For those seeking access to the global financial markets in Indonesia, they can be an attractive choice owing to its secure trading atmosphere, extensive range of financial offerings, and dedicated customer support services.

Distribution of Traders

The broker currently has the largest market share in these countries:

➡️️ Colombia – 16.83%

➡️️ Canada – 12.47%

➡️️ South Africa – 10.35%

➡️️ United Kingdom – 9.23%

➡️️ Cyprus – 6.47%

Popularity among traders

BDSwiss is one of the Top 100 forex brokers in Indonesia.

How does BDSwiss ensure informed trading decisions for Indonesian traders?

The broker focuses on informed decision-making by offering tools for understanding and managing the risks of trading Forex/CFDs and other derivatives.

What makes BDSwiss’ trading platforms superior to competitors for Indonesian traders?

The broker provides powerful tools and user-friendly interfaces for Indonesian traders via advanced trading platforms such as MetaTrader 4 and MetaTrader 5, as well as the BDSwiss Mobile App and WebTrader.

At a Glance

| 🏛 Headquartered | Seychelles |

| ✅ Global Offices | Cyprus, Mauritius |

| 🗓 Year Founded | 2012 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, X, LinkedIn, Instagram, YouTube, Blog, Telegram |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA |

| 🪪 License Number | Cyprus – 199/13 Mauritius – C116016172 Germany – 10134687 Seychelles – SD047 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | The United States, Belgium, and other OFAC-sanctioned regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | Yes |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant, Market |

| 📊 Average spread | From 0.0 pips |

| 📞 Margin Call | 50% |

| 🛑 Stop-Out | 20% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:2000 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 10 USD / 157,151 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based BDSwiss customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Credit/Debit Card Skrill Neteller Bank Wire Pay Retailers Cryptocurrencies QR Online Banking AstroPay GlobePay EFT Direct Bank Transfer MPESA Airtel TiGO Korapay |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss Mobile, BDSwiss Web |

| ✔️ Tradable Assets | Forex Commodities Shares Indices Cryptocurrencies |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Indonesian, Vietnamese, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | No |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is BDSwiss a safe broker for Indonesian traders? | Yes |

| 📊 Rating for BDSwiss Indonesia | 9/10 |

| 🤝 Trust score for BDSwiss Indonesia | 83% |

| 🎉 Open an account | Open Account |

Regulation and Safety of Funds

Safety and Security

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

Indonesian traders searching for a trustworthy platform should look no further than BDSwiss, which prioritizes the safety and security of its customers.

BDSwiss’ unwavering commitment to adhering to regulatory compliance is evidenced by their rigorous adherence to criteria set forth by multiple governing agencies.

Complying with strict financial standards and operating regulations, as regulated by reputable organizations like CySEC and BaFin, ensures transparent trading methods while securing client funds.

By meeting these exacting international benchmarks, the broker delivers peace of mind that Indonesian traders can rely on wholeheartedly.

At BDSwiss, safeguarding fund security is given the utmost importance. The platform employs various measures to secure its clients’ funds, such as segregated accounts, which keep traders’ money separate from the company’s operational resources.

This segregation becomes crucial during financial instability or bankruptcy, ensuring that customers’ assets are not utilized for any purpose other than trade and prohibit exploitation.

The broker employs robust encryption technology to safeguard sensitive personal and financial details and have segregated accounts. Considering the growing apprehensions of Indonesian traders regarding potential risks, this emphasis on digital security is highly reassuring.

Moreover, a crucial security aspect offered by them is their negative balance protection. Indonesian traders can benefit significantly from this feature as it safeguards them against losses exceeding the amount deposited.

In an unpredictable arena like online trading, this protective measure is necessary to counter unanticipated market developments while minimizing financial debt accumulation and functioning as a vital tool for managing risks.

Does BDSwiss provide a risk warning to its traders?

Yes, the broker issues a clear risk warning to traders regarding the speculative nature of Forex/CFDs and other derivatives.

Are there any compensation funds available for clients?

No, the broker does not provide a compensation fund or investment protection to qualified customers.

Awards and Recognition

BDSwiss received the following recent awards and recognition:

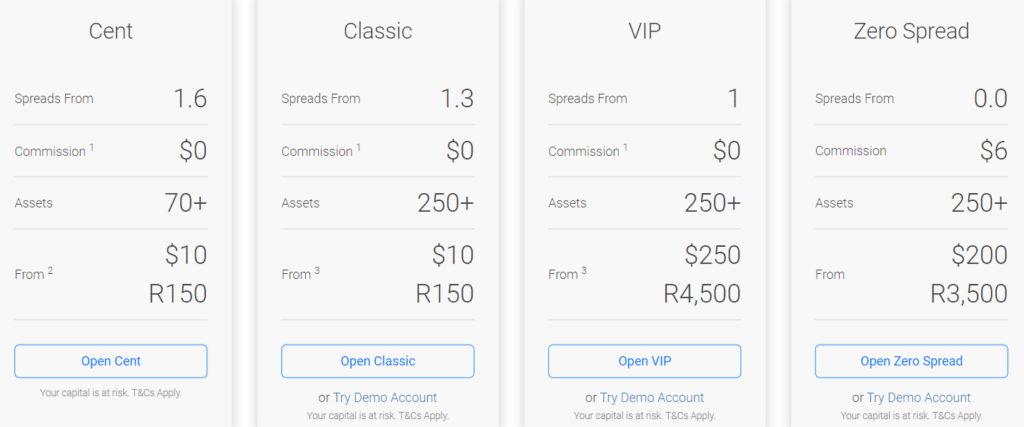

BDSwiss Account Types and Features

Cent Account

The Cent Account is a great starting point for Indonesian traders new to the Forex market. Through micro-lot trading, risk can be significantly reduced making it an ideal option for those unfamiliar with the complexities of trading.

This type of account would benefit cautious individuals looking to trade smaller sums and minimize their risk exposure.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 10 USD / 157,151 IDR |

| 📊 Average spreads | 1.6 pips |

| 💸 Commission Charges | $2 on Indices 0.15% on Shares |

| 📈 Maximum Leverage | 1:2000 |

| 📊 Available Assets | Forex CFDs Stocks CFDs Indices CFDs Commodities CFDs Cryptocurrencies CFDs |

| 📉 Instant Withdrawals offered? | Yes, only on credit cards up to 2,000 €/$/£ |

| 📈 Platforms available | All |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-out Level (%) | 20% |

| 📱 Personal Account Manager | Yes, with a $1,000 deposit |

| ☪️ Islamic Account | Yes |

| 🎉 Open an account | Open Account |

Classic Account

The Classic Account is perfectly tailored for adept traders seeking a well-rounded assortment of features. Geared towards those with prior knowledge in the financial markets, it offers an economical trading opportunity without demanding massive upfront capital investments.

This account is ideal for Indonesian traders who have transcended beginner status and are eager to elevate their trading techniques further.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 10 USD / 157,151 IDR |

| 📊 Average spreads | 1.3 pips |

| 💸 Commission Charges | $2 on Indices 0.15% on Shares |

| 📈 Maximum Leverage | 1:2000 |

| 📊 Available Assets | Forex CFDs Stocks CFDs Indices CFDs Commodities CFDs Cryptocurrencies CFDs |

| 📉 Instant Withdrawals offered? | Yes, only on credit cards up to 2,000 €/$/£ |

| 📈 Platforms available | All |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-out Level (%) | 20% |

| 📱 Personal Account Manager | Yes, with a $1,000 deposit |

| ☪️ Islamic Account | Yes |

| 🎉 Open an account | Open Account |

VIP Account

The VIP Account is exclusively designed for proficient traders in Indonesia who deal with substantial volumes. It provides exceptional services such as reduced spreads and a dedicated account manager.

This designated category of account suits Indonesian traders who execute sizable trades and require personalized assistance to enhance their trading tactics and implementation.

Account Features Value

💰 Minimum Deposit Requirement 250 USD / 3,917,662 IDR

📊 Average spreads 1 pip

💸 Commission Charges $2 on Indices

0.15% on Shares

📈 Maximum Leverage 1:2000

📊 Available Assets Forex CFDs

Stocks CFDs

Indices CFDs

Commodities CFDs

Cryptocurrencies CFDs

📉 Instant Withdrawals offered? Yes, only on credit cards up to 2,000 €/$/£

📈 Platforms available BDSwiss Web, BDSwiss Mobile, MetaTrader 4, MetaTrader 5

📞 Margin Call (%) 50%

🛑 Stop-out Level (%) 20%

📱 Personal Account Manager Yes

☪️ Islamic Account Yes

🎉 Open an account Open Account

Zero Spread Account

The broker has introduced its Zero Spread Account, catering to Indonesian traders who engage in high-frequency trading such as day and scalping. The account aptly lives up to its name by providing almost non-existent spreads, ideal for those with tight margins.

With minimal trade charges and efficient execution of short-duration deals, the low spread feature is particularly advantageous for regular traders seeking prompt transactions.

Account Features Value

💰 Minimum Deposit Requirement 250 USD / 3,917,662 IDR

📊 Average spreads 0.0 pips

💸 Commission Charges 0.15% on Shares

$6 on Forex and Commodities

$2 on Indices

📈 Maximum Leverage 1:2000

📊 Available Assets Forex CFDs

Stocks CFDs

Indices CFDs

Commodities CFDs

Cryptocurrencies CFDs

📉 Instant Withdrawals offered? Yes, only on credit cards up to 2,000 €/$/£

📈 Platforms available All

📞 Margin Call (%) 50%

🛑 Stop-out Level (%) 20%

📱 Personal Account Manager Yes

☪️ Islamic Account Yes

🎉 Open an account Open Account

Demo Account

The Demo Account is an excellent tool for Indonesian traders seeking to gain knowledge and expertise. Novices can benefit greatly from this account type as they practice trading in a simulated environment without the risk of losing real money, thereby refining their skills.

Experienced traders can also explore new strategies using the Demo Account and familiarize themselves with BDSwiss’ range of trading platforms and tools before investing funds.

This platform replicates authentic market conditions in real-time, making it indispensable for learning purposes among all levels of traders based in Indonesia who seek growth and development opportunities.

Islamic Account

The Islamic Account complies with Islam’s ethical trading norms prohibiting interest accumulation. This account type observes the Sharia law ban on ‘Riba’ and does not impose swap or rollover charges for overnight positions held.

It is an important option for Indonesian Muslim traders who seek to participate in financial markets while remaining faithful to their religious beliefs.

BDSwiss guarantees that this account meets all standards of Islamic finance, providing a swap-free trading experience without compromising access to non-Islamic account products and opportunities.

What types of accounts does BDSwiss offer?

The broker provides Cent, Classic, VIP, and Zero Spread accounts, each targeted to a distinct trading style and expertise level.

Are there commission fees for trading with the Zero Spread Account?

Yes, the Zero Spread Account costs a $6 fee for Forex and Commodities.

How to open an Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

Step 1 – Go to the BDSwiss website to sign up.

➡️ Click “Sign Up” in the upper right corner.

Step 2 – Fill in your details as requested.

➡️ Fill out the essential blanks with your name, country of residence, date of birth, and email address. Create a strong, secure password for your account.

BDSwiss Vs XM Vs FXTM – Broker Comparison

| BDSwiss | XM | FXTM | |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA | FSCA, IFSC, ASIC/AFSL, CySEC, DFSA | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, BDSwiss Mobile, BDSwiss Web | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 10 USD / 157,151 IDR | 5 USD / 78,575 IDR | 500 USD / 7,835,325 IDR |

| 📈 Leverage | Up to 1: 2000 | 1:1000 | 1:2000 |

| 📊 Spread | From 0.0 pips | 0.7 pips | 0.0 pips, Variable |

| 💰 Commissions | From $2 | $1 to $9 | From $0.4 to $2 |

| ✴️ Margin Call/Stop-Out | 50%/20% | 50%/20% 100%/50% (EU) | 40% to 50% (M) 60% to 80% (S/O) |

| ✴️ Order Execution | Instant/Market | Market, Instant | Market, Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | Cent Account, Classic Account, VIP Account, Zero Spread Account | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account | Micro Account, Advantage Account, Advantage Plus Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | Yes | No | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 4 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

10 USD / 157,151 IDR

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, BDSwiss Mobile App, BDSwiss Webtrader

Crypto

Total Pairs

83

Islamic Account

Trading Fees

Account Activation

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

MetaTrader 4

Specially designed for Indonesian traders, MetaTrader 4 offers a range of advanced functionalities and fundamental features.

Custom indicators and scripts can be accommodated on the platform, affording skilled coders unprecedented flexibility in devising personal technical tools that automate repetitive tasks – perfect for individual trading strategies.

With multi-charting capabilities, which allow users to access multiple charts simultaneously, it is ideal to monitor various instruments or particular time frames actively.

In addition, the strategy tester tool provides data-driven insights, enabling Indonesian traders to refine their approaches continuously, resulting in optimal performance during each trade cycle

MetaTrader 5

Significant improvements have been made to the MetaTrader 5 platform, making it a reliable choice for Indonesian traders.

The Depth of Market (DOM) feature provides crucial information on buy and sell orders at different price levels which can be beneficial for volume-based techniques and analyzing market sentiment.

Moreover, MT5 offers an increased range of order types, such as stop-limit orders that provide more control over market inputs and exits.

Additionally, integrated economic calendars grant quick access to important financial events, enabling informed decision-making by Indonesian traders. At the same time, its scripting features allow them to tailor indicators or Expert Advisors (EAs) specifically to their preferences when trading.

Mobile

For Indonesian traders who prefer trading while on the go, having the Mobile app is crucial. Keeping in line with Indonesia’s mobile-first approach, this user-friendly app allows even those with less experience to trade efficiently on their mobile devices.

Indonesian traders highly value real-time alerts and notifications as they update them about market trends and opportunities, irrespective of location.

The software works seamlessly alongside BDSwiss’ standardized trading conditions, ensuring a consistent trading encounter across all platforms for users to enjoy.

Web

BDSwiss WebTrader is ideal for Indonesian traders who prefer a web-based solution. It offers essential features like order management, charting tools, and real-time quotations via any browser.

In addition, its user-friendly interface makes online trading uncomplicated and particularly appealing to novice Indonesian traders.

Additionally, WebTrader’s compatibility with various browsers enables easy access to accounts across multiple devices or while travelling in Indonesia – providing convenience and accessibility no matter what device you use.

What trading platforms does BDSwiss offer?

The broker provides MetaTrader 4, MetaTrader 5, Mobile, and WebTrader platforms.

Are all BDSwiss platforms available to Indonesian traders?

Yes, all the trading platforms are available to traders in Indonesia.

Range of Markets

Indonesian traders can expect the following range of markets:

➡️ Forex

➡️ Commodities

➡️ Shares

➡️ Indices

➡️ Cryptocurrencies

Are indices available for trading on BDSwiss?

Yes, the broker gives users access to 14 worldwide indexes for trading.

Can Indonesian traders access all markets with BDSwiss?

Yes, Indonesian traders have complete access to all markets provided by BDSwiss.

Broker Comparison for Range of Markets

| BDSwiss | XM | FXTM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

BDSwiss Fees, Spreads, and Commissions

Spreads

The broker provides changeable spreads that are determined by market circumstances and liquidity. This implies that trading expenses may vary for Indonesian traders, especially when dealing with uncommon products or exotic pairings.

Major currency pairings, such as EUR/USD, have competitive spreads that may be as low as 0.01 pips, possibly lowering trading expenses for regular traders. However, traders should know that spreads might grow during turbulent market circumstances or outside regular trading hours.

Commissions

The commission structure at the broker differs according to the account type. Indonesian traders using Cent and Classic accounts are charged a fee on indices and equity CFDs, while VIP accounts are charged solely on shares.

The Zero Spread account, designed for traders seeking low bid-ask spreads, charges a flat fee on forex, commodities, and indices. Understanding these charges is critical for Indonesian traders, especially those who trade regularly or in large volumes, since they may affect the entire cost of trading.

Overnight Fees

The broker levies overnight fees, commonly known as swap costs, for open positions beyond the daily market closing. These costs are an important concern for Indonesian traders, particularly those who use swing trading tactics, which require holding positions for multiple days.

Fees vary per instrument and may rise over time, especially when utilizing leverage. Traders must closely monitor these expenses since they may significantly impact profitability, particularly in turbulent markets.

Deposit and Withdrawal Fees

The fact that the broker charges no fees for deposits or withdrawals is a huge benefit for Indonesian traders.

This guarantees that any extra costs the broker imposes do not affect the amounts that traders deposit or withdraw. However, traders should be aware of any costs imposed by payment providers or institutions participating in the transaction.

Inactivity Fees

They charge a 10% inactivity fee on accounts not traded over three months.

This is especially important for Indonesian traders, who may not always be actively trading. It encourages individuals to engage in regular trading activity or withdraw their cash if they do not intend to trade for a lengthy period.

Currency Conversion Fees

Indonesian traders must be aware of currency conversion costs when trading instruments denominated in currencies other than their account’s base currency or when making deposits or withdrawals in non-base currencies.

This price is paid to convert money to the account’s base currency. While the broker does not impose deposit or withdrawal fees, currency conversion fees may contribute to the cost of trading, depending on the frequency of such transactions and the amount exchanged.

What are the typical spreads for major forex pairs?

The broker provides narrow spreads, with EUR/USD beginning at 0.01 pips.

What are the spreads for trading cryptocurrencies with BDSwiss?

Spreads for cryptocurrencies such as BTC/USD start at 27.18 pips with BDSwiss.

Min Deposit

10 USD / 157,151 IDR

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, BDSwiss Mobile App, BDSwiss Webtrader

Crypto

Total Pairs

83

Islamic Account

Trading Fees

Account Activation

BDSwiss Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

Are there any withdrawal limits with BDSwiss?

Yes, withdrawal restrictions may change depending on the method utilized. Therefore traders should see BDSwiss’ conditions for information.

Does BDSwiss support local payment methods for Indonesian traders?

Yes, BDSwiss offers Indonesian traders local payment options, QR, and Online Banking.

How to Deposit Funds

To deposit funds into an account, Indonesian traders can follow these steps:

Step 1 – Log into your account.

➡️ Log into your BDSwiss account using your credentials.

Step 2 – Choose a trading account.

➡️ Choose the trading account that you want to fund by clicking on “Payments” followed by “Deposit.”

Step 3 – Select a deposit amount.

➡️ Indicate the amount that you want to deposit.

Fund Withdrawal Process

To withdraw funds from an account, Indonesian traders can follow these steps:

Step 1 – Log into your account.

➡️ Log into your BDSwiss profile and select “Payments” followed by “Withdraw.”

Step 2 – Choose an account.

➡️ Select the account from where you want to withdraw funds along with the amount to be withdrawn.

Step 3– Select a withdrawal method.

➡️ Proceed to the next step which allows you to choose your preferred withdrawal method, considering that BDSwiss could require additional proof that the account is in your name.

Education and Research

Education

The broker offers the following Educational Materials:

➡️ A learning centre

➡️ Forex eBooks

➡️ Live Education

➡️ Forex Basic Lessons

➡️ Forex Glossary

➡️ Educational Videos

➡️ Seminars

The broker offers Indonesian traders the following Research and Trading Tools:

➡️ Daily Analysis of the markets

➡️ Technical Analysis

➡️ VPS Service

➡️ Trade Comparison

➡️ Trend Analysis

➡️ Daily Videos

➡️ Weekly Outlook

➡️ Market Insights

➡️ Special Reports

➡️ Analyst financial commentary

➡️ Live Daily Webinars

➡️ Economic Calendar

➡️ Trading Central

➡️ AutoChartist

➡️ Real-Time Trading Alerts

➡️ Currency Heatmap

➡️ Trading Calculators

Does BDS offer educational materials for traders of all levels?

Yes, the broker is committed to empowering traders with educational resources. The platform provides a range of materials, including webinars, video tutorials, articles, and interactive courses.

What research tools and market insights are offered?

The broker provides traders with an extensive set of research tools, including daily market analysis, economic calendars, and live market news.

Bonuses and Promotions

The broker does not currently offer Indonesian traders any bonuses.

Affiliate Program Features

Members of the BDS network may have a substantial online presence, such as a blog, social media account, Forex educational centre, or other digital media. The affiliate program allows you to earn money while advertising BDSwiss’ goods and services to your intended audience.

Affiliates may promote the broker using a range of marketing and tracking methods. To benefit from the affiliate’s impact, partners must be aware of the affiliate commission options.

The broker offers its associates the following perks:

➡️ High conversion rates (37%), speedy referral onboarding, specialist contact centres, and several local and international payment methods all contribute to its success.

➡️ Multi-product solutions include over 250 CFDs and assets from several asset classes. Multi-award-winning platforms are accessible on many devices.

➡️ 100% response rate in 13 seconds or less. Affiliate managers and VIP account managers are available.

➡️ The broker delivers independent mobile traffic monitoring, speedy and detailed reporting performance, and other features.

What steps do I need to take to become a part of the Affiliate Program?

Start by visiting the BDSwiss website and locate the “Affiliate Program” section. Once there, carefully follow the provided instructions to complete the registration process.

What resources and tools are available for affiliates to promote BDSwiss effectively?

The broker equips its affiliates with a range of marketing tools, including banners, tracking links, widgets, and other promotional materials.

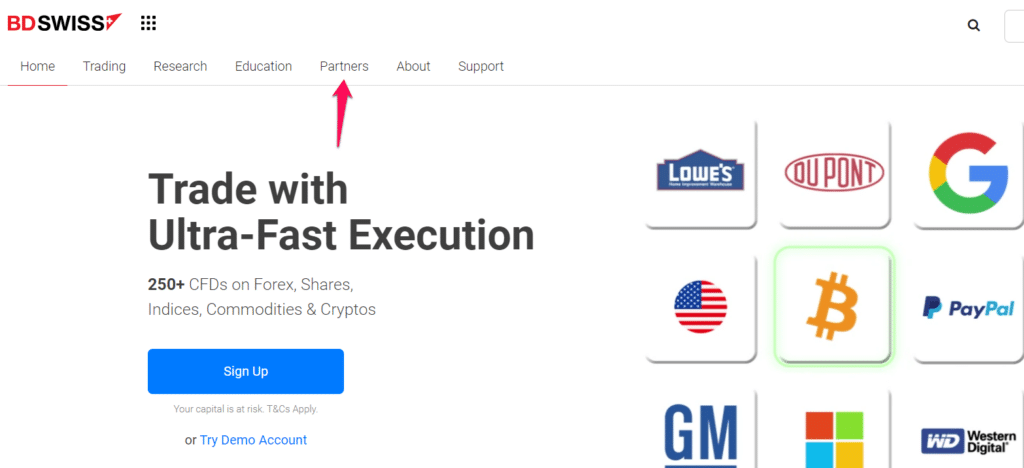

How to open an Affiliate Account

To register an Affiliate Account, Indonesians can follow these steps:

Step 1 – Click on the “Partners” section.

➡️ Navigate to the official BDSwiss website and navigate to the “Partners” tab on the homepage, at the top of the main menu.

Step 2 – Select the “Start Now” button.

➡️ A new page will load to the Partner Page where prospective affiliates can select “Start Now.”

Step 3 – Choose a program.

➡️ Affiliates can choose their preferred program and click on “Register.”

Step 4 – Complete the form.

➡️ Next, affiliates can complete the registration form and submit it to BDSwiss’ customer support.

Customer Support

The broker is well-known for its award-winning customer support that can be reached over several communication channels.

In what languages does BDSwiss provide customer support?

The broker offers customer support in multiple languages. Understanding the importance of effective communication, the support team is skilled in languages including English, German, Spanish, French, and many others.

What are the available channels for reaching BDSwiss customer support?

The broker provides multiple channels for customer support. Traders can contact the support team through live chat on the website, email, or phone.

User Comments and Reviews

➡️“BDSwiss’ customer assistance has been timely and helpful. They have helped me with some technical challenges with the platform. However, due to the absence of a local office in Indonesia, I must be cautious of time differences.”

➡️“The instructional materials at BDSwiss are fairly extensive. As an Indonesian trader, I found the webinars and market research quite useful, albeit I wish there were more information in Indonesia.”

➡️“The MetaTrader connection is smooth, and I like utilizing the custom indicators. The VPS service has been a game changer for my automated trading systems, allowing them to function seamlessly around the clock.”

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Conclusion

BDSwiss is a multi-regulated and award-winning broker offering a wide selection of trading products. They have won various industry accolades for their effective operating and trading technology investments.

The proprietary trading app and overall trade execution are both highly praised by BDSwiss, indicating its sustainable trading conditions.

Our Insight

In my opinion, BDSwiss is a great option for Indonesian traders. They have friendly and professional customer support as well as a fast deposit and withdrawal system.

Our Recommendations on FXGT.com

While BDSwiss has a compelling offer, there is some room for improvement, including the following few points:

➡️Consider expanding the base currency options so that African traders can avoid currency conversion fees while they trade using the platform.

➡️Consider adding regulation in Indonesia.

➡️Expand the account type for an IDR-denominated account.

BDSwiss Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders can use leverage of up to 1:2000 with BDSwiss | BDSwiss is not locally regulated in Indonesia |

| BDSwiss is multi-regulated and has a good reputation in the industry | There is no IDR forex pair that can be traded |

| There is high liquidity due to its substantial quarterly trading volumes | BDSwiss does not accept IDR deposits or withdrawals and does not offer an IDR-denominated account |

| Customer support is available across several channels, 24/5 | BDSwiss charges commissions on all account types |

| Traders can access user-friendly trading platforms | Dormant accounts face a 10% inactivity fee |

| There are flexible account types, including a Cent Account | |

| There are several flexible payment methods offered for deposits and withdrawals |

you might also like: Exness Review

you might also like: HFM Review

you might also like: FXTM Review

you might also like: AvaTrade Review

you might also like: JustMarkets Review

Frequently Asked Questions

How do I open a BDSwiss account in Indonesia?

Opening a BDSwiss account in Indonesia is simple and takes only a few minutes. You may sign up and verify your account online.

Does BDSwiss offer a demo account for practice?

Yes, BDSwiss provides a free sample account with $100,000 virtual money. This is an excellent method to practice trading and understand the platform without risking real money.

What trading instruments are available on BDSwiss?

BDSwiss provides diverse trading products, including forex, CFDs on stocks, indices, commodities, and cryptocurrency. This allows you to pick from various possibilities based on your trading style and risk tolerance.

Is BDSwiss regulated?

Yes, several reputable entities in Cyprus, Germany, the Seychelles, and Mauritius regulate BDSwiss. However, BDSwiss is not locally regulated in Indonesia.

Are there any reviews and testimonials from Indonesian traders about BDSwiss?

Yes, you can read reviews and testimonies from Indonesian traders about BDSwiss on their website and in online trading communities.

Does BDSwiss have Nasdaq 100?

Yes, BDSwiss offers Nasdaq trading under the ticker “NAS100”.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

BDS is a firm devoted to social responsibility. The broker does this by instilling philanthropic values in employees and establishing a culture that supports important global and local initiatives focused on positive change.

As part of their CSR initiatives, they gave €5,000 to the “Elpida” Foundation for Children with Cancer & Leukaemia in December 2021. This kind of contribution helped the hospital provide financial and emotional assistance to cancer patients and their families.

On December 10, 2021, they sponsored a blood donation drive in Limassol as part of its ongoing corporate social responsibility. BDS employees, colleagues, friends, and family members donated blood and organized the camp.

What are BDSwiss’ Corporate Social Responsibility initiatives?

The broker actively participates in various initiatives. These efforts encompass promoting financial literacy through educational programs, contributing to charitable causes, and adhering to ethical business practices.

Is BDS actively involved in promoting environmental sustainability?

Yes, they are dedicated to environmental sustainability. The company implements eco-friendly practices in its operations, such as adopting energy-efficient technologies and reducing its carbon footprint.