FBS Review

Overall FBS is considered an average risk with an overall Trust Score of 75 out of 100. They are licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). They offer three different retail trading accounts namely a Standard Account, Cent Account and Pro Account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

5 USD / 78,476 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade

Crypto

Total Pairs

36

Islamic Account

Trading Fees

Account Activation

Overview

FBS is a regulated brokerage renowned for offering online trading in various Forex and CFD instruments spanning various asset classes. Furthermore, they are committed to providing traders with competitive conditions with tight spreads, minimal fees, and swift trade execution speeds.

Notably, the broker offers a leverage that can reach up to 1:3000, although this is subject to regional variations. The specific trading conditions one can expect are contingent upon the chosen account type, the selected instrument, and the trading volume.

Emphasizing transparency, the broker facilitates trading using sought-after instruments such as Forex and Metals, all underpinned by instantaneous execution via the STP model. One of its standout features is its clear and transparent trading conditions, devoid of concealed fees or commissions.

Furthermore, Indonesian traders can appreciate the ease of depositing and withdrawing funds through many payment methods and the added advantage of commission-free transfers between accounts.

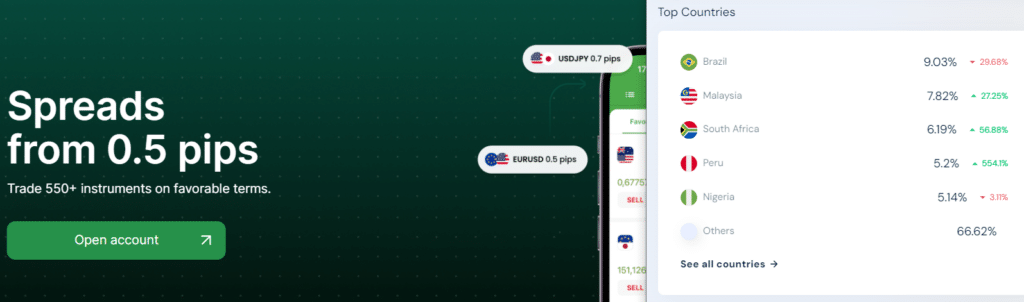

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders

The broker is one of the Top 10 forex and CFD brokers for Indonesian traders because of its tailormade solutions.

Does the broker cater to Asian markets?

Yes, they have a substantial presence in Asian countries.

Does the broker have local offices in any countries?

They have established local offices in several countries to serve regional clients better. However, there is no local office in Indonesia.

At a Glance

| 🏛 Headquartered | Belize |

| ✅ Global Offices | Malaysia, Laos, Thailand, Dubai, Brazil, Turkey |

| 🗓 Year Founded | 2009 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, X (Formerly Twitter), Telegram, Instagram, YouTube |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| 🪪 License Number | Belize – 000102/198 Cyprus (Tradestone) – 331/17 Australia (IFM) – 426359 South Africa (Trade Stone SA) – FSP 50885 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Malaysia, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Currenex |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:3000 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 5 USD / 78,476 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based FBS customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Bank Central Asia (BCA), QRIS, Mandiri, Virtual Account, Bank Negara Indonesia (BNI), DANA, Bank Sinarmas, CIMB Niaga, OVO, QRIS Gopay, Visa, Mastercard, Bank Sahabat Sampoerna, QRIS Shopee Pay, Bank Rakyat Indonesia (BRI), Perfect Money, QRIS DOKU Wallet, FasaPay, Permata Bank, Maybank, Maestro, Cryptocurrency Wallets, Danamon Virtual Account, Sticpay |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade |

| ✔️ Tradable Assets | Forex, Precious Metals, Indices, Energies, Stocks, Exotic Forex, Cryptocurrencies |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, German, Spanish, French, Italian, Portuguese, Indonesian, Malay, Vietnamese, Turkish, Korean, and others |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is FBS a safe broker for Indonesian traders? | Yes |

| 📊 Rating for FBS Indonesia | 9/10 |

| 🤝 Trust score for FBS Indonesia | 75% |

| 🎉 Open an account | Open Account |

Safety and Security

Regulation in Indonesia

The Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA) does not currently regulate FBS.

Security while Trading

They are a reputable broker regulated by trusted financial authorities, ensuring a secure trading environment.

The broker’s commitment to regulations and industry standards reflects its efforts in safeguarding clients’ funds and personal information. Unfortunately, in March 2021, security researchers discovered a data breach at FBS.

An unsecured ElasticSearch server containing over 16 billion records exposed nearly 20 TB of data, including sensitive information like names, passwords, email addresses, passport numbers, national IDs, credit cards, along with financial transaction details, among others being millions of confidential records contained within this breached database.

After the leak was reported, prompt action was taken, as the broker immediately secured the server.

As it highlights, such incidents reinforce that while using any online platform, users must always take additional precautions like having strong, unique passwords & enabling two-factor authentication to maintain their digital safety.

What encryption standards does the broker use?

The broker protects user data and transactions with advanced SSL encryption.

Are there any protective measures against negative balances?

Yes, the broker provides negative balance protection, ensuring traders do not owe more than their initial deposit.

Awards and Recognition

The broker has won more than 70 industry awards over the years that it has been providing trading solutions worldwide, including some of the following most recent awards:

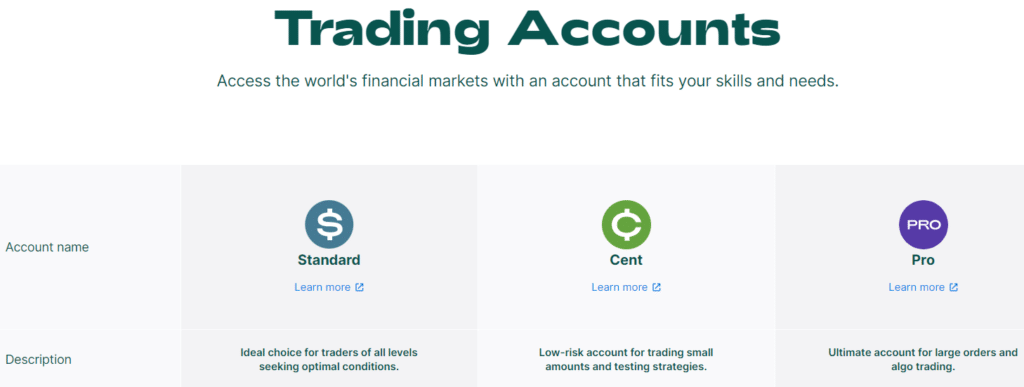

FBS Account Types and Features

Cent Account

The Cent account caters to traders who seek a trading environment with minimal risk. This account enables users to trade with smaller amounts, making it particularly suitable for beginners or individuals with limited capital.

Moreover, this type of account is perfect for traders who evaluate and fine-tune their strategies without investing significant money.

The Cent account offers a safe setting for experimentation and learning, gradually empowering traders to enhance their confidence and expertise.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 5 USD / 78,476 IDR |

| 📊 Average spreads | Floating, from 0.7 pips |

| 💸 Commissions charged | None |

| 📈 Leverage Ratios | Up to 1:1000 |

| 💵 Order volume | Between 0.01 to 1,000 cent lots |

| 💰 Market Execution | From 0.1 seconds, STP |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 |

| 💱 Tradable Instruments | 36 Forex Pairs 8 Metals 3 Energies 11 Indices 127 Stock CFDs 5 Crypto CFDs |

| 🎉 Open an account | Open Account |

Standard Account

The Standard Account is a versatile option for traders of all experience levels. Whether you are a beginner or a seasoned pro, the Standard account provides optimal trading conditions to meet your needs.

Furthermore, it balances risk and reward by providing traders with various tools and features to enhance their trading experience. This account type is ideal for those looking for a balance of flexibility and favourable trading conditions.

Account Features Value

💰 Minimum Deposit Requirement 5 USD / 78,476 IDR

📊 Average spreads Floating, from 0.7 pips

💸 Commissions charged None

📈 Leverage Ratios Up to 1:3000

💵 Order volume Between 0.01 to 500 lots

💰 Market Execution From 0.1 seconds, STP

📱 Trading Platform FBS Trader

MetaTrader 4

MetaTrader 5

💱 Tradable Instruments 36 Forex Pairs

8 Metals

3 Energies

11 Indices

127 Stock CFDs

5 Crypto CFDs

🎉 Open an account Open Account

Pro Account

The Pro account is the highest point in their range of accounts, specifically tailored for skilled traders dealing with numerous orders. Its exceptional suitability lies in its ability to facilitate algorithmic trading, guaranteeing the smooth and successful execution of significant trades.

This premium account equips professional traders and institutions with advanced features and tools that create an optimal environment for trading while offering superior conditions surpassing all other options available.

Account Features Value

💰 Minimum Deposit Requirement 200 USD / 3,139,070 IDR

📊 Average spreads Floating, from 0.5 pips

💸 Commissions charged None

📈 Leverage Ratios Up to 1:2000

💵 Order volume Between 0.01 to 500 lots

💰 Market Execution From 0.1 seconds, STP

📱 Trading Platform MetaTrader 4

MetaTrader 5

💱 Tradable Instruments 36 Forex Pairs

8 Metals

3 Energies

11 Indices

127 Stock CFDs

5 Crypto CFDs

🎉 Open an account Open Account

Demo Account

The broker offers a demo account that allows users to practice trading with virtual funds. This demo account is invaluable for learning to trade without fear of financial loss. You can open a demo account using the Personal Area on the web or the FBS Trader – Trading Platform app.

Setting up an account with the broker is a simple process. During this process, you can customize the account type, MetaTrader version, account currency, leverage, and initial balance to your liking.

It is worth noting that the demo account is designed for both beginners and experienced traders who want to evaluate and fine-tune their trading strategies.

Furthermore, the demo account typically lasts 45 to 90 days before expiring. On the other hand, Traders with live accounts can request that the broker convert their demo accounts into non-expiring ones.

Islamic Account

The broker provides Islamic or swap-free accounts to ensure halal trading by not paying or receiving interest. Two trading account levels are available for these accounts: Standard Swap-free Account and Cent Swap-free Account.

The broker provides Extended Swap-free status to all applicable trading accounts opened by non-Islamic clients. Islamic account holders are typically given wider spreads and charged higher fees. Some brokers may restrict Islamic account holders’ access to assets.

Furthermore, Islamic accounts may be available only to residents of specific countries. The account opening process at FBS is straightforward, and you can select the account type, MetaTrader version, account currency, leverage, and initial balance.

What’s the primary difference between the Cent and Standard accounts?

The Cent account is intended for low-risk trading and testing, whereas the Standard account provides optimal conditions for traders of all skill levels.

Are swap-free accounts available?

Yes, the broker provides an Islamic account that is swap-free and Sharia-compliant.

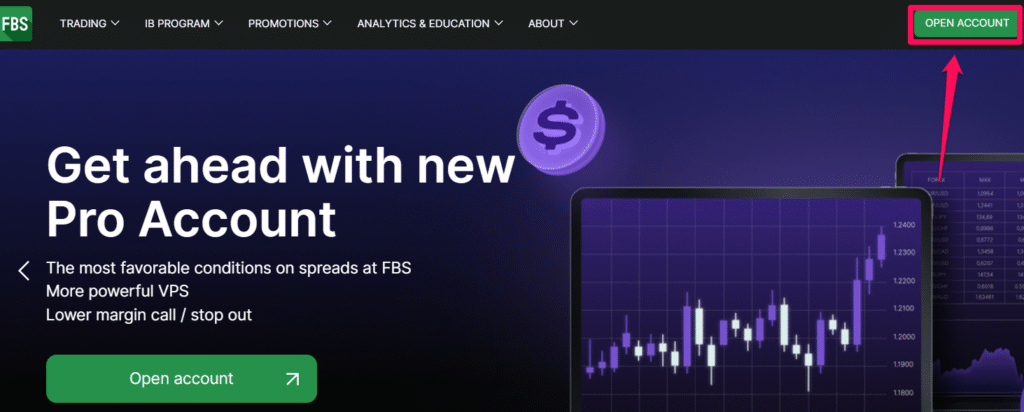

How to open an FBS Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

Step 1 – Go to the official FBS website.

Step 2 – Complete the form.

FBS Vs OANDA Vs Vantage Markets – Broker Comparison

| FBS | OANDA | Vantage Markets | |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC | CIMA, VFSC, FSCA, ASIC |

| 📱 Trading Platform | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade | MetaTrader 4, MetaTrader 5, OANDA Platform, FxTrade | MetaTrader 4, MetaTrader 5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade |

| 💰 Withdrawal Fee | Yes | Yes, bank wire | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 5 USD / 78,476 IDR | 0 USD / 0 IDR | 0 USD / 0 IDR |

| 📈 Leverage | Up to 1:3000 | 1:888 | 1:500 |

| 📊 Spread | From 0.5 pips | From 0.2 pips | From 0.0 pips |

| 💰 Commissions | $0 | From $35 | From $3 |

| ✴️ Margin Call/Stop-Out | 40%/ 20% | 100%/ 50% | 80%/50% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | Cent Account, Standard Account, Pro Account | Standard Account, Core Account, Swap-Free Account, Premium Account, Premium Core Account | Standard STP, Raw ECN, PRO ECN |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | Yes | Yes | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 3 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

5 USD / 78,476 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade

Crypto

Total Pairs

36

Islamic Account

Trading Fees

Account Activation

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

FBS Trader

FBS Trader is the premier mobile trading application for those who wish to engage in Forex trading easily. This all-inclusive multi-asset trading platform is intended to enable users to capitalize on market opportunities swiftly and make informed trading decisions.

Its user-friendly interface and robust capabilities enable traders to navigate the markets confidently. Multiple accolades, including “Best Mobile Trading Platform Asia 2020” and “Best Trading Platform Asia 2021,” prove the app’s excellence.

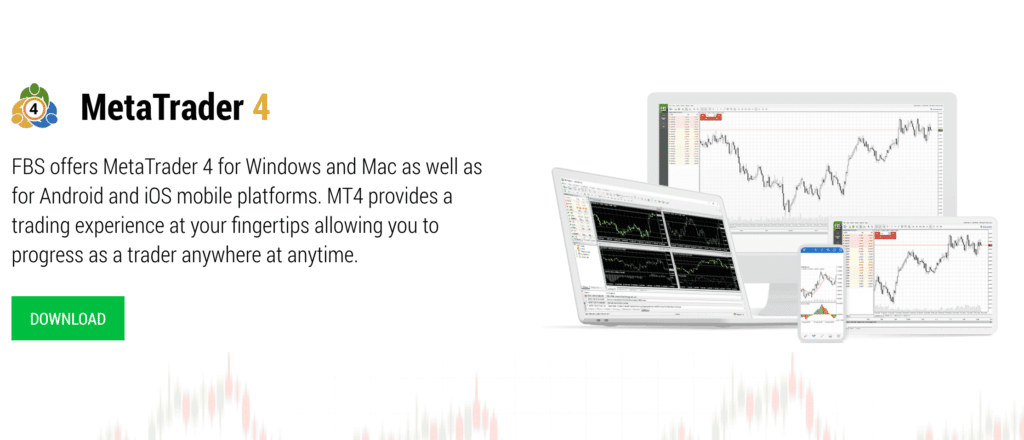

MetaTrader 4

MT4 is a widely recognized trading platform garnered global recognition within the trader community. It simplifies trade operations and offers comprehensive technical analysis for various financial instruments, notably currency pairs in the Forex market.

MT4 grants access across multiple devices, including PC, iOS, Mac OS, and Android. The platform provides an extensive range of tools facilitating thorough price analysis capabilities.

Furthermore, traders can use algorithmic trading by employing applications like automated robots and Expert Advisors (EAs). Regardless of your proficiency level – whether you’re new or experienced- MT4 delivers essential features and tools to enhance your overall trading experience effectively

MetaTrader 5

MT5 is a sophisticated multi-asset trading platform for Forex, stock, and futures traders. It improves upon its predecessor, MT4, by providing advanced tools for in-depth price analysis. Support for algorithmic trading applications is one of the most notable features of MT5.

Traders can create their own Expert Advisors (EAs) or use the platform’s pre-built EAs. This ensures that traders can automate their strategies, enhancing their trading experience.

CopyTrade

The broker’s CopyTrade application is a game-changer for those looking to enter the realm of social trading. It provides a platform on which users can easily invest by emulating the trades of experienced traders.

The application provides real-time, comprehensive statistics of each trader’s market activity, enabling users to make informed decisions. In addition, CopyTrade is designed with both novice and experienced traders in mind.

The app provides a Risk-Free option for novice investors, allowing them to practice and hone their investing skills in a safe environment.

Is there a mobile trading option available?

Yes, FBS Trader is a mobile trading app allowing online trading. Furthermore, Indonesians can also use MT4 and 5 on iOS and Android devices.

Can I use algorithmic trading on the platforms?

Yes, MT4 and MT5 support algorithmic trading, which includes trading robots and Expert Advisors.

Range of Markets

Indonesian traders can expect the following range of markets:

Does the broker offer cryptocurrency trading?

Yes, they offer 5 cryptocurrency pairs that can be traded as CFDs.

Does the broker offer options and futures trading?

No, they do not currently offer futures or options.

Broker Comparison for Range of Markets

| FBS | OANDA | Vantage Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

FBS Fees, Spreads, and Commissions

Spreads

The broker charges a range of spreads, varying from 0.5 pips on EUR/USD. The spread you encounter depends on factors such as your chosen account type and the instrument you are trading.

However, it is important to note that the spread is not fixed and can change based on the jurisdiction in which you conduct your trading activities.

Commissions

The broker does not charge any commission fees. Instead, the broker’s fee for facilitating the trade is included in the spread.

Overnight Fees

Traders who maintain positions for more than 24 hours may incur overnight fees, also known as interest or charges. These fees may be credited or debited depending on the trader’s position.

Deposit and Withdrawal Fees

Deposits using Indonesian payment methods are free. However, the following withdrawal fees apply:

Inactivity Fees

The broker does not charge any inactivity fees.

Currency Conversion Fees

Currency conversion fees could apply to IDR deposits or withdrawals to a USD or EUR-denominated account.

Are there hidden fees when trading with FBS?

No, the broker takes pride in its transparency, ensuring no hidden fees.

How are overnight or swap fees calculated on FBS?

The broker calculates swap fees based on the difference in interest rates between the two traded currencies, which can be found on their platform.

Min Deposit

5 USD / 78,476 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade

Crypto

Total Pairs

36

Islamic Account

Trading Fees

Account Activation

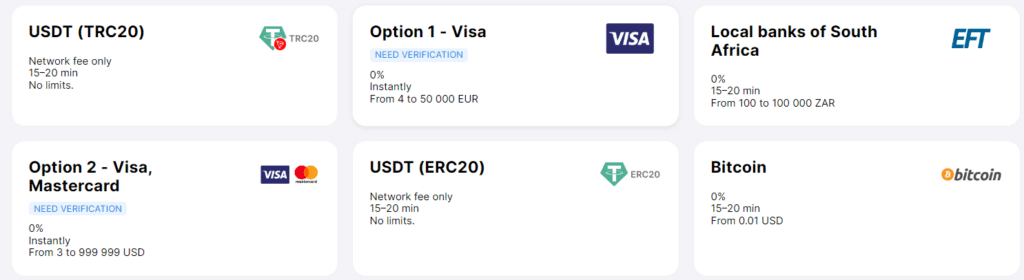

FBS Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

Are there any fees associated with withdrawals?

Yes, although the broker strives to provide fee-free withdrawals, specific methods may incur fees.

Is there a minimum withdrawal amount set?

Yes, depending on the method used, the broker may have a minimum withdrawal threshold; traders should review their withdrawal policies.

How to make a Deposit with FBS

To deposit funds into an account, Indonesian traders can follow these steps:

Log in with your FBS credentials.

Select the “Finances” tab in the primary menu.

Choose “Deposit” from the menu drop-down.

Choose your preferred payment method from the list of available options. FBS provides various payment options for Indonesian traders, including bank transfers, credit/debit cards, and e-wallets.

How to Withdraw from FBS

To withdraw funds from an account, Indonesian traders can follow these steps:

Log in with your FBS credentials.

Select the “Finances” tab in the primary menu.

Choose “Withdrawal” from the menu drop-down.

Choose your preferred payment method from the list of available options. The broker provides Indonesian traders various withdrawal options, including bank transfers, credit/debit cards, and e-wallets.

Education and Research

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Are the broker’s research tools updated regularly?

Yes, they ensure that its research tools, such as market analysis and news, are frequently updated to reflect current market conditions.

Are the educational resources free of charge?

Yes, most of the broker’s educational materials and resources are free.

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

The broker provides a generous 100% deposit bonus to its traders. This promotion is intended to enhance the trading experience by providing additional funds to traders based on their initial deposit.

Once a trader has made a deposit, they have 30 days to claim this bonus. Notably, traders can request this bonus with every deposit they make. If a trader receives multiple 100% deposit bonuses for a single account, these bonuses are combined and traded as a group.

However, it is vital to note that the required lot volume for each bonus is traded separately. While this promotion is available to most account types, the Pro account cannot participate.

This promotion is extremely generous, as the maximum bonus is $10,000. Nonetheless, there are some conditions to consider, including the following:

What types of bonuses does the broker offer to its traders?

The broker currently offers a 100% deposit bonus and cashback rebate program.

How frequently does the broker introduce new promotions?

The broker updates its promotions regularly, providing seasonal and special event bonuses to its traders.

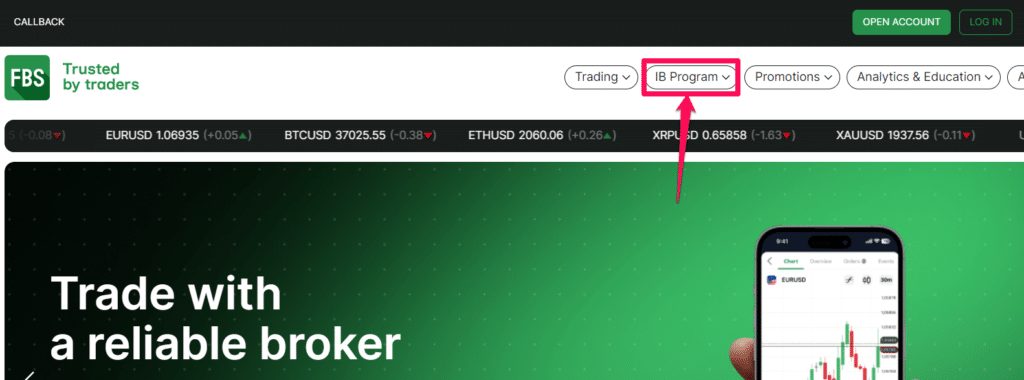

How to open an Affiliate Account with FBS

To register an Affiliate Account, Indonesian traders can follow these steps:

Find the “IB Program” button on the FBS website.

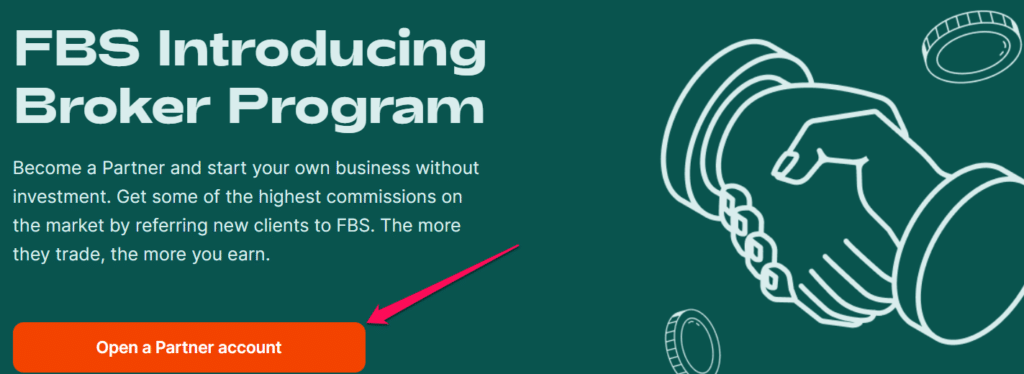

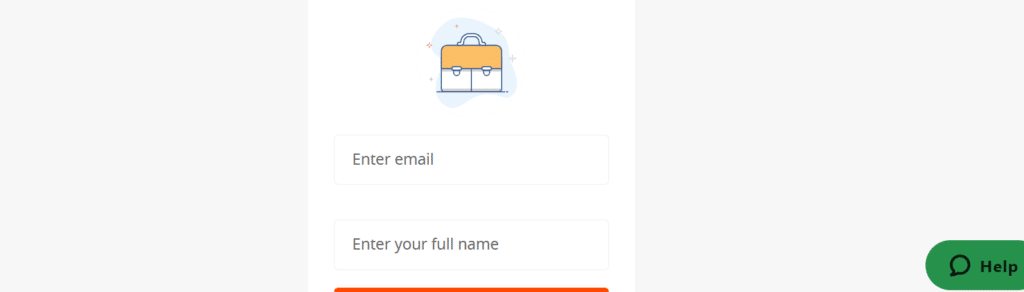

Click the “FBS IB Program” button and “Open a Partner account.”

Sign up with your Google, Facebook, or email credentials to complete the registration process.

Affiliate Program Features

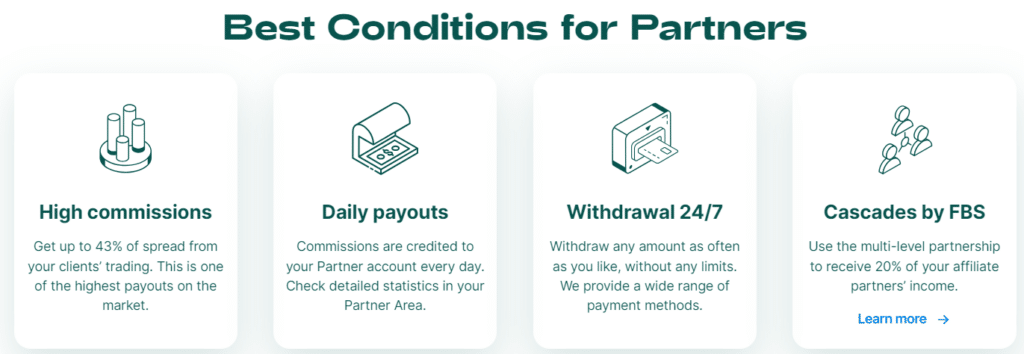

Cascades by FBS

“Cascades by FBS” is a new addition to our affiliate program to enrich affiliates’ earnings. This innovative partnership system allows affiliates to amplify their income potential significantly.

Furthermore, with this feature, affiliates can now increase their earnings by an additional 20% from the generated income of their referral partners.

Daily Commissions

The affiliate program’s daily pay-out system is one of its distinguishing features. Every day, commissions from client trades are credited to the affiliate’s Partner account. Affiliates can easily monitor and analyze their earnings by accessing detailed statistics in the Partner Area.

Commission Calculation

The affiliate commission is inextricably linked to the trading activities of the clients referred by the affiliate. The broker has implemented a tiered system known as “Grades” to determine the commission percentage.

Depending on their Grade, affiliates can earn up to 43% of the spread from their clients’ trades. Trades involving assets such as XAUUSD, US30, and XTIUSD, for example, can yield an average commission per lot of $11.9, with a spread from each trade of 43%.

Furthermore, Indonesian affiliates in higher grades can earn a monthly commission above $10,000.

High Pay-Outs

The generous commission structure of the affiliate program distinguishes it in the market. Affiliates can earn up to 43% of the spread from the trading activities of their clients.

This rate is notable as one of the highest available in the industry, demonstrating the broker’s dedication to rewarding its partners.

Flexible Withdrawals

When it comes to accessing earned commissions, the broker provides unparalleled flexibility. Affiliates can withdraw any amount, at any time, and without restriction. Furthermore, they accept various payment methods, allowing partners to select the most convenient withdrawal option.

What percentage of commission can I expect as an affiliate?

They provide competitive commission rates reaching up to 43% of the spread; however, rates may vary depending on the affiliate’s performance.

Are there any performance bonuses for top-performing affiliates?

Yes, the broker frequently rewards top-performing affiliates with additional bonuses and incentives, but details should be found in the affiliate program terms.

Customer Support

| ⏳ Operating Hours | 24/7 |

| 📚 Support Languages | English, Portuguese, Indonesian, Malay, Vietnamese, Arabic, Hindi, Chinese, and more |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of FBS Support | 4/5 |

Does the broker offer customer support in multiple languages?

Yes, they serve a global clientele and offer customer service in multiple languages.

How can I escalate a concern if I’m unsatisfied with the initial response?

If dissatisfied with the initial support, you can request to speak with a supervisor or escalate your concern through the proper channels.

Corporate Social Responsibility

The broker is distinguished not only for its trading services but also for its unwavering dedication to corporate social responsibility (CSR). At the core of their CSR initiatives is the desire to grant financial independence to those who utilize their trading platform.

This commitment extends beyond financial services; the broker actively partners with charitable organizations worldwide to ensure that aid reaches those who require it most.

“Desires Come True” is a monthly social media campaign that exemplifies FBS’ commitment to the local community. This unique campaign provides a forum for traders to express their deepest desires.

To make a difference, the broker undertakes the fulfilment of these desires. The realization of these desires has resulted in profoundly positive changes, affecting many people’s lives and reinforcing the belief in the power of dreams.

They organize an annual event called the Charity Trade Promotion to demonstrate its commitment to CSR further. This event is not only a chance to make money but also to make a difference. When a trader participates, the broker will double their initial deposit.

In addition, the commissions earned from this promotion are donated to various charitable causes. This initiative exemplifies FBS’ belief in combining business with altruism, ensuring that their success will result in societal improvement.

Is technical support available for VPS users?

Yes, the broker offers dedicated support to traders who use their VPS services to ensure smooth operations.

Can I use FBS’ VPS for platforms other than MT4 and MT5?

Yes, FBS’ VPS is optimized for MT4 and MT5, but compatibility with other platforms should be confirmed with their support.

Verdict

They have carved out a niche for itself in the competitive world of online trading over the years. Their dedication to providing a comprehensive trading experience is reflected in their platform offerings.

The flexibility of account types, from Cent to Pro, allows for a customized trading experience, but these options must be weighed against one’s own trading strategies and objectives.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Their account process is quick and simple | Their portfolio of trading instruments is limited, and Indonesians can only trade CFDs |

| Deposits are free on all payment methods supported by them for Indonesia | The broker recently scaled down its account type offering, and there are only three account types offered |

| Indonesian traders can access local and international payment options for deposits and withdrawals | The broker does not offer investor protection to traders outside the EU |

| There is a Cent Account offered | There are limited account base currency options |

| There are excellent educational materials | Credit/Debit Card withdrawals could take up to several days |

| Customer support receives positive feedback | |

| There is 24/7 customer support available |

you might also like: Exness Review

you might also like: Vantage Markets Review

you might also like: Octa Review

you might also like: XM Review

you might also like: Avatrade Review

Frequently Asked Questions

What is FBS?

FBS has been operating as a forex and CFD broker since 2009.

What account types do they offer?

They offer a Cent, Standard, and Pro Account. Furthermore, traders can register a demo account or convert an existing account to an Islamic account.

What is the minimum deposit required to open an account?

The minimum deposit for a Standard and Cent Account is $5, while the Pro Account requires a $200 minimum deposit.

What platforms does the broker offer for trading?

They offer FBS Trader, MetaTrader 4, MetaTrader 5, and CopyTrade App.

What instruments can I trade with?

They offer various trading instruments, such as forex, stocks, commodities, indices, metals, and energies.

Does the broker have Nasdaq 100?

Yes, they have Nasdaq under NAS100 as a CFD on Indices, with spreads from 2 pips across accounts.

Does the broker offer a demo account?

Yes, they offer a demo account that is available for 45 days.

Is FBS Safe or a Scam?

They are a legitimate Forex broker regulated by Belize’s International Financial Services Commission (IFSC), Cyprus’s Securities and Exchange Commission (CySEC), South Africa’s Financial Sector Conduct Authority (FSCA), and Australia’s Securities and Investments Commission (ASIC).

The broker provides a safe and secure trading environment, with an overall rating of 9/10 and an average trust score of 75 out of 100. As a result, FBS is not a scam.

Is FBS regulated?

Yes, the International Financial Services Commission (IFSC) of Belize, the Cyprus Securities and Exchange Commission (CySEC), the South African Financial Sector Conduct Authority (FSCA), and the Australian Securities and Investments Commission (ASIC) all regulate them.

How long does it take to withdraw from FBS?

Withdrawals can take 15 – 20 minutes or up to 7 days, depending on the payment method.

Does the broker have VIX 75?

No, they do not have the Volatility 75. However, FBS offers 11 other indices that can be traded as CFDs.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia