FXView Review

FXView is a CFD and Forex broker ideal for all types of traders in Indonesia. The broker welcomes beginners and is also ideal for professionals. They charge zero-pip spreads and offer flexible trade positions from micro-lots.

- Louis Schoeman

Updated : May 07, 2024

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

50 USD / 792,000 IDR

Regulators

CySEC, FSCA, FSC, SEBI

Trading Desk

ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overview

Throughout our investigation into this broker, we consistently saw that FXView is a notable broker in global financial trading.

The company history shows that FXView started its operations in 2009 and has since established a solid reputation.

They are renowned for providing transparent trading conditions and an extensive selection of educational materials. These conditions and tools are specifically designed to cater to traders worldwide, including those in Indonesia.

Built on the foundation of the Finvasia Group, the broker was established to provide easy access to advanced trading tools for institutional market participants and individual investors.

In addition, from what we can draw from the broker’s website, they have consistently demonstrated a dedication to staying ahead of the curve and adhering to rigorous regulations.

With a global presence in over 180 countries, FXView possesses extensive knowledge of various market dynamics, providing Indonesian traders with significant advantages.

Introducing multi-currency accounts is a strategic decision aimed at minimizing currency conversion fees, which resonates with the priorities of Indonesian traders: cost efficiency and effectiveness.

Throughout its growth, the broker has broadened its range of products to encompass a diverse selection of assets, including forex pairs, commodities, cryptocurrencies, indices, and stocks.

In addition, it has used platforms such as MetaTrader 4, MetaTrader 5, and ZuluTrade, which are well-suited for Indonesian traders looking for a comprehensive trading experience.

Today, they are widely acknowledged as a leading broker on a global scale, consistently adjusting to cater to the requirements of traders.

In our experience, FXView’s expertise in the Indonesian market and its ability to provide access to local markets and educational resources for traders of all levels make it a highly appealing option for traders in the region.

For Indonesian traders interested in FXView, we recommend visiting the broker’s official website or reliable financial news sources for the most up-to-date information because conditions can change quickly, attributed to the fast-paced markets and brokers’ aim to stay ahead of rivals.

How do FXView’s safety and security safeguards outperform those of its competitors?

The broker prioritizes the safety and security of its client’s assets by providing negative balance protection on all retail accounts, giving Indonesian traders peace of mind when trading.

What distinguishes FXView from its competitors?

FXView distinguishes itself with its social trading features, which enable Indonesian traders to interact with experienced global traders, access a variety of trading techniques, and profit from shared insights and teamwork.

At a Glance

| 🗓 Established Year | 2009 |

| ⚖️ Regulation and Licenses | CySEC, FSCA, FSC, SEBI |

| 🪪 Ease of Use Rating | 4/5 |

| 🚀 Bonuses | Yes, 100% deposit bonus, loyalty program, referral bonus |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade |

| 💻 Account Types | Zero Commission, Raw ECN, Premium ECN |

| 💰 Base Currencies | EUR, USD, GBP, AUD, CAD, ZAR |

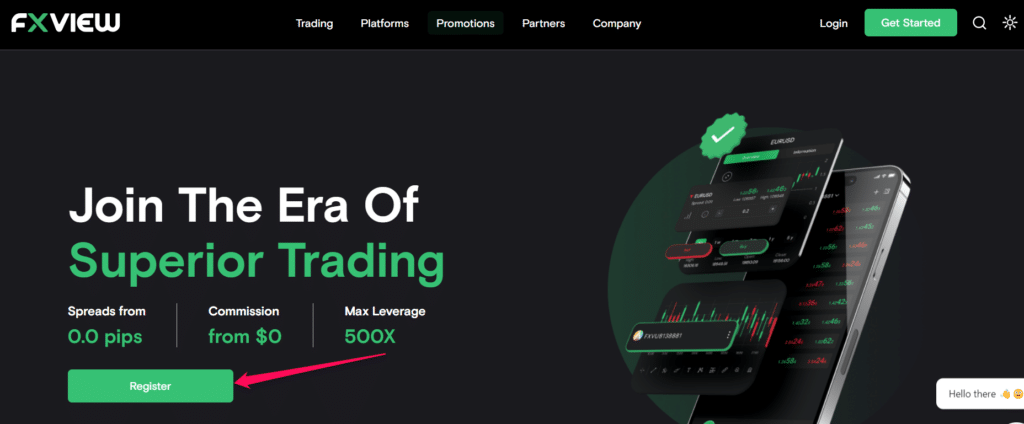

| 📈 Spreads | 0.0 pips |

| 📉 Leverage | 1:500 |

| 💸 Currency Pairs | 70; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 50 USD / 792,000 IDR |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Spanish, Chinese, Arabic, Vietnamese, German |

| ✔️ Fees and Commissions | Spreads from 0.0 pips; commissions from $1 per 100,000 USD traded |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States, North Korea, Sudan, Cuba, Myanmar, India, Syria, and others |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, commodities, cryptocurrencies, indices, stocks |

| 🎉 Open an account | Open Account |

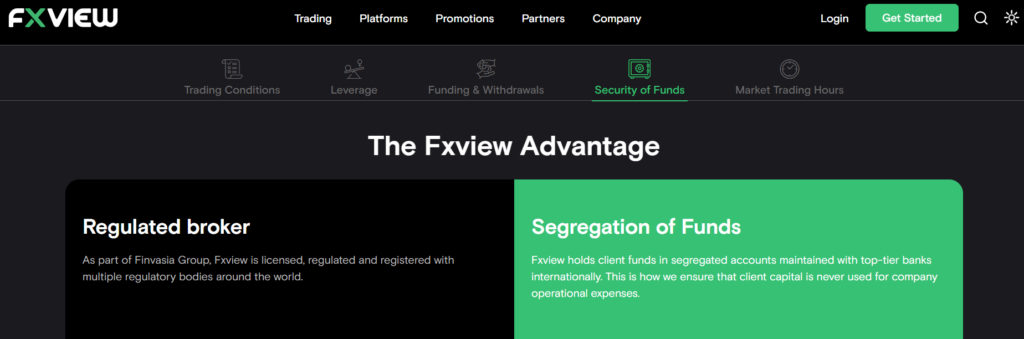

Regulation and Safety of Funds

During our investigation of FXView’s security protocols, we discovered a notable commitment to protecting the interests of Indonesian traders, notwithstanding the lack of domestic regulatory supervision in Indonesia.

The broker maintains compliance with global regulatory standards by obtaining licenses from reputable organizations such as CySEC and FSCA. These organizations enforce rigorous operational criteria and safeguard the interests of clients.

They implement stringent measures to safeguard traders’ funds, including the customary practice of segregating client accounts from company funds, which mitigates the potential for misuse and insolvency of the company and safeguards traders’ capital.

Furthermore, the broker’s participation in compensation funds provides additional financial security, which provides recourse in the exceedingly unlikely circumstance of broker default.

Combining these safeguards establishes a trading environment where Indonesian traders can concentrate on their operations securely, knowing that the broker proactively protects their interests with a solid security infrastructure.

Regulation in Indonesia

They are not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI). However, FXView’s global regulations are listed in the table below.

Global Regulations

⚖️ Registered Entity 🏦 Country of Registration 🪪 Company Reg. ✅ Regulatory Entity 🛍 Tier 🤝 License Number/Ref

FXView Europe under Charlgate Limited Cyprus 372060 CySEC 1 367/18

Finvasia Securities Private Limited India INZ000176037 SEBI 4 Reg. INZ000176037

Finvasia Capital Ltd Mauritius – FSC 4 IK21000018

Orivest Proprietary Limited South Africa 2018/30345/07 FSCA 2 FSP50410

Protection of Client Funds

🚫 Security Measure 🪪 Information

Segregated Accounts Yes

Compensation Fund Member No

Compensation Amount None

SSL Certificate Yes

2FA (Where Applicable) Yes

Privacy Policy in Place Yes

Risk Warning Provided Yes

Negative Balance Protection Yes

Guaranteed Stop-Loss Orders No

Which regulatory bodies are responsible for overseeing FXView’s operations in Indonesia?

They are regulated by CySEC and other international bodies, ensuring a secure trading environment for Indonesian clients.

Does the broker provide any compensation program for traders from Indonesia?

No. This fund might not provide coverage for traders from Indonesia and other non-EU countries.

Awards and Recognition

The achievements of FXView’s website features an outstanding collection of industry awards:

➡️They were named the “Best CFD Broker” award during the 2023 Forex Expo in Dubai.

➡️The broker received the “Best Global Broker” award during the UF Awards Global held in 2023.

➡️The FMAS awarded them the “Best Multi-Asset Broker” title in 2023.

➡️They were named the “Best ECN/STP Broker” at the 2023 UF Awards MEA.

➡️They were granted the “Most Trusted Broker” award during the Ultimate Fintech Awards held in 2022.

FXView Account Types

A first-hand exploration of FXView’s account types revealed options for beginners, casual traders, scalpers, and others. While we used a demo account to test these flexible live accounts, we could see that FXView offers competitive trading conditions across the board.

Zero Commission Raw ECN Premium ECN

✔️ Availability All; ideal for casual traders and beginners All; ideal for experienced traders All; ideal for scalpers and high-volume traders

💵 Markets All All All

💰 Commissions None; only the spread is charged $2 per 100,000 USD traded, per side $1 per 100,000 USD traded, per side

💻 Platforms All All All

🔨 Trade Size From 0.01 to 100 lots From 0.01 to 100 lots From 0.01 to 100 lots

📊 Leverage Up to 1:500 Up to 1:500 Up to 1:500

💸 Minimum Deposit 50 USD / 792,000 IDR 50 USD / 792,000 IDR 50 USD / 792,000 IDR

👉 Open an account Open Account Open Account Open Account

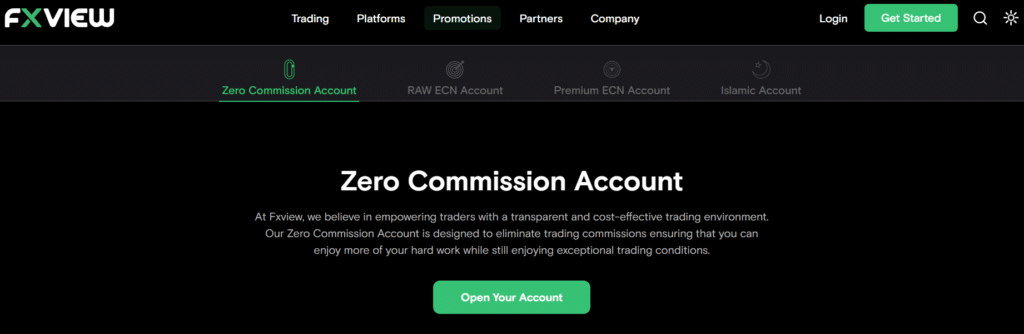

Zero Commission Account

Based on our research, the Zero Commission Account is the best option for Indonesian traders who want a low-cost entry point into the foreign exchange and contracts for different markets.

By doing away with trading commissions, this account type allows traders to participate in the markets while focusing solely on the spread. After testing this account, we believe it best suits novice traders or those who trade casually and infrequently.

With a leverage of up to 1:500, this account gives you a lot of room to manoeuvre in the market with a small starting capital requirement of only 792,000 IDR.

Raw ECN Account

Experienced Indonesian traders looking for a deeper connection to the market will find what they’re looking for with the Raw ECN Account.

The raw spreads on this account start at 0.0 pips, and the competitive commission is $2 for every 100,000 USD traded on either side. If you want to trade quickly and have access to top-tier liquidity providers, this account type is perfect for you.

Premium ECN Account

The Premium ECN Account is an excellent choice for serious traders in Indonesia. After reviewing the account, we were impressed by the extremely low commission rates—just $1 for every 100,000 USD traded—that surpass even the Raw ECN account.

For scalpers and high-volume traders who thrive on razor-thin margins and quick transaction execution, this feature is extremely tempting.

Premium ECN accounts are intended for serious investors since they have a higher minimum deposit requirement of 79.1 million IDR.

However, with such a high deposit, Indonesians get additional benefits, especially since substantial market positioning is possible with leverage ratios up to 1:500 on forex major pairs.

Demo Account

Based on our findings, the Demo Account is an excellent resource for local traders in Indonesia. We registered a demo account by clicking the “register” banner on the homepage.

Here, we had to provide a first name, country of residence, email address, user-generated password, and phone number. An OTP was sent to the email address we provided. Once the email address was confirmed, we were logged into the client portal automatically.

From here, we clicked the “Create Demo Account” banner in the top right corner of the dashboard and followed the steps to complete our Demo Account registration.

Based on our exploration of this account, the broker gives you $100,000 in virtual cash to trade with live pricing in a simulated trading environment. The demo account also gives traders access to several trading and learning tools.

Overall, this risk-free environment is perfect for both novice traders learning the ropes and seasoned pros honing their techniques.

This account is also useful for boosting Indonesian traders’ self-assurance, letting them practice trading in real-world settings, and putting their theoretical knowledge into practice.

Islamic Account

Muslim traders in Indonesia can find a solution with the Islamic Account, which complies with Islamic law by providing a swap-free trading experience.

This account is well-designed and offers the same conditions as the converted live account, as we saw in our assessment. Furthermore, it lets you maintain positions overnight without paying swap costs.

The Islamic Account has trading conditions, with spreads from 0.6 pips and negative balance protection. Furthermore, Muslim traders can access MetaTrader 4 with this account, allowing them to use EAs, scalping, hedging, and other strategies.

The layout of the Islamic Account demonstrates FXView’s dedication to inclusion and ethical trading. As a result, they can reach a wider audience in the religiously varied Indonesian market, which is important to many traders.

However, traders must note that positions held for longer than 6 days are subject to a set fee according to the market and financial instrument, with fees from $1 on forex up to $60 on commodities.

Despite these fees, the broker is extremely transparent about them and publishes the Terms and Conditions for perusal on the website under the Islamic Account option.

What extra features or perks do VIP account users get compared to other account types?

VIP account users receive special benefits, including priority customer service, access to premium analytical tools and research, cheaper trading expenses through narrower spreads and fees, and invites to exclusive events or seminars.

How does FXView protect the security and privacy of account information for Indonesian traders?

The broker uses advanced encryption and security procedures to protect Botswana traders’ personal and financial information, guaranteeing secure data transfer and storage while adhering to rigorous confidentiality and privacy guidelines.

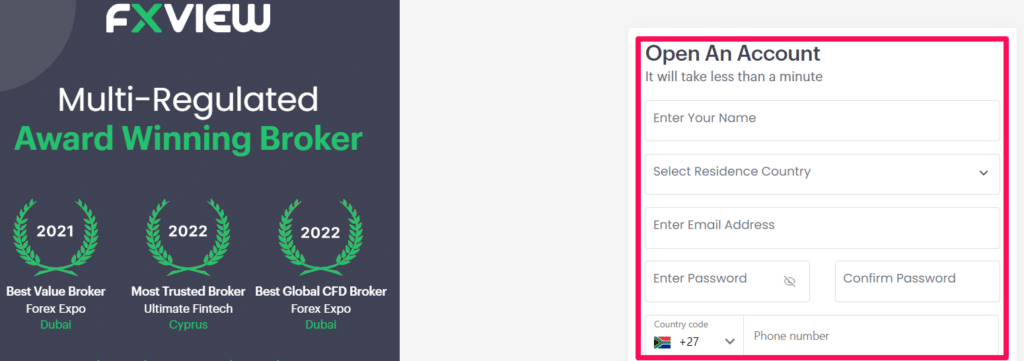

How To Open a FXView Account

Registering an account with FXView was a breeze, and here’s how Indonesians can do it:

Step 1 – Click on the Register option.

Indonesians can visit the official FXView website and find the registration section. In that section, they should select “Open an Account” or “Register.”

Step 2 – Complete the form.

Traders must complete the registration form by providing precise details and establishing a strong password.

Step 3 – Submit your documents.

To comply with FXView’s KYC and AML policies, traders must submit copies of their identification documents, such as a government-issued ID and a recent utility bill or bank statement, for address verification. Traders must wait for FXView to verify, typically within a few hours.

FXView vs. FP Markets vs. easyMarkets – Broker Comparison

| FXView | FP Markets | easyMarkets | |

| ⚖️ Regulation | CySEC, FSCA, FSC, SEBI | CySEC, FSCA, ASIC, FSC, FSA | BVI FSC, CySEC, ASIC, FSA |

| 📱Trading Platform | MetaTrader 4 MetaTrader 5 ActTrader | MetaTrader 4 MetaTrader 5 cTrader IRESS FP Markets App | easyMarkets Platform MetaTrader 4 MetaTrader 5 TradingView |

| 💰 Withdrawal Fee | None | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Min Deposit | 792,000 ($50) | 1.04 million IDR (AU$100) | 405,500 IDR ($25) |

| 📈 Leverage | 1:500 | 1:500 | 1:2000 |

| 📊 Spread | From 0.0 pips | 0.0 pips | 0.5 pips |

| 💰 Commissions | From $1 per lot | From US$3 | None, only the spread |

| ✴️ Margin Call/Stop-Out | 70%/50% | 100%/50% | 70%/30% |

| ✴️ Order Execution | ECN | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Zero Commission RAW ECN Premium ECN | MT4/5 Standard Account MT4/5 Raw Account MT4/5 Islamic Standard Account MT4/5 Islamic Raw Account | Web/App VIP Web/App Premium Web/App Standard MT4 VIP MT4 Premium MT4 Standard MT5 |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | Yes | No |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 4 | 7 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 50 lots | 50 lots |

| 💸 Minimum Withdrawal Time | 1 day | Instant | Instant |

| 💰Maximum Estimated Withdrawal Time | 1 day | Up to 10 working days | Up to 5 Days |

| 📞 Instant Deposits and Instant Withdrawals? | Yes, deposits | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

50 USD / 792,000 IDR

Regulators

CySEC, FSCA, FSC, SEBI

Trading Desk

ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

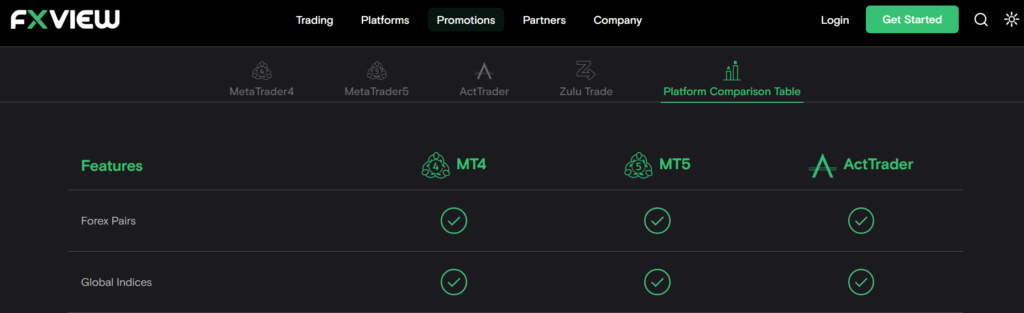

Trading Platforms and Software

Trading platforms are where FXView shines, and we were extremely impressed with how the features of each platform perfectly integrate and complement FXView’s trading conditions and features.

MetaTrader 4

After a thorough investigation, we discovered that most global traders value the MetaTrader 4 (MT4) platform because of its dependability and cutting-edge capabilities.

Because we evaluated the accounts offered by the broker, we noticed that the competitive spreads, which begin at 0.0 pips, perfectly match the platform’s seamless performance and capacity to manage complicated deals.

With FXView’s leverage options up to 1:500 and its user-friendly interface, we had the freedom to modify our positions according to our trading strategy and risk tolerance.

We were also impressed by the integration of FXView’s conditions, such as their raw pricing model, which enhances MT4’s sophisticated charting capabilities, even if standard features like Expert Advisors are frequently complimented.

ZuluTrade

Our experiences with ZuluTrade have demonstrated that Indonesia has a potential social trading market. This platform allows you to tap into the knowledge of experienced traders worldwide.

We believe that their policy of giving no minimum deposit on select accounts complements ZuluTrade’s low entry hurdles for copy trading.

The social components of the platform, together with the numerous account options provided by FXView, create an environment that fosters community trading.

Furthermore, their leverage options allow traders to adjust their exposure in reaction to the performance of copied strategies on ZuluTrade, which adds even another layer of complexity to the following approaches.

ZuluTrade’s real-time trade simulation, combined with FXView’s open pricing model, delivers an accurate and simple copy trading experience that we believe will appeal to Indonesians looking to get into trading without having to cope with a difficult learning curve alone.

ActTrader

ActTrader proved to be a delightfully adaptive trading environment. Furthermore, the “If Done Order” (IFO) tool is especially important since it improves FXView’s customizable leverage ratios by allowing traders to write complex order entries to only activate under certain conditions.

The ActTrader platform’s transparent pricing and fees supplement FXView’s spreads and commission structure by offering comprehensive information about potential charges.

ActTrader becomes a powerful tool when used with FXView’s vast choice of instruments, allowing portfolio diversification across many markets from a single interface.

MetaTrader 5

After reviewing the MetaTrader 5 (MT5), we discovered that it is a comprehensive and cutting-edge trading platform.

The broader market functionality and access to extra order types improve their offerings, particularly for Indonesian traders looking to adopt more complicated approaches.

Their narrow spreads and MT5’s broad analytical features enable you to capitalize on trading opportunities and undertake reliable market analysis immediately.

Trading with MT5 is made easier by seamlessly integrating trading instruments, particularly the vast variety of currency pairings and CFDs provided.

Based on our testing, using MT5 is both strategically advantageous and cost-effective, successfully meeting the needs of the modern Indonesian trader with its simple fee structure and lack of inactivity costs. FXView makes this feasible.

Is a demo account accessible for the trading platforms?

Yes, the broker provides demo accounts for all its trading platforms, allowing traders to test and acquaint themselves with the platform’s features and functions without risk.

How can I download and install the trading platforms?

Following simple installation instructions, traders can download and install the trading platforms directly from the broker’s website or via app stores for mobile devices.

Trading Instruments & Products

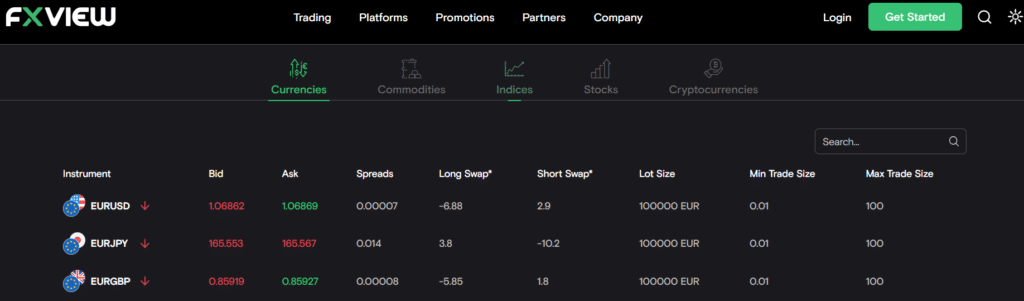

While limited, FXView’s portfolio of tradable products still lets Indonesians trade a few markets and their instruments, providing them the ideal way to diversify their portfolios. Here’s what you can expect from FXView in terms of financial instruments:

➡️Stock CFDs – The broker offers Indonesian traders 392 stock CFDs traded across various global sectors and companies, allowing them to leverage diverse industries and economic cycles to enhance their trading strategies.

➡️Index CFDs – They provide eleven index CFDs for Indonesian traders to speculate on the performance of leading corporations and industries, allowing them to mitigate personal stock exposure and understand market patterns.

➡️Forex – The broker offers Indonesian traders a wide range of seventy forex pairs, ranging from stable majors to exotic and minor currencies, providing greater volatility and potential financial gains.

➡️Commodities – They offer Indonesian clients five commodities to hedge against inflation and currency fluctuations, consisting of widely traded necessities in the international economic sphere.

➡️Crypto CFDs – The broker offers Indonesian traders five cryptocurrency CFDs, catering to the growing interest in digital currencies, allowing them to enter the volatile and potentially profitable crypto market, which is gaining prominence in the global financial arena.

What markets are accessible for trading?

The broker provides traders access to several markets, including forex, commodities, cryptocurrencies, indices, and stocks, allowing for various trading options.

Are there any limits on trading certain markets?

No, the broker normally does not impose limits on trading individual markets, but traders should study the applicable trading rules for each market.

FXView Spreads and Fees

Indonesians must consider all trading and non-trading fees to ensure that they can accurately calculate their costs and profits. We’ve gone onto the FXView website to reveal the typical fees Indonesians can expect from this transparent broker.

Spreads

After reviewing FXView’s cost structure, we looked into how it might affect Indonesian clients. We immediately saw that they maintain high transparency, particularly with their spread offering, which begins at a competitive 0.0 pips for each currency pair.

This small spread is very advantageous for scalpers and day traders who want to keep their entry and exit expenses as low as possible. As our investigation progressed, we saw how these low spreads could boost Indonesian trading outcomes, particularly when combined with large leverage ratios.

Commissions

Looking at the commission fees, we discovered a very competitive scenario for Indonesian traders. The Raw ECN account charges a fee of just $2 per 100,000 USD transacted per side. This rate falls even lower to $1 for Premium ECN account customers.

These low commission prices are consistent with their commitment to fair trading, allowing Indonesian traders to keep more earnings while executing large transactions without incurring substantial expenditures.

Overnight Fees

Overnight fees are a necessary part of forex trading for positions held overnight, and FXView is no exception. However, the company waives the first three nights of swaps for Islamic account users.

The broker discusses these fees on the website and gives an accurate breakdown of the swap fees that Indonesians can expect. Furthermore, all conditions and limitations regarding the Swap-Free option are discussed, ensuring that traders know what they can expect.

Deposit and Withdrawal Fees

When it comes to deposits and withdrawals, the broker stands out from other brokers since it does not charge any internal costs.

Inactivity Fees

One of the most trader-friendly rules we discovered was the lack of inactivity fees. This policy demonstrates the broker’s commitment to providing a flexible trading environment.

Therefore, Indonesian traders can arrange their market activity without feeling pushed to trade often only to avoid these penalties.

Currency Conversion Fees

Finally, currency conversion costs are an essential consideration for Indonesians, particularly considering the wide range of base currencies the broker offers. They do not provide IDR-denominated accounts, although it does handle trading in other major currencies.

As a result, traders must be aware of the conversion costs applied to IDR deposits and withdrawals, which are computed based on current currency rates. From the information available, we found these fees are moderate, allowing for effective foreign currency trading management.

What are the average spreads charged?

The broker charges competitive spreads as low as 0.0 pips on some account types, allowing traders to trade at a lower cost.

How does FXView manage overnight fees?

FXView offers comprehensive overnight charge schedules for numerous currency pairings, ensuring that traders are informed of any overnight expenses connected with holding holdings.

FXView Deposit & Withdrawal Options

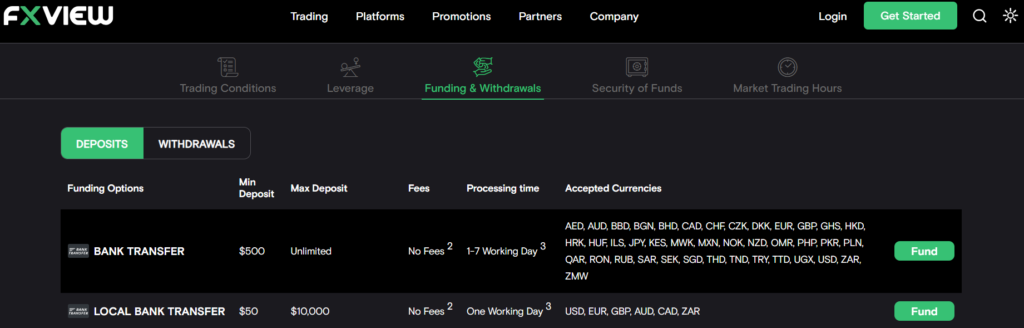

The broker stands out from other brokers by offering flexible and multi-currency deposits and withdrawals. To give Indonesians an idea of what they can expect, we put the important information regarding funding in the following table, giving them an overview.

Then, we’ve detailed the general steps Indonesians can follow to deposit and withdraw funds with FXView.

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

Bank Transfer (international) All AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, RUB, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZAR, ZMW 1 – 7 days

Local Bank Transfer All USD, EUR, GBP, AUD, CAD, ZAR 1 working day

Visa and MasterCard All EUR, USD, GBP, AUD, ZAR Instant

Help2Pay All USD, EUR, GBP, AUD, CAD, VND, IDR, THB, PHP, MYR Instant

Skrill All EUR, USD, GBP, AUD, ZAR, CAD Instant

Neteller All EUR, USD, GBP, AUD, ZAR, CAD Instant

Cryptocurrencies All BTC, USDT, ETH, USDC Instant

Deposits

How to Deposit using Bank Wire Step by Step

✅Log into the client portal and navigate to the Bank Wire option in the deposit methods section.

✅If available, select IDR as the transaction currency; otherwise, be prepared to convert your deposit to one of the accepted currencies (EUR, USD, GBP, AUD, CAD, or ZAR) through a currency conversion process.

✅Ensure that the deposit quantity you provide satisfies the account type’s minimal deposit requirement.

✅Use the bank information provided to establish a wire transfer from your bank account, and include the reference number provided to verify that the deposit is appropriately credited to your account.

✅Bank wire transfers might require a processing time of up to seven business days; if you deposit IDR, your funds will typically be converted during this time.

How to Deposit using Credit or Debit Card Step by Step

✅Navigate to the client portal’s deposit section and select the credit or debit card option.

✅Choose IDR to prevent currency conversion; otherwise, choose a currency available from the list.

✅Provide your card information, including the number, expiration date, CVV, and the deposit amount

✅Confirm the transaction and wait for funds to be credited to your account.

How to Deposit using Cryptocurrency Step by Step

✅Select your preferred cryptocurrency option in the deposit section of the client portal.

✅Copy the unique wallet address for the cryptocurrency you are depositing.

✅Log into your digital wallet, enter the deposit amount, and perform any verifications required to confirm the deposit.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅Log into your client portal and select your preferred e-wallet or payment gateway provider from the deposit choices.

✅Choose your deposit currency from the available options and note that IDR might not be supported.

✅You will be taken to the e-wallet or payment gateway’s website to log in and complete the transaction.

✅Enter your deposit amount and complete the transaction.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅In the client interface, initiate a withdrawal and choose a bank wire transfer method.

✅Provide your bank account information, ensuring precision for a seamless transaction, and select IDR as the currency if available; otherwise, prepare for a currency exchange.

✅Specify the amount you want to withdraw.

✅Submit your request and allow for processing.

How to Withdraw using Credit or Debit Cards Step by Step

✅Go to the withdrawal area of your client portal and choose your credit or debit card.

✅Choose your withdrawal currency and provide the amount that should not exceed the amount already deposited with the same card.

✅Finalize your withdrawal request.

How to Withdraw using Cryptocurrency Step by Step

✅Select the crypto withdrawal option from the client portal.

✅Choose your withdrawal currency.

✅Enter your unique wallet address into the required field.

✅Enter your withdrawal amount and submit the request for processing.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Log into your client portal on the website.

✅Select your preferred e-wallet or payment gateway and preferred withdrawal currency.

✅Enter your withdrawal amount and complete the withdrawal request.

Does FXView provide multi-currency accounts for deposits and withdrawals?

Yes, the broker offers multi-currency accounts, which allow traders to deposit and withdraw funds in a variety of currencies. However, IDR is excluded from this, leading to currency conversion fees.

Can I use my credit or debit card to deposit funds?

Yes, they support credit/debit card deposits, making it easy and secure for traders to fund their accounts and start trading immediately.

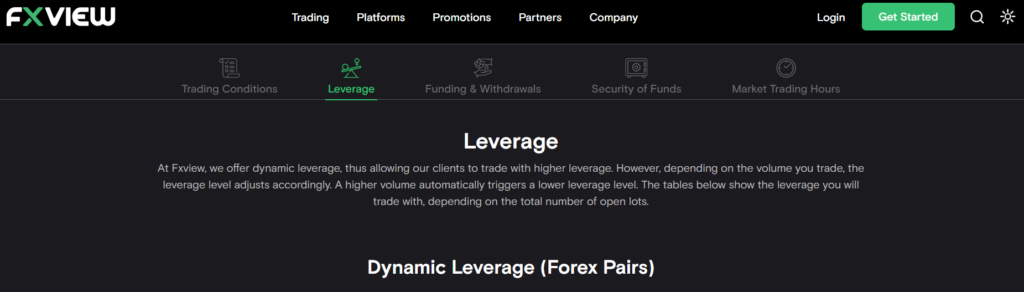

Leverage and Margin

We evaluated FXView’s leverage and margin requirements on the official website by comparing account types, and instruments, and reading the broker’s client agreement. The leverage ratios offered are ideal for the Indonesian market and appeal to all types of traders.

With a leverage of up to 1:500, the broker provides traders with substantial trading power that can be adjusted to suit various trading techniques and risk profiles.

By using the leverage offered, traders can expect their profits to be amplified, particularly in the foreign exchange markets where currency fluctuations are frequently negligible.

Nonetheless, they also exhibit accountability regarding leverage, given its high risk if the market moves against a trader’s position.

Margin requirements are subject to variation based on the magnitude of open positions. In proportion to the increase in exposure, the amount of leverage available to Indonesian traders diminishes.

This mechanism aids in the mitigation of risks linked to excessive leverage, safeguarding merchants against overextension.

Our research also indicates that the dynamic leverage system can benefit hedging strategies. The broker effectively minimizes the overall margin commitment in hedged positions by requiring margin only on net open positions.

We were impressed throughout our evaluation by how FXView adapted its leverage and margin structure to meet the requirements of Indonesian traders.

Their methodology balances between accommodating aggressive trading strategies and safeguarding against market volatility.

What leverage can I use?

Up to 1:500. The broker provides high leverage for forex trading and different levels for other instruments, giving Indonesian traders the freedom to manage their holdings.

What variables should I consider when determining the best leverage level?

Indonesian traders should choose leverage levels on FXView according to their risk tolerance, trading experience, and market conditions to ensure safe risk management.

Educational Resources

We found the dedicated “Education” section on the website under the “Platforms” option from the top toolbar. Here’s what we found in this section:

➡️Forex Glossary –The Forex Glossary provides a comprehensive guide to the complex language of forex trading, offering clarity on terms often confusing beginners. It also serves as a useful reference for experienced traders to stay updated on the evolving language of the financial markets.

➡️Market news – The market news feature provides Indonesian traders with timely financial updates on global economic developments, affecting market sentiment and trading decisions within the Indonesian context, ensuring they stay informed about potential forex market events.

➡️FAQ Section – The FAQ section offers quick answers to common questions, aiding Indonesian traders in problem-solving operational, technical, and trading issues, ensuring uninterrupted trading activities, and supporting uninterrupted trading activities.

➡️Market Insights – Their Market Insights provides Indonesian traders with strategic insights by analyzing market trends, enabling them to make informed trading decisions and identify potential investment opportunities.

➡️Market Holidays – The broker provides Indonesian traders with a comprehensive list of market holidays, enabling them to anticipate non-trading days, thereby preventing unexpected market gaps or liquidity issues.

➡️The “Learn” Segment – The broker offers a diverse range of educational content for both novice Indonesian traders and experienced traders, catering to both basic and advanced strategies.

➡️Webinars – Their webinars provide interactive sessions with expert analysis and live Q&A, enabling traders to directly engage with experts and apply their learnings to trading practices.

➡️Video Tutorials – The video tutorials are visually appealing and practical, covering topics from basic concepts to advanced analysis tools for experienced Indonesian traders. Their visual presentation aids in easier information absorption and retention, providing a significant advantage in the fast-paced trading environment.

Does FXView offer any live educational events?

Yes, they occasionally conduct live webinars and events where traders learn from industry professionals, engage with other traders, and obtain useful insights into trading tactics and market movements.

Can I access the instructional materials on my Samsung?

Yes, FXView’s teaching materials are available on mobile devices via its mobile app or mobile-friendly website, allowing traders to study while on the go and access educational resources at any time.

Bonuses and Promotions

We investigated FXView’s advertising strategy for Indonesian traders, and it indicates a tailored approach that addresses the local market’s unique demands and preferences.

The referral Bonus program effectively increases their market presence in Indonesia by tapping into social networks and community ties.

By rewarding both referrers and referrals, the broker encourages organic development within its existing customer base, ultimately enhancing its market position and reputation.

The Loyalty Program is very well suited to the Indonesian market. It rewards traders for their continuous commitment and consistent trading operations by providing benefits such as lower transaction costs and incentives on future deposits.

These incentives are designed to foster long-term trading relationships and build a loyal clientele, which is critical in Indonesia’s competitive forex market.

Furthermore, the 100% deposit bonus offer is a notable feature, allowing traders to double their original investment. This feature is especially appealing in Indonesia, where the availability of funds might be difficult for individuals wishing to enter the trading market.

Overall, FXView’s promotional products for Indonesian traders are methodically designed to enable market access, incentivize trading activity, and promote development via network-based referrals. These characteristics make the broker an appealing choice for traders of varying ability levels.

How can Indonesian traders access the 100% deposit bonus?

Once traders have successfully registered and verified their account, they must opt-in for the bonus before making their initial deposit.

Are there any trading contests available for Indonesian traders?

Yes. FXView regularly hosts trading contests that provide extra rewards and incentives.

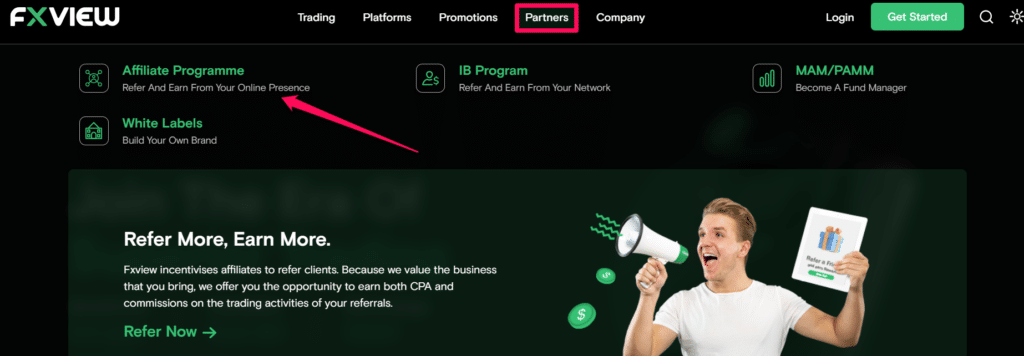

Affiliate Programs

Features

In Indonesia, the affiliate program provides a distinct set of features that appeal to the dynamic and social character of the local trading community. Our investigation shows that the software suits Indonesian traders’ collaborative mentality well.

The program’s compensation scheme is intended to give affiliates a consistent income stream by compensating them for the trading volume created by the clients they recommend.

In our experience, this is especially tempting in Indonesia, where a strong culture of community-based company growth exists.

The broker provides affiliates with a wide range of advertising materials, which are vital for attracting new clients in the Indonesian market.

These materials are designed to be culturally appropriate and offered in various forms to accommodate different marketing channels.

We also found that the program provides comprehensive data, letting Indonesian affiliates monitor their success and get insight into the efficacy of their marketing activities.

Furthermore, the program’s support system stands out to us, with FXView providing specific help to Indonesian affiliates.

By combining these elements, FXView’s affiliate program is an even more attractive option for Indonesian traders to leverage their professional networks and increase their earning potential.

How to Register an Affiliate Account with FXView Step-by-Step

To become an affiliate with FXView in Indonesia, follow these steps:

Step 1 – Click on the Affiliate section.

Visit the FXView website and click the ‘Affiliates’ link to learn more about the program designed specifically for Indonesian users.

Step 2 – Click on the Join button.

Select the ‘Join Now’ option to be led to a sign-up page.

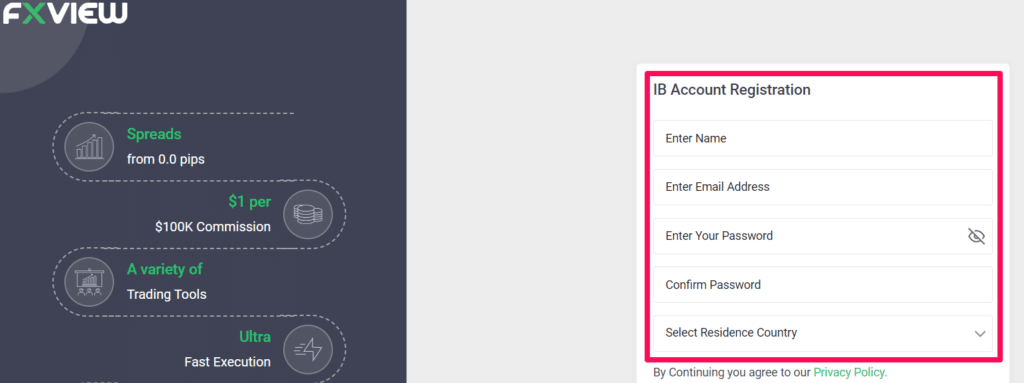

Step 3 – Fill out the form.

Complete the registration form with correct and up-to-date personal information.

Step 4 – Verify your identity

Verify your Indonesian identity by presenting a legitimate form of identification, such as a KTP (Kartu Tanda Penduduk) or passport. Once accepted, log in to your affiliate dashboard to access specific marketing tools and begin your affiliate journey.

What is the commission structure that FXView offers to affiliates in Indonesia?

FXView provides a commission structure that is highly competitive and is determined by the trading activity of referred clients. You can find all the relevant information on the affiliate dashboard.

Are there any marketing materials available in Indonesian for affiliates?

Yes. FXView offers a variety of marketing materials in Indonesian, such as banners, links, and promotional content.

Customer Support

Customer Support FXView Customer Support

⏰ Operating Hours 24/5

🗣 Support Languages Multilingual

👥 Live Chat Yes

📱 Email Address Yes

📞 Telephonic Support Yes

✅ The overall quality of FXView Support 4/5

Response Time

📞 Support Channel ⏰ Average Response Time 👥 User-based Response Time

Phone 5 – 6 minutes 3 – 4 minutes

Email 24 – 48 hours 24 – 48 hours

Live Chat 2 – 4 minutes 3 – 4 minutes

Social Media 5 minutes 2 – 6 minutes

Affiliate 24 – 48 hours 24 – 48 hours

How can Indonesian traders reach out to FXView customer support?

Support is available through live chat, email, or phone. You can find the contact details on the FXView website.

What is the average response time for customer support inquiries in Indonesia?

FXView’s response times range from a few minutes to 48 hours, depending on the query and the customer support channel used.

User Comments and Reviews

Reading user comments and reviews on trusted sites gave us an idea of the type of broker FXView is, and can be, for Indonesians. While this is a useful resource, we urge Indonesians to conduct their own research instead of relying solely on the reviews or comments of others.

Here are a few top comments on FXView:

➡️“After over a year with FXView, I must say that it has been a fantastic experience. This broker has not only facilitated my trading but has also helped me gain a better understanding of the market. The experience was excellent, providing both information and practical insights into trade dynamics.”

➡️“My journey with FXView began at the beginning of 2022. Despite early reservations about the many alternatives, I found FXView’s offers and services excellent. The experience thus far has been great, instilling trust and trustworthiness in their platform.”

➡️“Joined with a small investment. Regulation seems solid, and spreads seem favourable. Hope they remain this way.”

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Conclusion

We have arrived at a nuanced conclusion after our in-depth analysis of FXView as a brokerage service for Indonesian traders.

With its global reach and dedication to upholding international regulatory standards, the broker instils a sense of trust, even without local Indonesian regulations.

FXView offers a range of trading platforms, and their social trading feature through ZuluTrade allows users to connect with a trading community.

Nevertheless, there are certain disadvantages that we urge traders to consider. Traders who value localized transactional convenience might be discouraged by the absence of IDR-denominated accounts and the possibility of incurring currency conversion fees.

Our Insight

In my opinion, FXView is a good option for Indonesian traders. They offer tight spreads and low commissions, which are two huge factors for me in choosing a broker. Additionally, their instant withdrawals are a big plus. The only downside is that they don’t offer stock CFDs.

Our Recommendations on FXView

We found that FXView has a compelling offer for Indonesians. However, there is always some room for improvement even when a broker fits the bill perfectly, and here’s what we believe FXView can aim to improve:

➡️Consider holding more webinars, workshops, and trading competitions aimed at Indonesian traders.

➡️Provide detailed breakdowns and examples of how fees are applied in different scenarios to help traders plan strategies more effectively and accurately.

➡️Expand the available payment methods for deposits and withdrawals so that they are country-specific, giving traders access to local payment methods and the ability to deposit and withdraw in local currency.

FXView Pros & Cons

While FXView is a top participant in offering trading solutions to Indonesians, traders must consider the benefits and drawbacks of using this broker. Here’s what we found.

| ✔️ Pros | ❌ Cons |

| Indonesians can start trading with a minimum deposit of 0.001 BTC, giving them access to various markets and corresponding instruments | PrimeXBT is not locally regulated in Indonesia |

| PrimeXBT is well-known for its robust trading platform and sophisticated trading tools | Indonesians cannot deposit or withdraw in IDR, and there are no local payment methods available |

| There is a free demo account for Indonesians to test strategies and practice trading | There are restrictions on the number of payment methods offered for deposits and withdrawals |

| There is a competitive commission structure in place with favourable rates | PrimeXBT does not accept fiat currencies as the base currencies for accounts |

| PrimeXBT offers dedicated customer support and a website available in Indonesian | PrimeXBT does not offer MetaTrader |

| Indonesians can trade several other instruments like forex, commodities, and indices | There is a steep learning curve involved with PrimeXBT’s platform |

| Traders can use several competitive strategies on PrimeXBT | Inactivity and withdrawal fees apply |

| There are no deposit fees charged when Indonesians finance their accounts | |

| PrimeXBT has a global reach and a good reputation as a Forex and CFD broker | |

| Indonesians can use leverage of up to 1:1000 with PrimeXBT |

you might also like: FP Markets Review

you might also like: FXGT.com Review

you might also like: BDSwiss Review

you might also like: FXTM Review

you might also like: Vantage Markets Review

Frequently Asked Questions

Is FXView a good broker?

Yes, they are a good broker with strong security measures, regulations, competitive trading conditions, a range of platforms and tools, and flexible trading accounts.

In which countries is FXView restricted?

FXView’s services are restricted in Crimea, Cuba, Cyprus, The United States, and several other nations.

What is the minimum deposit?

50 USD or an equivalent in other currencies. The minimum deposit required will depend on the account type that Indonesians select.

What are the account options available for Indonesian traders?

Indonesian traders have a variety of account types to choose from, including RAW ECN, Zero Commission Account, Premium ECN Account, and an Islamic Account.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Social Responsibility

FXView does not currently provide any information regarding CSR initiatives or projects.