5 Best Indonesian Rupiah Forex Trading Accounts

The 5 best Indonesian Rupiah Forex Trading Accounts in Indonesia are revealed. We have explored and tested several prominent Forex Brokers with Rupiah accounts for Indonesians.

This is a complete guide to the 5 best Indonesian Rupiah Forex Trading Accounts.

In this in-depth guide you’ll learn:

- What is a Rupiah Forex Account?

- Who are the brokers that accept Rupiah trading options?

- How to choose an IDR Forex broker in Indonesia

- Which brokers are best for beginner traders?

- A closer look at the Indonesian Rupiah for Forex traders

- The Indonesian economy – explained.

And lots more…

So, if you’re ready to go “all in” with the 5 best Indonesian Rupiah Forex Trading Accounts in Indonesia…

Let’s dive right in…

- Kayla Duvenage

5 Best Indonesian Rupia Forex Trading Accounts – Comparison

| 🥇 Forex Broker | 🎉 Open An Account | 💳 Minimum Deposit | 💻 Trading Platforms | 📊 Minimum spread |

| 1. FBS | Open Account | 5 USD / 78,476 IDR | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade Platform | From 0.1 pips |

| 2. XM | Open Account | 5 USD / 78,575 IDR | MetaTrader 4, MetaTrader 5, XM Mobile App | From 0.0 pips |

| 3. eToro | Open Account | 200 USD / 3,143,030 IDR | eToro proprietary platform | From 1 pip |

| 4. FXTM | Open Account | 10 USD / 157,151 IDR | MetaTrader 4, MetaTrader 5, FXTM Trader | From 0.0 pips |

| 5. Alpari | Open Account | 5 USD / 78,476 IDR | MetaTrader4, MetaTrader5, Alpari Mobile App | From 0.4 pip |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

What is the Indonesian Rupiah?

The Indonesian rupiah is the country’s official currency. Bank Indonesia both issues and controls it. The rupiah has the currency code IDR and is traded on the forex market against a variety of other currencies.

1. FBS

Forex and CFD trading with FBS is highly recommended. They provide a variety of trading accounts and a cutting-edge, feature-rich trading app developed in-house. Traders can put their trust in FBS’s safety of customer assets and the fact that it offers cheap, competitive costs.

Traders may rest assured that FBS is a genuine broker because it is licensed in over 150 countries by organisations like CySEC, ASIC, FSCA, and IFSC. Combining STP with an ECN, FBS is able to handle data quickly and efficiently.

Min Deposit

5 USD / 78,476 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade

Crypto

Total Pairs

36

Islamic Account

Trading Fees

Account Activation

Since 2009, FBS has served as a global CFD broker. FBS has established itself as a trusted broker. Online forex broker FBS has swiftly become famous and is highly respected by its customers, leading to a daily increase of 10,000 new clients.

Unique Features

| 📝 Regulation | ASIC, CySEC, FSCA, and IFSC |

| 📱 Social Media Platforms | Facebook, Twitter, LinkedIn, YouTube, Instagram, Telegram |

| 📜 OJK Regulation? | No |

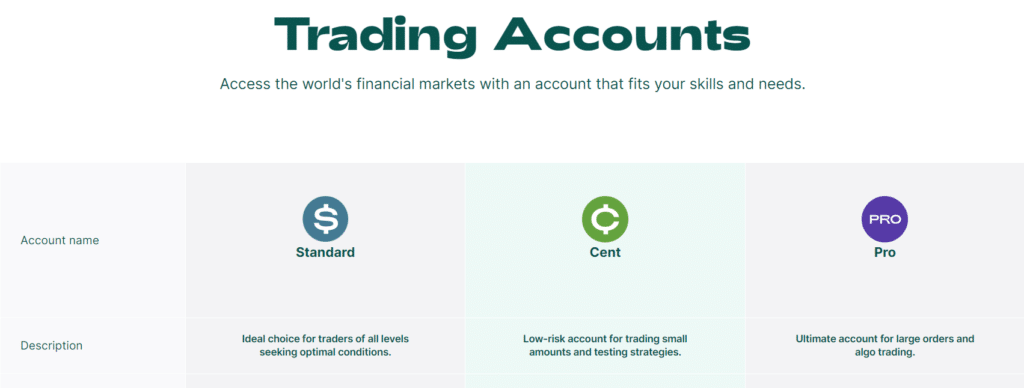

| 🔎 Trading Accounts | FBS Cent Account, FBS Micro Account, FBS Standard Account, FBS Zero Account, FBS ECN Account, FBS Crypto Account |

| 💻 Trading Platforms | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade Platform |

| 💸 Minimum Deposit | 5 USD / 78,476 IDR |

| 🔁 Trading Assets | Forex, Precious Metals, Indices, Energies, Stocks, Exotic Forex, Cryptocurrencies |

| 📊 Minimum spread | From 0.1 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders at FBS have their pick of several different account types, including a demo and an Islamic account, and they have access to round-the-clock customer service and a wide variety of bonuses and promotions. | FBS only accepts a limited number of deposit and withdrawal methods |

| The demo account expires after 40 days | |

| Withdrawal and deposit fees are charged | |

| Inactive accounts are charged |

2. XM

With a trust score of 84%, XM is considered a broker of low risk for Indonesian investors. When it comes to online trading platforms, security, customer service, account financing, and minimal fees are some of the most crucial elements, and XM delivers on all fronts.

This potent mix makes XM a top pick for those looking to enter the trading industry or advance their current careers.

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

More than a decade has passed since XM’s inception in 2009. It is one of the most reputable and strictly regulated brokerages, with offices in over 196 countries and a customer care team that can communicate in 30 languages.

Because of this synergy, XM is a great place for both novice and experienced traders to launch their careers.

Unique Features

| 📝 Regulation | ASIC, FSCA, IFSC, CySEC, DFSA |

| 📱 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, LinkedIn |

| 📜 OJK Regulation? | No |

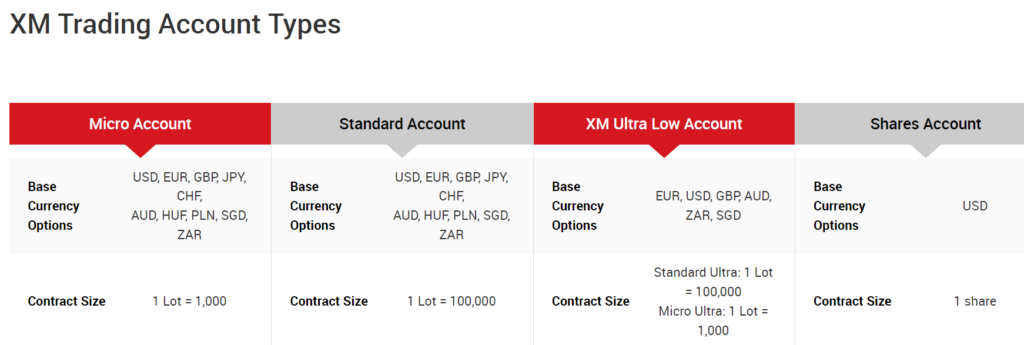

| 🔎 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💸 Minimum Deposit | 5 USD / 78,575 IDR |

| 🔁 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| More than 5 million people use XM’s services every day | There are no fixed spreads |

| Client funds are safe | Inactivity fees apply to dormant accounts |

| XM has won multiple awards since its founding in 2009 | |

| Deposits and withdrawals incur no fees | |

| XM is a low-cost forex broker with a high trust score. |

3. eToro

The main purpose of eToro is to provide universal access to the financial markets. In 2007, three Israeli businesspeople established the firm.

Min Deposit

200 USD / 3,143,030 IDR

Regulators

CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC

Trading Desk

eToro proprietary platform

Crypto

Total Pairs

40+

Islamic Account

Trading Fees

Account Activation

The philosophy driving eToro is that the less reliance there is on traditional financial institutions, the more trading and investing can be made simple and transparent. Indonesian traders with eToro have access to a plethora of cutting-edge trading and investment tools.

Unique Features

| 📝 Regulation | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC |

| 📱 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, LinkedIn |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | One Standard Live Trading Account with the option for Retail and Professional |

| 💻 Trading Platforms | eToro proprietary platform |

| 💸 Minimum Deposit | 200 USD / 3,143,030 IDR |

| 🔁 Trading Assets | Forex Pairs, Commodities, Exchange-traded funds (ETFs), Indices, Crypto Assets, Stocks |

| 📊 Minimum spread | From 1 pip |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has multiple Tier-1 regulations, making it a highly trusted, low-risk broker | Higher spreads on foreign exchange and contracts for difference |

| eToro offers Indonesian a user-friendly trading platform for web and mobile use | Fewer analytical tools |

| eToro provides access to a wide variety of markets | Only one retail account and trading platform. |

| VIP benefits are available to those who join the eToro club | |

| eToro has a unique, comprehensive, and robust social trading capability. |

4. FXTM

FXTM is an excellent choice for a low-risk, competitive forex broker. Its headquarters are in Cyprus and it was founded in 2011. In its over a decade of operation, FXTM has racked up more than 25 awards, including “Best Investment Broker.”

FXTM is a multi-regulated foreign exchange broker that is approved by the UK’s Financial Conduct Authority. Retail customers’ funds are segregated from other accounts at major financial institutions.

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

FXTM offers trading in the foreign exchange market around the clock, five days a week. It trades in all of the major, minor, and exotic currency pairs for fees that are reasonable to low.

FXTM has a streamlined and efficient customer support system that can be contacted via phone, chat, or email. Trading and technical support includes analysis of trading errors and solutions to trading issues as they emerge.

Unique Features

| 📝 Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| 📱 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, LinkedIn, Telegram |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💸 Minimum Deposit | 10 USD / 157,151 IDR |

| 🔁 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs, Commodities, Stock Baskets |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated, widely-used trading platform that provides its customers with convenient, speedy deposit and withdrawal options with no hidden fees. | There are inactivity fees that will be applied if the trading account goes dormant |

| There is a wide variety of learning resources available. | |

| FXTM provides multilingual, specialised local support in your area |

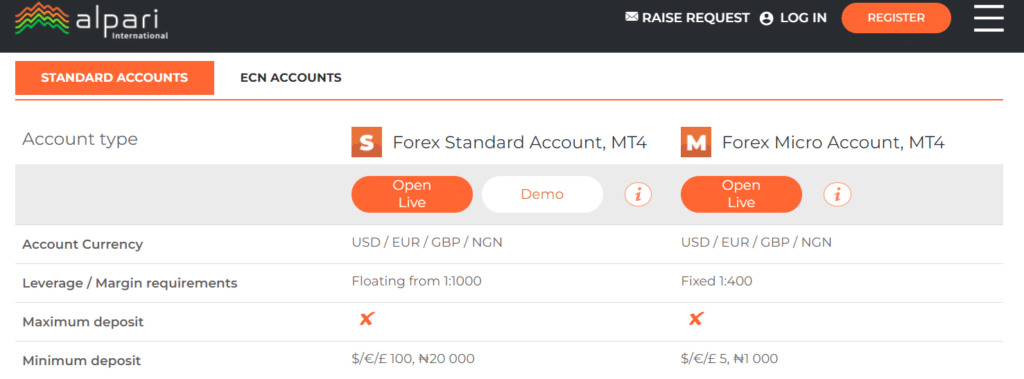

5. Alpari

Forex Standard Account, Forex Micro Account, Forex ECN Account, and Forex Pro Account are the four retail trading accounts available from Alpari.

Alpari is a major player in the industry. Regular traders and investors can rely on a dedicated team to provide comprehensive trading and investment solutions.

Min Deposit

5 USD / 78,476 IDR

Regulators

Financial Services Commission of Mauritius

Trading Desk

Crypto

Total Pairs

61+

Islamic Account

Trading Fees

Account Activation

Retail traders can take advantage of a wide range of services designed to assist them in getting superior customer service, trading conditions, and investment decision-making resources. Alpari is a well-known broker worldwide since it provides its clients with a trustworthy and open trading platform.

Alpari serves more than 2 million registered customers from 8 offices in 5 countries across 3 continents. Alpari is a broker with over twenty years of experience in a wide variety of financial markets, and they offer more than two hundred and fifty different financial products.

Unique Features

| 📝 Regulation | Financial Services Commission Mauritius (FSC) |

| 📱 Social Media Platforms | Facebook, Twitter, Instagram |

| 📜 OJK Regulation? | No |

| 🔎 Trading Accounts | Forex Standard Account, Forex Micro Account, Forex ECN Account, Forex Pro Account |

| 💻 Trading Platforms | MetaTrader4, MetaTrader5, Alpari Mobile App |

| 💸 Minimum Deposit | 5 USD / 78,476 IDR |

| 🔁 Trading Assets | 61 pairs – Forex Major Pairs, Minors, Exotics, 5 Spot Metals, 14 Spot CFDs |

| 📊 Minimum spread | From 0.4 pip |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Alpari provides copy trading opportunities and a proprietary mobile trading app | Alpari does not have Tier-q or Tier-2 regulations |

| Alpari allows Muslims to convert their live account into an Islamic Swap-free account | There are no fixed spread accounts |

| Alpari offers tight spreads and competitive commissions | Charges an inactivity fee |

| Alpari has a global presence and has been in business for decades | Charges withdrawal fees |

| Alpari allows Indonesian traders a variety of local deposit and withdrawal options | Offers a limited range of tradable instruments |

| By accepting deposits in IDR, Indonesian traders can avoid costly currency conversions. | |

| FxWirePro provides traders with news updates, while AutoChartist allows for hands-free trading. |

How to choose the best IDR Forex Brokers in Indonesia

Indonesian traders must evaluate the following components of an IDR Forex broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Indonesians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Indonesians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Indonesians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Indonesians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Indonesian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

Research can include some of the following:

A closer look at the Indonesian Rupiah (IDR) for Forex traders

Located in Southeast Asia, the archipelago nation of Indonesia is home to more than 17,000 islands and uses the Indonesian Rupiah (IDR) as its official currency.

The Indonesian Rupiah is issued and managed by Bank Indonesia, the country’s central bank. In 1946, the Dutch East Indies Guilder was replaced by the Indonesian Rupiah as the country’s official currency.

Due to high rates of inflation, it has been redenominated multiple times since then. As Indonesia’s economy has strengthened, the currency has become more stable. The Indonesian Rupiah is issued and managed by Bank Indonesia, the country’s central bank.

It’s vital to the country’s economic prosperity since it helps keep the currency stable and implements monetary policies.

The Indonesian Economy

The economy of Indonesia is founded mostly on four pillars: agriculture, manufacturing, exports, and natural resources.

The textile and auto industries are flourishing, and the country is also a major producer of palm oil, rubber, and coal. Tourism and other service industries also play a key role in the national economy.

However, Indonesia’s economy is threatened by a number of factors, such as its exposure to global commodity price swings, the need for new infrastructure, and the potential effects of climate change on the country’s agriculture and natural resources.

Economic growth, economic diversification, and social issues like income inequality and poverty reduction are all targets of government policy initiatives. Indonesia uses the Rupiah as its national currency, which is controlled by the Bank of Indonesia.

The value of the currency is set by market forces and possible intervention from the Bank under a managed floating exchange rate regime.

There are a wide variety of banknotes and coinage available in IDR. Natural resources, agriculture, manufacturing, and services make up the backbone of Indonesia’s economy, but the country confronts difficulties due to its exposure to global market volatility, its need to improve its infrastructure, and the potential effects of climate change.

Trading exotic currencies like the IDR

One major currency paired with a currency from a developing or emerging market constitutes an exotic currency pair.

When a lesser-used currency, like the Turkish lira (TRY) or the Hungarian forint (HUF), is coupled with a more widely used currency, like the US dollar (USD) or the euro (EUR), an exotic forex pair is formed.

Interest rates, geopolitical instability, the soundness of their country’s economy, and the level of foreign direct investment into their domestic market are all factors that affect the price of exotic currency pairs.

Since exotic pairs are typically less liquid than major currency pairs, traders may prefer to focus on the most widely traded exotic currency pairs.

Despite the higher volatility and lower liquidity of exotic currency pairs, several proven trading methods can be successfully implemented in the foreign exchange market:

Trend Trading

Identifying an overall trend for a currency pair and then going long or short based on whether the trend is bullish or bearish is a common trading technique for exotic currencies.

When speculating on the price movements of exotic currencies, trend trading can provide the quantitative facts to support your decision-making, despite its reliance on technical research rather than fundamental analysis.

Breakout strategy

When an asset’s price breaks through a previously established support or resistance level, traders can profit by acting on both technical and fundamental analysis. Ascending and descending triangles, pennants, and wedges are the most common chart patterns used to predict price movement after a breakout.

An important consideration when trading with a breakout strategy is the possibility of a false breakthrough.

Range trading

When trading an exotic currency pair, it’s common practice to do so inside a predetermined range of support and resistance. Traders look for chart patterns like wedges and triangles to corroborate their forecasts about the direction of a market, and they attempt to benefit from the range’s peaks and troughs by trading long or short.

The Best Forex Brokers in Indonesia

In this article, we have listed the best brokers that offer IDR trading accounts to Indonesian traders. We have further identified the brokers that offer additional services and solutions to Indonesian traders.

Best MetaTrader 4 / MT4 Forex Broker

Min Deposit

10 USD / 157,151 IDR

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader mobile, Exness Trade App, Exness Terminal, MetaTrader 5, MetaTrader 4, MetaTrader WebTerminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best MetaTrader 4 broker in Indonesia. Exness is a brokerage that has earned a good reputation among investors thanks to its long history of regulation by a wide variety of agencies and its generous leverage ratios. Exness is a great choice for investors in Indonesia because it provides round-the-clock service.

Best MetaTrader 5 / MT5 Forex Broker

Min Deposit

100 USD / 1,571,515 IDR

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, CYCES, ISA, JFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best MetaTrader 5 broker in Indonesia. Trusted broker AvaTrade provides customers with over 1,250 trading options across a variety of financial markets. AvaTrade’s services are particularly appealing because they are tailored to the needs of Indonesian traders.

Best Forex Broker for beginners

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best forex trading platform for beginners in Indonesia. XM offers a wide array of trading strategies in an effort to provide a welcoming environment for inexperienced traders. XM provides a wealth of resources for those interested in learning more about foreign exchange trading.

Best Low Minimum Deposit Forex Broker

Min Deposit

5 USD / 78,476 IDR

Regulators

Financial Services Commission of Mauritius

Trading Desk

Crypto

Total Pairs

61+

Islamic Account

Trading Fees

Account Activation

Overall, Alpari is the best minimum deposit forex trading platform in Indonesia. Alpari streamlines the deposit and withdrawal processes for Indonesian traders by supporting their local methods. Alpari has low spreads and commissions that are inexpensive. Alpari, a financial company that offers a trading application, also offers a software program for copy trading.

Best ECN Forex Broker

Min Deposit

200 USD / 3,143,030 IDR

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, WebTrader, MetaTrader Mobile, cTrader, cTrader Web, cTrader Mobile

Crypto

Total Pairs

65

Islamic Account

Trading Fees

Account Activation

Overall, IC Markets is the best ECN forex trading broker in Indonesia. IC Markets is an established ECN trader with a stellar reputation and history of success. IC Markets is a brokerage firm that allows for a wide variety of trading strategies, including hedging, scalping, and more. They also have accounts with cheaper transaction fees, accounts that adhere to Islamic principles, and practice accounts.

Best Islamic / Swap-Free Forex Broker

Min Deposit

50 USD / 785,757 IDR

Regulators

FCA

Trading Desk

MetaTrader 4, Trading Station

Crypto

Total Pairs

7

Islamic Account

Trading Fees

Account Activation

Overall, FXCM is the best Islamic/swap-free forex trading platform in Indonesia. Foreign Exchange (Currency) Trading Services for Retail and Institutional Clients FXCM is a well-known organisation in the international market that specialises in providing such services. FXCM has had the distinction of being the first Forex broker to be listed on the New York Stock Exchange (NYSE: FXCM) since its inception in 1999.

Best Forex Trading App

Min Deposit

10 USD / 157,151 IDR

Regulators

CySec, FSC

Trading Desk

MT4, MT5, Mobile Trading

Crypto

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, FXTM has the best forex trading app in Indonesia. FXTM provides its customers with a selection of three different live trading accounts, in addition to a wide range of cutting-edge trading tools. A demo account is available to everyone with a live trading account at FXTM.

Best Forex Rebates Broker

Min Deposit

100 USD / 15,715,150 IDR

Regulators

CySec, FSCA, FCA

Trading Desk

FxPro Trading Platfrom

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overall, FxPro is the Best Forex Rebates Broker in Indonesia. Located in the United Kingdom, FxPro is a brokerage firm that focuses on providing STP and ECN services to its customers.

Monthly forex cashback refunds of up to 30% may be made available to retail traders as direct transfers into their trading accounts.

Best Lowest Spread Forex Broker

Min Deposit

100 USD / 1,555,300 IDR

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best lowest spread forex trading platform in Indonesia. Tickmill is a low-cost broker that supports numerous trading methods. Users of Tickmill can make deposits into their accounts using a number of different methods, all of which are free of charge. This facilitates the user’s trading activities.

Best Nasdaq 100 Forex Broker

Min Deposit

0 USD / 0 IDR

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 5, MetaTrader 4, HFM App

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HFM is the best Nasdaq 100 forex trading platform in Indonesia. New traders will appreciate HFM’s minimal opening deposit requirement and extensive library of trading resources. At HF Markets, you can get as much as a 1:1000 leverage.

Best Volatility 75 / VIX 75 Forex Broker

Min Deposit

0 USD / 0 IDR

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Total Pairs

80

Islamic Account

Trading Fees

Account Activation

Overall, IG is the best Volatility 75/VIX 75 forex trading platform in Indonesia. Traders from Indonesia can now join the IG Academy. Professional traders have access to a wide variety of state-of-the-art trading instruments.

Best NDD Forex Broker

Min Deposit

100 USD / 1,625,795 IDR

Regulators

ASIC, CySEC, FSCA, FSA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best NDD forex trading broker in Indonesia. FP Markets accepts a wide variety of deposit and withdrawal methods. FP Markets is noted for its low, competitive spreads thanks to the ECN (Electronic Communication Network) pricing technique it uses.

Best STP Forex Broker

Min Deposit

0 USD / 0 IDR

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best STP forex trading broker in Indonesia. Using Oanda’s advanced trading tools does not necessitate a large initial investment. Oanda provides a variety of trustworthy and adaptable trading tools.

Best Sign-up Bonus Broker

Min Deposit

10 USD / 157,151 IDR

Regulators

FSC

Trading Desk

R StocksTrader, RoboForex terminals, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

40+

Islamic Account

Trading Fees

Account Activation

Overall, RoboForex is the best sign-up bonus forex trading platform in Indonesia. RoboForex welcomes new clients with a generous 100% bonus on initial deposits and provides them with access to a wide range of trading opportunities across many financial markets.

Overview

Overall, IDR accounts allow Indonesian traders to make deposits without incurring conversion fees. Indonesian traders should sign up with brokers offering IDR accounts that are regulated and provide competitive trading conditions.

you might also like: Best Forex No-Deposit Bonus Brokers

you might also like: Best Forex Trading Platforms

you might also like: Best Forex Trading Platforms

you might also like: Best ECN Forex Brokers

you might also like: Best CFD Forex Brokers

Frequently Asked Questions

Can I trade Forex in Indonesia?

Yes, In Indonesia foreign exchange trading is lawful. For local brokers in Indonesia, however, foreign exchange trading remains unregulated. For this reason, many Indonesians who engage in foreign exchange trading use the services of foreign forex brokers based outside the country.

Where can I trade exotic currencies like the IDR?

Any forex broker will allow you to trade exotic currency pairs however some will have more options than others.

What are the best exotic pairs to trade?

Some of the most recommended exotic pairs to trade include:

- USD/TRY (US dollar/Turkish Lira)

- EUR/TRY (Euro/Turkish lira)

- USD/CZK (US dollar/Czech koruna)

- USD/ZAR (US Dollar/South Africa Rand)

- EUR/MXN (Euro/Mexican peso)

- USD/HUF (US dollar/Hungarian forint)

- USD/SEK (US dollar/Swedish krona)

Which currency is most profitable in Forex?

A trader’s approach to the foreign exchange market and the currency pairs they choose to focus on will determine their level of success. EUR/USD, USD/JPY, GBP/USD, USD/CAD, AUD/USD, and CHF/USD are among the most traded and potentially lucrative currency pairs in the foreign exchange market.

Who trades exotic options?

The OTC market is the typical venue for trading exotic options. The Over-the-Counter (OTC) market is a dealer-broker network as opposed to a centralised exchange like the New York Stock Exchange (NYSE). In addition, the asset underlying an exotic option may be very different from the asset underlying a standard option.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia