FP Markets Review

FP Markets is one of the best ECN and STP brokers for Indonesian retail and institutional traders. Indonesians can use leverage of up to 1:500 and expect spreads from 0.0 pips on major forex pairs.

- Louis Schoeman

Updated : April 23, 2024

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD / 1,625,795 IDR

Regulators

ASIC, CySEC, FSCA, FSA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overview

FP Markets is well-known as a leading online brokerage, especially among Indonesian traders. When Matthew Murphie founded the firm in 2005, he had one goal: to provide first-rate trading services.

Over the years, the broker has reliably met its objectives and garnered more than 40 esteemed accolades for its outstanding service.

Our research shows FP Markets’ dedication to affordable pricing and good execution is evident from these awards. Because the broker accepts deposits in IDR, the minimum deposit is 1.04 million IDR, making it easy for traders in Indonesia to deposit and start trading.

The stellar reputation of FP Markets inspires trust among Indonesian investors. Several accolades attest to the firm’s dedication to providing traders with first-rate services. Furthermore, the broker is trustworthy since it follows the rules of respected agencies like ASIC and CySEC.

When we explored the platform, we found that more than 10,000 financial products are now available to traders in Indonesia through the broker. Because of this, Indonesians can easily spread their money across different types of assets in their investment portfolios.

Furthermore, Indonesians can expect a first-rate trading experience with their platforms, including IRESS, MetaTrader 4, and MetaTrader 5. The EUR/USD pair has ECN spreads as little as 0.0 pips.

We feel that their commitment to meeting the needs of Indonesian traders is evident in the variety of platforms and account options it offers, including Raw and Islamic Raw accounts.

Our initial thoughts on the broker is that they offer a strong platform tailored to the unique requirements of traders in Indonesia, supported by their vast worldwide expertise.

In addition, the broker’s ability to adapt and prioritize client demands is demonstrated by its journey from its Australian beginnings to becoming a respected brand in Indonesia and other Asian regions.

Is FP Markets more customizable than other brokers?

Yes, their software is highly customizable, allowing traders to adjust their trading environment to their preferences and methods.

Does the broker offer any unique trading execution methods?

Yes, they employ a No Dealing Desk execution methodology, reducing potential conflicts of interest between the broker and the trader.

At a Glance

| 🗓 Established Year | 2005 |

| ⚖️ Regulation and Licenses | ASIC, CySEC, FSCA, FSA, FSC |

| 🪪 Ease of Use Rating | 4/5 |

| 🚀 Bonuses | No |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App |

| 💻 Account Types | Standard, Raw, Islamic Standard, Islamic Raw |

| 💰 Base Currencies | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD, SGD |

| 📈 Spreads | From 0.0 pips |

| 📉 Leverage | 1:500 |

| 💸 Currency Pairs | Major, Minor, Exotic |

| 💳 Minimum Deposit | 100 USD / 1,625,795 IDR |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Arabic, German, Portuguese, Indonesian, Indonesian, French, Malay, Italian, Russian |

| ✔️ Fees and Commissions | Spreads from 0.0 pips, commissions from US$3 per side |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States, Japan, New Zealand |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, Shares, Metals, Commodities, Indices, Cryptocurrencies, Energies, ETFs, Bonds |

| 🎉 Open an account | Open Account |

Regulation and Safety of Funds

The first thing we noticed while exploring FP Markets’ security measures is that the broker is not locally regulated or overseen in Indonesia. However, despite this, the broker maintains strict international standards that should give Indonesian traders peace of mind.

They are regulated by well-respected authorities in Australia, Cyprus, South Africa, Mauritius, and Seychelles by corresponding regulatory entities (ASIC, CySEC, FSCA, FSC, and FSA).

As with other brokers, we always verify that brokers have additional security measures and were pleased to find SSL encryption that protects the traders’ information.

Moreover, this encryption keeps the data transmitted between their servers and the trader’s devices completely secure from unauthorized access.

In addition, as is standard with well-regulated brokers, they keep all client funds in segregated accounts that are separated from the broker’s capital and only used for trading activities.

Another benefit is that the broker is a member of a compensation fund that offers investor protection should it go bankrupt or be unable to meet its financial obligations.

Our research also showed that the broker has a dedicated cybersecurity team to monitor and counter potential cyber threats, ensuring a secure trading environment.

Overall, all the proactive security measures we found demonstrate a strong commitment to ensuring the safety and security of its clients, even in the absence of Indonesian regulation. This instils a sense of confidence in the broker’s high standards.

What measures does the broker take to protect client funds?

FP Markets ensures the safety of client funds through segregated accounts and is a member of a compensation fund.

Are Indonesian traders eligible for investor protection?

No, they are not. Indonesian traders might not be eligible for investor protection under FP Markets’ European entity.

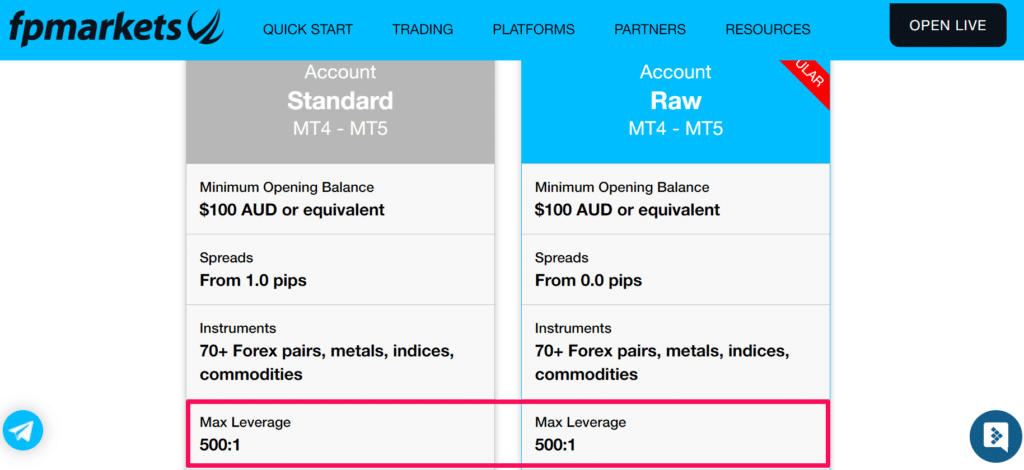

FP Markets Account Types

We explored each of FP Markets’ account types for Indonesians to provide an overview of each, letting traders decide which account type might suit their trading objectives and needs best.

Standard Raw Islamic Standard Islamic Raw

✔️ Availability All Traders; ideal for beginners and casual traders All traders; ideal for scalpers and algorithmic traders Muslim traders; ideal for beginners and casual traders Muslim traders’ ideal for scalpers and algorithmic traders

💵 Markets All All All All

💰 Commissions None US$3 per side None US$3 per side

💻 Platforms All All All All

🔨 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots From 0.01 lots

📊 Leverage 1:500 1:500 1:500 1:500

💸 Minimum Deposit 100 USD / 1,625,795 IDR 100 USD / 1,625,795 IDR 100 USD / 1,625,795 IDR 100 USD / 1,625,795 IDR

👉 Open an account Open Account Open Account Open Account Open Account

Demo Account

Our evaluation of the demo account shows that it is essential for both novice traders and experienced investors to experiment with new strategies in a safe and controlled setting.

Using virtual funds, traders can simulate real-market conditions, providing an authentic trading experience without any financial risk.

One notable advantage we noticed is that the broker does not impose a time limit on demo account usage, which sets them apart from competitors who often have restrictions.

This feature allows Indonesian traders to practice at their own pace, which aligns with their client-focused philosophy. In addition, the demo account provides Indonesian traders with ongoing access to refine their strategies and stay ahead in the ever-changing trading environment.

Standard Account

The Standard Account is suitable for a wide range of Indonesian traders. The unique account structure provides access to various financial instruments, allowing you to trade in forex, indices, and commodities.

It is worth mentioning that the zero-commission model encourages transparency in terms of costs, making it accessible to traders with a minimum deposit requirement that suits the local economic conditions.

Overall, the Standard Account provides Indonesian traders, whether beginners or experts, a favourable trading environment where they can flourish and improve their trading strategies to enhance their profitability.

Raw Account

According to our investigation, the Raw Account stands out for its competitive spreads, which start from 0.0 pips. These razor-thin spreads are especially useful for trading strategies where rapid entry and exit are crucial, such as with scalping strategies.

Despite the commission fee of around US$3 per side for every lot, the account remains a competitive component that balances the benefit of lower spreads.

Therefore, if you routinely engage in high-volume trading, the Raw Account will be a very enticing alternative.

Islamic Standard Account

Our study of the Islamic Standard Account highlights its specialized approach to serving Indonesian Muslim traders.

It offers a Sharia-compliant trading experience while maintaining a swap-free environment. This account assures no swap or rollover interest is levied on overnight holdings, which aligns with Islamic financial norms.

Despite its focus on Islamic financial principles, the account provides competitive trading conditions, with spreads starting at 1 pip and no commission costs.

This account lets traders with specific religious views engage in trading activities consistent with their principles, ensuring they are not barred from the financial markets.

Islamic Raw Account

Our examination of this account type highlights their dedication to ethical trading practices, delivering a swap-free environment while preserving a competitive edge with spreads starting at 0.0 pips.

The account also retains the Raw account’s attributes, such as a commission of US$3 per side for each lot, resulting in an atmosphere that allows for maintaining religious beliefs and sophisticated trading opportunities.

Professional Account

The Professional Account is intended for the top tier of Indonesian traders, with various features geared exclusively to the demands of seasoned investors.

While we examined this account type, we noticed that professional traders receive access to higher leverage, tailored customer support, and several other benefits.

Furthermore, this account also improves access to market depth and allows for faster execution, where the broker stands out from other brokers in the industry.

What types of trading accounts are offered?

FP Markets offers several account types: Standard, Raw, Islamic Standard, and Islamic Raw.

Can Indonesian traders open all types of accounts?

Yes, Indonesian traders have access to all account types offered by FP Markets.

How To Open an FP Markets Account

Here are the steps we followed on the FP Markets website to register an account and complete KYC, allowing us to start trading with the broker:

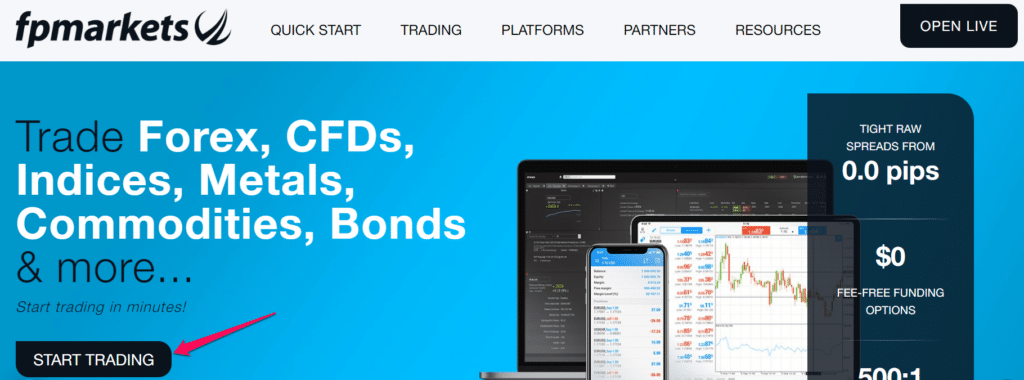

Step 1 – Click on the Start Trading button.

We began by visiting the FP Markets official website and clicking on the ‘Start Trading’ banner on the homepage.

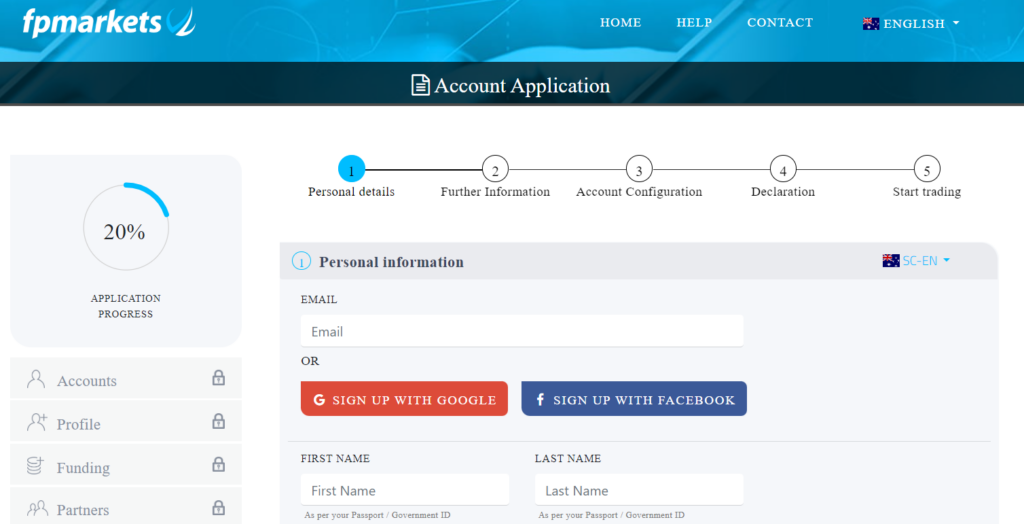

Step 2 – Complete the form.

The registration form loaded and based on our previous evaluation of the different account types, we decided on registering a Standard Account, aligned with our trading objectives and overall experience in the financial markets. The form required personal information, contact info, trading experience, and a few other sections. From our experience, we knew that providing accurate information was crucial to smooth account verification through KYC.

Step 3 – Select a base currency.

We could choose AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD, and SGD as the base currency for the account. We also noted that because IDR was not a listed base currency, currency conversion fees would apply to deposits and withdrawals later.

Trading Platforms and Software

Before we tested each of the trading platforms, we were pleased to find that there is a unique balance between third-party and proprietary software. Keep reading to discover how FP Markets’ trading platforms can benefit Indonesian traders.

IRESS

Before we started exploring the IRESS platform, we were already captivated by its renowned commitment to delivering a top-tier trading experience.

After testing the platform, it became clear that IRESS is a highly reliable platform that perfectly aligns with their dedication to offering complete trading solutions.

Created for traders seeking a diverse range of trading instruments, the platform provided easy access to a vast selection of financial products, including stocks and CFDs.

We were further impressed by the smooth real-time data stream and the advanced order management capabilities.

Combined with FP Markets’ transparent pricing model and direct market access, these enabled precise and sophisticated trade executions.

In addition, we highly appreciated the option to personalize our trading workspace in IRESS. This allowed us to customize the platform according to our unique trading requirements and preferences.

FP Markets App

To test the platform, we downloaded and installed the FP Markets app on a Xiaomi Note 11 Pro (Android).

While we put this app through its paces, we noticed that it is a highly efficient tool for Indonesian traders who value flexibility and convenience, allowing them to trade on the go.

The app maintained the low spreads typical of FP Markets, and we could easily execute trades quickly as advertised by the broker and aligned with many client reviews.

The user-friendly design made handling our trades easy, with important account details and trading tools always within reach.

With the app’s seamless integration into FP Markets’ infrastructure, we could stay on top of real-time pricing and execute orders promptly, maximizing our trading potential.

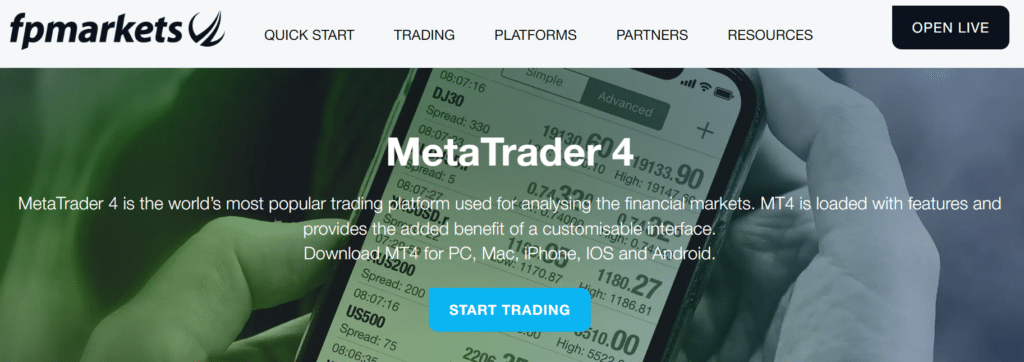

MetaTrader 4

After testing MetaTrader 4, it became clear why this platform remains a top choice for traders worldwide and why top brokers like FP Markets include it in their offerings.

While testing the MT4 platfrom, our trades were executed flawlessly, and the platform’s interface was easy to navigate and provided all the necessary features for our trading needs.

The charting package provided by the broker is highly valuable when combined with their competitive pricing. They allow for in-depth market analysis and help users make well-informed decisions.

Combining the powerful features of MetaTrader 4 with FP Markets’ exceptional trading environment has enabled us to capitalize on market movements. This is a valuable benefit for Indonesian traders seeking a trustworthy and well-established platform.

MetaTrader 5

Utilizing MetaTrader 5 in partnership with FP Markets provides traders with an advanced trading environment that caters to a wide range of financial instruments.

By testing MT5 with the Standard Account, we registered, we could confirm that the platform’s advanced features were fully backed by their liquidity and execution models, guaranteeing efficient and precise trade execution.

We utilized the advanced charting features and analytical tools to navigate their wide selection of products effectively.

Furthermore, the ability to handle multiple trades simultaneously was an impressive additional feature that perfectly complements FP Markets’ high leverage and tight spreads, appealing to traders with conservative and aggressive styles.

Therefore, we recommend this platform to Indonesian traders seeking a state-of-the-art and versatile platform, especially when combined with FP Markets’ robust trading infrastructure.

cTrader

During our review with FP Markets, cTrader’s commitment to serving advanced traders was evident.

The platform’s interface provided us with comprehensive insights into market depths, aligning perfectly with FP Markets’ commitment to transparent ECN pricing.

Furthermore, our testing showed that cTrader’s focus on order execution speed and precision aligns perfectly with the raw spreads and fast trade execution offered by FP Markets.

We took full advantage of the platform’s algorithmic trading capabilities, which were greatly enhanced by FP Markets’ technological infrastructure, resulting in a smooth and effortless trading experience.

Therefore, we typically recommend this platform to Indonesian traders who value comprehensive market data and want precise control over their trading activities.

Does the broker offer educational resources through its trading platforms for Indonesian traders?

Yes, they provide educational resources and tutorials on its platforms for Indonesian traders.

Is a demo account option available on the trading platforms for Indonesian users?

Yes, FP Markets provides a demo account option on its platforms for Indonesian traders to practice trading.

Trading Instruments & Products

We explored FP Markets’ instrument offering to great lengths on the official website, and Indonesians can access over 10,000 financial instruments with spread across the following:

➡️Stocks – Indonesian traders can access many trading options, including over 10,000 Direct Market Access (DMA) stocks and shares. This allows for extensive exposure to global equity markets. With such a wide range of options available, you can implement various investment strategies and take advantage of the success of specific companies.

➡️Bonds – Indonesians can trade two bond instruments that offer them a stable and reliable investment opportunity, helping them hedge their positions.

➡️Digital Currencies – The broker provides a range of 11 popular cryptocurrencies for trading, demonstrating the broker’s dedication to staying up-to-date with the ever-changing world of digital finance. These enable Indonesian traders to participate in the rapidly growing crypto market, renowned for its unpredictable nature and the possibility of substantial profits.

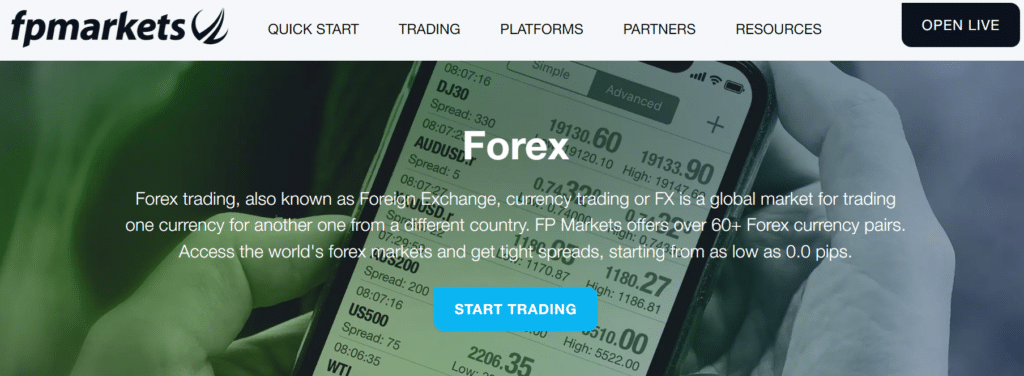

➡️Forex – They offer a wide range of forex currency pairs, providing options for traders in Indonesia who are interested in major, minor, and exotic currencies. With this wide range of options, you can easily tap into the highly liquid global market and take advantage of currency fluctuations at any time, 5 days a week.

➡️Commodities – The broker offers access to a wide range of five agricultural commodities markets. These instruments are affected by various factors, providing traders with a range of speculative opportunities.

➡️Energies – Traders from Indonesia have the opportunity to explore the energy sector. They provide trading options for four important energy commodities: oil and natural gas.

➡️Precious Metals – The broker offers a range of precious metals, allowing traders to protect themselves from market fluctuations or add diversity to their investment portfolios.

➡️Indices (CFDs) – Traders from Indonesia can speculate on broader market trends without actually owning the underlying assets through a suite of 17 global indices CFDs.

What range of markets can Indonesian traders access?

Forex, Shares, Metals, Commodities, Indices, Cryptocurrencies, and Bonds are available for trading.

Are cryptocurrencies available for trading to Indonesian traders?

Yes, they offer a selection of 11 cryptocurrencies for trading.

Min Deposit

100 USD / 1,625,795 IDR

Regulators

ASIC, CySEC, FSCA, FSA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

FP Markets Spreads and Fees

As an ECN and STP forex broker, FP Markets offers some of the industry’s lowest spreads and commission fees. In the sections below, we detail the fees Indonesians can expect when trading.

Spreads

When we examined FP Markets, we found that the spreads they offer are quite impressive.

While registering a Standard Account, we could still view the spreads on the Raw Account using FP Markets’ comprehensive website and transparent details across markets and accounts.

The Raw account, in particular, stands out with its incredibly low starting spreads of 0.0 pips for major currency pairs such as EUR/USD.

This is particularly advantageous for our active trading strategies that take advantage of minor price fluctuations.

With the Standard account, we could enjoy spreads that start at a highly competitive rate of just 1 pip. While this seems extremely wide, we weren’t charged any commissions on our trades.

Furthermore, their tight spreads reflect their access to deep liquidity pools and their ECN pricing model. This allows for real-time bid-ask prices that are consistently lower.

This pricing structure is quite appealing to Indonesian traders, enabling us to execute trades cost-effectively. This is crucial to maximize our potential profits from our trading activities.

Commissions

The broker offers a commission structure that is clear and competitive. With the Raw account, the commission fee of around USD 3 per side for each standard lot seems fair, especially when you consider the available tight spreads.

Therefore, trading with them can lead to significant savings over time for high-volume traders from Indonesia.

Overnight Fees

Forex trades are typically charged or credited overnight fees, depending on the trader’s position. While we investigated their swap rates, we discovered that they align with the standard practices observed in the industry.

In addition, the fees for different instruments traded are clearly outlined on the broker’s website. As an ECN broker, the broker provides institutional-grade liquidity, leading to lower swap rates.

Furthermore, they also offer an Islamic Account that exempts Muslim traders from incurring swap fees.

Deposit and Withdrawal Fees

According to our research, the broker does not impose any deposit fees, which is a positive aspect for Indonesians as it lets them allocate more funds towards trading instead of covering transaction costs.

Withdrawal fees are typically charged by FP Markets across payment methods, including PaymentAsia for Indonesians. In addition to internal fees, Indonesians might face fees charged by the payment provider.

Inactivity Fees

While we read through the legal documents of FP Markets, we found that inactivity fees do not apply as a penalty on dormant accounts. This lets us manage long-term strategies easily without worrying about additional fees.

Currency Conversion Fees

Indonesian traders who fund their accounts in IDR should be aware that the broker will convert these funds into one of the accepted base currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD, or SGD.

A fee is associated with this conversion, and although the costs may not be significant for each transaction, they can add up over time, particularly for traders who frequently deposit and withdraw funds.

Therefore, as responsible reviewers, we recommend that potential clients consider these conversion fees when assessing the cost-effectiveness of their trading strategies.

What are the typical spreads for major currency pairs for Indonesian traders?

Zero Pips on the Raw Account. The account we registered, the Standard Account, featured spreads from 1 pip EUR/USD, which is competitive but much wider than the Raw Account despite the commissions charged.

Are there any deposit fees for Indonesian traders?

No, FP Markets does not charge deposit fees. However, while internal fees are waived, payment providers can still apply their fees.

FP Markets Deposit & Withdrawal Options

FP Markets stands out from other forex and CFD brokers because the broker caters to all traders globally regarding deposits and withdrawals. In the table below, we provide comprehensive information about these payment methods.

Then, we detail the steps traders can use to deposit and withdraw funds using the various payment method categories.

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

Credit/Debit Card All AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED Instant – 10 days

Bank Transfer All AUD, USD, EUR, GBP, SGD, CAD 1 day

Neteller All AUD, CAD, CHF, EUR, GBP, JPY, INR, BRL, SGD, USD Instant – 1 day

Skrill All AUD, CAD, EUR, GBP, INR, USD, BRL Instant – 1 day

Asia Banks All MYR, IDR, VND Instant

SticPay All JPY, EUR, GBP, USD, HKD, TWD, KRW, SGD Instant – 2 days

FasaPay Nigeria USD, IDR Instant – 1 day

Virtual Pay All KES, UGX, TSH Instant – 1 day

Rupee Payments All INR Instant – 2 days

Rapyd All BRL, MXN, COP, CLP Instant – 2 days

Perfect Money All USD Instant – 1 day

Pagsmile South Africa BRL, CLP, COP, PEN, MXN, USD Instant – 1 day

Cryptocurrencies All ADA, BCH, BTC, DASH, ETH, LTC, PAX, XRP Instant – 1 day

Deposits

How to Deposit using Bank Wire Step by Step

✅You can find the bank wire option by logging into your trading account and selecting the “Funding” or “Deposits” section.

✅Choose IDR as your preferred currency if available. If not, you should know that FP Markets will convert your investment to one of its base currencies.

✅Enter the amount you want to deposit and the banking information that FP Markets provided.

✅Using the facilities offered by your bank, start the bank wire transfer and include any reference numbers that FP Markets would have given you for the transaction.

✅For your records, save a copy of the transaction receipt.

How to Deposit using Credit or Debit Card Step by Step

✅Go to the “Funds” or “Deposits” section of the client area and choose the credit/debit card option.

✅Select IDR if supported; if not, a currency conversion will be performed on your deposit.

✅Provide the card number, expiration date, CVV, and the amount of the deposit, along with other card information.

✅Verify the transaction and wait for the funds to be credited.

How to Deposit using Cryptocurrency Step by Step

✅Navigate to your trading account’s “Funds” or “Deposits” area, then choose “Cryptocurrency” as the deposit option.

✅Enter the amount of your deposit and choose the specific coin.

✅Log into your digital wallet using FP Markets’ unique address.

✅Confirm the transaction and wait for the blockchain to verify your deposit.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅Enter your account’s ‘Deposit’ area after logging in.

✅Select the e-wallet or payment gateway you want to use, such as PaymentAsia, which allows IDR deposits.

✅Log into your e-wallet and complete the transaction.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅Go to the “Funding” tab and locate the “Withdraw” option in your trading account.

✅Select “Bank Wire” as the withdrawal option, then provide your banking information.

✅Submit the withdrawal request and wait for the funds to return to your bank account.

How to Withdraw using Credit or Debit Cards Step by Step

✅Go to your trading account’s ‘Withdraw’ section and choose ‘Credit/Debit Card.’

✅Ensure the card details match those used for deposits and provide the withdrawal amount.

✅After reviewing the information, send in the request.

How to Withdraw using Cryptocurrency Step by Step

✅Go to your client area, pick the withdrawal option, and choose “Cryptocurrency.”

✅Enter your wallet address and the withdrawal amount.

✅Send in the withdrawal request.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Go to the withdrawal area of your trading dashboard after logging in.

✅Select one of the various payment gateways or e-wallets and use PaymentAsia for IDR withdrawals.

✅Indicate the withdrawal amount and follow any other steps indicated.

✅Submit the withdrawal request to FP Markets for processing.

What is the processing time for deposits?

Instant. Most deposit methods at FP Markets, including Credit/Debit Cards and e-wallets, offer instant processing for Indonesian traders.

Do they offer any protection against a negative balance for Indonesian traders?

Yes, FP Markets provides negative balance protection, ensuring Indonesian traders do not lose more than their account balance.

Leverage and Margin

The broker offers significant leverage of up to 1:500, making it particularly advantageous for forex and precious metals trading.

With a high degree of leverage, traders can significantly increase their exposure to different markets using a relatively small amount of capital.

As we engaged in trades within this high-leverage environment, it became clear that there was a significant potential for amplifying profits. However, we were well aware of the heightened risk associated with this field.

Margin requirements are set to cater to the varying financial capabilities of Indonesian traders, ensuring accessibility.

These requirements guarantee that traders can enter the market without a significant amount of capital, which closely agrees with their inclusive approach to trading.

Throughout our experience with the platform, we found the margin rates incredibly transparent. This transparency enabled us to easily determine the funds needed to open and sustain our positions.

As reviewers, we must highlight the importance of considering your risk tolerance and trading experience before utilizing the maximum leverage available as a prospective Indonesian client of FP Markets.

What are their margin call and stop-out levels?

Margin call is 100%, and Stop-out is 50%.

What maximum leverage can I use on Crypto CFDs?

1:5. You can use leverage of up to 1:5 on cryptocurrencies, meaning you can multiply your position by 5 times.

Educational Resources

We know every trader needs a solid foundation to trade forex successfully and safely. Here’s what FP Markets offers Indonesian beginner (and other) traders.

Traders Hub Blog

The Traders Hub Blog provides valuable educational content for Indonesian traders, covering market analysis, trading strategies, and financial news.

It aims to empower traders by helping them understand market intricacies and improve decision-making. The resource goes beyond basic trading concepts, delving into complex dynamics to navigate local and global market events.

Forex Calculator

The Forex Calculator is a useful tool for Indonesian traders, simplifying complex calculations and allowing quick evaluation of potential profits, losses, and trading costs.

It aids in risk management and trade planning, ensuring precision in the broker’s leveraged trading environment, particularly in competitive spreads and leverage options.

Trading Knowledge

The Trading Knowledge section offers a wealth of educational resources for Indonesian traders, covering fundamental trading basics and advanced strategies.

The collection includes introductory articles and in-depth guides on trading techniques, enhancing their understanding of the intricate forex market and supporting their learning journey.

Fundamental Analysis

The Fundamental Analysis resources are highly practical and insightful for Indonesian traders, providing insights into global economic events and indicators.

These resources are particularly useful for those analyzing policy decisions and political events, particularly in Indonesia’s commodity-driven economy, to incorporate macroeconomic factors into their trading strategies.

Trader’s Hub

Their Trader’s Hub is an educational platform offering webinars, eBooks, and video tutorials for traders of all expertise levels.

While we viewed this resource, we found it caters to beginners and advanced traders, providing a global perspective with localized relevance. The Hub covers many topics, ensuring Indonesian traders have access to a solid foundation.

Technical Analysis

Traders who depend on chart patterns and technical indicators will find the Technical Analysis resources extremely valuable.

We have explored a range of video courses and seminars that can help traders improve their skills in interpreting and utilizing technical data for trading.

In our experience, strong analytical skills are crucial for Indonesian traders who often face unpredictable currency movements, and these skills help them identify the right moments to enter or exit the market.

Economic Calendar

The Economic Calendar by FP Markets offers real-time updates on economic events and upcoming news that could impact financial markets.

Furthermore, the calendar also aids in strategy planning, allowing traders to anticipate market movements and manage their trades accordingly, making it an essential component of trading discipline.

Is there a glossary available for trading terms?

Yes, FP Markets offers a comprehensive glossary to help Indonesian traders understand complex trading terms and concepts.

Does FP Markets offer a platform for trading knowledge and updates?

Yes, FP Markets has a Trader’s Hub blog where traders can access the latest trading knowledge and market updates.

User Comments and Reviews

FP Markets’ good reputation precedes it, and here are some of the top user comments and reviews we found that prove it, especially in terms of customer support and assistance:

➡️“I recently ran into some verification troubles while setting up my first trading account, being a novice to the trading world. Steve Tee, a member of the support staff, went out of his way for me personally over WhatsApp before I ever asked for help, and he gave me clear, quick answers. The service was really clear and efficient, and I was quite satisfied.”

➡️“The FP Markets support agent astounded me with her lightning-fast responses and pinpoint precision. Their help was second to none, and I have no reservations about saying that the FP Markets Support team provides exceptional service.”

➡️“The service offered by FP Markets is second to none and available at all times. Their rapid and competent help never fails to satisfy me. I am really pleased with the service quality offered by FP Markets, and the platform has shown to be trustworthy and reliable for trading.”

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Conclusion

We can conclude our review of FP Markets by confidently stating that FP Markets is a robust platform for Indonesian traders, offering a wide range of financial instruments, competitive trading conditions, and high operational security.

We were especially impressed by the Raw account with its tight spreads and leverage options up to 1:500, especially because it is suitable for both novice and seasoned traders.

To cater to a range of Indonesian traders with sophisticated trading styles, FP Markets provides a wide array of platforms like MetaTrader 4, MetaTrader 5, IRESS, and the proprietary FP Markets App, giving them powerful tools and resources for effective trading.

However, like with any review, there are areas where FP Markets could improve to serve the Indonesian market better.

Our Insight

In my opinion, is FP Markets a good option for Indonesian traders. Leverage of up to 1:500 is offered when forex is traded and negative balance protection is applied. They also offer a non-expiring demo account which is great for beginners.

Our Recommendations on FP Markets

When considering the points that we discussed in our review, we can safely provide a few recommendations for FP Markets to improve its services overall, especially for Indonesian clients:

➡️Create forums where Indonesians can interact, share their strategies, and learn from one another.

➡️Include more payment methods available specifically in Indonesia and consider adding IDR as a base currency for trading accounts, helping traders minimize their trading expenses.

➡️Consider expanding the regulatory framework by acquiring more regulations and licenses in Asia.

FP Markets Pros & Cons

| ✔️ Pros | ❌ Cons |

| Registering an account with FP Markets is easy and quick | FP Markets charges withdrawal fees across payment methods |

| Indonesians can use leverage of up to 1:500 when they trade forex, and negative balance protection is applied | FP Markets is globally regulated but holds no licenses in Indonesia |

| FP Markets has a transparent trading environment that caters to all types of traders | IDR deposits and withdrawals are subject to currency conversion fees |

| FP Markets’ platforms are user-friendly and offer a range of features | The minimum deposit with FP Markets might not be low enough for complete beginners |

| The demo account with FP Markets does not expire | |

| FP Markets is known for its competitive ECN pricing across markets, especially major instruments | |

| Indonesian traders can use PaymentAsia for IDR deposits | |

| Apart from local payment methods, FP Markets offers traders various flexible deposit and withdrawal avenues |

you might also like: FXGT.com Review

you might also like: BDSwiss Review

you might also like: Octa Review

you might also like: HFM Review

you might also like: FBS Review

Frequently Asked Questions

Does FP Markets accept common Indonesian deposit methods?

Yes, FP Markets supports local deposits from Indonesian banks and e-wallets like PaymentAsia, among others. However, in our experience, FP Markets has limited local payment methods for deposits and withdrawals to and from Indonesia.

Can I trade micro-lots on FP Markets if I am new to forex?

Yes, you can trade micro-lots on FP Markets. FP Markets allows you to trade position sizes from 0.01 standard lots, reducing your risk exposure as you familiarize yourself with the online trading environment.

Can I still utilize Expert Advisors (EAs) on MT4 and MT5 with FP Markets?

Yes, you can. FP Markets allows using EAs for automatic trading on their MT4 and MT5 platforms.

Are there any limits to asset availability with the Islamic account option?

No, there should not be. FP Markets’ Islamic accounts should have the same asset selection as typical live accounts. However, note that FP Markets might restrict financial instruments on Islamic Accounts if they are not halal.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia