AvaTrade Review

Overall AvaTrade is considered low-risk, with an overall Trust Score of 93 out of 100. They are licensed by five Tier-1 Regulators (high trust), five Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). They offer Indonesian traders two live trading accounts namely a Retail account and a Professional account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overview

AvaTrade is a well-known brokerage firm providing various trading opportunities to Indonesian clients. They offer different leverage options depending on the account type, with leverage as high as 1:400 for some accounts and as low as 1:30 for others.

A minimum deposit of $100, including the Islamic Account, is required for all account types. They provide standard accounts, Shariah-compliant Islamic accounts, and a Professional Account for experienced traders.

The Islamic Accounts do not charge fees or swaps on overnight trades. They support MetaTrader 4 and 5, allowing for manual or automated trading, and also provide copy trading and web trading for Android and iOS.

Free access to Trading Central, an award-winning technical analysis tool, and 1-on-1 trading assistance are available for deposits of $1,000 or more.

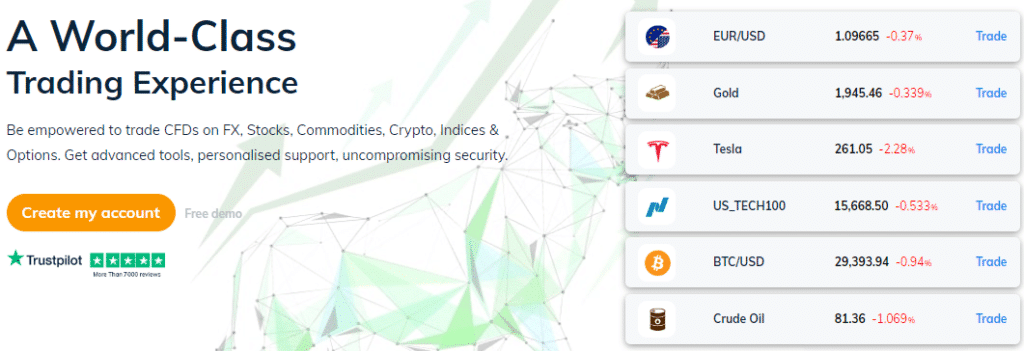

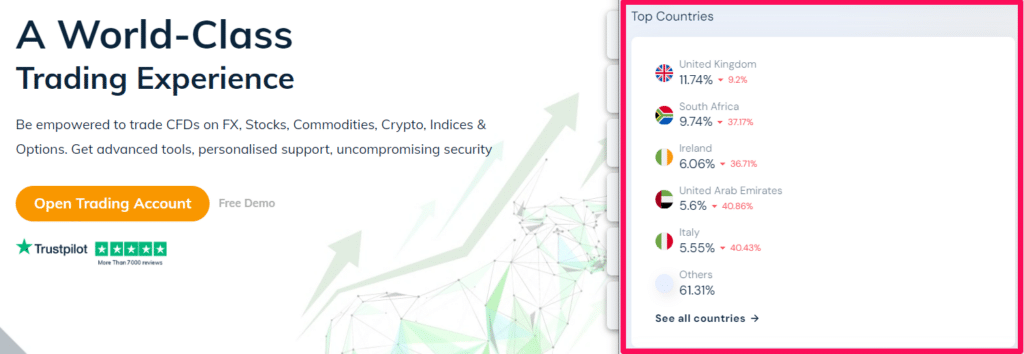

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders

They are one of the Top 10 Brokers for Indonesian traders.

In which countries are they available?

The broker operates in many countries worldwide, but certain jurisdictions may have restrictions due to regulatory constraints.

Are there any limitations to services in specific regions?

Yes, Due to local regulations and market conditions, their offerings may differ by region. For example, they do not accept traders from the United States, New Zealand, Belgium, Syria, Cuba, and Iran.

At a Glance

| 🏛 Headquartered | Dublin, Ireland |

| ✅ Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 🗓 Year Founded | 2006 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | • Twitter • YouTube |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 🪪 License Number | Ireland (C53877) Australia (406684) South Africa (45984) British Virgin Islands (SIBA/L/13/1049) Japan (JFSA 1662, FFAJ 1574) Abu Dhabi (190018) Cyprus (247/17) Israel (514666577) Poland (693023) Canada (Friedberg Mercantile) |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | United States, Belgium, Syria, Iran, New Zealand, Cuba |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| 📊 PAMM Accounts | MAM Accounts |

| 🤝 Liquidity Providers | Currenex and other bank and non-bank entities |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant |

| 📊 Average spread | 0.9 pips EUR/USD |

| 📞 Margin Call | 50% on Retail 25% on AvaOptions Accounts |

| 🛑 Stop-Out | 10% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:30 (Retail) 1:400 (Pro) |

| 🚫 Leverage Restrictions for Indonesia? | Yes, based on trading experience |

| 💰 Minimum Deposit | 100 USD / 1,571,515 IDR |

| ✅ IDR Deposits Allowed? | No |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based AvaTrade customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💰 Bonus | 20% welcome bonus accordengly to regulation |

| 💵 Deposit and Withdrawal Options | • Wire Transfer • Electronic Payment Gateways • Credit Cards • Debit Cards |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| ✔️ Tradable Assets | • Forex • Stocks • Commodities • Cryptocurrencies • Treasuries • Bonds • Indices • Exchange-Traded • Funds (ETFs) • Options • Contracts for • Difference (CFDs) • Precious Metals |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📊 Average deposit/withdraw processing time | Depends on the method used. – CC and e-payments is immediate. Bank wire can take up to 7 business days depending on the banking institution |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is AvaTrade a safe broker for Indonesian traders? | Yes |

| 📊 Rating for AvaTrade Indonesia | 9/10 |

| 🤝 Trust score for AvaTrade Indonesia | 93% |

| 🎉 Open an account | Open Account |

Safety and Security

Regulation in Indonesia

They are not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

The broker is subject to regular audits because top-tier authorities regulate it. These audits ensure the broker follows regulatory requirements, adding another layer of oversight and security.

Risk Management Tools:

The broker offers a variety of risk management tools, such as stop-loss orders, to assist traders in effectively managing their risks. These tools are critical for safeguarding investments against significant losses.

Two-Factor Authentication (2FA):

The broker provides 2FA, an additional layer of security that requires not only a password and username but also something that only the user has on them, such as a piece of information they should know or have readily available.

Secure Sockets Layer (SSL) Encryption:

SSL encryption is used to secure data transmission on their website and trading platforms. This encryption technology ensures the secure transmission of personal and financial information over the internet, preventing unauthorized access.

Funds Segregation:

They keep their clients’ funds separate from their own operating funds. This separation ensures that client funds are not used for the broker’s business activities and are safe in the event of the company’s insolvency.

Customer Service:

The broker’s team is available to help with any security concerns. The availability of the support team adds to the overall sense of security because clients know they can contact them with any issues or questions.

International Standards Compliance:

The broker follows international financial standards and anti-money laundering (AML) policies. This compliance ensures that the broker operates with transparency and integrity, further protecting the client’s interests.

They are regulated by several top-tier financial authorities worldwide, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and many more. Being regulated by these authorities means that the broker must adhere to stringent regulatory requirements, which increases the platform’s trustworthiness.

How does the broker ensure the safety of my funds?

They employ industry-standard security measures such as encryption and segregated accounts to ensure client funds’ safety and integrity.

What measures do they take to protect against unauthorized access to my account?

To prevent unauthorized access and provide a secure trading environment, they employ advanced authentication methods and continuous monitoring.

Awards and Recognition

They received the following recent awards and recognition:

Has the broker received any awards or recognition for its services?

Yes, they have received numerous awards and recognition for their services. Over the years, the broker has been recognized by various industry experts and organizations for its excellence in providing top-notch trading services and innovative solutions.

What are some of the notable awards won by them?

The broker has earned several notable awards from prestigious institutions and industry publications. These awards may include “Best Forex Broker,” “Best Customer Service,” “Best Trading Platform,” and “Best Education Provider,” among others.

AvaTrade Account Types and Features

Retail Investor Account

The broker provides Indonesians with the Standard Retail Account, meticulously designed for traders and intermediate investors seeking to enter global markets.

This specialized account offers various features specifically tailored to meet the needs of retail investors. This account contains several key features, including:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 100 USD / 1,571,515 IDR |

| 💵 Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📈 Maximum Leverage | 1:30 |

| 📊 Range of Markets offered | More than 1,260 tradable instruments |

| 💰 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💸 Commissions on trades | None |

| 📊 Average spreads | From 0.9 pips EUR/USD |

| 💵 Margin Requirements | From 0.25% when using leverage of 1:400 |

| 📞 Customer Support Channels | Social Platforms Email Request Telephone Live Chat |

| ✔️ Trading Strategies Allowed | All |

| 🎉 Open an account | Open Account |

Professional Account

The Brokers Pro account, available only to accredited Indonesian investors, offers many advantages, including lower spreads and no trading fees. This account is a premier option because it is tailored to meet the specific needs of accredited traders.

Compared to the Standard account’s standard spread of 0.9 pips, the Pro account has an impressive average EUR/USD spread of 0.6, significantly increasing its appeal to traders.

Pro account holders can seamlessly integrate their real accounts with DupliTrade or ZuluTrade, further enhancing trading capabilities.

To be eligible for the Professional Account, you must meet the following requirements:

- Have a minimum of twelve months of continuous market engagement in the relevant financial market, with no fewer than ten CFD, Forex, or spread betting transactions in the previous four quarters.

- Have at least one year of experience in the financial services industry.

- Maintain a minimum investment portfolio of €500,000 (or equivalent in other currencies), including monetary assets and financial instruments.

Demo Account

The broker provides Indonesian traders with the opportunity to learn about market dynamics and test the functionality of their trading platform by providing a free demo account. This invaluable feature enables beginners in the forex market to gain valuable experience without risking their capital.

Accessing the demo account is simple, as traders can choose between a quick registration process, submitting their information, and signing in using their existing social media credentials, such as Facebook or Google.

Unlike the procedures for opening a live trading account, traders are not required to provide identification or verification documents. This simplified procedure ensures a simple account setup.

The demo account is only for educational purposes and is funded with virtual funds of up to $100,000. As a result, traders can experiment with various strategies and navigate the vast array of markets available on the broker’s platform while being protected from the risks associated with live trading.

Using the demo account, Indonesian traders can fine-tune their skills, experiment with new approaches, and build confidence in their trading abilities in a risk-free environment.

This instrumental learning phase effectively prepares them for live trading when they can invest real money in the market.

Islamic Account

For Muslim traders in Indonesia who adhere to Sharia law principles, the broker offers the Islamic Account, a dedicated solution that allows trading per religious beliefs.

This account type eliminates swap and interest fees, per Riba principles. Islamic account holders can hold positions for up to 5 days without incurring rollover fees.

Acquiring an Islamic account entails verifying and funding the account and then applying for the Islamic account. The application is reviewed and typically approved within 1-2 business days.

In addition, they expand the Islamic account’s halal trading options to include gold, silver, oil, and stock indices.

Can I customize the features of my account?

Yes, the broker allows for the customization of trading conditions and features based on individual preferences and trading strategies.

Are Islamic accounts available with them?

Yes, they provide Sharia-compliant Islamic accounts that allow traders to trade interest-free.

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

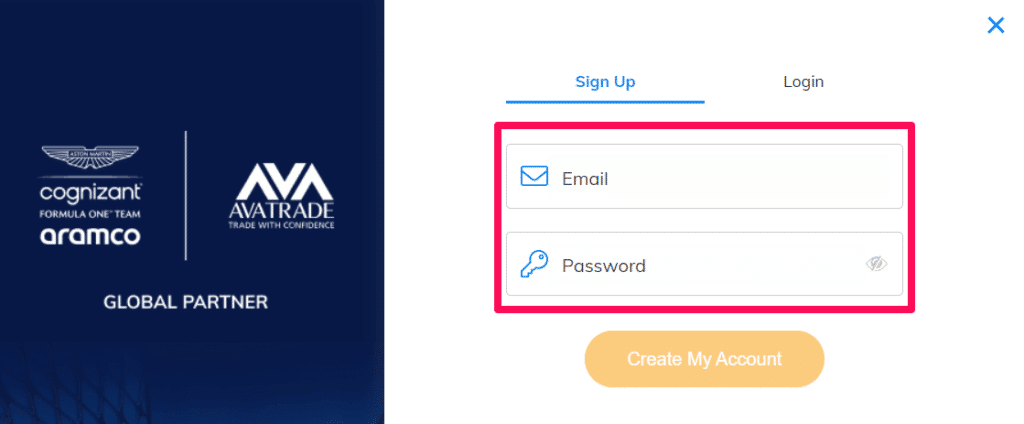

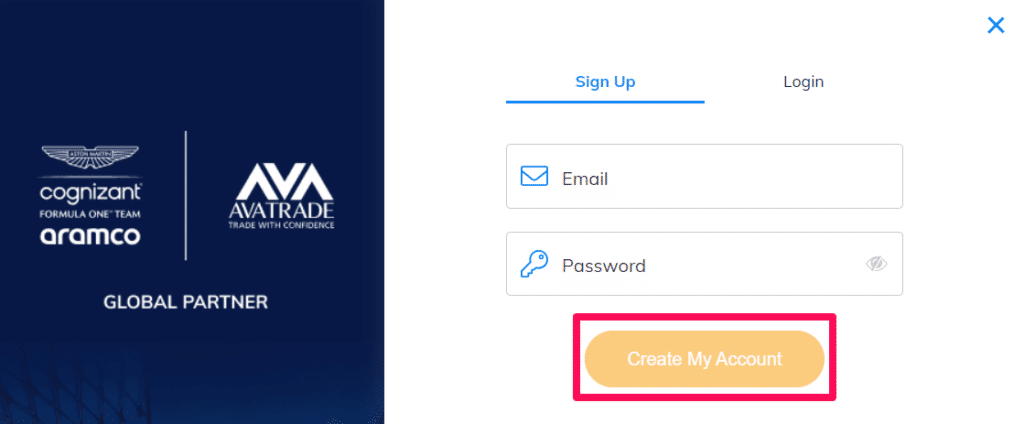

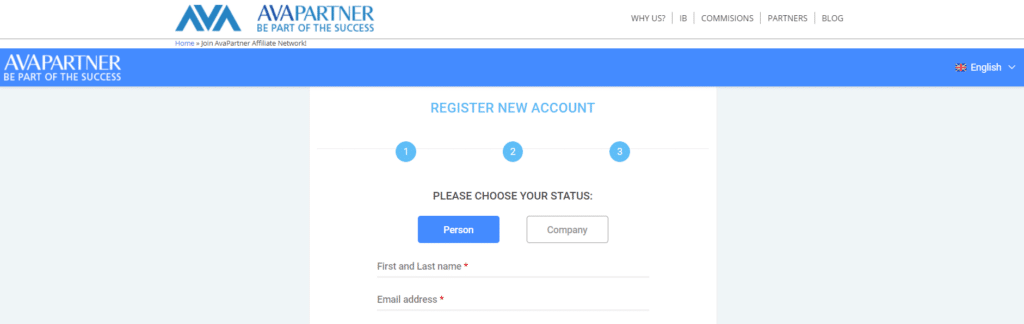

How to open an AvaTrade Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

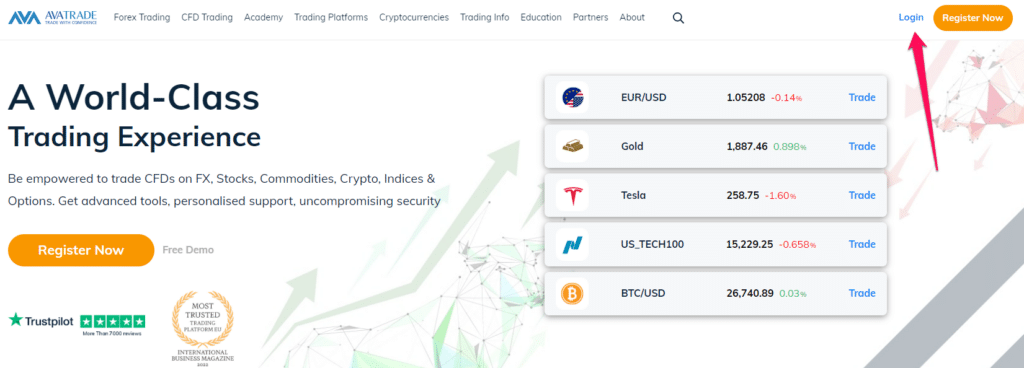

Go to the AvaTrade official website. Click the ‘Register’ button: Locate and select the ‘Register’ or ‘Open an Account’ button.

Provide personal information such as your name, email address, and phone number, as well as a password.

Once you are finished filling in all your details you can click on the open my account button.

AvaTrade Vs eToro Vs FXTM – Broker Comparison

| AvaTrade | eToro | FXTM | |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC | CySEC, FSCA, FCA, FSC Mauritius |

| 📱 Trading Platform | AvaTrade WebTrader AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade | eToro proprietary platform | MetaTrader 4 MetaTrader 5 FXTM Trader |

| 💰 Withdrawal Fee | No | Yes | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 100 USD / 1,571,515 IDR | 10 USD / 157,151 IDR | 10 USD / 157,151 IDR |

| 📈 Leverage | 1:30 (Retail) 1:400 (Pro) | 1:30 (Retail) 1:400 (Pro) | 1:2000 |

| 📊 Spread | Fixed, from 0.9 pips | From 1 pip | 0.0 pips, Variable |

| 💰 Commissions | None | None | From $0.4 to $2 |

| ✴️ Margin Call/Stop-Out | 25% – 50% (M) 10% (S/O) | None indicated | 40% to 50% (M) 60% to 80% (S/O) |

| ✴️ Order Execution | Instant | Market/Instant | Market/Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Standard Live Account Professional Account Option | Standard Account | Micro Account Advantage Account Advantage Plus Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | No | Yes |

| 📊 IDR Account | No | No | Yes |

| 👥 Customer Service Hours | 24/5 | 24/6 | 24/5 |

| 📊 Retail Investor Accounts | 2 | 1 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

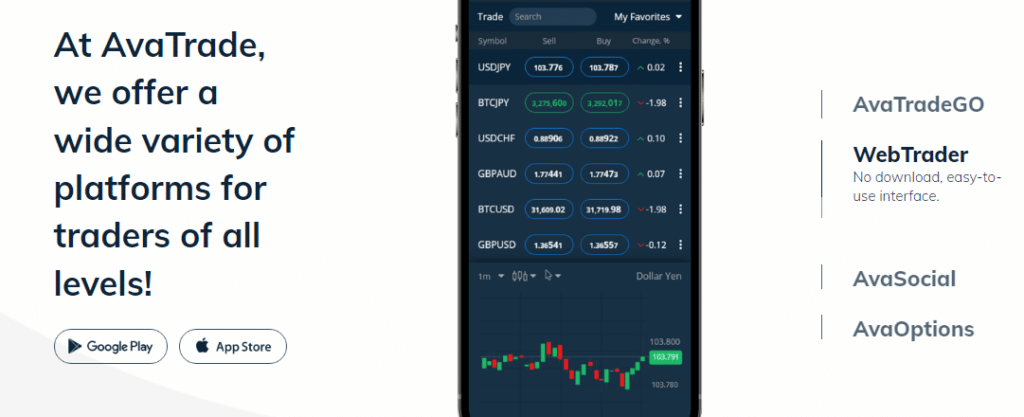

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

- MetaTrader 4 and 5

- AvaTradeGO

- AvaSocial

- AvaTrade Web

- ZuluTrade

- DupliTrade

- AvaOptions

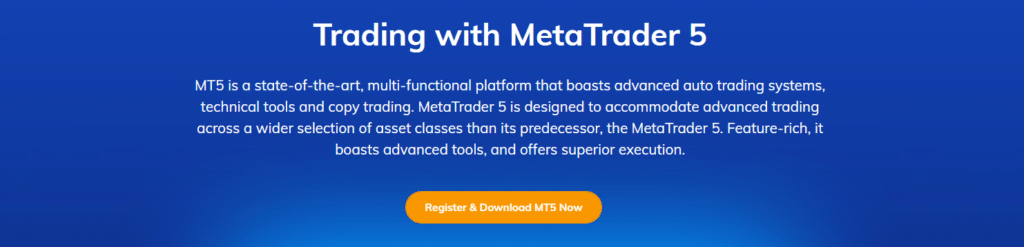

MetaTrader 4 and 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are offered by the broker, each with its own set of features. MT4 focuses on Forex trading, providing 24 graphical objects and 30 built-in indicators, algorithmic trading support, and customization options.

MT5, the more advanced version, permits trading on all assets and includes additional technical indicators and analytical tools. Both trading platforms cater to distinct preferences and objectives.

AvaTradeGO

AvaTradeGO is a mobile application for managing the MetaTrader 4 trading platform. It offers a user-friendly dashboard, educational content, market analysis, and simple access to customer support.

Traders can place orders, set alerts, create watchlists, and use AvaProtect, AvaTrade’s risk management system, to protect against losing trades for a predetermined period.

AvaSocial

AvaSocial, launched in collaboration with Pelican Exchange, is an all-inclusive social trading application for traders of all levels. It establishes a new benchmark for social trading technology, enabling users to copy and follow the trades of top-performing traders.

The application offers real-time trading signals, a network of similar traders, and the ability to share social media trades.

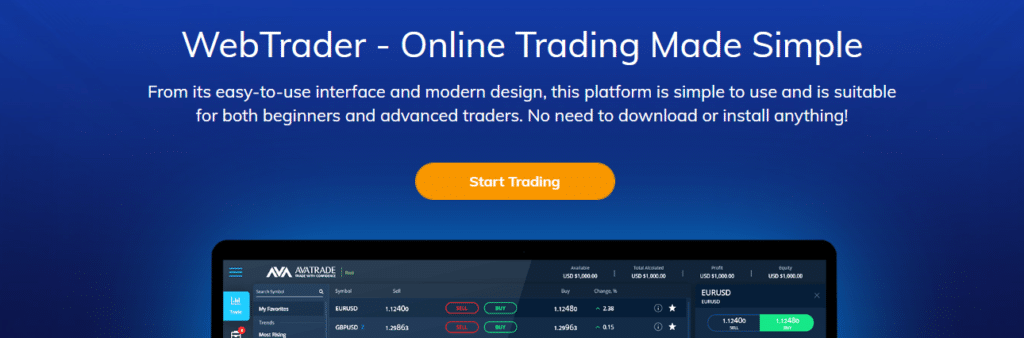

WebTrader

WebTrader is a platform designed for traders who prefer a straightforward approach and do not require extensive market research. WebTrader is accessible via any browser without installation and provides real-time market sentiment data.

This information enables traders to make well-informed decisions independent of technical or fundamental analysis.

The trading platform includes essential trading instruments such as market and pending orders, take profit and stop loss options, partial position closure, and simple individual and aggregate positions management.

ZuluTrade

ZuluTrade is designed to meet the requirements of traders of all skill levels, featuring an intuitive interface and layout.

Key features include a selection of reputable traders, ZuluGuard for trade protection, and real-time trading strategy sharing and monitoring. ZuluTrade, accessible via the web, MT4 integration, and a downloadable app, fosters a sense of community among traders.

DupliTrade

DupliTrade is an automated trading platform that enables direct duplication of the actions of expert traders into an account. With a minimum deposit of $2,000, DupliTrade provides an extensive selection of profitable trading strategies and automated trading capabilities.

Whether a trader is a novice or has limited time, DupliTrade offers numerous benefits, including a demo account for testing the platform.

AvaOptions

AvaOptions is a sophisticated platform designed for professional options traders with a minimum deposit of $1,000. It permits trading in over 40 currency pairs, gold and silver and is accessible via desktop (Windows only) and mobile platforms.

The platform integrates Autochartist for analysis and enables portfolio management and risk balancing.

What trading platforms does the broker offer?

They provide several trading platforms to accommodate various trading preferences and devices, including MetaTrader 4, MetaTrader 5, and their proprietary AvaTradeGO.

Are their trading platforms customizable?

Yes, their platforms include features tailored to individual trading styles and strategies, such as charting tools, indicators, and layouts.

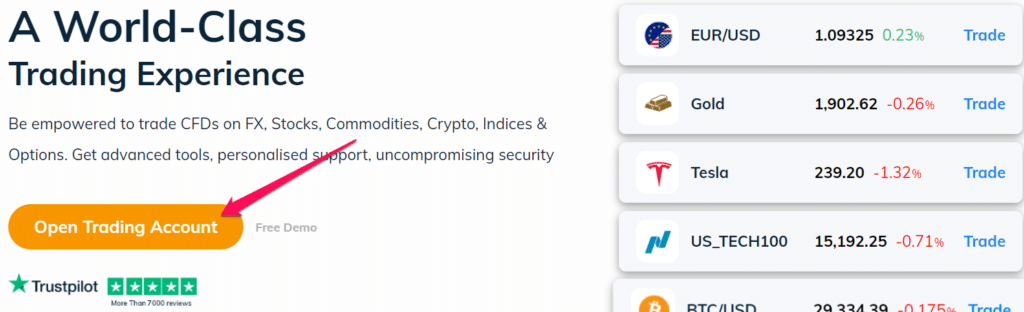

Range of Markets

Indonesian traders can expect the following range of markets:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Treasuries

- Bonds

- Indices

- Exchange-traded funds (ETFs)

- Options

- Contracts for Difference (CFDs)

- Precious Metals

Are there any market restrictions with the broker?

Yes, while they provide access to a wide range of markets, some limitations may apply due to regulatory requirements and geographic location. Furthermore, the full suite of asset classes is only available on MetaTrader 5.

Can I trade cryptocurrencies with them?

Yes, depending on regional regulations and market conditions, the broker offers a variety of cryptocurrencies for trading.

Broker Comparison for Range of Markets

| AvaTrade | eToro | FXTM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | Yes | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Avatrade Fees, Spreads, and Commissions

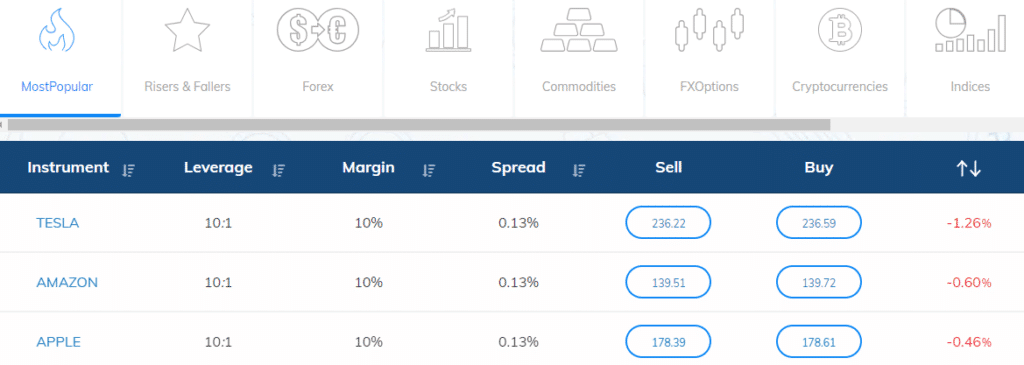

Spreads

The brokers’ fixed spreads include a mark-up to cover broker fees related to trade facilitation, ensuring complete transparency. AvaTrade, as a Market Maker broker, executes orders exclusively using its proprietary execution methods.

To provide traders with access to the interbank market, the broker acquires substantial positions from various liquidity providers, which it then presents to traders.

Commissions

The broker offers Indonesian traders a commission-free trading environment. Instead of separately charging commissions, they include a premium in their fixed spreads. This framework enables a transparent, all-inclusive trading environment, eliminating the need for additional commission fees.

Overnight Fees

The fees associated with overnight trading vary based on position type (long or short), position size, traded financial asset type, and general market conditions during the position’s duration.

The overnight interest rate is multiplied by the total trade value to determine overnight fees.

Deposit and Withdrawal Fees

The broker adheres to a policy of not charging deposit or withdrawal fees across all supported deposit and withdrawal methods.

Inactivity Fees

They impose an inactivity fee on accounts that have been dormant for three consecutive months. If no trading activity is observed during this period, a $50 monthly inactivity fee will be assessed.

Traders must know this fee increases to $100 after 12 consecutive months of inactivity. This fee structure is intended to encourage active trading while maintaining platform efficiency.

Currency Conversion Fees

Traders should be mindful of currency conversion costs. When traders deposit funds in a non-acceptable deposit or base currency, such as IDR, currency conversion fees may apply. Transaction of deposited funds into the account’s designated currency incurs these fees.

Traders are encouraged to consider this aspect when initiating deposits, including potential currency conversion fees.

What are the broker’s fees and spreads?

They have competitive spreads and may charge fees for services such as overnight financing. The broker charges fixed spreads with markup to cover its fee for facilitating the trade.

Does the broker charge commissions on trades?

No, they typically offer commission-free trading on most instruments, with costs rolled into the spread.

Avatrade Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

- Bank Wire Transfer

- Credit/Debit Card

- PayPal

- WebMoney

- Neteller

- Skrill

How long do withdrawals take?

Withdrawal processing times vary depending on the method, but they typically range from 1 to 5 business days.

Are there any fees for deposits or withdrawals?

No, the broker does not charge deposit or withdrawal fees. However, your payment provider may charge fees on transactions.

How to make a Deposit with AvaTrade

To deposit funds into an account, Indonesian traders can follow these steps:

To access your account, you can log in through their website or trading platform.

Next, locate the deposit section within your account dashboard or under the ‘Funds’ menu.

Choose your preferred deposit method from options like credit/debit card, bank transfer, or e-wallets such as Skrill and Neteller.

How to Withdraw from AvaTrade

To withdraw funds from an account, Indonesian traders can follow these steps:

To log in to your account, you can go through the website or use their trading platform.

Next, locate the withdrawal section. This is usually found on your account dashboard or under the ‘Funds’ menu.

Choose your preferred withdrawal method. Please note that it should match how you deposited into your account.

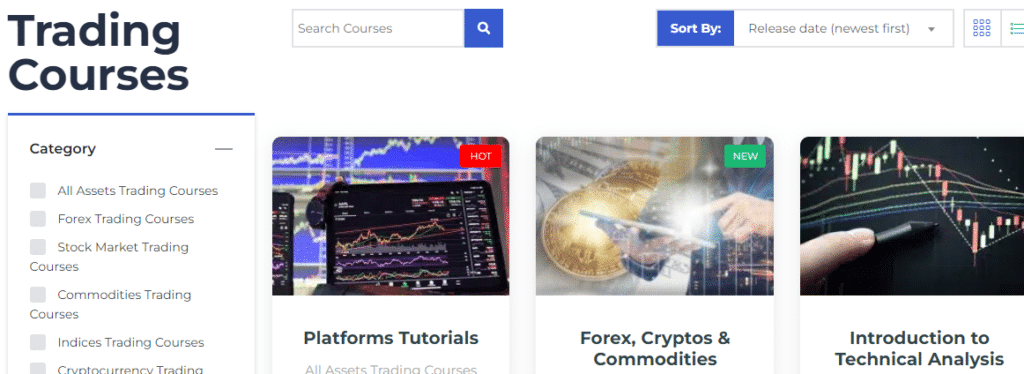

Education and Research

Education

The broker offers the following Educational Materials to Indonesian traders:

They also offer Indonesian traders the following additional Research and Trading Tools:

Does the broker provide research and analysis tools?

Yes, they have various research and analysis tools, such as market insights, economic calendars, and technical analysis features.

Where can I find the broker’s education and tools?

You can visit their official website and navigate to the education and tools sections from the homepage in the main menu.

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

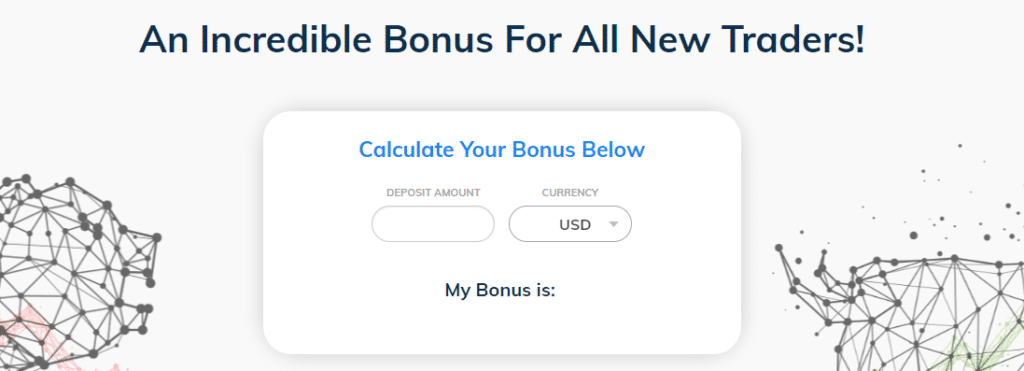

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

- Referral Bonus

Through the Referral Bonus program, Indonesian traders can earn substantial compensation. Traders can benefit from this lucrative initiative by referring their friends and family to the platform.

When the referred individual deposits $500 or more into their live account, the $50 to $250 referral bonus becomes available.

In addition, the Indonesian trader’s earning potential is contingent on the initial deposit made by their referred acquaintance into their newly verified live account.

This dynamic approach ensures that the Indonesian trader’s reward is proportional to the referral’s initial deposit size. This initiative fosters community while providing tangible incentives for the broker’s ecosystem participation and contribution.

Does the broker subject the bonuses to any conditions?

Their bonuses and promotions are subject to specific terms and conditions, such as trading volume requirements. Before participating, it is critical to review these terms.

Can I withdraw the bonus offered by the broker?

No, withdrawing a bonus may be subject to certain conditions, such as meeting trading volumes.

How to open an Affiliate Account with AvaTrade

To register an Affiliate Account, Indonesian traders can follow these steps:

Proceed to the affiliate-specific section of the AvaTrade website.

Find the appropriate button to start the registration procedure.

Include your name, email address, phone number, and website (if applicable) in the required fields.

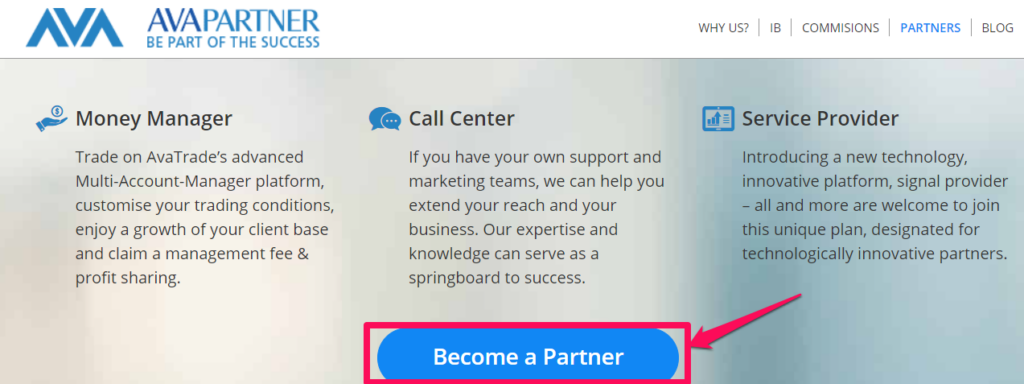

Affiliate Program Features

What tools and support does the broker provide to its affiliates?

They provide their affiliates with various tools and support, including marketing materials, tracking tools, dedicated account managers, and more.

Can anyone join the broker’s affiliate program?

Yes, anyone can join. However, the affiliate program may have specific eligibility requirements.

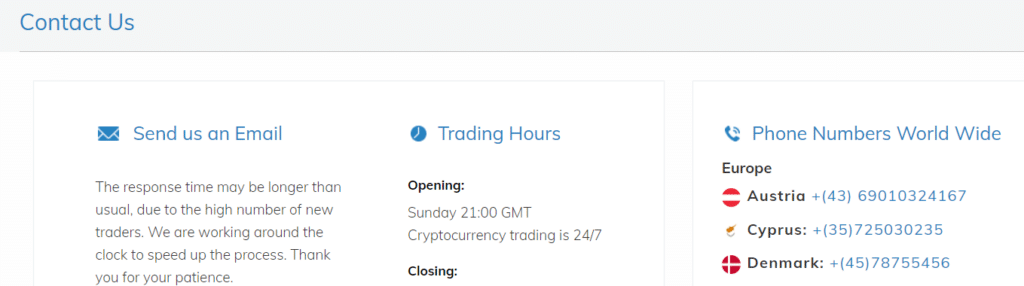

Customer Support

The broker offers excellent customer support, especially when compared to the support received from other brokers. The live chat agents for the broker are both prompt, polite, and helpful, providing relevant information regarding queries.

Is the broker’s customer support available 24/7?

No, their customer support is only available 24 hours a day, 5 days a week, during weekdays.

Do they offer support in multiple languages?

Yes, the broker offers customer service in various languages to better serve its global clientele.

Verdict

According to our research, they have established themselves as a reliable partner for traders, particularly in the Indonesian market. Furthermore, the broker’s extensive selection of trading platforms is a major advantage.

The broker ensures that all types of traders, regardless of their trading experience, have access to various tools, features, and benefits via mobile, desktop, and web-based platforms.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: XM Review

you might also like: FXTM Review

you might also like: Exness Review

you might also like: FXOpen review

you might also like: HFM Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker provides a range of leverage levels to accommodate diverse risk appetites and trading strategies | Depending on the jurisdiction, leverage restrictions may hinder certain trading strategies |

| Their $100 minimum deposit makes trading accessible to a wide range of investors | Islamic accounts do not permit cryptocurrency trading, limiting the options available to those who adhere to Shariah law |

| The broker is suitable for Muslim traders due to the availability of Shariah-compliant Islamic accounts | Bonuses and promotions are not as extensive as some competitors, which may disadvantage some traders |

| Support for MetaTrader 4 and 5, in addition to web-based trading options, offers traders flexibility | Some withdrawal methods may incur fees, which increases the cost of trading |

| The broker is regulated in multiple jurisdictions, which lends credibility and safety to its services | The variety of platforms and tools may be overwhelming for novices, necessitating a learning curve |

| Traders have access to a vast array of financial instruments, including Forex, cryptocurrencies, and shares, among others | |

| They provide educational materials and tools, such as Trading Central, to assist both novice and experienced traders | |

| The broker provides multilingual customer support, thereby enhancing the user experience |

Frequently Asked Questions

How good is AvaTrade in Indonesia?

They are well-known in Indonesia for their user-friendly platform, diverse trading options, and prompt customer service.

How long does it take to withdraw?

Their withdrawals can take a few hours or days, depending on the payment method.

Can I use the broker’s trading platform in Indonesia?

Yes, AvaTrade’s trading platform is user-friendly and accessible to Indonesian traders.

Is AvaTrade Safe or a Scam?

They are a safe broker for Indonesian traders. Multiple jurisdictions regulate it, which increases its safety and dependability.

Does the broker in Indonesia offer a demo account?

Yes, they offer a demo account for Indonesian traders to practice trading strategies without risking real money.

How can I contact their customer support in Indonesia?

You can contact their customer service in Indonesia via their provided contact channels, which include live chat, email, and phone.

Does the broker have Nasdaq 100?

Yes, they provide Nasdaq 100 shares and US TECH 100 CFDs.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

AvaTrade, an internationally renowned forex and CFD broker, is committed to corporate social responsibility (CSR) and sustainability. Although specific information regarding their CSR initiatives is not widely accessible, there are indications of their efforts in this area.

The broker has engaged in socially responsible partnerships, such as partnering with Aston Martin Aramco Cognizant Formula OneTM Team to support women.

Moreover, the company’s presence on platforms such as Comparably, which focuses on sustainability and CSR, indicates an interest in these areas.

Is VPS service free?

Under certain conditions, such as a minimum account balance or trading volume, the broker may provide free VPS services.

How can I set up VPS with my account?

Subscribing to the service and following the instructions are required to set up a VPS. Their customer service may be able to assist you.