5 Best Cent Account Forex Brokers in Indonesia

The 5 best cent account Forex brokers in Indonesia revealed. We have explored and tested several prominent cent account Forex brokers in Indonesia to identify the 5 best.

This is a complete guide to the 5 best cent account Forex brokers in Indonesia.

In this in-depth guide you’ll learn:

- What is a Cent Account?

- Which forex brokers offer cent (micro) accounts to Indonesian traders?

- What is the difference between a cent account and a micro account?

- Are cent accounts profitable?

- What is an ECN Cent account?

- How to choose the best cent account Forex broker in Indonesia

- Who are the best Forex brokers in Indonesia?

- The differences between a cent account and a standard account for Indonesian traders

And lots more…

So, if you’re ready to go “all in” with 5 best cent account Forex brokers in Indonesia…

Let’s dive right in…

- Kayla Duvenage

Best Cent Account Forex Brokers in Indonesia – Comparison

| 🥇 No-Deposit Broker | 🎉 Open Account | 💰 Bonus Amount | 📝 Regulation | 💻 Trading Accounts Offered | 🚀 Trading Platforms |

| 1. Exness | Open Account | 10 USD / 6,030 IDR | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 2. AvaTrade | Open Account | 100 USD / 60,300 IDR | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA | Retail Account, Professional Account | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 3. HFM | Open Account | 0 USD / 0 IDR | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account | MetaTrader 4 and MetaTrader 5 |

| 4. Oanda | Open Account | 0 USD / 0 IDR | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | Standard Account, Core Account, Swap-Free Account, Demo Account | MetaTrader 4, OANDA Platform, TradingView |

| 5. XM | Open Account | 5 USD / 3,015 IDR | FSCA, IFSC, ASIC, CySEC, DFSA | Live Account, Base Account, Demo Account, Islamic Account | MetaTrader 4, MetaTrader 5 |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

What is a cent account?

A cent account allows Indonesian traders to engage in currency trading with minimal financial commitment. Denominated in cents, it offers a low-risk entry point, ideal for beginners or those with limited capital.

This account type enables traders to hone their skills and navigate the Forex market efficiently.

5 Best Cent Account Forex Brokers in Indonesia Summary

- ✔️Exness – Overall, Best Cent Account Forex Brokers in Indonesia

- ✔️AvaTrade – Offers Competitive Trading Conditions

- ✔️HF Markets – Several Account Types Available for Different Traders

- Oanda – Low Minimum Deposit Required to Start Trading

- XM – Massive Range of Markets Across Several Asset Clauses

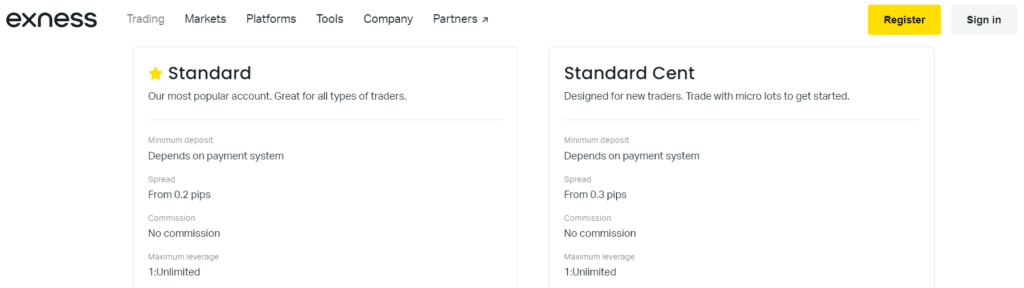

1. Exness

Exness provides a user-friendly platform with diverse trading options. Notably, they offer a cent account, catering to traders seeking low-risk entry. This account, denominated in cents, allows for minimal investment, making it ideal for beginner traders in Indonesia.

Exness’ cent account features competitive trading conditions, including tight spreads and flexible leverage. With a focus on transparency and customer satisfaction, Exness ensures seamless transactions and rapid order execution.

Min Deposit

10 USD / 157,151 IDR

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader mobile, Exness Trade App, Exness Terminal, MetaTrader 5, MetaTrader 4, MetaTrader WebTerminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

The platform’s adaptability to the Indonesian market, along with localized support, positions Exness as a reliable choice for traders seeking a robust Forex experience in Indonesia.

Exness Overview

| 📝 Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱 Social Media Platforms | Instagram, Facebook, Twitter, YouTube, LinkedIn |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💸 Minimum Deposit | 10 USD / 157,151 IDR |

| 🔁 Trading Assets | Forex, Metals, Crypto, Energies, Indices, Stocks |

| 🚀 IDR-based Account? | No |

| 💳 IDR Deposits Allowed? | No |

| 💰 Bonuses for Indonesian traders? | No |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness provides complimentary hosting for virtual private servers (VPS). | There are fewer assets that can be traded with Exness, and there are limited educational resourced for new traders to learn on the Exness platform. |

| Exness is kept in check by a trusted group of regulators. | |

| Exness provides some of the most competitive leverage rates on the FX market. | |

| Indonesian traders can contact customer service at any time of day or night. |

2. AvaTrade

AvaTrade, a trusted Forex broker catering to Indonesian traders, introduces a cent account designed for accessibility. This account, denominated in cents, provides a low-risk avenue for entry into the Forex market, particularly suitable for novice traders in Indonesia.

AvaTrade’s cent account offers favourable trading conditions, featuring tight spreads and flexible leverage options. The platform prioritizes user-friendly interfaces and comprehensive educational resources to empower Indonesian traders.

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

With localized support and a commitment to transparency, AvaTrade stands as a reliable choice for those seeking a tailored and secure Forex trading experience in Indonesia.

AvaTrade Overview

| 📝 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 📱 Social Media Platforms | Instagram, Facebook, Twitter, YouTube |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Retail Account, Professional Account |

| 💻 Trading Platforms | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💸 Minimum Deposit | 100 USD / 1,571,515 IDR |

| 🔁 Trading Assets | Forex, Stocks, Commodities, Cryptocurrencies, Treasuries, Bonds, Indices, Exchange-Traded Funds (ETFs), Options, Contracts for Difference (CFDs), Precious Metals |

| 🚀 IDR-based Account? | No |

| 💳 IDR Deposits Allowed? | No |

| 💰 Bonuses for Indonesian traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade demonstrates adherence to regulatory standards in multiple jurisdictions. | Variable spreads are not present within the offered services. |

| The availability of over 1,250 trading instruments spans various financial markets. | The available account options consist of a single retail account and a single professional account. Dormant accounts are subject to inactivity fees. |

| Advanced traders can benefit from a range of valuable trading tools. | Currency conversion costs may be applicable. |

| The platform offers a selection of innovative and robust trading platforms. | Indonesian traders do not have access to a IDR-denominated account or local deposit and withdrawal methods. |

| Indonesian traders can take advantage of AvaTrade’s competitive trading conditions. | |

| AvaTrade presents an Islamic account option and a demo account. | |

| AvaTrade has earned trust and recognition through multiple awards received since its establishment. Traders have access to a variety of trading strategies and opportunities for social trading. |

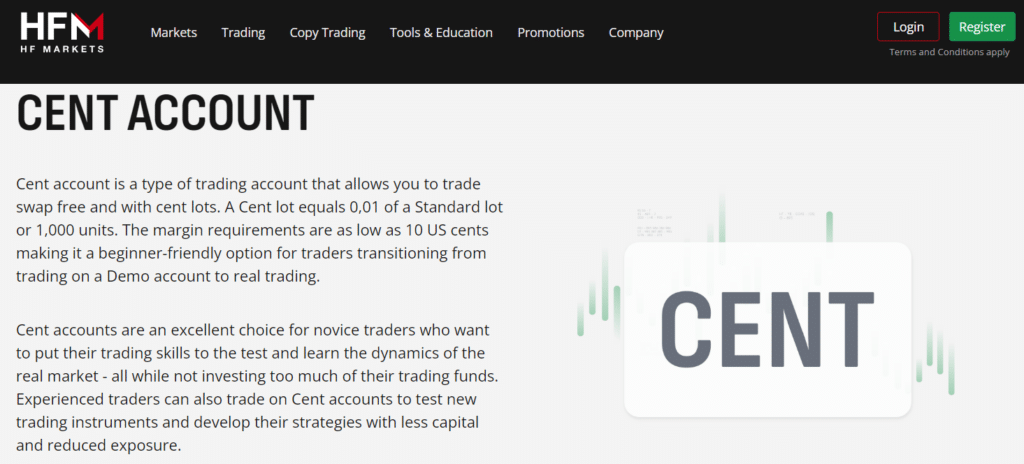

3. HF Markets

HFM introduces a cent account, offering an accessible entry into the Forex market. The cent account, denominated in cents, is designed to accommodate the needs of Indonesian traders, allowing them to start with minimal financial commitment.

HFM’s cent account provides favourable trading conditions, including competitive spreads and flexible leverage options.

Min Deposit

0 USD / 0 IDR

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 5, MetaTrader 4, HFM App

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

With a focus on localizing support and ensuring a seamless trading experience, HFM stands out as a reliable choice for Indonesian traders seeking a secure and user-friendly platform with comprehensive trading features to navigate the complexities of the Forex market.

HF Markets Overview

| 📝 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📱 Social Media Platforms | Facebook, Twitter, Telegram, Instagram, YouTube, LinkedIn |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 💻 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💸 Minimum Deposit | 0 USD / 0 IDR |

| 🔁 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 🚀 IDR-based Account? | No |

| 💳 IDR Deposits Allowed? | Yes |

| 💰 Bonuses for Indonesian traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The EUR/USD currency pair offers highly competitive spreads starting from 0.9 pips. | HFM only offers a few deposit and withdrawal methods to Indonesian traders |

| A demo account is available for both novice traders seeking to acquire trading skills and experienced traders aiming to evaluate and refine their tactics. | |

| HFM offers a diverse range of asset classes that may be traded by investors. | |

| Traders from Indonesia are provided with convenient access to MetaTrader 4 and 5 platforms, which are available on PCs, mobile applications, and web-based interfaces. |

4. Oanda

Oanda, a reputable Forex broker catering to Indonesian traders, introduces a cent account for accessible entry into the market. Denominated in cents, this account allows Indonesian users to engage in Forex trading with minimal financial commitment.

Oanda’s cent account boasts competitive trading conditions, including tight spreads and flexible leverage options, ensuring optimal performance. The platform prioritizes user-friendly interfaces, offering intuitive tools for Indonesian traders to navigate the complexities of the Forex market seamlessly.

Min Deposit

0 USD / 0 IDR

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

With a commitment to localizing support and a solid reputation, Oanda stands as a reliable choice for Indonesian traders seeking a secure and feature-rich trading experience.

Oanda Overview

| 📝 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📱 Social Media Platforms | Facebook, Twitter, YouTube, LinkedIn |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Standard Account, Core Account, Swap-Free Account, Demo Account |

| 💻 Trading Platforms | MetaTrader 4, OANDA Platform, TradingView |

| 💸 Minimum Deposit | 0 USD / 0 IDR |

| 🔁 Trading Assets | Index CFDs, Forex, Metals, Commodity CFDs, Bonds CFDs, Precious Metals, Real-time Rates |

| 🚀 IDR-based Account? | No |

| 💳 IDR Deposits Allowed? | No |

| 💰 Bonuses for Indonesian traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| OANDA is subject to strict rules in a number of countries around the world. OANDA has different kinds of accounts. | Indonesian traders cannot open IDR-denominated accounts. |

| Trading tools are advanced and cutting edge | Traders will be charged an inactivity fee on dormant accounts. |

| There are no minimum deposits | |

| Tutorials for new traders | |

| Reliable ways to deposit money | |

| Spreads that are right | |

| Oanda has a number of trading features that are flexible and high-tech. |

5. XM

XM stands as a prominent Forex broker, offering a cent account for accessible market entry for Indonesian traders. With denominations in cents, this account allows Indonesian users to engage in Forex trading with a minimal financial commitment.

XM’s cent account features favourable trading conditions, including competitive spreads and flexible leverage options. The platform prioritizes user-friendly interfaces, providing intuitive tools for Indonesian traders to navigate the complexities of the Forex market seamlessly.

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Renowned for its commitment to localizing support, XM emerges as a reliable choice for Indonesian traders seeking a secure, feature-rich, and locally-attuned trading experience.

XM Overview

| 📝 Regulation | ASIC, FSCA, IFSC, CySEC, DFSA |

| 📱 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, LinkedIn |

| 📜 OJK Regulation? | No |

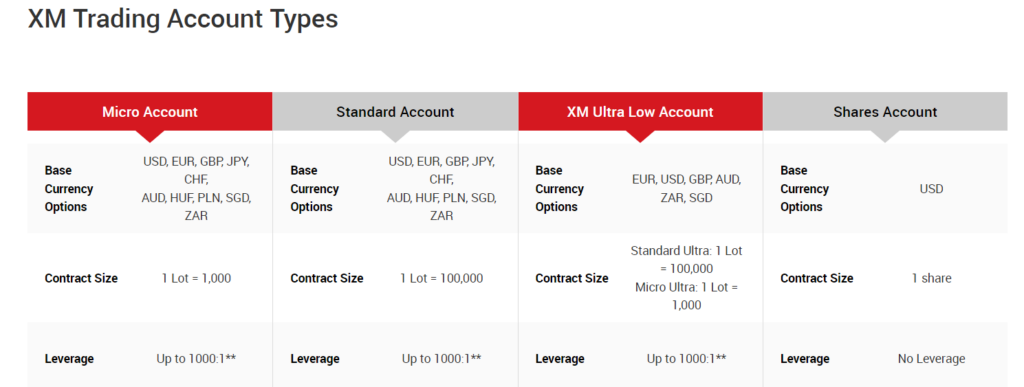

| 🔎 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💸 Minimum Deposit | 5 USD / 78,575 IDR |

| 🔁 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| More than 5 million people use XM’s services every day | There are no fixed spreads |

| Client funds are safe | Inactivity fees apply to dormant accounts |

| XM has won multiple awards since its founding in 2009 | |

| Deposits and withdrawals incur no fees | |

| XM is a low-cost forex broker with a high trust score. |

Cent Account vs. Micro Account – The difference

The key distinction between a cent account and a micro account lies in the measurement and denomination of the trading size. In a cent account, the trading size is typically measured in cents, where 1 cent equals 0.01 of a standard lot.

This means that traders can execute trades with much smaller volumes compared to standard accounts, making it ideal for those with limited capital or who want to practice trading with lower risk.

For example, a trade of 0.01 lot in a cent account would be equivalent to trading 1,000 units of the base currency, such as 1,000 EUR/USD units. On the other hand, in a micro account, the trading size is measured in micro lots, where one micro lot represents 1,000 units of the base currency.

This allows traders to execute trades with slightly larger volumes compared to cent accounts but still smaller than standard accounts. For instance, a trade of 0.01 micro lot in a micro account would also be equivalent to trading 1,000 units of the base currency.

Both cent and micro-accounts cater to traders who prefer smaller trade sizes and lower capital requirements, but the specific denomination of trade sizes varies between them, providing flexibility to traders based on their preferences and trading strategies.

How to choose the best cent account Forex broker in Indonesia

Indonesian traders must evaluate the following components of a cent account Forex broker to decide whether the broker is suited to their unique trading objectives and needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Indonesians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Indonesians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Indonesians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Indonesians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Indonesian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other necessary tools.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

Research can include some of the following:

The Key Differences Between Cent Accounts and Standard Accounts

In the dynamic world of Forex trading, Indonesian traders often encounter different account types, each tailored to cater to specific needs and preferences. Two common account types, the Cent Account and the Standard Account, exhibit notable differences that can significantly impact trading strategies and outcomes.

Account Denomination

One of the primary distinctions between Cent and Standard accounts lies in the denomination of the trading units. Cent accounts, designed with novice and risk-averse traders in mind, are denominated in cents.

This allows Indonesian traders to trade smaller position sizes, providing a gradual and less financially burdensome entry into the Forex market. For instance, while a standard account might require trading lots of 100,000 units, a cent account would enable trading lots of 1,000 units, making it more accessible for those with limited capital.

Minimal Financial Commitment for Beginners

Cent accounts are particularly advantageous for Indonesian traders who are new to Forex. These accounts necessitate a significantly lower initial investment compared to standard accounts, enabling traders to gain hands-on experience without exposing themselves to excessive risk.

The reduced financial commitment is a key factor in attracting beginners, allowing them to test strategies, understand market dynamics, and build confidence before transitioning to standard accounts.

Risk Management and Leverage

Standard accounts, on the other hand, are more suitable for experienced Indonesian traders seeking greater exposure to the market.

While cent accounts offer reduced risk due to smaller position sizes, standard accounts allow for higher leverage. Leverage amplifies both gains and losses, and experienced traders may use it strategically to maximize profit potential.

However, this also demands a more thorough understanding of risk management to navigate the complexities of the Forex market successfully.

Trading Conditions for Both Account Types

Cent and Standard accounts often share common trading conditions on reputable platforms. Brokers, including those catering to Indonesian traders, offer competitive spreads and access to a variety of currency pairs for both account types. This ensures that traders can execute their strategies efficiently, regardless of the account they choose.

Psychological Impact of Cent Accounts for Emotional Management

The psychological aspect of trading is crucial, especially for beginners. Cent accounts, with their lower stakes, allow traders to experience the emotional aspects of trading without the intensity of significant financial exposure.

This gradual approach aids in emotional management, helping Indonesian traders maintain discipline and make rational decisions in the face of market fluctuations.

Transition and Skill Development

Cent accounts serve as a valuable stepping stone for Indonesian traders looking to transition to standard accounts.

As traders gain experience, build confidence, and enhance their skills in a cent account environment, they may consider scaling up to a standard account. This transition is natural and aligns with the trader’s growing expertise and willingness to take on more significant financial exposure.

Broker Selection

Regardless of the chosen account type, Indonesian traders should prioritize brokers that offer localized support and understand the unique needs of the Indonesian market. This includes customer support in local languages, familiarity with local regulations, and a commitment to providing a trading environment tailored to the preferences of Indonesian traders.

The Best Forex Brokers in Indonesia

In this article, we have listed the best Forex brokers that offer cent accounts to Indonesian traders. We have further identified the brokers that offer additional services and solutions to Indonesian traders.

Best MetaTrader 4 / MT4 Forex Broker

Min Deposit

10 USD / 157,151 IDR

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader mobile, Exness Trade App, Exness Terminal, MetaTrader 5, MetaTrader 4, MetaTrader WebTerminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best MetaTrader 4 broker in Indonesia. A considerable number of traders prefer Exness as a brokerage due to its strong regulatory reputation with multiple authorities and considerable leverage ratio. Exness is an exceptionally advantageous choice for Indonesian traders due to its continuous client support service.

Best MetaTrader 5 / MT5 Forex Broker

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best MetaTrader 5 broker in Indonesia. AvaTrade, a highly regarded brokerage firm, offers an extensive assortment of trading products that encompass over 1,250 distinct financial industries. Ensuring a visually appealing trading environment is a top priority for AvaTrade with the intention of meeting the needs and demands of Indonesian traders.

Best Forex Broker for beginners

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best forex trading platform for beginners in Indonesia. XM prioritizes an inclusive environment for novice traders and offers an extensive selection of trading methods. XM offers an extensive assortment of resources that facilitate thorough examination and the attainment of knowledge in the field of foreign exchange trading.

Best Low Minimum Deposit Forex Broker

Min Deposit

5 USD / 78,476 IDR

Regulators

Financial Services Commission of Mauritius

Trading Desk

Crypto

Total Pairs

61+

Islamic Account

Trading Fees

Account Activation

Overall, Alpari is the best minimum deposit forex trading platform in Indonesia. Alpari streamlines the deposit and withdrawal procedures for traders in Indonesia through the provision of domestic payment methods. Alpari provides spreads and commissions that are competitive in nature. Alpari, a financial corporation, provides a copy trading strategy alongside its trading application.

Best ECN Forex Broker

Min Deposit

200 USD / 3,143,030 IDR

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, WebTrader, MetaTrader Mobile, cTrader, cTrader Web, cTrader Mobile

Crypto

Total Pairs

65

Islamic Account

Trading Fees

Account Activation

Overall, IC Markets is the best ECN forex trading broker in Indonesia. IC Markets has garnered a solid standing for its accomplishments in the ECN broker industry. A variety of trading strategies, including arbitrage and hedging, are offered by IC Markets. Furthermore, the company provides demo accounts, Islamic-compliant accounts, and accounts with minimal transaction fees.

Best Islamic / Swap-Free Forex Broker

Min Deposit

50 USD / 785,757 IDR

Regulators

FCA

Trading Desk

MetaTrader 4, Trading Station

Crypto

Total Pairs

7

Islamic Account

Trading Fees

Account Activation

Overall, FXCM is the best Islamic/swap-free forex trading platform in Indonesia. FXCM is a globally recognized organization that specializes in institutional and retail currency (foreign exchange) trading. Since its inception in 1999, FXCM has been the first Forex broker to be publicly traded on the esteemed New York Stock Exchange (NYSE: FXCM).

Best Forex Trading App

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, FXTM has the best forex trading app in Indonesia. FXTM offers three live trading accounts, in addition to a variety of cutting-edge brokerage instruments. Demo accounts are available via the FXTM trading interface for all users.

Best Forex Rebates Broker

Min Deposit

100 USD / 15,715,150 IDR

Regulators

CySec, FSCA, FCA

Trading Desk

FxPro Trading Platfrom

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overall, FxPro is the Best Forex Rebates Broker in Indonesia. FxPro is a United Kingdom-based brokerage that specializes in straight-through processing (STP) and electronic communication network (ECN) services.

Retail traders who qualify may receive monthly direct remittances into their trading accounts of up to 30% in forex commission rebates.

Best Lowest Spread Forex Broker

Min Deposit

100 USD / 1,555,300 IDR

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best lowest spread forex trading platform in Indonesia. Tickmill is a reasonably priced broker that provides support for a wide range of trading strategies. Tickmill offers its account bearers a diverse selection of financing alternatives that empower them to perform deposits without incurring any additional charges. As a result, commerce is enhanced.

Best Nasdaq 100 Forex Broker

Min Deposit

0 USD / 0 IDR

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 5, MetaTrader 4, HFM App

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HFM is the best Nasdaq 100 forex trading platform in Indonesia. HFM requires a modest minimum deposit for account establishment, and the platform offers a comprehensive collection of instructional resources to aid inexperienced traders. The utmost leverage offered by HF Markets is 11,000:1.

Best Volatility 75 / VIX 75 Forex Broker

Min Deposit

0 USD / 0 IDR

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Total Pairs

80

Islamic Account

Trading Fees

Account Activation

Overall, IG is the best Volatility 75/VIX 75 forex trading platform in Indonesia. Novice traders from Indonesia are encouraged to enrol at the IG Academy. Exceptional traders are provided with unrestricted usage of a vast assortment of cutting-edge trading instruments.

Best NDD Forex Broker

Min Deposit

100 USD / 1,625,795 IDR

Regulators

ASIC, CySEC, FSCA, FSA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best NDD forex trading broker in Indonesia. FP Markets provides an extensive array of deposit and withdrawal methods. FP Markets implements a well-established pricing strategy for Electronic Communication Network (ECN) in order to determine spreads that are equitable and competitive.

Conclusion

Overall, cent accounts provided by Forex brokers offer Indonesian traders an invaluable opportunity to enter the market with minimal financial risk. Tailored for beginners, these accounts facilitate skill development, emotional management, and a gradual transition to standard accounts. Choosing a broker attuned to the Indonesian market enhances the overall trading experience.

you might also like: Best MT5 Forex Brokers

you might also like: Best Forex No-Deposit Bonus Brokers

you might also like: Forex Trading for Beginners

you might also like: Best CFD Forex Brokers

you might also like: Best ECN Forex Brokers

Frequently Asked Questions

How do cent account trading conditions differ from standard accounts?

Cent account trading conditions involve smaller position sizes and reduced financial exposure, making them ideal for beginners in Indonesia. Traders opt for cent accounts to manage risk, gain experience, and gradually transition to larger accounts.

Can experienced traders in Indonesia benefit from the accounts?

While the accounts are tailored for beginners, experienced traders in Indonesia can use them for strategy testing, refining skills, and exploring new approaches with lower risk before implementing them in standard accounts.

How does emotional management play a role in trading with Forex cent accounts?

Forex cent accounts contribute to emotional management for Indonesian traders by allowing them to experience market dynamics with lower financial stakes. This gradual approach helps traders build confidence and discipline over time.

What should Indonesian traders consider when choosing a broker?

Indonesian traders should prioritize brokers offering cent accounts with localized support, language options, and an understanding of the Indonesian market. Choosing a broker attuned to the local landscape enhances the overall cent account trading experience.

Can Indonesian traders transition from a cent account to a standard account?

Traders in Indonesia can smoothly transition from a cent account to a standard account as they gain experience and confidence. It is advisable to consider the switch when a trader feels ready for larger financial exposure and aims to implement more advanced strategies in the Forex market.

Are cent accounts profitable?

Whether cent accounts are profitable depends on various factors, including your trading skills, strategy, market conditions, and risk management. While cent accounts provide a lower-cost entry point and allow you to gain trading experience, they may not yield substantial profits on their own due to the smaller trade sizes.

What is an ECN Cent account?

An ECN Cent account is a type of trading account that offers access to an Electronic Communication Network (ECN) and allows traders to execute transactions with smaller lot sizes, typically denominated in cents rather than full units of currency.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia