FXTM Review

Overall FXTM is considered low-risk with an overall Trust Score of 93 out of 100. They are licensed by one Tier-1 Regulator (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). The broker offers three different retail trading accounts: a Micro Account, an Advantage Account, and an Advantage Plus Account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overview

FXTM has been a leading global Forex and CFD broker since 2011, offering traders an extensive range of trading tools and educational resources. Furthermore, they are highly respected for their strict regulatory oversight in all operating regions, ensuring enhanced customer protection and transparency.

Notably, the broker is overseen by esteemed organizations such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Australian Securities and Investments Commission (ASIC).

What sets them apart from competitors are its strong safety measures: shielding against negative balances, keeping client funds segregated, and membership with the Investor Compensation Scheme (ICF).

With various account types available, novice traders seeking guidance and seasoned professionals can easily navigate their suitable choices on this platform. Additionally, beginners benefit from comprehensive learning resources tailored to accelerate their progress.

Moreover, the broker accommodates experienced users through support for MetaTrader platforms that offer powerful features essential for sophisticated trading strategies

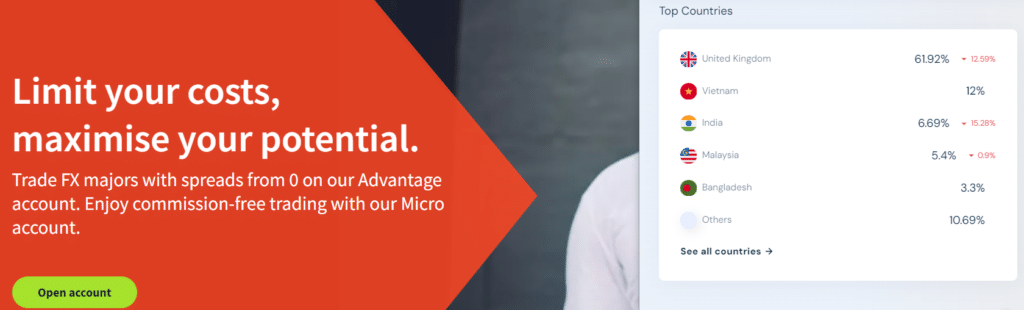

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders

FXTM is one of the Top 20 forex and CFD brokers in Indonesia.

Are there any countries where the broker doesn’t operate?

The broker does not provide its services in countries such as the United States.

Can I access the broker from any device globally?

Yes, you can access their platform from various devices, but ensure you’re in a region where their services are available.

At a Glance

| 🏛 Headquartered | Cyprus |

| ✅ Global Offices | Cyprus, Mauritius, Kenya, Nigeria, India, Indonesia, South Korea, South Africa, United Kingdom |

| 🗓 Year Founded | 2011 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, X, LinkedIn, Instagram, YouTube, Telegram |

| ⚖️ Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| 🪪 License Number | Cyprus – 185/12 South Africa – FSP 46614 United Kingdom – 777911 Kenya – 135 Mauritius – C113012295 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | The United States, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus, Hong Kong |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Top-tier global banks, exchanges, and major financial institutions |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant and Market |

| 📊 Starting spread | 0.0 pips, variable |

| 📞 Margin Call | 60% to 80% |

| 🛑 Stop-Out | 40% to 50% |

| ✅ Crypto trading offered? | Yes, CFDs |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:2000 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 10 USD / 156,953 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based FXTM customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Local Indian Payment Methods (UPI and Netbanking) Local Nigerian Instant Bank Transfers Equity Bank Transfer Ghanaian Local Transfer Africa Local Solutions M-Pesa FasaPay TC Pay Wallet Debit/Credit Cards Google Pay GlobePay Skrill PayRedeem Perfect Money Neteller Bank Wire Transfer |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| ✔️ Tradable Assets | Forex Forex Indices Spot Metals CFD Kenya Stocks Kenya Stocks CFD US Stocks US Stocks Hong Kong Stocks CFD EU Stocks Spot Commodities Spot Indices Stock Baskets Cryptocurrency CFDs |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Arabic, Chinese (Simplified), Chinese (Traditional), Czech, French, Hindi, Indonesian, Polish, Spanish, Italian, Korean, Malay, Russian, Thai, Vietnamese, Persian, Urdu |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | Yes |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is FXTM a safe broker for Indonesian traders? | Yes |

| 📊 Rating for FXTM Indonesia | 9/10 |

| 🤝 Trust score for FXTM Indonesia | 93% |

| 🎉 Open an account | Open Account |

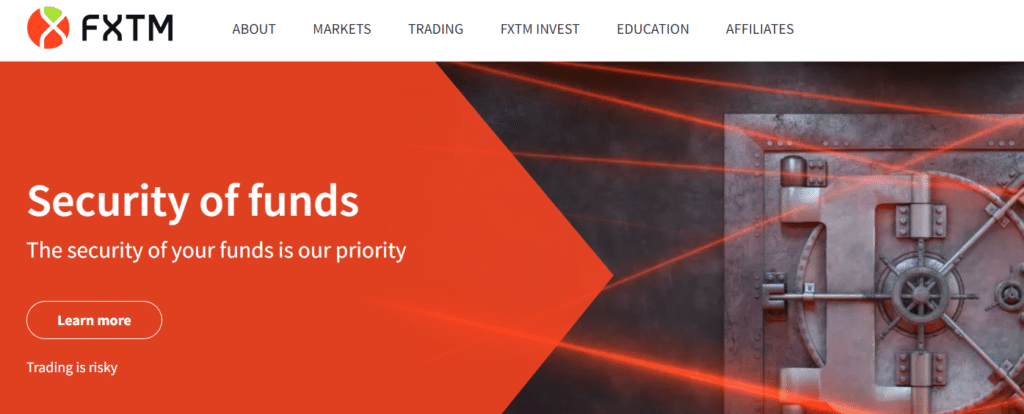

Safety and Security

Regulation in Indonesia

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

The broker implemented a comprehensive framework of measures. First, they prioritize the safety of traders’ funds, ensuring that their investments are protected against unforeseen events.

Does the broker employ encryption methods?

Yes, they protect user data and transactions with advanced SSL encryption.

What steps does the broker take in the event of a dispute?

They have a transparent dispute resolution process and are regulated, so they follow fair practices.

Awards and Recognition

The broker received the following recent awards and recognition:

FXTM Account Types and Features

Micro Account

The Micro Account is intended for traders who desire genuine experience but are hesitant to make large deposits. Some major markets, such as forex and metals, can be traded for as little as $10.

This account is popular among novices just becoming acquainted with the financial markets. Additionally, some advanced traders use it to test their most recent trading strategies and theories with real money.

Account Features Value

💰 Minimum Deposit Requirement 10 USD / 156,953 IDR

📊 Average spreads Floating from 1.5 pips EUR/USD

💱 Trading Instruments available Forex

Metals

Commodities

Indices

Forex Indices

Stock Baskets

💳 Commission charges None

📱 Platforms Supported MetaTrader 4, FXTM Trader

🌐 Base Account Currency US Cent, EU Cent, GBP Pence, or Nigerian kobo

🚀 Leverage and Margin Forex – from 1:3 to a maximum of 1:1000 (Fixed)

Metals – up to a maximum of 1:500 (Fixed)

📈 Order Execution Instant Execution

🎉 Open an account Open Account

Advantage Account

The Advantage Account is the most popular account offered, with spreads starting from zero on major FX pairs. It offers some of the best pricing in the industry, with spreads as low as zero on Gold/US Dollar (XAUUSD) and typically zero on major forex pairs.

Hundreds of instruments are available, including stocks, indices, and commodities. This account provides commission-free stock trading on the MT5 platform.

Account Features Value

💰 Minimum Deposit Requirement 500 USD / 7,774,000 IDR

📊 Average spreads From 0.0 pips EUR/USD

💱 Trading Instruments available Forex

Precious Metals

Commodities

Indices

Forex Indices

Stock Baskets

Stock CFDs on MetaTrader 5

Individual Stocks on MetaTrader 5

💳 Commission charges An average between $0.40 and $2, according to the trading volume

📱 Platforms Supported MetaTrader 4, MetaTrader 5, FXTM Trader

🌐 Base Account Currency USD, EUR, GBP, or NGN

🚀 Leverage and Margin Up to 1:2000 (floating)

📈 Order Execution Market Execution

🎉 Open an account Open Account

Advantage Plus Account

The Advantage Plus Account is comparable to the Advantage account, but commission-free trading is available.

However, with no commissions come wider spreads than the Advantage account. This account is preferred by experienced traders willing to incur spread costs and would rather trade commission-free.

Account Features Value

💰 Minimum Deposit Requirement 500 USD / 7,774,000 IDR

📊 Average spreads From 1.5 EUR/USD

💱 Trading Instruments available Forex

Precious Metals

Commodities

Indices

Forex Indices

Stock Baskets

Stock CFDs on MetaTrader 5

Individual Stocks on MetaTrader 5

💳 Commission charges None

📱 Platforms Supported MetaTrader 4, MetaTrader 5, FXTM trader

🌐 Base Account Currency USD, EUR, GBP, or NGN

🚀 Leverage and Margin Up to 1:2000 (floating)

📈 Order Execution Market Execution

🎉 Open an account Open Account

Demo Account

The demo account is a comprehensive tool designed to provide traders a risk-free simulation of the real trading environment. It is an ideal platform for both novice traders who are just starting and seasoned traders who wish to test new strategies.

The 30-day trial period is one of the most valuable features of the demo account. This provides ample time for traders to familiarize themselves with the platform, investigate various markets, and practice their trading strategies.

Demo accounts are accessible to anyone interested in trading because they are free. It is a low-cost way to gain valuable trading experience without incurring costs.

The demo account allows traders to tailor their trading environment to their preferences. This feature enables traders to create an environment resembling real-world trading scenarios.

The demo account provides access to all markets and assets. The financial instruments available to traders include forex, commodities, indices, and stocks. This broad access enables traders to comprehend how various markets function and are interconnected.

Finally, the demo account is compatible with Expert Advisors (EAs). EAs are automated trading systems that execute trades based on predefined rules on the trader’s behalf. This feature permits traders to test EAs in a risk-free environment before using them on a live account.

Islamic Account

The broker provides a swap-free or Islamic account option for traders who wish to engage in halal trading. This type of account adheres to the principles of Islamic finance, which prohibit earning or paying interest (Riba) and engaging in speculative or risky transactions (Gharar).

Islamic accounts ensure no interest is paid or received and that overnight/swap fees are not charged on leveraged positions. The account may utilize alternative structures instead of earning or paying interest.

Typically, investments are avoided in industries deemed incompatible with Islamic principles, such as alcohol, gambling, pork, and weapons.

The broker provides swap-free options for all accounts, including Micro, Advantage, and Advantage Plus. The commissions vary depending on the chosen account type; an additional fee may replace the swap fee. Typically, Islamic account holders are offered wider spreads and additional fees.

How many types of trading accounts does FXTM offer?

The broker offers a variety of account types, including Micro, Advantage, and Advantage Plus, to meet various trading needs.

Are Islamic accounts available with FXTM?

Yes, they provide Shariah-compliant Islamic swap-free accounts.

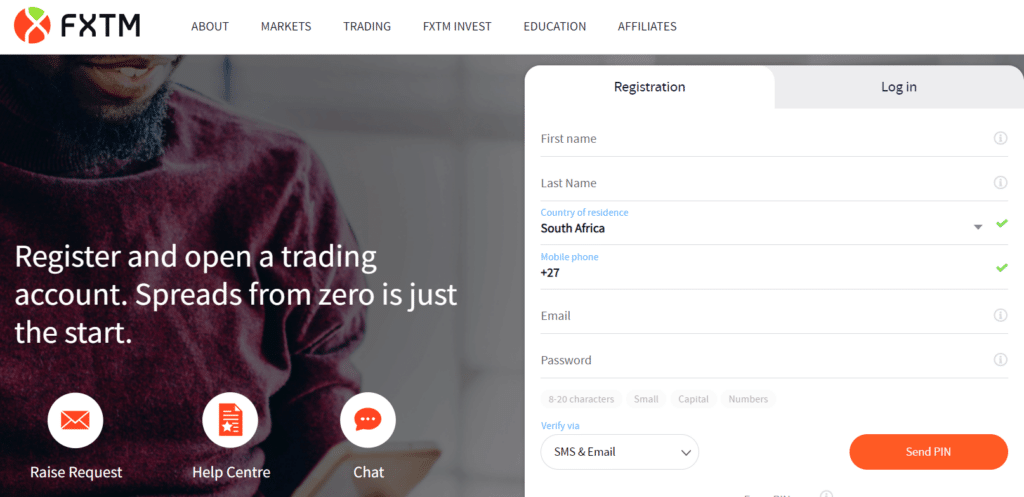

How to open an FXTM Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

Step 1 – Go to the Official FXTM website

Step 2 – Fill Out Your Personal Details

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

FXTM Vs FP Markets Vs Octa – Broker Comparison

| FXTM | FP Markets | Octa | |

| ⚖️ Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius | ASIC, CySEC | CySEC, SVG FSA |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader | MetaTrader 4, MetaTrader 5, Myfxbook AutoTrade, FP Markets App | MetaTrader 4, MetaTrader 5, OctaFX App, CopyTrade App |

| 💰 Withdrawal Fee | Yes | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 10 USD / 156,953 IDR | 100 USD / 1,554,800 IDR | 25 USD / 392,878 IDR |

| 📈 Leverage | 1:2000 | 1:500 | 1:500 |

| 📊 Spread | 0.0 pips, Variable | 0.0 pips | 0.6 pips |

| 💰 Commissions | From $0.4 to $2 | From US$3 | None |

| ✴️ Margin Call/Stop-Out | 40% to 50% (M) 60% to 80% (S/O) | 100%/50% | 25%/15% |

| ✴️ Order Execution | Market, Instant | Market | Market |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Micro Account, Advantage Account, Advantage Plus Account | MT4/5 Standard Account, MT4/5 Raw Account, MT4/5 Islamic Standard Account, MT4/5 Islamic Raw Account | MetaTrader 4 Habitual Trader, MetaTrader 5 Smart Trader |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | Yes | Yes | No |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 3 | 4 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

MetaTrader 4

Traders benefit from MetaTrader 4, a powerful platform for real-time market monitoring and effective trade management. Known for its user-friendly interface, advanced charting tools, and extensive selection of technical indicators, MT4 is a valuable resource.

The broker enhances this experience by offering an MT4 trading platform, granting access to various markets and instruments. Additionally, traders can utilize Expert Advisors (EAs) for automated trading strategies.

MetaTrader 5

Traders using MetaTrader 5 can execute, end, and oversee trades. They can also stay updated with real-time market monitoring and analysis. MT5 enables trading across various financial markets, including foreign exchange, commodities, CFDs (contracts for difference), indices, stocks, and more.

Furthermore, the broker grants traders access to these expanded options on the MT5 platform. Additionally, the platform offers additional timeframes and options for different order types and includes an economic calendar feature.

FXTM Trader

The proprietary mobile trading app of FXTM enables traders to conveniently access their trading accounts and execute trades at any place or time.

This application presents a user-friendly interface that enhances the trading experience, providing real-time price updates and numerous useful tools for efficient trading.

Through this app on their mobile devices, traders can effortlessly monitor market trends, manage positions effectively, and utilize various charts and technical analysis tools to make informed decisions.

Can I use third-party tools with FXTM’s platforms?

Yes, you can integrate various third-party tools and plugins, particularly with MetaTrader platforms.

Is there a demo mode on FXTM’s trading platforms?

Yes, the demo mode lets traders practice with virtual funds on FXTM platforms.

Range of Markets

Indonesian traders can expect the following range of markets:

Can I trade cryptocurrencies with FXTM?

Yes, the broker offers cryptocurrency trading, though availability may vary depending on regulations.

How frequently are new assets added to the platform?

The broker reviews and updates its asset offerings regularly based on market demand and conditions

Broker Comparison for a Range of Markets

| FXTM | FP Markets | Octa | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | No |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

FXTM Fees, Spreads, and Commissions

Spreads

Spread rates at FXTM are subject to change and can differ depending on various factors. These include the type of account utilized, the specific financial instrument being traded, and current market conditions for that particular day.

Below is a breakdown of average spreads based on different trading accounts:

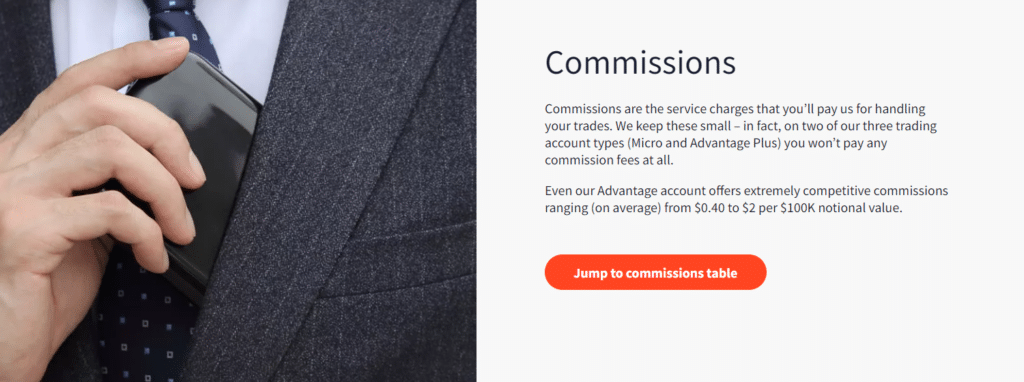

Commissions

The commission fees are exclusive to the Advantage Account, offering FXTM’s narrowest spreads (also called zero pip spreads). Depending on a trader’s overall activity, commission rates for trades made through the Advantage Account range from $0.40 to $2 per trade.

Overnight Fees

When a trader keeps a position open overnight, the account will be deducted or credited with overnight fees. The broker provides clear and transparent fees determined by factors such as the trading instrument used, the size of the position held, and its duration.

Deposit and Withdrawal Fees

The broker does not charge any deposit fees. However, the following withdrawal fees apply:

Inactivity Fees

The broker applies a monthly inactivity fee of $5 to dormant accounts after 6 months.

Currency Conversion Fees

Currency conversion fees could apply when Indonesian traders deposit or withdraw in IDR.

Does the broker charge a commission on trades?

Yes, commission charges vary by account type, with some accounts being free of charge and others charging a fee.

How does FXTM’s fee structure compare to competitors?

The broker’s fees are competitive, frequently offering traders cost-effective trading solutions.

FXTM Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

Are there any fees associated with deposits or withdrawals?

The broker does not typically charge deposit fees, but withdrawal fees may apply depending on the method used.

Is there a minimum withdrawal amount?

Yes, the minimum withdrawal amount is determined by the method used.

How to make a Deposit with FXTM

To deposit funds to an account with FXTM, Indonesian traders can follow these steps:

Sign in to your MyFXTM Dashboard account.

Proceed to “My Money”> “Deposit funds.”

Select your preferred deposit method, then click the “Deposit” button.

How to Withdraw from FXTM

To withdraw funds from an account, Indonesian traders can follow these steps:

Access your MyFXTM Dashboard.

Select ‘My Money’> ‘Withdraw funds’.

Select your preferred withdrawal method and click the ‘Withdraw’ button.

Education and Research

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Can I access the educational content without an account?

While some educational resources are free, others may necessitate an active account.

How often is the research content updated?

The broker’s research content, including market analyses and insights, is updated regularly to reflect current market conditions.

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

The broker offers a Refer a Friend program in which you can earn $50 for each friend or family member you refer to FXTM. You can earn up to $10,000 in real, withdrawable cash by using your personalized referral link to spread the word about FXTM in your online social circles.

Once qualified, your referral will receive $50 as well. You can track your referral progress as you promote and share FXTM pages with your contacts by visiting the dedicated ‘Refer a Friend Program’ section in your personal MyFXTM portal.

Do FXTM bonuses have any trading requirements?

Yes, bonuses frequently come with trading volume or other requirements that must be met before withdrawal.

How do I participate in the promotions?

Traders must typically opt-in via the dashboard or follow specific promotion instructions to participate.

How to open an Affiliate Account

To register an Affiliate Account, Indonesian traders can follow these steps:

Navigate to the FXTM Affiliates page.

Select the “Register Now” option.

Fill out and submit the registration form with your personal information.

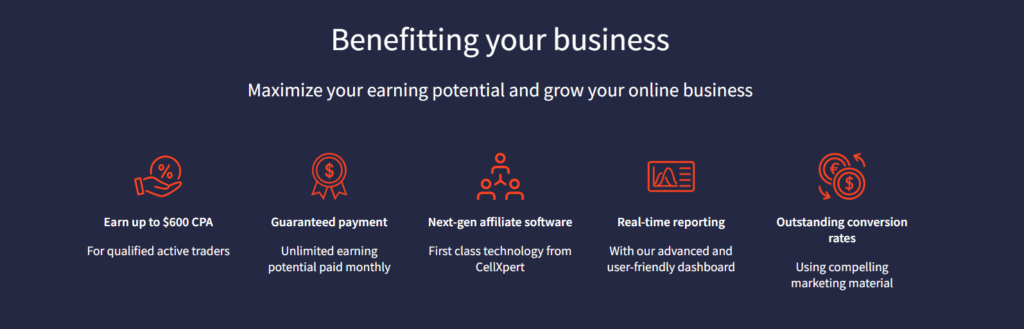

Affiliate Program Features

Customers in the foreign exchange partnership market benefit from a significant competitive advantage due to the partnership program’s unique benefits.

Through its innovative hybrid Affiliate Program and robust Introducing Brokers Program, this system is thoughtfully designed to cater to various partners, including bloggers, social media influencers, and Forex trainers.

Each of these programs serves as a portal to one of the world’s most important financial markets, with customization to meet the specific needs of potential business partners.

Affiliates primarily interact with their clients via digital channels, whereas Introducers place a premium on developing and maintaining personal relationships.

In addition, Introducers receive progressive refunds, whereas Affiliates continue to earn commissions for each Qualified Active Trader even after the Qualification Period has ended.

Choose the partnership program that best meets your company’s requirements to reap the most benefits. Joining the affiliate program provides numerous benefits, including:

How often are the affiliate commissions paid out?

Affiliate commissions are typically paid monthly, varying depending on individual agreements.

Can I track my referral’s activities?

Yes, the affiliate dashboard tracks referrals, trading activities, and commissions earned in great detail.

Customer Support

The broker offers dedicated customer support with typical operating hours in all languages except English, which is available 24/7.

How can I contact their customer support?

You can contact their customer support by visiting their website and looking for the “Contact Us” or “Support” section. They typically provide options such as live chat, email, and phone support. Choose the method that suits you best, and their support team will assist you with your inquiries.

Is the brokers’ customer support available 24/7?

The availability of their customer support may vary. While they strive to offer support around the clock, it’s essential to check their website or contact them directly to confirm their specific support hours. This ensures you can reach them when you need assistance with your trading account or platform.

Verdict

FXTM’s commitment to transparency and its strategic initiatives indicates a well-thought-out approach to forex trading.

Their emphasis on trader education and continuous support showcases a dedication to client success. They are a reliable and advanced choice for those venturing into the forex market.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: Octa Review

you might also like: Octa Review

you might also like: Exness Review

you might also like: XM Review

you might also like: HFM Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a proprietary copy trading platform, low minimum deposit, and high leverage | There is no customer support over weekends or public holidays |

| Traders can expect a commission-based pricing environment and transparency in the Forex market | There are inactivity fees charged |

| Major financial regulators oversee them in four jurisdictions. | The CFD fees are not the lowest |

| The minimum deposit starts from $10 | There is a limited product portfolio |

| Outstanding customer service is available in multiple languages | Withdrawal fees are charged |

| Indonesians can expect extremely low spreads from 0.0 pips | |

| There are several useful tools offered | |

| The broker’s account-opening process is simple and quick | |

| FXTM offers upgraded MT4/MT5 trading platforms | |

| Traders can access an electronic communications network account or ECN account opening, allowing traders direct market access | |

| There is a vast selection of trading instruments available | |

| There is beginner-oriented market research and educational content of the highest calibre |

Frequently Asked Questions

How do I become a verified FXTM client?

To become a verified client, you must complete the account verification procedure, which may require submitting specific documents.

How can I reset my MyFXTM password?

You can reset your MyFXTM password by using the option for account recovery provided on the login page.

What deposit/withdrawal methods does the broker offer?

They provide various deposit and withdrawal options, including M-PESA, FasaPay, Neteller, Skrill, Google Pay, and many more.

How long does it take to withdraw?

Depending on the payment method, withdrawals can be instant or take up to 5 working days.

What are the trading account minimum deposits?

The minimum initial deposit for a Micro Account is $10, while it is $500 for the Advantage and Advantage Plus Accounts.

Does the broker have VIX 75?

No, Volatility 75 / VIX is not currently available.

Where can I find the status of my deposit/withdrawal/internal transfer?

You can check the status of your transactions in your MyFXTM account.

Does FXTM have Nasdaq 100?

Nasdaq is available on FXTM’s Advantage and Advantage Plus Accounts on the Spot Indices market as NQ100_M.

Are there any fees to join the Affiliates programme?

There might be. The website contains information about any fees associated with joining the Affiliates program.

Do I need a website to join the Affiliates programme?

No, you do not need a website to become an Affiliate with them. However, having a website may be advantageous for promoting FXTM.

Is FXTM Safe or a Scam?

They are safe because the prestigious FCA and several other reputable regulatory bodies regulate it.

Is FXTM regulated?

Yes, they are regulated by CySEC, FSCA, FCA, CMA, and the FSC.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

There is currently no information regarding FXTM’ Corporate Social Responsibility initiatives or projects.