Octa Review

Overall Octa is considered an average risk, with an overall Trust Score of 79 out of 100. Octa is licensed by zero Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). They offer three retail trading accounts: a MetaTrader 4 account, a MetaTrader 5 account and an Octatrader account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

25 USD / 392,878 IDR

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overview

Octa is an emerging broker with nearly 10 years of operation, offering a low-cost MetaTrader experience and a social copy-trading platform. Known for competitive trading costs and over 220 tradeable symbols, Octa has made significant strides in pricing.

However, it struggles with a limited range of tradeable instruments and lacks variety in trading tools. Payment options for deposits and withdrawals include Visa, Neteller, FasaPay, Bitcoin, and various local bank transfers. The maximum leverage ratio is 1:500 on Forex Major pairs.

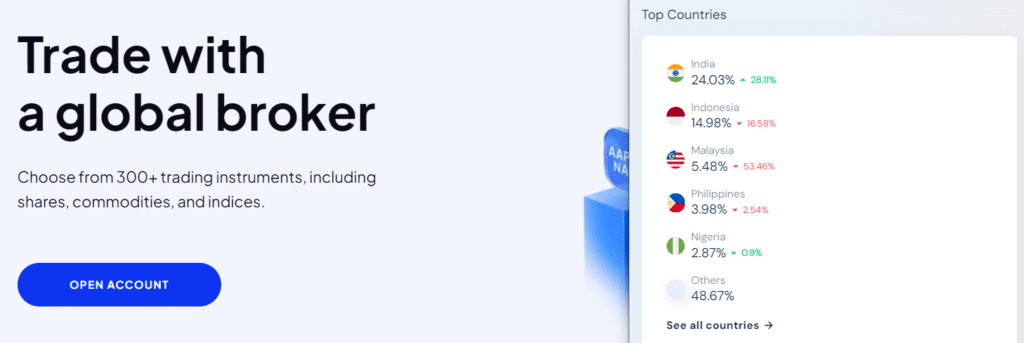

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders who choose Octa

Octa is a well-regulated trading provider ranked among the top 20 Forex and CFD brokers for Indonesian traders.

Is the broker regulated to provide financial services in Indonesia?

Yes, they are regulated. However, they are not locally regulated by BAPPEBTI.

How responsive is the broker’s customer support?

Octa’s customer support is extremely responsive and helpful.

At a Glance

| 🏛 Headquartered | Saint Vincent and the Grenadines |

| ✅ Global Offices | United Kingdom, Hong Kong, Indonesia, Cyprus, Malaysia, Thailand, South Africa |

| 🗓 Year Founded | 2011 |

| 📞 Indonesia Office Contact Number | 0838 0838 5555 |

| 🤳 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, Telegram, LinkedIn |

| ⚖️ Regulation | CySEC, SVG FSA, FSCA |

| 🪪 License Number | Cyprus – 372/18 Saint Vincent and the Grenadines – 19776 South Africa – FSP 51913 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.6 pips |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 25 USD / 392,878 IDR |

| ✅ IDR Deposits Allowed? | No |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based Octa customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Debit/Credit Cards, Cryptocurrencies, Skrill, Neteller, Electronic Transfers, E-Wallets |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, Octa App, CopyTrade App |

| ✔️ Tradable Assets | Forex, Index CFDs, Commodities, Cryptocurrencies, Energies, Precious Metals |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Malaysian, Hindi, Bangla, Thai, Spanish, German, Vietnamese, Portuguese, Arabic, Chinese (Simplified) |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Indonesia-based customer support? | Yes |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is Octa a safe broker for Indonesian traders? | Yes |

| 📊 Rating for Octa Indonesia | 7/10 |

| 🤝 Trust score for Octa Indonesia | 79% |

| 🎉 Open an account | Open Account |

Safety and Security

Regulation in Indonesia

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

Does the broker have stop-loss?

Yes, you can use stop-loss and take-profit orders.

How does Octa protect my funds?

All client funds are kept in segregated accounts with top-tier banks.

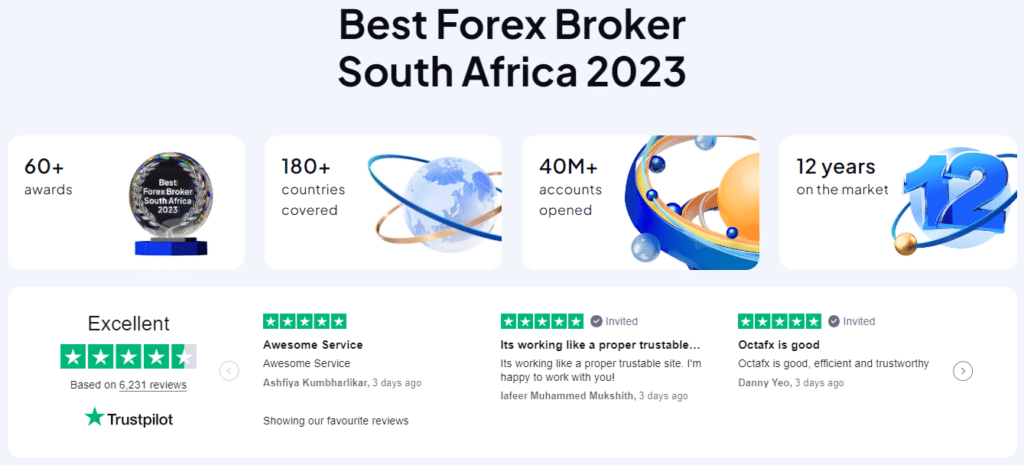

Awards and Recognition

They have received the following recent awards and recognition:

Has OctaFX received any awards for its trading services?

Yes, the broker has been honoured with multiple awards in the forex industry. These awards include recognition for its customer service, trading conditions, and regional excellence.

What are some notable awards the broker has won recently?

They have recently received awards such as “Best Forex Broker Asia 2022” and “Best ECN/STP Broker 2022.”

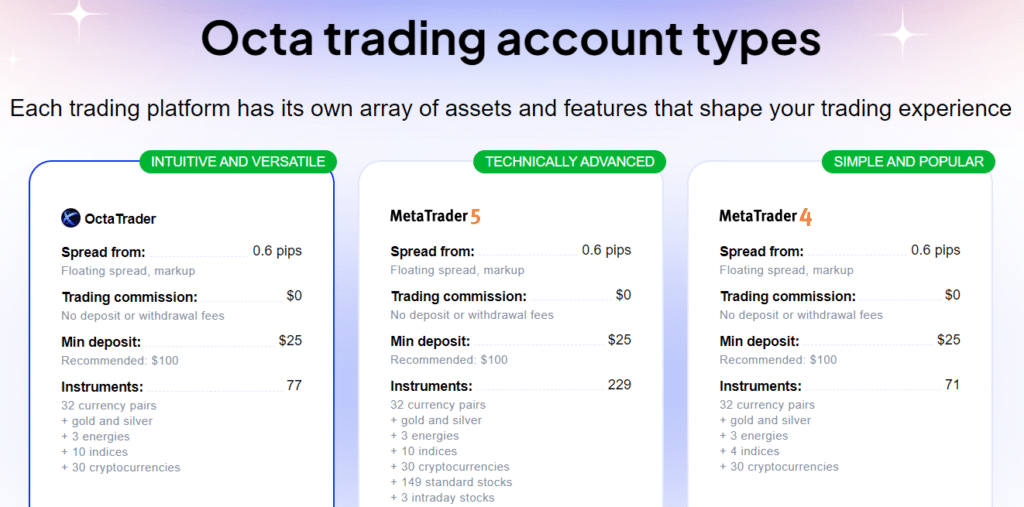

Octa Account Types and Features

MetaTrader 4 Account

The retail investor account is ideal for Indonesians new to the forex market who want standard trading conditions and features. This type of trading account is ideal for new Indonesian traders because it includes the following features:

Account Features Value

💰 Minimum Deposit Requirement 25 USD / 392,878 IDR

📊 Average spreads Floating, from 0.6 pips

💸 Commissions charged None, the mark-up is added to the spread

📊 Instruments offered on account 35 Forex Pairs, Gold and Silver, 3 Energies, 10 Indices, 30 Cryptocurrencies

📈 Leverage Ratios Forex – up to 1:500 (1:100 for ZAR/JPY), Precious Metals – up to 1:200, Energies – up to 1:100, Indices – up to 1:50, Crypto – up to 1:25

💵 Minimum Trading Volume 0.01 lots

💰 Maximum Trading Volume 200 lots

💵 Margin Call / Stop-out 25% / 15%

📞 Trade Execution Type Market

✔️ Trading Strategies Allowed Hedging, Scalping, Expert Advisors

🎉 Open an account Open Account

MetaTrader 5 Account

The MetaTrader 5 account is designed for sophisticated Indonesian traders actively participating in various financial markets and assets.

This account gives advanced traders access to cutting-edge trading technology and superior trading conditions, as well as the following features:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 25 USD / 392,878 IDR |

| 📊 Average spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 📊 Instruments offered on account | 32 currency pairs, gold and silver, 3 energies, 10 indices, 30 cryptocurrencies, 149 standard stocks, 3 intraday stocks |

| 📈 Leverage Ratios | Forex – up to 1:500 (1:100 for ZAR/JPY) Precious Metals – up to 1:200 Energies – up to 1:100 Indices – up to 1:50 Crypto – up to 1:25 Stocks 1:20 Stocks daily 1:200 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 💰 Maximum Trading Volume | 500 lots |

| 💵 Margin Call / Stop-out | 25% / 15% |

| 📞 Trade Execution Type | Market |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| 🎉 Open an account | Open Account |

OctaTrader Account

The OctaTrader Account is designed for traders seeking a high degree of flexibility and precision in their trading strategies. It provides access to a suite of advanced tools and features, making it suitable for both novice and experienced traders.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 25 USD / 392,878 IDR |

| 📊 Average spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 📊 Instruments offered on account | 32 currency pairs, gold and silver, 3 energies, 10 indices, 30 cryptocurrencies |

| 📈 Leverage Ratios | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:100 Indices 1:50 Crypto 1:25 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 💰 Maximum Trading Volume | 50 lots |

| 💵 Margin Call / Stop-out | 25% / 15% |

| 📞 Trade Execution Type | Market |

| ✔️ Trading Strategies Allowed | Scalping |

| 🎉 Open an account | Open Account |

Demo Account

The broker introduces a demo account tailored for Indonesian traders, delivering an unparalleled replication of the genuine trading experience. This exceptional platform immerses traders in an authentic environment, mirroring actual market conditions to the last detail.

Accessible without any constraints, the demo account provides abundant virtual funds, offering traders a playground for many purposes. From newcomers honing their skills to seasoned traders meticulously refining their strategies, this resource proves indispensable.

This is particularly advantageous for Indonesian traders aiming to elevate their trading prowess and refine their approaches before executing them in live markets.

Furthermore, the demo account extends a golden opportunity for Indonesian traders to partake in the exhilarating Champion Demo Contest, wherein the prospects of securing real monetary rewards await.

This engagement not only offers a chance for traders to test their skills against peers but also stands as a testament to the broker’s commitment to fostering trader growth and success.

Islamic Account

Recognizing the diverse trading landscape, the broker expands its reach to meet the unique needs of Indonesian traders who follow Sharia Law principles.

The Islamic Account, a hallmark of the broker’s innovation, addresses the unique needs of Muslim traders who adhere to Islamic teachings that forbid participation in interest-based transactions.

Unlike the traditional forex landscape, which frequently imposes overnight fees, their Islamic Account is a game changer for Indonesian Muslim traders.

This award-winning and meticulously crafted account paves the way for profit generation through medium- to long-term trading techniques while adhering to Sharia Law principles.

The Islamic Account distinguishes itself by not charging additional fees for overnight fees. This distinguishing feature ensures that Indonesian traders who adhere to Islamic principles can trade with complete peace of mind without any impediments jeopardizing their strategies or goals.

Can I register an Islamic Account?

Yes, you can register an MT4 or MT5 live trading account and then request that it be converted to an Islamic account.

Can I open a demo account on the Octa platform in Indonesia?

Yes, you can. Octa’s demo account is free and can be used for 30 days.

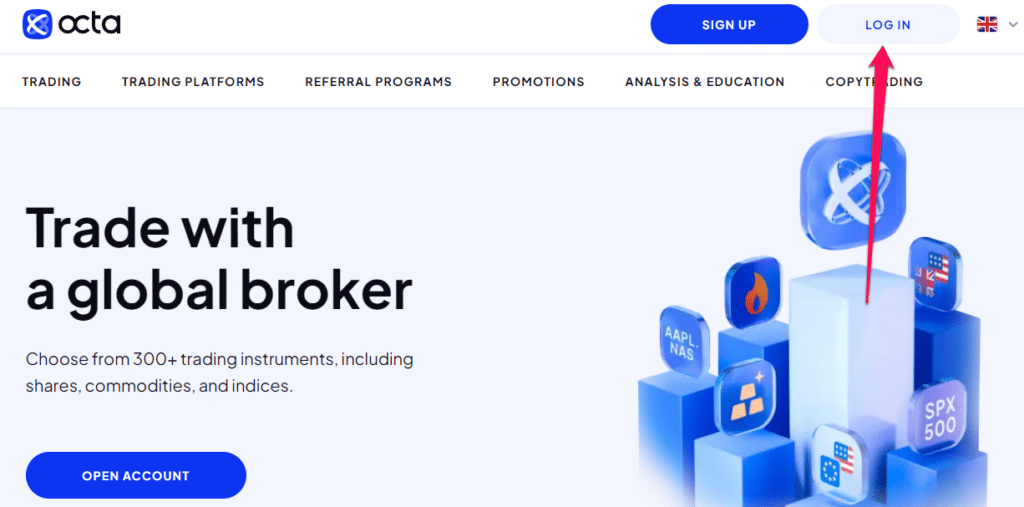

How to open an Octa Account – A Step-by-Step Guide

To open an account with Octa, Indonesians can follow these steps:

To open a Forex account, go to the Octa website and click the “Open Account” button.

Fill out your first and last name, your email address and create a password for your account. Now click on “Open Account”.

Octa vs Exness Vs XM – Broker Comparison

| Octa | Exness | XM | |

| ⚖️ Regulation | CySEC, SVG FSA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | FSCA, IFSC, ASIC/AFSL, CySEC, DFSA |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, OctaFX App, CopyTrade App | MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal | MetaTrader 4, MetaTrader 5 |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 25 USD / 392,878 IDR | 10 USD / 157,151 IDR | 5 USD / 78,575 IDR |

| 📈 Leverage | 1:500 | Unlimited | 1:888 |

| 📊 Spread | 0.6 pips | Variable, from 0.0 pips | 0.0 pips |

| 💰 Commissions | None | From $0.1 per side, per lot | $1 to $9 |

| ✴️ Margin Call/Stop-Out | 25%/15% | 60%/0% | 50%/20% 100%/50% (EU) |

| ✴️ Order Execution | Market | Market | Market, Instant |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | Octa MT4, Octa MT5, OctaTrader | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | Yes | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 5 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

25 USD / 392,878 IDR

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

MetaTrader 4 and 5

The broker has a simple user interface that allows for easy navigation. MT4 provides traders with an array of pre-loaded indicators, allowing them to make informed decisions. Notably, it also allows traders of all skill levels to execute automated trading strategies, streamlining the trading process.

MT5, on the other hand, is a more advanced option for Indonesian traders. MT5 expands on the fundamental features of MT4 by including an impressive set of technical and fundamental indicators. This improves chart analysis and gives traders a better understanding of market trends.

Adding an economic calendar improves decision-making by keeping traders updated on important events that may affect their trading strategies.

MT5 introduces a broader range of order types and an expanded set of indicators and analysis tools. This adaptability gives Indonesian traders more control over their trading activities, allowing them to cater to various strategies and risk preferences.

Furthermore, MT5 allows traders to create unlimited charts and test multiple currency pairings simultaneously, facilitating efficient portfolio management.

Octa App

The broker introduces the Octa Trading App to Indonesian traders seeking a smooth and efficient trading experience. This mobile application provides traders easy access to all accounts, including demo accounts, and integrates seamlessly with Market Insights to improve decision-making.

The Trading App combines various account management tasks into an easy-to-use interface.

Indonesian traders can easily manage their trading activities, from adjusting leverage to executing and cancelling trades, depositing and withdrawing funds, and monitoring bonuses and promotions.

The app’s design caters to new traders who prefer mobile technology, providing a convenient entry point into the financial markets.

CopyTrading App

CopyTrading software from the broker introduces an innovative way for Indonesian traders to replicate signals from other traders.

The software’s intuitive layout, designed with simplicity, allows traders to locate and follow signal sources based on personalized criteria easily. This feature enables Indonesian traders to build well-informed portfolios, improving their trading efforts.

Furthermore, CopyTrading goes above and beyond replication by providing master accounts. Indonesian traders who excel at trading strategies can offer their insights to followers as signals.

This dynamic fosters a collaborative atmosphere in which expertise is shared, and success is multiplied. In turn, followers can copy signals from master accounts, diversifying their trading strategies while learning from experienced traders.

How does MT5 benefit Indonesian traders?

MetaTrader 5 offers Indonesian traders additional trading tools, timeframes, graphical objects, and more.

Does the broker have an app?

Yes, they offer a proprietary app for iOS and Android devices.

Range of Markets

Indonesian traders can expect the following range of markets:

Is cryptocurrency trading available?

Yes, the broker offers crypto CFDs that can be traded.

Can I trade commodities like gold and oil on Octa’s platform?

Yes, you can trade gold and oil.

Broker Comparison for Range of Markets

| Octa | Exness | XM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

Octa Fees, Spreads, and Commissions

Spreads

The spreads vary depending on the broker’s service charge and market conditions on the day of trading, with spreads calculated for each trade based on the financial instrument being traded. Some examples of common spreads include, but are not limited to, the following:

Commissions

Octa does not charge commission fees, as the broker’s fee is already included in the spread.

Overnight Fees

According to the broker’s spreads and conditions, swaps do not apply to major instruments such as EUR/USD, NASDAQ, Bitcoin, etc.

Deposit and Withdrawal Fees

The broker does not charge any deposit or withdrawal fees on payment methods available in Indonesia.

Inactivity Fees

Inactivity fees do not apply to dormant accounts.

Currency Conversion Fees

Currency conversion fees could apply when Indonesian traders deposit and withdraw in IDR to accounts denominated in USD or EUR.

Does the broker charge inactivity fees?

No, they do not charge any inactivity fees.

How much are the broker’s withdrawal fees?

Withdrawals are free.

Octa Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

Can I withdraw using PayPal?

No, you cannot use PayPal to withdraw funds.

Does the broker charge Indonesians withdrawal fees?

No, they do not charge any withdrawal fees.

How to make a Deposit

To deposit funds into an account, Indonesian traders can follow these steps:

Log into your Personal Area on the Octa platform to get started. After logging in, you will be presented with various trading-specific options.

Navigate to the dashboard menu within your Personal Area and select “Deposit.” This will allow you to fund your preferred trading account.

You can decide which trading account to fund depending on your trading strategy and personal preferences. The broker provides a variety of account options to accommodate various trading styles.

How to make a withdrawal

To withdraw funds from an account, Indonesian traders can follow these steps:

Begin by logging into your Octa Personal Area as you would when making a deposit.

Locate and select the “Withdrawal” option from your Personal Area dashboard. This is your entry point for making a withdrawal request.

Choose the trading account from which you want to withdraw money. This customization enables you to manage your various accounts.

Education and Research

Education

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Does the broker have an education?

Yes, they have a dedicated education section on the website.

Does the broker have trading calculators?

Yes, they offer a trading and profit calculator on the website.

Bonus Offers and Promotions

The broker offers a variety of opportunities designed to enhance the trading experiences of Indonesian traders. These products are tailored to the Indonesian market and are intended to provide tangible benefits and rewards.

The broker offers Indonesian traders the following bonuses and promotions:

Demo Trading Contest

Indonesian traders who wish to hone their trading skills can participate in the demo trading competition. This platform provides a risk-free environment where traders can practice and refine their trading strategies without incurring any financial risk.

The competition recognizes and rewards outstanding traders with cash prizes. The ability to withdraw or trade these rewards promotes skill development within a secure framework.

Trade and Win Giveaway

Through the “Trade and Win Giveaway” promotion, the broker appreciates the dedication of Indonesian traders. Traders meeting certain trading volume requirements can enter a random drawing.

This draw offers alluring prizes, including smartphones, laptops, and trips to exotic locales. This initiative adds an element of excitement and tangible rewards to the trading journey in recognition of the traders’ efforts and engagement.

50% Deposit Bonus

The broker offers the “50% Deposit Bonus” promotion to Indonesian traders. This promotion grants traders a bonus of up to 50% on their deposits.

These additional funds may be used for trading, allowing traders to strengthen their positions and strategies. The bonus funds can be withdrawn after meeting certain volume requirements, contributing to the expansion of trading resources.

Status Program

The broker introduced the “Status Program” to cater to Indonesian traders’ loyalty and trading activity.

This initiative allows traders to accumulate points based on their trading activities. These points allow traders to advance their account status and unlock various advantageous perks.

These benefits include reduced spreads, expedited withdrawal procedures, and individualized assistance from a dedicated account manager. The Status Program demonstrates Octa’s dedication to improving traders’ experiences.

Does the broker have a no-deposit bonus?

No, they do not have a no-deposit bonus.

Can I earn money from referring friends and family?

No, they do not have a referral program.

Min Deposit

25 USD / 392,878 IDR

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

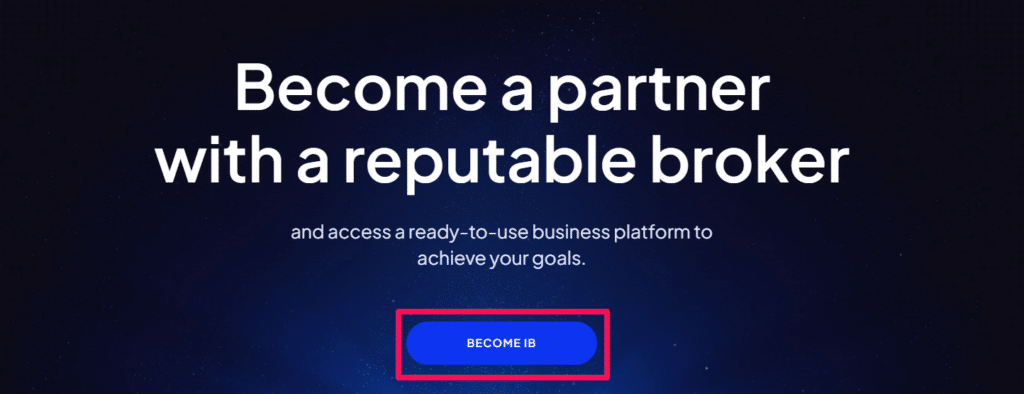

How to open an Affiliate Account with Octa

To register an Affiliate Account, Indonesian traders can follow these steps:

Visit the official website of Octa.

Select this option from the “IB Program” dropdown menu to begin registering as a potential affiliate.

Acquaint yourself with the variety of services offered by Octa. When you’re ready to continue, click the “Become IB” button on the partner site.

Fill out the required fields on the IB Account application form.

Affiliate Program Features

The affiliate network of the broker is an exceptional way for partners to earn substantial compensation while providing customers with competitive trading conditions. The program offers its affiliates several advantageous features:

In addition, the broker offers a rebate program that is especially attractive to traders. This scheme allows traders to recoup a portion of the trading spread or commission they paid when placing or closing an order.

The rebate value ranges from $4.8 to $8 per lot on the MT4, MT5, and OctaTrader platforms. These discounts apply to both profit and loss orders.

In addition to the rebate, Octa offers discerning traders a 5% loyalty bonus and reward points equal to 1% of the rebate they receive. The rebate is automatically deposited into the trader’s account weekly, with the option to withdraw at any time based on the available balance.

Clients are considered active if they have a balance over $100 and have completed five valid orders within 30 days. In addition, should IB commissions change, the rebate reporting system will automatically adapt to reflect these modifications.

Does the broker have a cashback rebates program?

Yes, they offer a lucrative rebate program to partners.

How much can I earn with the rebates?

You can earn from $4.80 to $8 per lot your clients trade on MetaTrader 4, MetaTrader 5, or the Octa platform.

Customer Support

| ⏳ Operating Hours | 24/7 |

| 📚 Support Languages | English, Malay, Portuguese, Indonesian, Thai, Chinese, and Vietnamese |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of Octa Support | 4/5 |

Does the broker have 24/7 customer support?

Yes, they offer customer support 24 hours a day, 7 days a week.

Does the broker have a live chat?

Yes, they have a live chat function on the official website.

Verdict

Octa has firmly established itself in the trading community as a reputable broker providing user-friendly platforms, competitive spreads, and commendable customer service.

They are regulated by reputable authorities such as the FCA and CySEC.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: Exness Review

you might also like: XM Review

you might also like: HFM Review

you might also like: AvaTrade Review

you might also like: FXOpen Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| They charge competitive spreads from 0.6 pips | There is an extremely limited range of financial instruments that can be traded |

| There are no commissions charged on trades | They are not regulated in Indonesia. |

| The broker offers multilingual customer support | The broker does not have Tier-1 regulations |

| Indonesian traders have the freedom to use any trading strategy | |

| They offer copy trading | |

| Traders can choose between MetaTrader and Octa platforms | |

| Traders can use leverage up to 1:500 |

Frequently Asked Questions

Can I trust the broker in Indonesia?

Yes, they are regarded as a credible broker. Before investing, it is essential to conduct extensive research.

How is Octa’s trading experience for Indonesian traders?

The trading experience in Indonesia can vary based on the preferences and trading styles of the trader.

The broker provides Indonesian traders with a user-friendly platform, numerous trading tools, and educational resources to enhance their overall trading experience.

How long does it take to withdraw?

Withdrawals take from 5 minutes up to three hours. However, some users have reported longer withdrawal times.

What are the pros and cons of using Octa in Indonesia?

The broker provides numerous benefits, including various trading instruments, competitive spreads, and account types.

On the negative side, some traders may find that certain features could be enhanced, and there could be restrictions on certain trading preferences.

Does Octa have VIX 75?

No, they do not currently offer the Volatility 75 Index as a tradable instrument.

Does Octa have Nasdaq 100?

Yes, they offer Nasdaq as a CFD on Indices.

How can I deposit and withdraw funds in Indonesia?

The broker provides Indonesian traders with multiple deposit and withdrawal options, including bank transfers, e-wallets, and credit/debit cards.

The process is typically uncomplicated and can be accomplished via the user-friendly interface of the Octa trading platform.

Is Octa Safe or a Scam?

They are considered a safe broker with a trust score of 79%.

Is Octa regulated?

Yes, they are regulated by the FSA, FSCA, and CySEC.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

Octa does not offer any information regarding its current or future CSR projects or initiatives.