XM Review

Overall XM is considered low-risk, with an overall Trust Score of 90 out of 100. They are licensed by one Tier-1 Regulator (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). XM offers four retail trading accounts: a Micro Account, a Standard Account, an Ultra-Low Account, and a Shares Account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overview

The broker provides a frictionless experience for traders while emphasizing key features that differentiate it from other companies in the sector. Traders can effortlessly manage their funds thanks to various deposit and withdrawal methods.

Additionally, withdrawals are typically processed within twenty-four hours and do not incur any hidden fees.

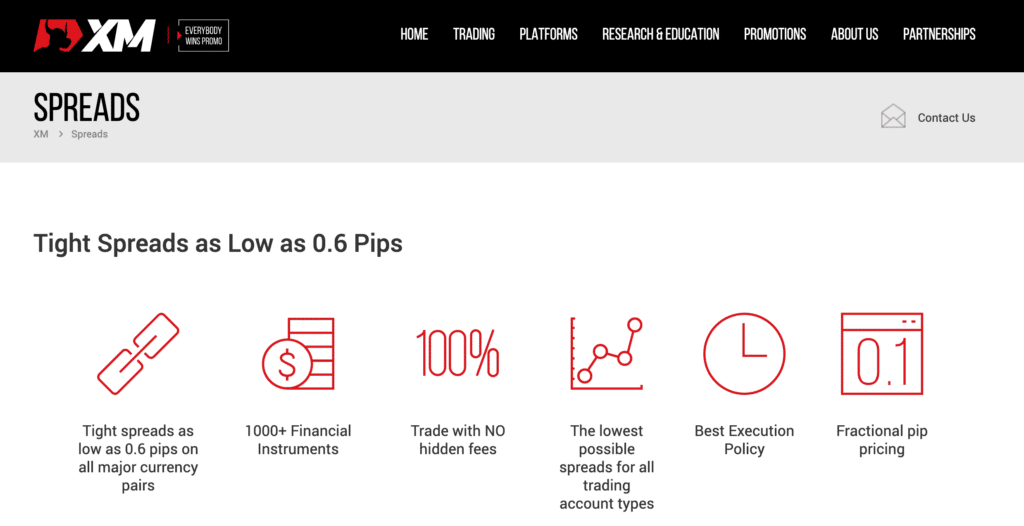

Flexible trading strategies can be implemented thanks to the competitive spreads, which can be as low as 0.7 pips on major currency pairs, as well as the option to choose between fixed and variable spreads.

One of the most notable aspects of the broker is the high leverage, which can reach up to 1:1000. This enables traders to control large positions while only requiring a relatively small amount of capital.

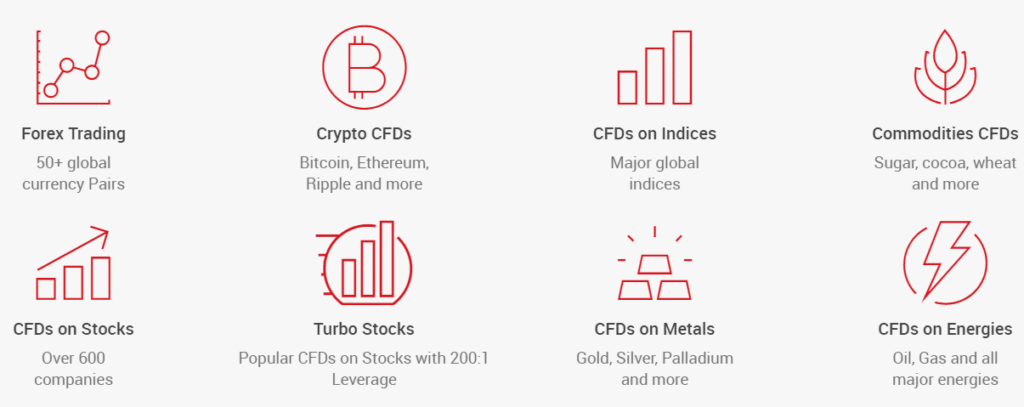

In addition to this, there is a broad selection of over 1,429 tradable instruments, which can be used to trade things like cryptocurrencies, commodities, indices, and 55 forex pairs.

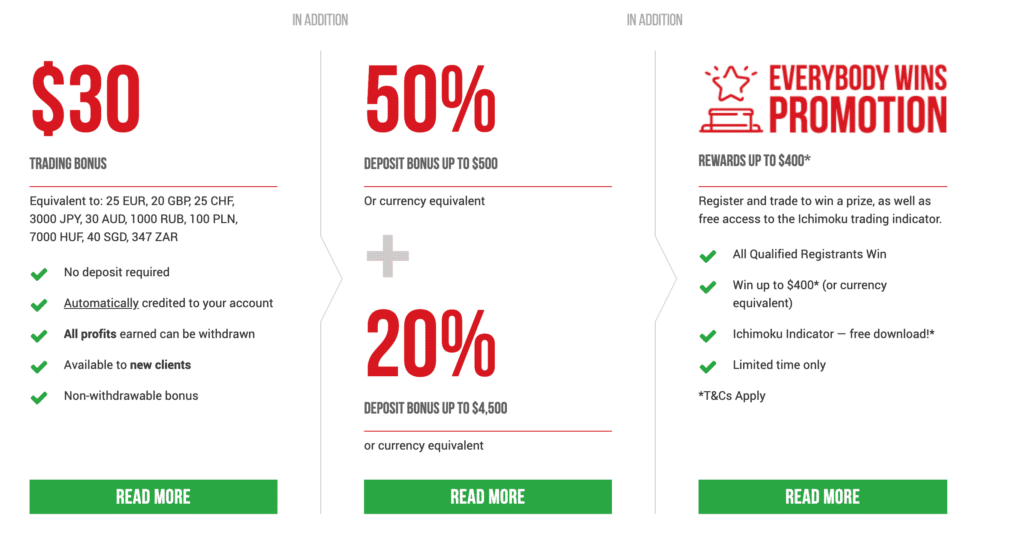

Incentives are added for new and existing clients through the cashback rebate program, based on trading volumes, and various bonuses, such as a deposit and a 30 USD No-Deposit Bonus.

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

XM is a large and reputable forex and CFD broker that ranks in the Top 10 in Indonesia.

In which countries does the broker operate?

They operate in over 190 countries, giving traders global access.

Can I access the broker’s platform from any device globally?

Yes, the broker’s platforms can be accessed via various devices, including mobile, allowing global access.

At a Glance

| 🏛 Headquartered | Belize |

| ✅ Global Offices | Belize, South Africa, Australia, Cyprus, Dubai |

| 🗓 Year Founded | 2009 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, Twitter, YouTube, Instagram, LinkedIn |

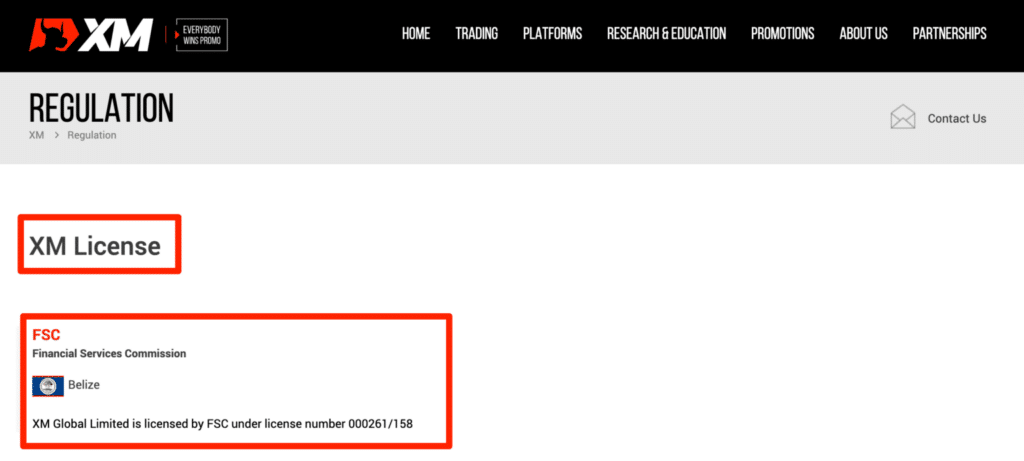

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| 🪪 License Number | Belize – 000261/158 South Africa – 49976 Australia – ABN 32 164 367 113, AFSL 443670 Cyprus – 120/10 Dubai – F003484 United Kingdom – 705428 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | The United States, Canada, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market, Instant |

| 📊 Average spread | From 0.7 pips |

| 📞 Margin Call | 50% to 100% (EU) |

| 🛑 Stop-Out | 20% to 50% (EU) |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 🚫 Leverage Restrictions for Indonesia? | No |

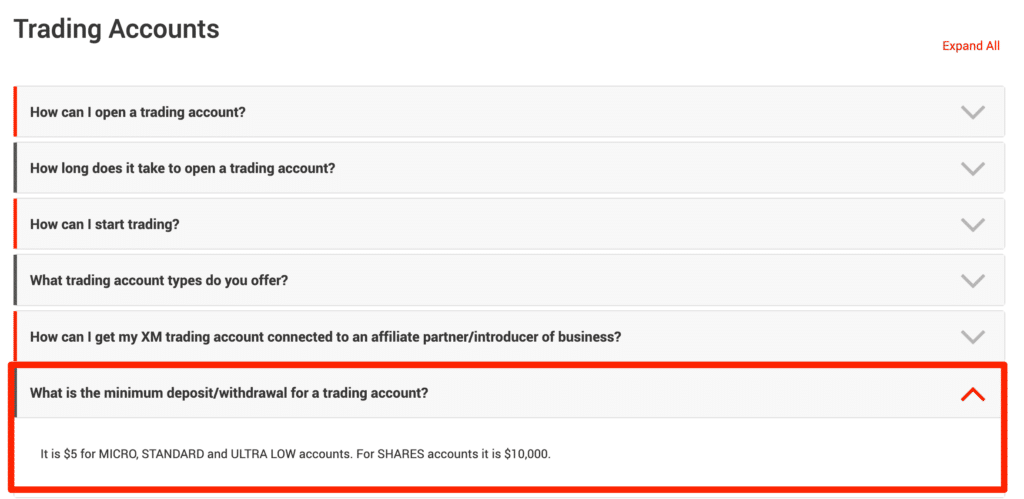

| 💰 Minimum Deposit | 5 USD / 78,575 IDR |

| ✅ IDR Deposits Allowed? | No |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based XM customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Credit Card, Debit Card, Bank Wire Transfer, Local Bank Transfer, Skrill, Neteller, WebMoney |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, XM Mobile App |

| ✔️ Tradable Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Individual Shares, Turbo Stocks |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Malaysian, Chinese Simplified, Chinese Traditional, Russian, French, Italian, German, Polish, Spanish, Portuguese, and several others |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is XM a safe broker for Indonesian traders? | Yes |

| 📊 Rating for XM Indonesia | 9/10 |

| 🤝 Trust score for XM Indonesia | 90% |

| 🎉 Open an account | Open Account |

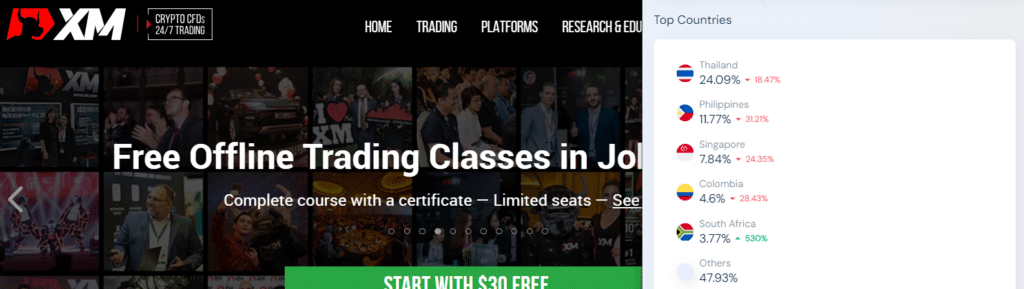

Safety and Security

Regulation in Indonesia

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

Do any financial authorities regulate the broker?

Yes, they are regulated by multiple authorities, including ASIC, FCA, DFSA, FSCA, CySEC, and IFSC, to ensure industry compliance.

How can I ensure the security of my account?

Using strong passwords, two-factor authentication, and adhering to the broker’s security guidelines can help to improve account security.

Awards and Recognition

The broker received the following recent awards and recognition:

Has the broker received any awards for its services?

Yes, the broker has received numerous awards and recognition for its exceptional services in the financial industry. These awards include accolades for its customer service, trading platforms, educational resources, and overall excellence.

What awards has the broker won?

The broker has received awards from well-known organizations such as the World Finance Forex Awards, Global Banking & Finance Review, and the Forex Awards, among others. These awards often recognize XM as a leader in areas like customer satisfaction, trading execution, and educational resources.

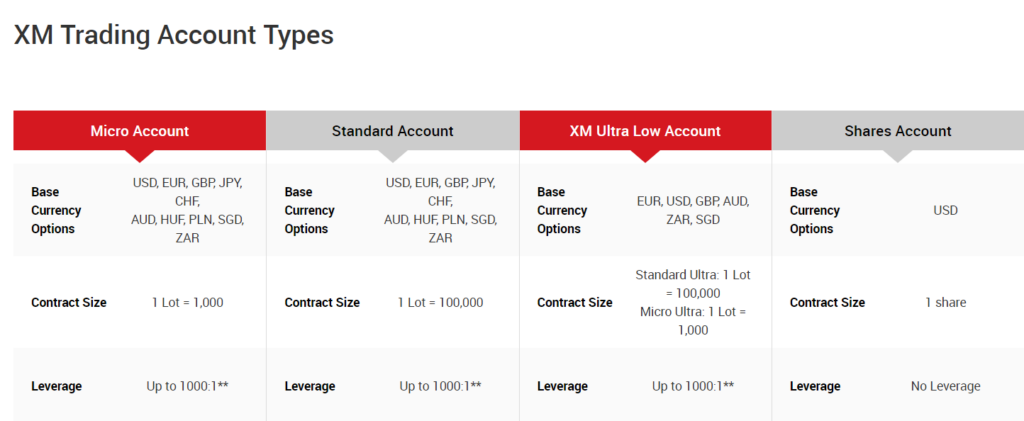

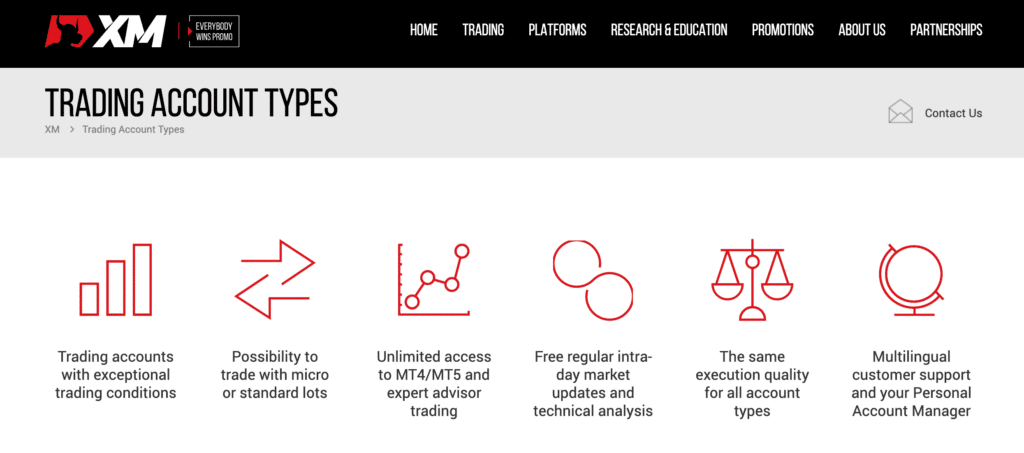

XM Account Types and Features

Micro Account

The Micro account is designed for Indonesian novice traders who want to test their trading strategies in the currency markets while making a small initial deposit.

This account type allows you to trade 1 lot, equal to 1,000 currency units – a much smaller size than the standard lot of 100,000 currency units.

Account Features Value

💰 Minimum Deposit Requirement 5 USD / 78,575 IDR

📊 Average spreads 1.7 pip EUR/USD

💸 Commissions charged None

💱 Base Currency Options USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

📈 Leverage Ratios Account balance of $5 – $20,000 = 1:1 to 1:888

$20,001 to $100,000 = 1:1 to 1:200

$100,001+ – 1:1 to 1:100

💵 Minimum Trading Volume MetaTrader 4 0.01 lots

💰 Minimum trade volume MetaTrader 5 0.01 lots

💳 Lot Restrictions per trade out 100 lots

📞 Maximum open or pending orders per trader 300 lots

✔️ Is an Islamic Account offered? Yes

🎉 Open an account Open Account

Standard Account

The Standard account, which is available across all XM Group entities, caters to Indonesian investors who prefer simple trading based on bid-and-ask prices without the burden of additional fees.

Account Features Value

💰 Minimum Deposit Requirement 5 USD / 78,575 IDR

📊 Average spreads 1.7 pip EUR/USD

💸 Commissions charged None

💱 Base Currency Options USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

📈 Leverage Ratios Account balance of $5 – $20,000 = 1:1 to 1:888

$20,001 to $100,000 = 1:1 to 1:200

$100,001+ – 1:1 to 1:100

💵 Minimum Trading Volume MetaTrader 4 0.01 lots

💰 Minimum trade volume MetaTrader 5 0.01 lots

💳 Lot Restrictions per trade out 50 lots

📞 Maximum open or pending orders per trader 300 lots

✔️ Is an Islamic Account offered? Yes

🎉 Open an account Open Account

Ultra-Low Account

The Ultra Low account, designed specifically for Indonesian traders, offers highly competitive pricing, particularly for currency pair trading.

This account features spreads as low as 0.7 pips and no commissions. It should be noted, however, that the Ultra-Low account cannot be accessed through the CySEC-regulated entity in Cyprus.

Account Features Value

💰 Minimum Deposit Requirement 5 USD / 78,575 IDR

📊 Average spreads 0.7 pips EUR/USD

💸 Commissions charged None

💱 Base Currency Options EUR, USD, GBP, AUD, ZAR, SGD

📈 Leverage Ratios Account balance of $5 – $20,000 = 1:1 to 1:888

$20,001 to $100,000 = 1:1 to 1:200

$100,001+ – 1:1 to 1:100

💵 Minimum Trading Volume MetaTrader 4 Standard Ultra – 0.01 lots

Micro Ultra – 0.1 lots

💰 Minimum trade volume MetaTrader 5 Standard Ultra – 0.01 lots

Micro Ultra – 0.1 lots

💳 Lot Restrictions per trade out Standard Ultra – 50 lots

Micro Ultra – 100 lots

📞 Maximum open or pending orders per trader 300 lots

✔️ Is an Islamic Account offered? Yes

🎉 Open an account Open Account

Shares Account

The Shares account is available to Indonesian traders who want to gain exposure to global corporations and banks. Traders become shareholders in this account and are entitled to dividends proportionate to their investment.

The Shares account has no leverage and uses the MT5 interface. Remember that this account type is only available to entities regulated by the Belize FSC.

Account Features Value

💰 Minimum Deposit Requirement 10,000 USD / 155,130,000 IDR

📊 Average spreads According to the exchange

💸 Commissions charged From $1 per share

💱 Base Currency Options USD

📈 Maximum Leverage Ratio None

💵 Minimum Trading Volume MetaTrader 4 1 lot

💰 Minimum trade volume MetaTrader 5 1 lot

💳 Lot Restrictions per trade out It will depend on each share

📞 Maximum open or pending orders per trader 50 lots

✔️ Is an Islamic Account offered? Yes

🎉 Open an account Open Account

Demo Account

Opening a risk-free demo account can give Indonesian traders a first-hand look at the offerings and services. This trial account simulates a real trading environment, allowing new traders to hone their skills while avoiding financial risk.

Furthermore, using a free, long-term demo account, traders can use the trading interface to investigate pricing on various forex, indices, stocks, and commodities. However, if the account remains inactive for three months, the unlimited demo account will expire.

Islamic Account

In Indonesia, clients can use the MetaTrader 4 or MetaTrader 5 trading platforms. Trading Point of Financial Instruments Ltd. (Cyprus) account holders can choose between three trading accounts: the Micro Account, Standard Account, and Ultra-Low Account.

They also offer an Islamic Account option for each account type, with the added benefit of no additional charges for Islamic accounts – a departure from the norm, where brokers frequently charge administrative fees instead of swaps on such accounts.

What types of accounts does the broker offer?

The broker provides a variety of account types, including Micro, Standard, Shares, and XM Ultra-Low accounts, to meet various trading needs.

Are there any unique features in the accounts?

Yes, the accounts include benefits such as negative balance protection, flexible leverage, and no re-quotes.

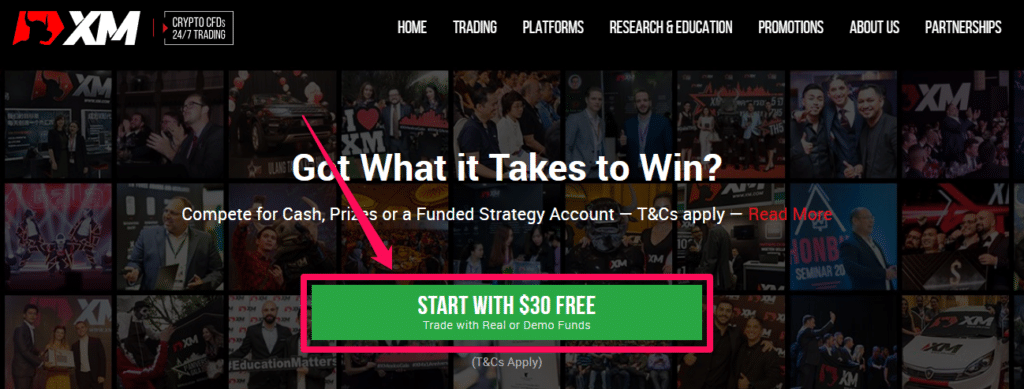

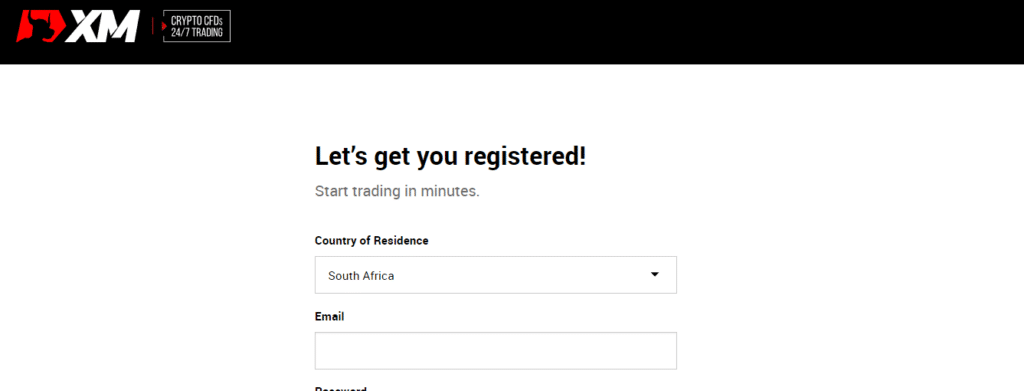

How to open an XM Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

Visit the official XM website.

Click on the “start” button and choose between a real and a demo account.

Fill out the online registration form with your personal information, including your name, email address, phone number, and country of residence.

XM VS Windsor Brokers VS OANDA – Broker Comparison

| XM | Windsor Brokers | OANDA | |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA, FCA | FSC, CySEC, JSC, FSA, CMA | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 XM Mobile App | MetaTrader 4 Windsor Brokers App | MetaTrader 4 MetaTrader 5 OANDA Platform TradingView |

| 💰 Withdrawal Fee | No | Yes | Yes, bank wire |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 5 USD / 78,575 IDR | 10 USD / 157,151 IDR | 0 USD / 0 IDR |

| 📈 Leverage | 1:1000 | 1:500 | 1:200 |

| 📊 Spread | 0.7 pips | 0.0 pips | Variable, from 0.1 pips |

| 💰 Commissions | $1 to $9 | $8 Round Turn | $40 |

| ✴️ Margin Call/Stop-Out | 50%/20%, 100%/50% (EU) | 100%/20% | 100%/ 50% |

| ✴️ Order Execution | Market, Instant | Market/Instant | Market |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | Micro Account Standard Account XM Ultra-Low Account Shares Account | MT4 Zero Account MT4 Prime Account VIP ZERO | Standard Account Core Account Swap-Free Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | No | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 3 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

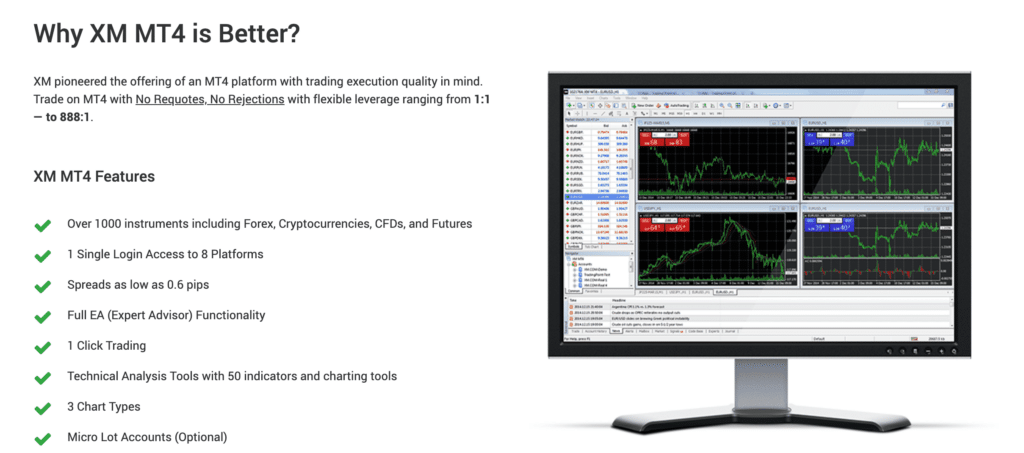

MetaTrader 4

The broker offers MetaTrader 4, widely regarded as one of the most popular trading platforms, to Indonesian traders. It has an easy-to-use interface and powerful trading tools, with some of the following unique features:

MetaTrader 5

MetaTrader 5, an improved version of MT4, includes new features and trading instruments. It is appropriate for both new and experienced traders in Indonesia and has the following unique features:

Mobile App

The app gives Indonesian traders a mobile trading experience, allowing them to trade on the go. It works with both Android and iOS devices. The XM app has some of the following unique features:

Can I use the platforms on mobile devices?

Yes, MetaTrader 4, MetaTrader 5, and the app for various devices are available.

Are the trading platforms customizable?

Yes, the MetaTrader platforms from the broker provide extensive customization options, such as indicators, charts, and trading tools.

Range of Markets

Indonesian traders can expect the following range of markets:

Can I trade global markets?

Yes, the broker gives you access to major global markets, allowing you to conduct international trade.

Are there any market restrictions?

Depending on regulatory requirements and geographic location, some market restrictions may apply.

Broker Comparison for a Range of Markets

| XM | Windsor Brokers | OANDA | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

XM Fees, Spreads, and Commissions

Spreads

The broker’s spreads vary depending on the account type and the traded asset.

Commissions

The commission fees will differ depending on the type of account and the item exchanged. For example, fees on forex and CFD transactions are typically waived for the Micro, Ultra-Low, and Standard Accounts because a markup is added to the spread to cover the broker’s fee.

However, on the Shares Account, traders can expect commissions from $1 on shares such as Amazon, Apple, and others. Furthermore, commissions vary between shares and can go up to $9 per share on Sainsbury, Burberry, BATobacco, and many others.

Overnight Fees

To determine the cost of holding an overnight position, traders must consider various factors, including the type of financial instrument being traded, the position’s direction (long or short), the amount of money involved, and so on.

These variables can impact the position’s overall trading costs and profitability. When trading with them, traders must understand and consider these factors.

Deposit and Withdrawal Fees

Indonesian traders do not pay deposit or withdrawal fees.

Inactivity Fees

If a live trading account becomes dormant after 12 months, a $15 maintenance fee is charged to the account, followed by a monthly $5 inactivity fee.

Currency Conversion Fees

When Indonesian traders deposit or withdraw in currencies other than their account currency, they could face currency conversion fees.

Does the broker charge commissions?

Yes, Certain account types, such as the XM Shares account, are subject to commissions, while others are not.

The full fee schedule, including spreads and commissions, is available on their website.

XM Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

What deposit methods does the broker accept?

The broker accepts credit cards, e-wallets, and bank transfers as deposit methods.

Are there any fees for deposits and withdrawals?

There are no fees for deposits or withdrawals, but third-party fees may apply.

How to make a Deposit with XM

To deposit funds into an account, Indonesian traders can follow these steps:

Log in to the XM Members Area on the website or app to access your account.

Locate the deposit section in the account dashboard or financial management section.

Select your preferred deposit method from the list of options, which includes credit/debit cards, electronic wallets, and bank transfers.

How to Withdraw from XM

To withdraw funds from an account, Indonesian traders can follow these steps:

Log in to the XM Members Area to access your account.

Locate the withdrawal section in the account dashboard or financial management area.

Select your preferred withdrawal method, which is frequently the same as your deposit method.

Min Deposit

5 USD / 78,575 IDR

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5, XM Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

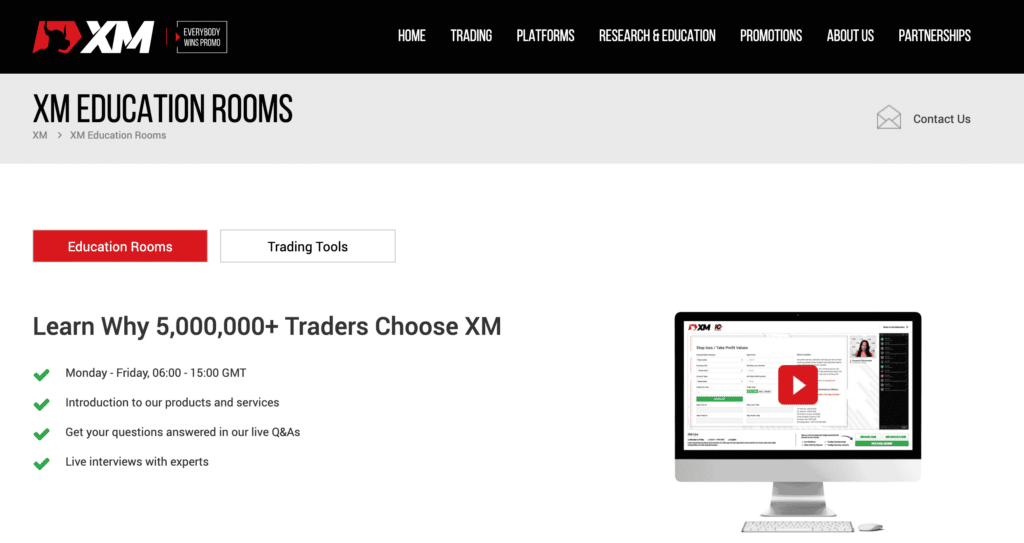

Education and Research

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Are the broker’s educational materials suitable for beginners?

Yes, the broker provides educational materials for traders of all skill levels, from novice to advanced.

Can I access their research and analysis for free?

Yes, all registered clients have free access to their research, market analysis, and insights.

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

What types of bonuses does the broker offer?

They provide a variety of bonuses, such as welcome bonuses, no-deposit bonuses, and loyalty rewards.

How can I claim a bonus from the broker?

Bonuses can be obtained by logging into the client portal or following promotional instructions.

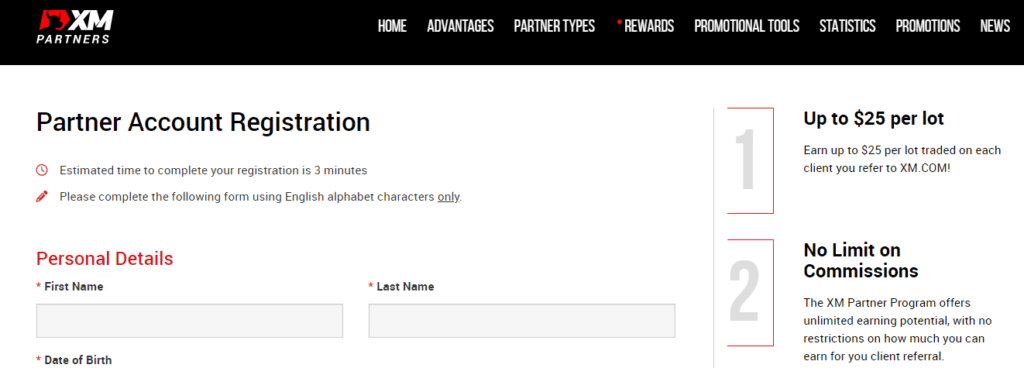

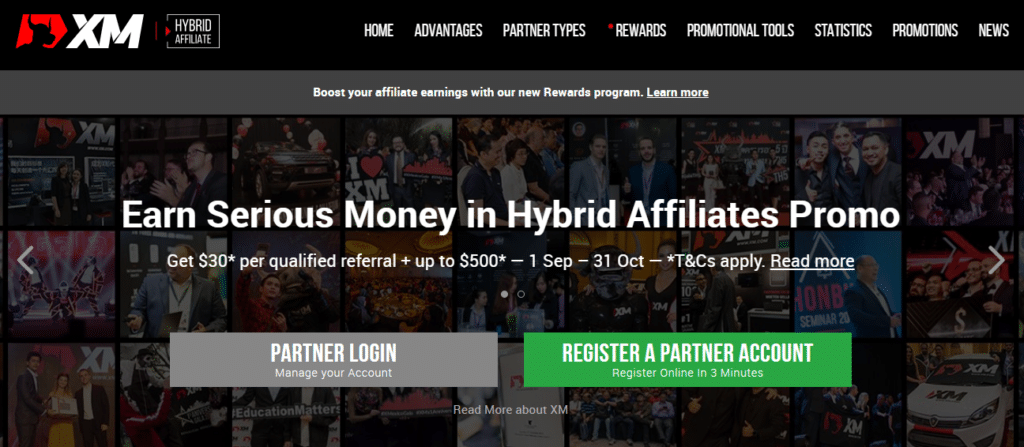

How to open an Affiliate Account with XM

To register an Affiliate Account, Indonesian traders can follow these steps:

Navigate to the “Affiliates” section of the official XM website.

Select “Join Now” and fill out the online application form. This includes providing personal and contact information and selecting preferred payment methods and account currency.

Affiliate Program Features

The Affiliate Program features an extensive Partner Program tailored for affiliates, brimming with various benefits and features. These are some examples:

What commission structure does the affiliate program offer?

Depending on the affiliate’s performance and agreement, the affiliate program offers a variety of commission structures, including CPA and revenue share.

How can I track my performance as an affiliate?

The broker provides tracking tools and detailed reports to affiliates to monitor performance, conversions, and earnings.

Customer Support

| ⏳ Operating Hours | 24/5 |

| 📚 Support Languages | English, Chinese, Russian, French, Italian, Spanish, Portuguese, Polish, Arabic, and more |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of XM Support | 5/5 |

What issues can the customer support assist with?

The support team can help with account-related questions, technical issues, trading inquiries, etc.

Can I get localized support?

Yes, the broker provides localized support in various languages and regions to meet the needs of its clients.

Verdict

They stand out in our experience as a top-tier broker that provides a comprehensive and satisfying trading experience. Innovative trading platforms and the XM app, offer powerful tools and quick execution.

Competitive trading conditions, clear schedules, and excellent customer service improve the overall experience.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: FBS Review

you might also like: AvaTrade Review

you might also like: Octa Review

you might also like: HFM Review

you might also like: FXOpen Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Provides 1,429 CFDs, including 55 currency pairs | Spreads can be expensive when compared to industry leaders |

| Trading Central’s tools and XM’s in-house research are both valuable assets | The broker does not provide its own trading platforms for desktop or the web |

| A wide range of educational webinars, articles, and courses are available | Average spreads for the commission-free Zero account are not published |

| The entire MetaTrader suite is available, including copy trading | The broker does not have an IDR-denominated account |

| Specific order types have guaranteed fills | |

| The broker offers a 30 USD no-deposit bonus to newly registered traders | |

| They are an award-winning, multi-regulated broker with a 90% trust score |

Frequently Asked Questions

What is XM Indonesia?

XM Indonesia is a leading forex broker that provides various trading services and financial investment opportunities.

How do I open an account with them?

To sign up for an account, go to their official website, fill out the registration form, and follow the instructions.

Is XM regulated?

Yes, they are regulated by ASIC, IFSC, CySEC, FSC, DFSA and FSCA.

Is XM Safe or a Scam?

They are a highly reputable and safe broker for Indonesians, with a trust score of 90%.

What trading platforms does the broker offer?

They provide access to popular trading platforms such as MetaTrader 4 and MetaTrader 5 and advanced trading tools. In addition, XM also offers an iOS and Android app.

Are there any bonuses available for new traders?

Yes, they provide bonuses to new traders to improve their trading experience and potential profits.

How can I deposit funds into my account?

You can fund your account using a secure and convenient payment method on their platform.

How long does it take to withdraw?

Withdrawals take at least 1 working day and up to 5 working days. However, some clients have complained that withdrawal times can be much longer than indicated.

Can I trade forex on the platform?

Yes, the broker offers a comprehensive forex trading experience, allowing traders to trade diverse currency pairs.

Does XM have VIX 75?

No, the broker does not have the Volatility 75 but offers several other indices that can be traded.

Does XM have Nasdaq 100?

They offer Nasdaq as a cash index under US100, with spreads from 1.10 pips.

What is the withdrawal process like?

Withdrawing funds from your account is a simple process. Log in to your account, go to the withdrawal section, and follow the instructions.

Are there any educational resources available for traders?

Yes, they provide various educational resources, such as webinars, tutorials, and market analysis, to assist traders in making sound decisions.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

In pursuing equal opportunities, the broker continues engaging in humanitarian efforts with cross-cultural, religious, and ethnic boundaries.

With a mission to uplift individuals and assist them in reaching their full potential, they are dedicated to making a positive difference in people’s lives worldwide.

Education and Skill Development: Making Knowledge Available

The broker takes pride in initiating projects that promote educational access and vocational skills development. As a result, the company enables individuals to broaden their horizons and secure brighter futures for themselves and their communities.

Fostering Innovation for the Greater Good through Research and Development

As part of its corporate social responsibility, the broker invests in research, development, and innovation initiatives that benefit society. The dedication to progress extends beyond financial growth, highlighting XM’s commitment to a more inclusive and advanced world.

International Aid Provides Global Outreach

Collaboration with domestic and international human aid foundations expands XM’s global impact. By collaborating with these organizations, XM hopes to address pressing issues, provide relief, and foster long-term change in the lives of those in need.

A Look at Humanitarian Missions

Their dedication to making a positive difference is demonstrated by several recent initiatives that embody its core values:

Does the broker engage in charitable activities as part of its Corporate Social Responsibility?

Yes, the broker is actively involved in charitable initiatives as part of its Corporate Social Responsibility efforts. They have supported various causes, including education, health, and disaster relief, through donations and partnerships with charitable organizations.

What steps has the broker taken to promote environmental sustainability as part of its CSR initiatives?

The broker is committed to environmental sustainability. They have implemented measures to reduce their carbon footprint, including energy-efficient practices and eco-friendly office operations.