FxOpen Review

Overall FXOpen is considered low-risk, with an overall Trust Score of 89 out of 100. They are licensed by two Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and zero Tier-3 Regulators (low trust). The broker offers four retail and three PAMM accounts: Micro, STP, ECN, Crypto, STP PAMM, ECN PAMM, and Crypto PAMM.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

1 USD / 15,715 IDR

Regulators

ASIC, FCA, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, TickTrader

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overview

They are regulated by reputable organizations such as the FCA, CySEC, and ASIC and provide a diverse trading experience suitable for a wide range of investors.

It provides flexibility for different trading strategies with a $1 minimum deposit requirement and leverage opportunities up to 1:30 for UK and EU investors (up to 1:500 for global investors).

The broker provides access to a wide range of instruments such as Forex, CFDs, Indices, Commodities, Cryptocurrencies, ETFs, and Shares via multiple trading platforms such as MetaTrader 4, MetaTrader 5, TickTrader, and TradingView.

A specialized Crypto Account with tight spreads, a 0.1% commission fee, and access to 27 crypto pairs is available for crypto enthusiasts. Furthermore, the broker provides a free demo account for practice, making it an accessible and versatile option for Indonesian traders.

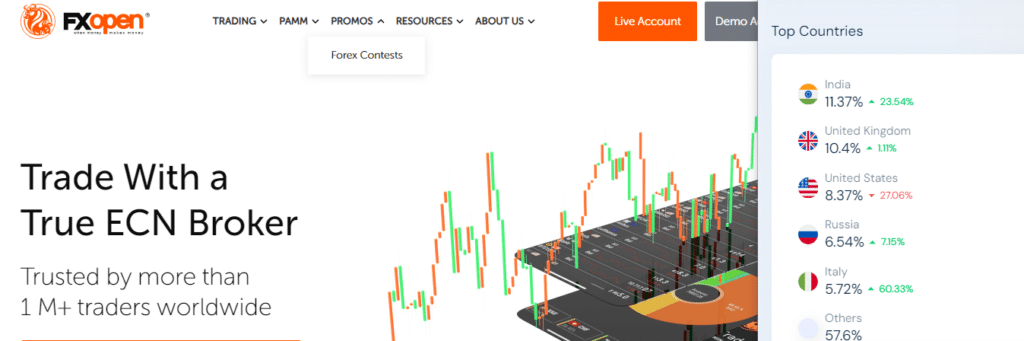

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders

The broker currently ranks among the top 100 CFD and Forex Brokers for Indonesians.

What sets them apart from their competitors?

They provide competitive spreads, advanced trading platforms, and a variety of account types to meet the needs of different traders.

How does the broker’s ECN trading environment compare to others?

The broker’s ECN trading gives you direct access to liquidity providers, resulting in more transparent pricing and faster execution.

At a Glance

| 🏛 Headquartered | United Kingdom, Australia, Saint Kitt and Nevis |

| ✅ Global Offices | United Kingdom, Australia, Saint Kitt and Nevis |

| 🗓 Year Founded | 2005 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | • YouTube |

| ⚖️ Regulation | ASIC, FCA, CySEC |

| 🪪 License Number | Australia – AFSL 412871, United Kingdom – 579202, Cyprus – 194/13 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 Retail, 3 PAMM |

| 📊 PAMM Accounts | Yes, 3 |

| 🤝 Liquidity Providers | Dresdner, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JP Morgan, Morgan Stanley, Deutsche Bank AG, RBS, CITI, UBS, Hotspot INST, Goldman, LavaFX |

| 💸 Affiliate Program | Yes, White Label, Affiliate, Introducing Broker, Regional Representative |

| 📲 Order Execution | Instant, Market |

| 📊 Average spread | 0.0 pips (floating) |

| 📞 Margin Call | 100% – 20% |

| 🛑 Stop-Out | 50% – 10% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 50% – 10% |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 1 USD / 15,715 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based FXOpen customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💰 Bonus | Yes |

| 💵 Deposit and Withdrawal Options | • PayPaid • WebMoney • FasaPay • ADVCash • Bitcoin • Bitcoin Cash • Litecoin • Ethereum • Tether • Emercoin • Bank Transfer • Credit/Debit Card • Easy Bank Transfer |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, TickTrader |

| ✔️ Tradable Assets | Forex, Indices, Commodities, Shares, ETFs, Cryptocurrency |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, French, German, Italian, Spanish, Turkish, Arabic, Chinese, Russian, Indonesian, Hungarian, etc. |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes, minimal |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is FXOpen a safe broker for Indonesian traders? | Yes |

| 📊 Rating for FXOpen Indonesia | 8/10 |

| 🤝 Trust score for FXOpen Indonesia | 89% |

| 🎉 Open an account | Open Account |

Safety and Security

Regulation in Indonesia

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

How does the broker ensure the safety of client funds?

They use strict security measures, such as segregated accounts and encryption technologies.

What measures does the broker take to protect client data?

The broker employs advanced encryption and firewall technologies to ensure client data confidentiality and integrity.

Awards and Recognition

The broker received the following recent awards and recognition:

Furthermore, the following are a few of the broker’s most recent achievements:

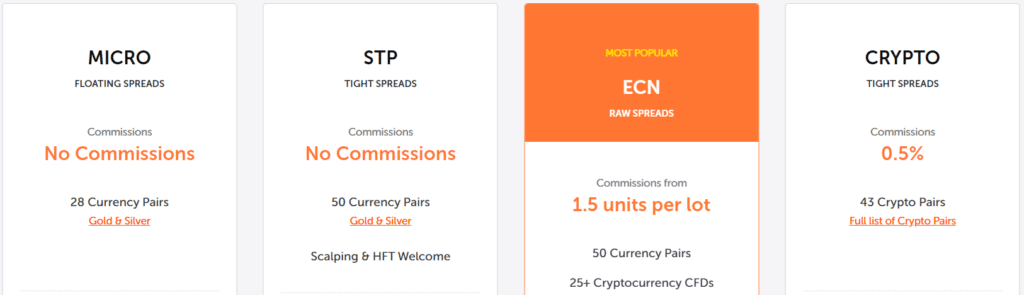

FXOpen Account Types and Features

Micro Account

The broker provides Micro forex accounts denominated in US cents for Indonesian traders. With a minimum initial deposit of only $1, these accounts facilitate market entry.

Micro accounts offer comparable trading conditions to STP accounts, with small minimum transaction sizes and low margin requirements.

This option is ideal for novice traders seeking experienced and seasoned traders testing new strategies, indicators, and advisors with limited risk. Key characteristics of the Micro Account include:

Account Features Value

💰 Minimum Deposit Requirement 1 USD / 15,715 IDR

💵 Base Account Currency Options USD

📈 Maximum Leverage 1:500

📊 Instruments Available 28 Forex Pairs, Gold, Silver

💰 Minimum Position Size 0.01 micro-lots

💸 Dormant Account Fees $10 for Maintenance, $50 for reactivation

📊 Average spreads Variable, from 0.0 pips

💵 Maximum Open Orders Allowed 100

📞 Trading Time Midnight on Monday – 10h59 pm Friday

✔️ Access to Bonuses Yes

🎉 Open an account Open Account

STP Account

Traders from Indonesia can access the STP accounts, where Straight Through Processing (STP) execution is the norm. This execution type incorporates the broker’s commission into the spread, which varies based on the order availability of ECN.

Every trade is executed in real-time, with minimum transaction sizes as low as 0.01 lot and maximum leverage of 1:500 for accounts under USD 25,000.

Furthermore, STP accounts provide a variety of tradable instruments with no restrictions on trading styles, making them a flexible option. The account’s distinctive characteristics include the following:

Account Features Value

💰 Minimum Deposit Requirement 10 USD / 157,151 IDR

💵 Base Account Currency Options USD, EUR, GBP, JPY, RUB, CHF, Gold

📈 Maximum Leverage 1:500

📊 Instruments Available 50 Forex Pairs, Gold, Silver

💰 Minimum Position Size 0.01 micro-lots

💸 Dormant Account Fees $10 for Maintenance, $50 for reactivation

📊 Average spreads Variable, from 1 pip

💵 Maximum Open Orders Allowed 100

📞 Trading Time Midnight on Monday – 10h59 pm Friday

✔️ Access to Bonuses Yes

🎉 Open an account Open Account

ECN Account

The ECN accounts ensure competitive trading conditions for Indonesian traders. Utilizing cutting-edge price aggregation technology, these accounts offer market spreads beginning at zero pips and seamless order execution.

In addition, the lack of a dealing desk ensures objectivity by matching orders with those of other ECN participants. Acceptable trading strategies include scalping and expert advisors. Key ECN Account features include the following:

Account Features Value

💰 Minimum Deposit Requirement 100 USD / 1,571,515 IDR

💵 Base Account Currency Options USD, AUD, CHF, EUR, GBP, JPY, RUB, SGD, Gold, mBTC

📈 Maximum Leverage 1:500

📊 Instruments Available 50 Spot Forex CFDs, 35+ Crypto CFDs, 600+ Share CFDs, Index CFDs, Spot Metals, Commodity CFDs

💰 Minimum Position Size 0.01 micro-lots

💸 Dormant Account Fees $10 for Maintenance, $50 for reactivation

📊 Average spreads Variable, from 0.0 pips

💵 Maximum Open Orders Allowed 100

📞 Trading Time Midnight on Monday – 10h59 pm Friday

✔️ Access to Bonuses Yes, access to rebates

🎉 Open an account Open Account

Crypto Account

The broker provides a CFD trading platform for Bitcoin and Litecoin against major currencies for Indonesian traders interested in cryptocurrency. Due to price fluctuations, these accounts permit investment and speculation.

They utilize premier liquidity providers to aggregate liquidity and manage risks. ECN Aggregator is used for execution, ensuring tight spreads and low commissions.

In addition, all styles of Forex trading are supported, with a maximum use of 1:3. The Crypto Account’s distinctive features are as follows:

Account Features Value

💰 Minimum Deposit Requirement 10 USD / 157,151 IDR

💵 Base Account Currency Options USD, EUR, GBP, RUB, JPY, ETC, Bitcoin (mBTC), Litecoin (LTC)

📈 Maximum Leverage 1:3

📊 Instruments Available 43 Cryptocurrency Pairs

💰 Minimum Position Size 0.01 micro-lots

💸 Dormant Account Fees $10 for Maintenance, $50 for reactivation

📊 Average spreads Variable, from 1 pip

💵 Commission Fee 0.5% half-turn

📞 Trading Time 24/7

✔️ Access to Bonuses No

🎉 Open an account Open Account

Demo Account

Demo accounts from the broker allow Indonesian traders to explore forex trading without risk. These simulations, available for STP, ECN, and Crypto Accounts, replicate real-world conditions.

Offering virtual funds and a simulated environment, they cater to traders of all levels. The demo account sharpens the skills of traders, instils confidence, and fosters strategic growth.

Its significance stems from its capacity to provide real-world trading experience without the associated financial risk.

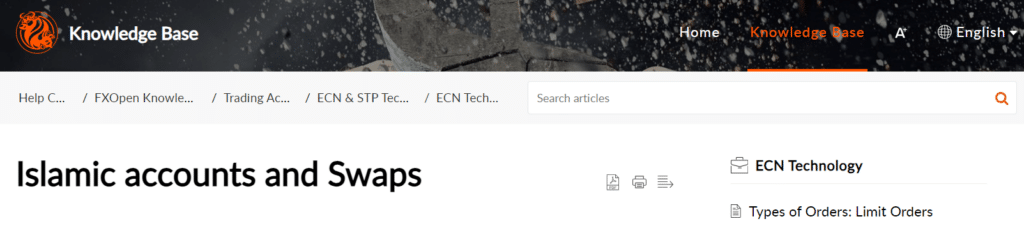

Islamic Account

The broker respects Indonesian Muslim traders by offering Islamic accounts that adhere to Sharia law without swaps. Rather than swaps, rollovers incur an additional commission equivalent to the swap.

This feature is available for ECN and STP accounts and is compatible with Islamic beliefs. Islamic accounts provide a Sharia-compliant approach to trading, preserving the honour of financial transactions.

What are the main account types offered?

The broker provides ECN, STP, Crypto, and Micro accounts, each with its own features and benefits.

Can I switch between different account types?

Yes, you can switch between account types, subject to the terms and conditions of the broker.

Min Deposit

1 USD / 15,715 IDR

Regulators

ASIC, FCA, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, TickTrader

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

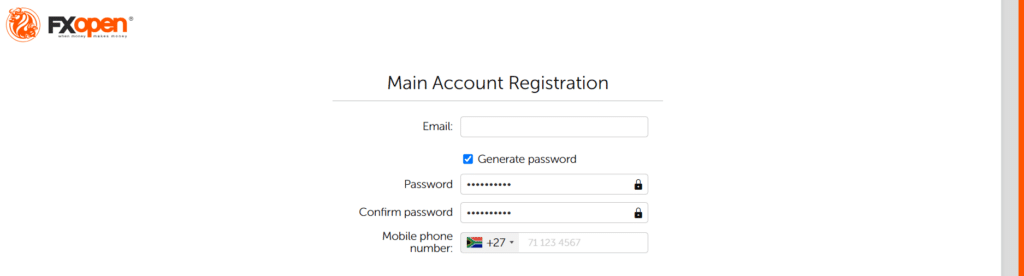

How to open an Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

To get started, navigate to the FXOpen website and select the “Open an account now” option.

You will be redirected to a secure server to complete the online application. Fill out all required fields with precision.

You will be provided with a username and password after completing the application.

FXOpen Vs RoboForex Vs Exness – Broker Comparison

| FXOpen | RoboForex | Exness | |

| ⚖️ Regulation | ASIC, FCA, CySEC | IFSC | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, TickTrader | MetaTrader 4, MetaTrader 5, cTrader, R StocksTrader, R MobileTrader | MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal |

| 💰 Withdrawal Fee | Yes | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 USD / 15,715 IDR | 1 USD / 15,715 IDR | 1 USD / 15,715 IDR |

| 📈 Leverage | 1:500 | 1:2000 | Unlimited |

| 📊 Spread | From 0.0 pips | 0.0 pips | Variable, from 0.0 pips |

| 💰 Commissions | From $1.5 | $10 per million traded | From $0.1 per side per lot |

| ✴️ Margin Call/Stop-Out | M – 100% – 20% S/O – 50% – 10% | M: 40% – 60% S/O: 10% – 40% | 60%/0% |

| ✴️ Order Execution | Instant, Market | Market | Market |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | Yes, Micro | No | Yes |

| 📈 Account Types | Micro Account, STP Account, ECN Account, Crypto Account, PAMM STP, PAMM ECN, PAMM Crypto | Prime Account, ECN Account, R StocksTrader Account, ProCent Account, Pro Account | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | Yes | Yes | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 4 retail, 3 PAMM | 5 | 5 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

MetaTrader 4

The broker offers the MetaTrader 4 (MT4) trading platform, first introduced by MetaQuotes in 2005. This outstanding platform allows traders to access various markets via Contract for Differences (CFDs), including indices, forex pairs, and commodities.

In addition, MT4 is best known for its association with forex trading, but it also stands out for its adaptability to individual trading preferences.

The remarkable flexibility of MT4 is one of the key factors contributing to its widespread popularity. Traders value the platform’s ability to be customized to their specific preferences and needs.

Furthermore, the platform includes algorithmic features that enable automatic trade execution and termination based on predefined parameters. This feature saves time while ensuring that trades are executed precisely per the trader’s strategies.

MetaTrader 5

The broker’s trading platform includes the MetaTrader 5 (MT5) platform, allowing traders to access global financial markets. MT5 has a wide range of features, including order execution, rigorous testing of trading strategies, and in-depth market analysis.

The advanced charting package with MT5 can benefit novice and experienced traders. This package includes a variety of technical indicators and drawing tools, allowing traders to make informed decisions.

MT5 goes above and beyond by including advanced trading algorithms, such as neural networks, which can help shape trading strategies. Furthermore, the platform embraces the concept of social trading, allowing traders to observe and follow their peers’ strategies.

The Strategy Tester tool is a particularly noteworthy feature of MT5. This tool allows traders to design and fine-tune their own trading strategies within the platform.

This increases a trader’s involvement and control over their strategies and contributes to the platform’s reputation as a reliable and adaptable trading tool.

TickTrader

TickTrader stands out as a trading platform that caters to traders of varying levels of expertise. This platform takes pride in its user interface, which speeds up the decision-making process for traders and ensures quick and efficient actions.

TickTrader’s sophisticated charting package is central to its appeal. This package provides traders with the tools to conduct comprehensive technical analysis, allowing them to make more informed trading decisions.

Furthermore, the platform includes a real-time news feed, updating traders on developments that may affect their trading strategies.

TickTrader improves the trading experience even more by incorporating powerful analytical tools. These tools enable traders to delve deeply into market trends, uncover insights and make calculated trading decisions.

Overall, TickTrader demonstrates the broker’s commitment to providing traders with a comprehensive and intuitive trading environment that meets both their analytical needs and their need for quick decision-making.

TradingView

Traders can access over 600 instruments in currency pairs, indices, and commodity CFDs directly from TradingView thanks to the broker’s true ECN technology model. This integration enables access to the interbank market without needing a dealing desk or requotes.

Deep liquidity, tight spreads starting at 0.0 pips, and fast order execution are available to traders. The broker’s TradingView integration supports a variety of trading styles, including swing trading, scalping, and the use of Expert Advisors (EAs).

Furthermore, the broker and TradingView have joined forces to make Forex trading more professional, accessible, and secure, with responsive customer support and competitive commissions.

Can I trade on mobile devices with them?

Yes, they offer mobile trading apps for both Android and iOS devices.

Do they offer any proprietary trading platforms?

No, they primarily use the MetaTrader platforms.

Range of Markets

Indonesian traders can expect the following range of markets:

What financial instruments can I trade?

The broker provides various instruments, including Forex, commodities, indices, and cryptocurrencies.

Does the broker offer trading in emerging market currencies?

Yes, they give you access to various emerging market currencies, broadening your trading options.

Broker Comparison for Range of Markets

| FXOpen | RoboForex | Exness | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Min Deposit

1 USD / 15,715 IDR

Regulators

ASIC, FCA, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, TickTrader

Crypto

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

FXOpen Fees, Spreads, and Commissions

Spreads

The broker charges variable spreads that diverge based on diverse factors, including the type of account, the financial instrument being traded, and the prevalent market conditions on any given trading day.

Commissions

The broker extends the option of commission-free transactions for the Micro Account category. Conversely, commissions are levied on trading activities conducted through the ECN, Crypto, PAMM ECN, and PAMM Crypto account classifications

Overnight Fees

The broker imposes overnight, rollover fees on open positions beyond a single trading day.

These fees encompass the cost of borrowing funds to maintain a particular position. Furthermore, their calculation hinges on the differential in interest rates between the two currencies constituting the currency pair being traded.

In cases where the interest rate applicable to the currency being acquired exceeds that of the currency being divested, traders stand to accrue a rollover credit.

Conversely, traders incur a rollover fee if the interest rate linked to the currency being purchased is inferior to that of the currency being sold.

The broker’s assessment of overnight fees, or rollovers, exhibits variability contingent on factors such as the currency pair under consideration, the trading account’s classification, and the assumed position’s magnitude.

These fees are automatically tabulated and debited after each trading day, and their presence is duly reflected in the account statement.

Deposit and Withdrawal Fees

The broker charges the following deposit fees:

The broker charges the following deposit fees:

Inactivity Fees

The broker charges the following Maintenance and Inactivity Fees:

Currency Conversion Fees

When traders opt to deposit or withdraw funds in currencies divergent from their pre-designated base account currency, they will be subject to Currency Conversion fees.

How does the broker structure its fees and spreads?

The fees, spreads, and commissions charged by them vary depending on the account type and instrument, with detailed information available on their website.

Are there any hidden fees?

No, the broker does not have hidden fees. However, even though they strive for transparency, reviewing its fee schedule and terms for any additional charges is prudent.

FXOpen Deposits and Withdrawals

Indonesians can choose from the following deposits and withdrawals:

Are there any fees for deposits or withdrawals?

Yes, deposit and withdrawal fees apply depending on the method.

How long do withdrawals take?

Withdrawal times vary depending on the method, but they typically range from a few hours to several business days.

How to make a Deposit

To deposit funds into an account, Indonesian traders can follow these steps:

Visit the FXOpen website and sign in to your account.

In the top right-hand corner of the screen, click the “Deposit” button.

Select the payment method you want to use. The broker accepts bank transfers, credit/debit cards, and e-wallets such as PayPal, Skrill, and Neteller as payment methods. Enter the deposit amount and any other required information, such as your payment information.

How to Withdraw funds

To withdraw funds from an account, Indonesian traders can follow these steps:

Visit the FXOpen website and sign in to your account.

In the top right-hand corner of the screen, click the “Withdraw” button.

Select the withdrawal method you want to use. FXOpen accepts bank transfers, credit/debit cards, and e-wallets such as PayPal, Skrill, and Neteller as withdrawal methods. Enter the withdrawal amount and any other required information, such as your payment information.

Education and Research

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Does the broker offer market research and analysis?

Yes, the broker provides market research, analysis, and insights to assist traders in making sound decisions.

Can beginners benefit from the broker’s educational materials?

Yes, the broker’s educational materials are intended to help traders of all levels, including beginners.

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions under its FSA regulations:

The FXOpen ForexCup Trading Championship 2023 is a one-of-a-kind competition that brings together investors, traders, and portfolio managers for a fair and trustworthy global showdown.

This year-long competition invites participants to compete for the title of the best trader and a $50,000 cash prize. The most important criterion for victory is demonstrating the greatest profit by the end of 2023.

This fantastic contest is open to anyone with an active ECN account, ensuring accessibility to a wide range of people. The only participation requirement is to keep a minimum trading deposit and follow the contest rules.

The contest parameters’ flexibility extends to the available tradable instruments, which include spot FX, indices, commodities, stocks, metals, and crypto CFDs. This multifaceted approach encourages participants to apply their knowledge of various financial products.

Does the broker offer any bonuses or promotions to new clients?

Yes, the broker may offer a variety of bonuses and promotions; further information can be found on their website or by contacting support.

Are there any specific terms and conditions for the bonuses?

Yes, the bonuses and promotions are subject to terms and conditions that should be carefully read.

How to open an Affiliate Account with FXOpen

To register an Affiliate Account, Indonesian traders can follow these steps:

Navigate to the FXOpen official website and look for the prominent “Affiliate Program” button in the top menu.

To begin the registration process, click the “Join Now” button.

Fill out the registration form with your personal information, including your full name, email address, and country of residence.

Affiliate Program Features

The affiliate program distinguishes itself through various exceptional features, each contributing to its affiliates’ increased earning potential and overall growth. The following are the key features of the affiliate program:

What commission structure does the affiliate program offer?

The affiliate program offers a variety of commission structures based on performance and agreement.

Does the broker provide marketing support to affiliates?

Yes, the broker provides affiliates with marketing materials, tools, and support to help them promote their services.

Customer Support

| ⏳ Operating Hours | 24/5 |

| 📚 Support Languages | Multilingual |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of FXOpen Support | 4/5 |

How can I contact the broker’s customer support?

The broker’s customer service can be reached by phone, email, live chat, or through the contact form on their website.

Is the broker’s customer support available 24/7?

No, the broker’s support is not available 24/7 but only 24 hours a day during weekdays.

Verdict

Based on our research, the broker appears to be a promising option for Indonesian traders. It provides a diverse trading experience, with a trust score of 89% and regulation by reputable organizations such as the FCA, CySEC, and ASIC.

The broker’s dedication to transparent pricing, competitive trading conditions, and exceptional customer service adds significantly to its appeal.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: Exness Review

you might also like: FXTM Review

you might also like: Octa Review

you might also like: AvaTrade Review

you might also like: HFM Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The Web Platform improves user experience by allowing one-click trading and trading directly from the chart | For some users, the educational material may appear meagre when compared to industry standards |

| The broker caters to the growing interest in digital currencies by offering 27 Cryptocurrency CFDs | For FCA, ASIC, and CySEC-regulated entities, leverage is limited to 1:30, which may be restrictive for some trading strategies |

| The broker provides a demo account for practice, allowing traders to become acquainted with the platform | |

| The broker caters to both advanced and novice traders with MetaTrader 4, MetaTrader 5, TickTrader, and a Web Platform |

Frequently Asked Questions

How can I open an account with FXOpen Indonesia?

You can open an account by going to their website, filling out a registration form, and providing the necessary identification documents.

How long does it take to withdraw?

The broker’s withdrawals are processed quickly, with a minimum time of instant and a maximum time ranging from 2 to 5 days, depending on the withdrawal method used.

Does the broker have VIX 75?

No, they do not allow you to trade the VIX 75 index.

Are they a reliable trading platform?

Yes, they are well-known for their trading services, but it’s critical to read user reviews and consult regulatory information to ensure they meet your requirements.

What trading platforms does the broker offer?

The broker provides popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView, providing Indonesian traders with various tools and features to help them trade effectively.

Are they Safe or a Scam?

They are regarded as a secure broker. Several regulatory bodies govern it, and FXOpen follows stringent compliance standards to ensure transparency and security in its operations.

What are the withdrawal fees?

Withdrawal fees vary depending on the method and currency used.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

FXOpen does not offer information regarding past or future CSR initiatives or projects.