Vantage Markets Review

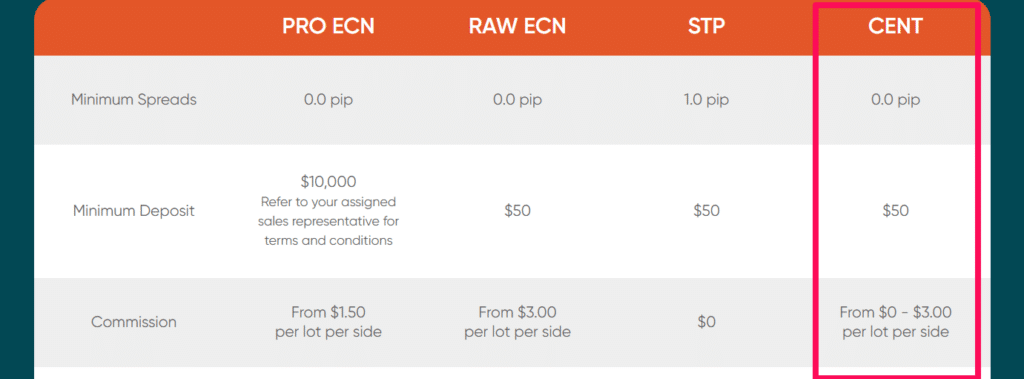

Overall Vantage Markets is considered low-risk with an overall Trust Score of 90 out of 100. They are licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). They offer four retail trading accounts: Standard STP, Raw ECN, PRO ECN and Cent.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

50 USD / 777,400 IDR

Regulators

CIMA, VFSC, FSCA, ASIC

Trading Desk

MT4, MT5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade

Crypto

Total Pairs

40+

Islamic Account

Trading Fees

Account Activation

Overview

Vantage Markets is a licensed Forex broker that connects traders to the global Forex market via top-tier FX liquidity providers.

They have over a decade of market experience and have established themselves as a global, multi-asset broker that provides clients with an elegant and powerful service for trading CFDs on Forex, Commodities, Indices, and Shares.

The broker has a $50 minimum deposit, making it accessible to traders of all capital levels. Furthermore, it has a maximum leverage of 1:500, which allows traders to maximize their trading potential.

The broker provides a variety of trading platforms, including MetaTrader 4 and MetaTrader 5, as well as a web-based platform and a proprietary app with a high degree of flexibility. This ensures that traders have instant access to their forex charts, regardless of where or when they need to access their platform.

They provide various types of accounts to meet the needs of different traders. The Standard STP Account is ideal for new traders who want simple, direct market access without commissions.

The RAW ECN account is intended for experienced traders who require high liquidity and tight spreads. The PRO ECN account is designed for high-volume professional traders and money managers.

Vantage Markets is fully legal and accessible to Indonesian traders. It has several features that are tailored to the needs of Indonesian traders.

These include swap-free/Islamic accounts that follow Sharia law. Furthermore, depending on the account type, Vantage Markets offers competitive spreads at 0.0 pips and commissions at $3.00 per lot per side.

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among Indonesian traders

Vantage Markets is well-regulated and safe, making it one of the top 35 forex and CFD brokers for Indonesians.

Can US residents trade with Vantage Markets?

No, due to regulatory restrictions, the broker does not serve US residents at this time.

Is Vantage Markets available in the Middle East?

Yes, they operate in certain Middle Eastern nations with certain restrictions.

At a Glance

| 🏛 Headquartered | Sydney, Australia |

| ✅ Global Offices | South Africa, Australia, Cayman Islands, Vanuatu |

| 🗓 Year Founded | 2009 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, X, LinkedIn, Instagram, YouTube |

| ⚖️ Regulation | CIMA, VFSC, FSCA, ASIC |

| 🪪 License Number | Australia – AFSL 428901 South Africa – FSP 51268 Cayman Islands – 1383491 Vanuatu – 700271 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | United States, Canada, China, Romania, Singapore, etc. |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | Yes |

| 🤝 Liquidity Providers | KCG Hotspot, JP Morgan, NAB, Citibank, Westpac, Nomura, BNP Paribas, HSBC, Credit Suisse, Goldman Sachs, Bank of America, Société Générale, RBS, UBS |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📞 Margin Call | 80% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | Yes (via Australian entity) |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 50 USD / 777,400 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based Vantage Markets customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Domestic EFT Domestic Fast Transfer (Australia) International EFT Credit/Debit Card JCB China UnionPay Neteller Skrill AstroPay Broker-to-Broker Transfer FasaPay Thailand Instant Bank Wire Transfer |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 ProTrader Vantage App Vantage Social trading ZuluTrade Myfxbook AutoTrade DupliTrade |

| ✔️ Tradable Assets | Forex Indices Precious Metals Soft Commodities Energies ETFs Share CFDs Bonds Cryptocurrency CFDs (Australian entity) |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, French, German, Italian, Spanish, Vietnamese, Korean, Mongolian, Arabic, Dutch, Estonian, Chinese, Thai, Portuguese, Malay, Indonesian, Russian, Polish |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | Yes |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is Vantage Markets a safe broker for Indonesian traders? | Yes |

| 📊 Rating for Vantage Markets Indonesia | 9/10 |

| 🤝 Trust score for Vantage Markets Indonesia | 90% |

| 🎉 Open an account | Open Account |

Safety and Security

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Security while Trading

Is two-factor authentication available at Vantage Markets?

Yes, the broker provides two-factor authentication for account security.

Are funds segregated at Vantage Markets?

Client funds are held in accounts distinct from the company’s operational funds.

Awards and Recognition

They have received the following recent awards and recognition:

Vantage Markets Account Types and Features

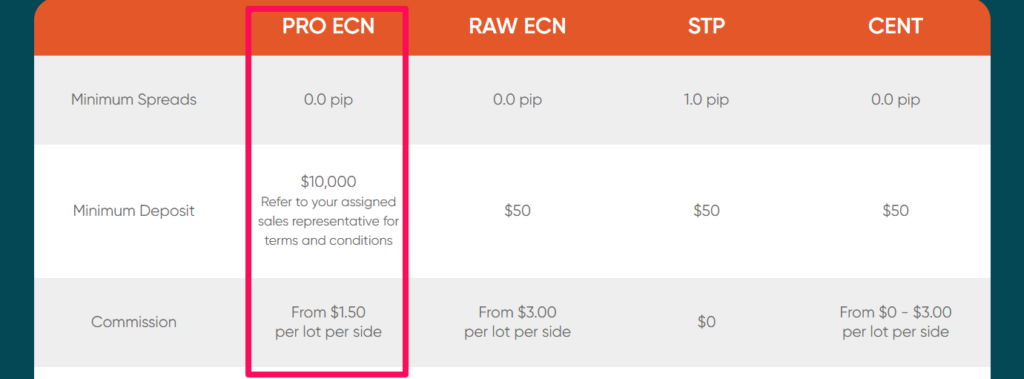

PRO ECN Account

The Vantage PRO ECN account offers professional traders, money managers, and algorithmic traders from Indonesia the opportunity to access top-tier liquidity from reputable sources.

With this unparalleled access, users can trade in global markets at highly competitive rates while benefiting from fast execution speed and narrow spreads.

Additionally, this account charges a modest commission rate of only $1.50 per side for each standard forex lot traded. Notably, some remarkable features of this account are:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 10,000 USD / 155,480,000 IDR |

| 📊 Minimum spreads | From 0.0 pips EUR/USD |

| 💳 Commission Fees | From $1.5 per lot, per side |

| 📱 Trading Platforms Available | MT4, MT5, Vantage App, ProTrader Platform |

| 💱 Range of Markets | 49 Forex Pairs 25 Indices 51 ETFs 22 Commodities 800+ Share CFDs 43 Cryptocurrency CFDs |

| 📈 Minimum Trade Size | 0.01 lots (micro-lot) |

| 🚀 Maximum Leverage | 1:500 |

| 🎉 Open an account | Open Account |

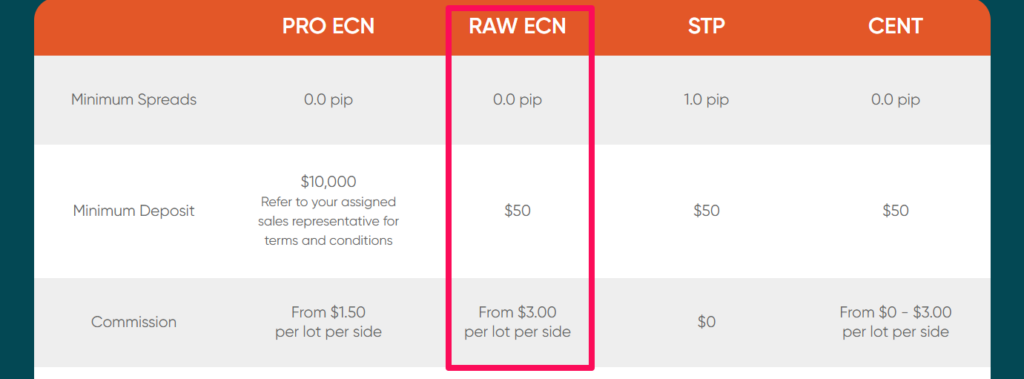

Raw ECN Account

The Raw ECN Account offers an extremely cost-effective solution for Forex trading, enabling traders to directly access top-level liquidity from the world’s most prominent banks and institutions.

With this account, every trade carries a minimal commission of $3.00 without any extra spread markup. Here are some notable features provided by this account:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 50 USD / 777,400 IDR |

| 📊 Minimum spreads | From 0.0 pips EUR/USD |

| 💳 Commission Fees | From $3 per lot, per side |

| 📱 Trading Platforms Available | MT4, MT5, Vantage App, ProTrader Platform |

| 💱 Range of Markets | 49 Forex Pairs 25 Indices 51 ETFs 22 Commodities 800+ Share CFDs 43 Cryptocurrency CFDs |

| 📈 Minimum Trade Size | 0.01 lots (micro-lot) |

| 🚀 Maximum Leverage | 1:500 |

| 🎉 Open an account | Open Account |

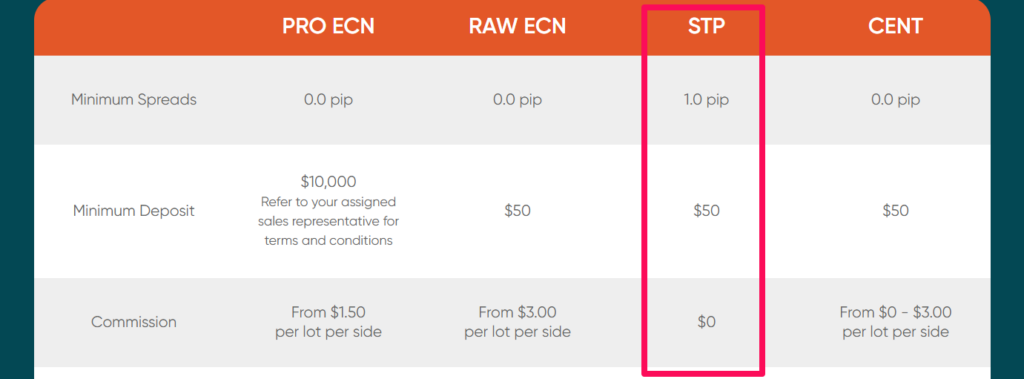

Standard STP Account

With the Standard STP Account, traders can access spreads and dark liquidity pools that are on par with institutions. This enhances the liquidity in real-time trading.

Moreover, this account guarantees market depth, transparent pricing, swift execution of trades and narrow spreads without any commissions involved. To achieve lightning-fast execution speeds during trades, traders can use Equinix Fibre Optic Network.

The key features of the Standard STP Account consist of:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 50 USD / 777,400 IDR |

| 📊 Minimum spreads | From 1 pip EUR/USD |

| 💳 Commission Fees | None; only the spread is charged |

| 📱 Trading Platforms Available | MT4, MT5, Vantage App |

| 💱 Range of Markets | 49 Forex Pairs 25 Indices 51 ETFs 22 Commodities 800+ Share CFDs 43 Cryptocurrency CFDs |

| 📈 Minimum Trade Size | 0.01 lots (micro-lot) |

| 🚀 Maximum Leverage | 1:500 |

| 🎉 Open an account | Open Account |

Cent Account

The broker’s Cent Account stands out as a distinctive financial offering tailored to meet the needs of traders who prefer a low-risk entry.

This account enables users to engage in trading activities with reduced risk exposure by allowing them to trade with smaller position sizes.

What sets it apart is the denomination of account balances in cents rather than the conventional currency units, providing traders with a more granular and accessible approach to the markets.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 50 USD / 777,400 IDR |

| 📊 Minimum spreads | From 0.0 pip EUR/USD |

| 💳 Commission Fees | From $0 – $3.00 per lot per side |

| 📱 Trading Platforms Available | MT4, MT5, Vantage App |

| 💱 Range of Markets | 49 Forex Pairs 25 Indices 51 ETFs 22 Commodities 800+ Share CFDs 43 Cryptocurrency CFDs |

| 📈 Minimum Trade Size | 0.01 lots (micro-lot) |

| 🚀 Maximum Leverage | 1:500 |

| 🎉 Open an account | Open Account |

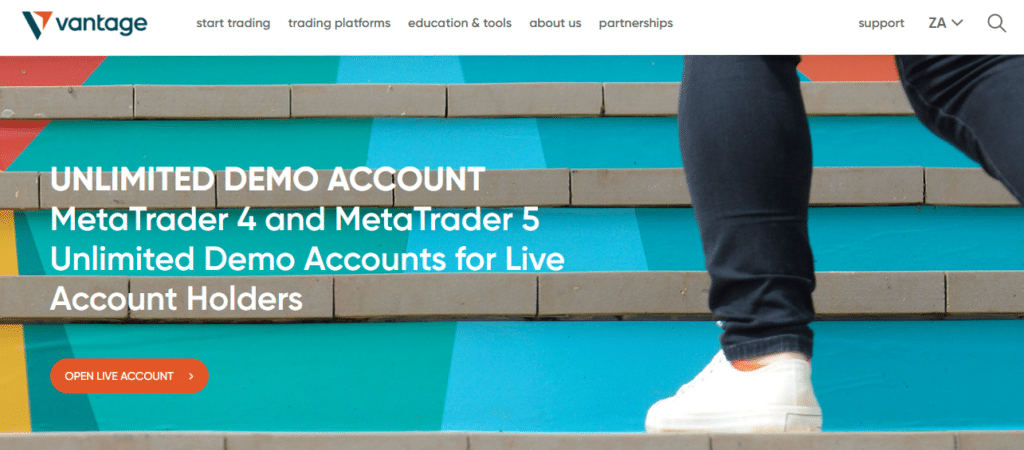

Demo Account

The broker recognizes the time it takes to acquire the skills needed for sustained profitability in Forex trading. Therefore, they understand that a standard 30-day MT4 or MT5 demo may not be sufficient for traders to develop these crucial abilities.

Vantage has introduced an unparalleled broker feature to tackle this issue: an unlimited MT4 and MT5 demo account. This unique offering allows traders to continue practising their trades until they feel fully prepared to transition into live trading.

By utilizing the platform’s demo conditions, traders can refine their skills before venturing into Forex trading. What sets Vantage apart is the commitment to providing this exceptional opportunity without any limitations on practice time.

Choose Vantage Markets as your go-to brokerage today and make informed decisions while enjoying unrestricted access to your personal unlimited MT4 orMT5demo account – ensuring you have a smooth experience when transitioning from practice sessions to real-time trades

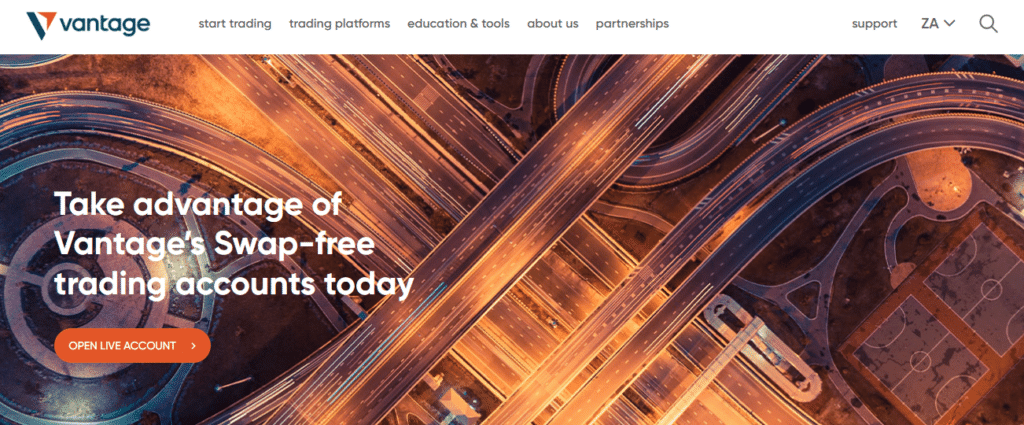

Islamic Account

The broker provides swap-free trading accounts specifically designed for Indonesian traders who adhere to religious beliefs prohibiting swap transactions. These swap-free options can be accessed across all account types, including Standard STP and RAW ECN.

With this feature, traders can take advantage of Vantage’s institutional-grade liquidity sourced from reputable financial institutions and integrated into the MT4 platform. The Islamic Account offers several advantageous features tailored to meet the needs of Indonesian traders:

Are swap-free accounts available?

Yes, there are swap-free accounts for traders who adhere to Islamic financial principles.

How does Vantage handle inactive accounts?

Dormant accounts incur a fee after a specified period of inactivity.

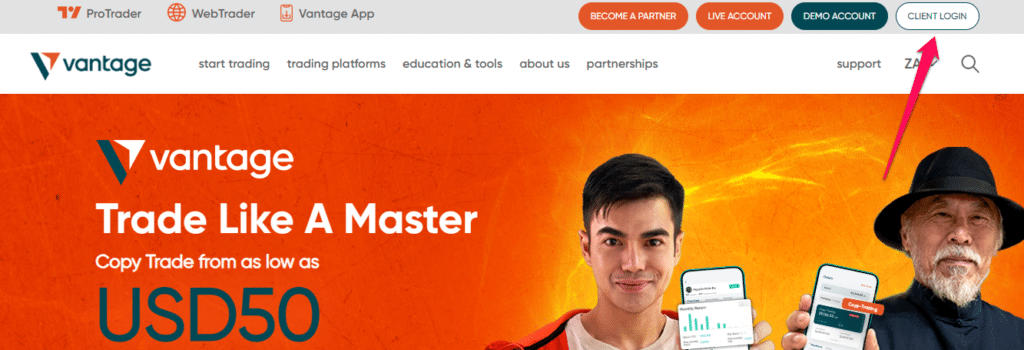

How to open a Vantage Markets Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

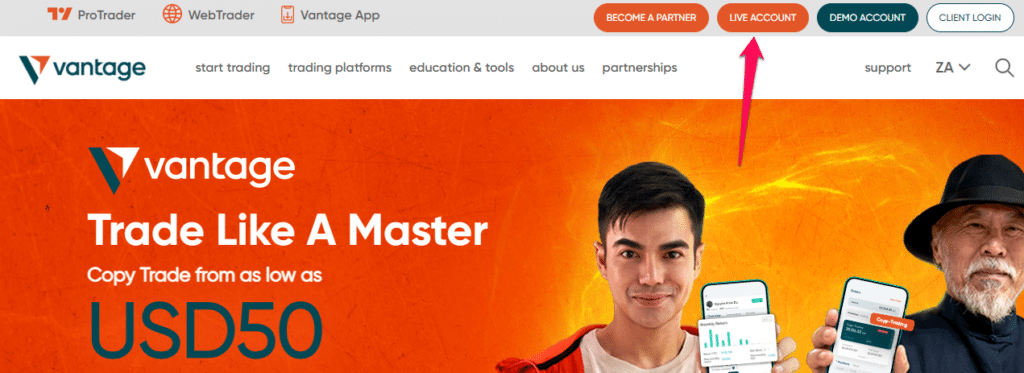

Visit the website for Vantage Markets.

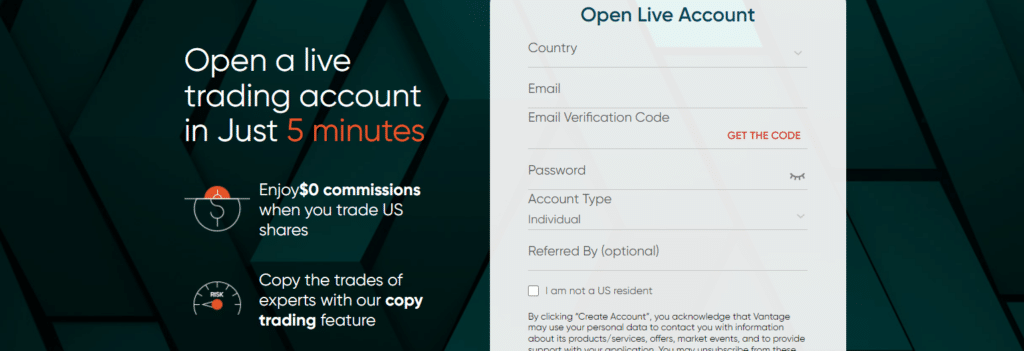

Find the “Live Account” button in the top right corner of the website and click it.

Fill out the registration form with your personal details, such as your name, email address, and phone number.

Min Deposit

50 USD / 777,400 IDR

Regulators

CIMA, VFSC, FSCA, ASIC

Trading Desk

MT4, MT5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade

Crypto

Total Pairs

40+

Islamic Account

Trading Fees

Account Activation

Vantage Markets Vs Windsor Brokers Vs Pepperstone – Broker Comparison

| Vantage Markets | Windsor Brokers | Pepperstone | |

| ⚖️ Regulation | CIMA, VFSC, FSCA, ASIC | FSC, CySEC, JSC, FSA, CMA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱 Trading Platform | MT4, MT5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade | MetaTrader 4, Windsor Brokers App | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

| 💰 Withdrawal Fee | Yes | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 50 USD / 777,400 IDR | 100 USD / 1,554,800 IDR | 0 USD / 0 IDR |

| 📈 Leverage | 1:500 | 1:500 | 1:400 |

| 📊 Spread | From 0.0 pips | 0.0 pips | Variable, from 0.0 pips |

| 💰 Commissions | From $3 | $8 Round Turn | From AU$7 |

| ✴️ Margin Call/Stop-Out | 80%/50% | 100%/20% | 90%/20% |

| ✴️ Order Execution | Market | Market, Instant | Market |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | Standard STP, Raw ECN, PRO ECN, Cent | MT4 Zero Account, MT4 Prime Account, VIP ZERO | Standard Account, Razor Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | Yes | No | No |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 3 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

MetaTrader 4

The MT4 platform is an excellent choice for Indonesian traders who value functionality and usability. The platform has an easy-to-use interface and a wide range of technical indicators, making it suitable for novice and experienced traders.

Expert Advisors (EAs) are supported in MT4, and Vantage Markets offers competitive spreads at 0 pips. Furthermore, the platform supports Islamic accounts, catering to Indonesia’s Muslim trading community.

MetaTrader 5

The MT5 platform is the next logical step for Indonesian traders looking for advanced features. The platform includes more timeframes, technical indicators, and the ability to trade financial instruments other than Forex.

The integration of MT5 allows traders to benefit from robust risk management tools and fast execution speeds, all while trading in a highly secure environment.

ProTrader

The ProTrader is designed for Indonesian traders looking for a sophisticated yet user-friendly trading interface.

The platform offers trading with a single click, customizable charting tools, and a variety of order types. It will be especially useful for professional traders who require a variety of in-depth analytics and prefer a customizable trading experience.

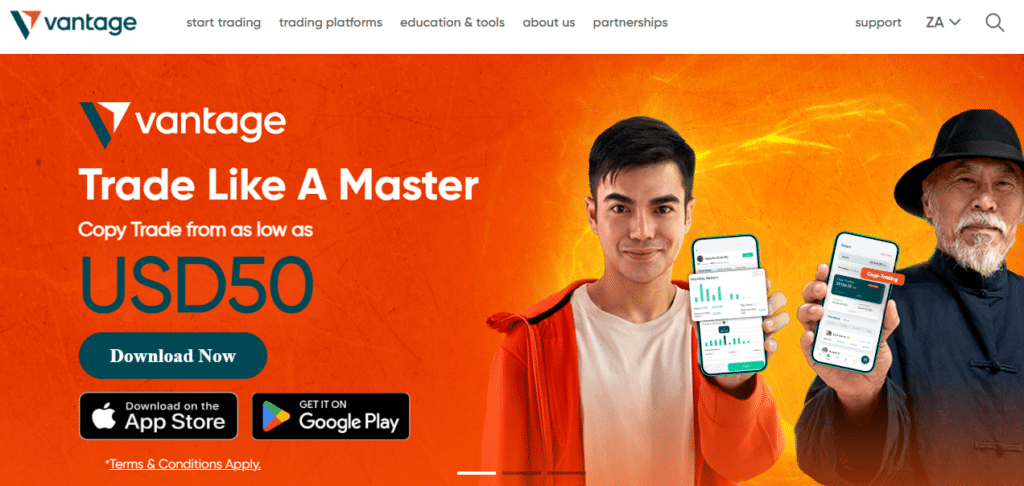

Vantage App

The Vantage App is ideal for Indonesian traders constantly on the go because it puts complete trading functionality at their fingertips. This mobile app ensures that traders never miss a trading opportunity, whether on their way to work, in a meeting, or away from their computer.

The seamless integration of the application with Vantage Markets enables secure trading with real-time price updates and notifications.

Vantage Social trading

The broker offers a collaborative environment where Indonesian traders interested in social trading can interact with, follow, and even copy the trades of more experienced traders.

This is especially beneficial for beginners who want to learn from experienced traders and those who prefer a hands-off approach to trading.

ZuluTrade

The broker also provides the ZuluTrade social trading platform. It is perfect for Indonesian traders who want to diversify their trading strategies by following traders worldwide.

Furthermore, traders on ZuluTrade can tailor their risk parameters to ensure that their trading strategy aligns with their financial goals.

Myfxbook AutoTrade

Myfxbook AutoTrade, in collaboration with Vantage Markets, makes automated Forex trading accessible to Indonesian traders.

The platform only provides thoroughly vetted trading systems, ensuring that traders mimic the trades of successful traders. It is an excellent tool for traders looking to automate their trading strategy without developing their own algorithms.

DupliTrade

Vantage Markets’ DupliTrade is an additional automated trading platform with a diverse portfolio of vetted strategy providers. This is advantageous for Indonesian traders looking to diversify their trading strategies.

The platform works with MT4 and MT5, allowing traders to select the most comfortable trading environment.

Are there any fees associated with using the trading platforms?

While the platforms are free, traders should know spreads, commissions, and other trading costs.

Can I use Vantage’s trading platforms on multiple devices simultaneously?

Yes, traders can access their accounts from multiple devices, but synchronized trading activities are essential.

Range of Markets

Indonesian traders can expect the following range of markets:

How diverse is the cryptocurrency offering?

The broker offers trading in a variety of popular cryptocurrencies.

Are there any region-specific instruments available for traders?

No, there are no region-specific instruments for traders in Indonesia.

Broker Comparison for a Range of Markets

| Vantage Markets | Windsor Brokers | Pepperstone | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Min Deposit

50 USD / 777,400 IDR

Regulators

CIMA, VFSC, FSCA, ASIC

Trading Desk

MT4, MT5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade

Crypto

Total Pairs

40+

Islamic Account

Trading Fees

Account Activation

Vantage Markets Fees, Spreads, and Commissions

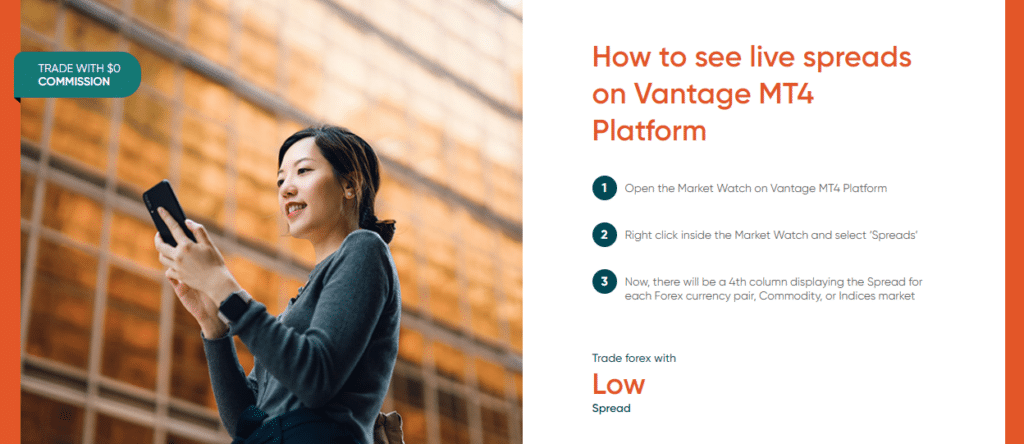

Spreads

Vantage’s liquidity comprises banks and liquidity providers, presenting users with access to spreads from around 70 institutions on the MT4 platform. As a result, Vantage can provide unparalleled spreads for RAW ECN accounts starting as low as 0 pips, while Standard STP accounts start at 1 pip.

In times of abundant liquidity, major Forex currency spreads might even dip below 1 pip.

Commissions

If you opt for a Raw ECN account, the commission for trading is $3 per side per lot or $6 for a round lot. However, selecting the PRO ECN account incurs a commission of $1.75 per side per lot (or $3.5 for a round lot).

Overnight Fees

When trading forex with them, transactions are settled within two business days. On the other hand, cash indices and commodities settle at midnight server time every business day’s end. It is important to highlight that Vantage does not conduct physical delivery.

Instead of physically delivering assets, any open positions remaining at the close of each trading day will be carried forward to a new value date while incurring swap charges or credits. Moreover, it should be noted that Forex positions left open from Wednesday through Thursday will have tripled rollover fees applied as a special case.

Additionally, there will be tripled swap charges for holding cash indices and commodities over weekends. However, Indonesian traders must remember that overnight swaps do not apply when trading crude oil.

Deposit and Withdrawal Fees

The broker charges the following deposit fees:

The broker charges the following withdrawal fees:

Inactivity Fees

Inactivity fees will not be applied to dormant accounts.

Currency Conversion Fees

Currency conversion fees could apply if traders deposit or withdraw in currencies other than their account-based currency.

Are there any commission-free account types?

Yes, the broker provides both commission-free and commission-based account options.

Are there any discounts for high-volume traders?

Yes, high-volume traders and ECN account holders may benefit from lower commissions and tighter spreads.

Vantage Markets Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

What’s the minimum deposit amount?

The minimum deposit varies depending on the type of account, with some requiring as little as $50.

How can I make a withdrawal from my account?

Withdrawals can be requested through the client portal, and the withdrawal method should typically correspond to the initial deposit source.

How to make a Deposit with Vantage Markets

To deposit funds into an account, Indonesian traders can follow these steps:

Access your Vantage Markets account.

Select the “Deposit” option.

Select your preferred method of deposit and enter the desired deposit amount.

How to Withdraw from Vantage Markets

To withdraw funds from an account, Indonesian traders can follow these steps:

Sign in to your account with Vantage Markets.

To withdraw, click the “Withdraw” button.

Choose your preferred method of withdrawal and enter the amount to be withdrawn.

Education and Research

The broker offers the following Educational Materials to Indonesian traders:

The broker also offers Indonesian traders the following additional Research and Trading Tools:

Is there a demo account to practice trading?

Yes, they provide a demo account so traders can practice trading without risking real money.

Are there any courses on advanced trading strategies?

Yes, they offer courses on both fundamental and advanced trading techniques.

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

Are there any promotions for existing clients?

Yes, the broker values its current customers and frequently offers promotions that are tailored to them.

Are there any cashback or rebate promotions?

Yes, they sometimes offer cashback or rebate promotions based on trading volume or account activity.

How to open an Affiliate Account

To register an Affiliate Account, Indonesian traders can follow these steps:

Visit the website of Vantage Markets Affiliate Partners.

Select the “Become a CPA Affiliate” option.

Fill in your personal information on the registration form, such as your name, email address, and phone number.

Affiliate Program Features

The Affiliate Program provides many features that enhance profitability and user-friendliness. Affiliates can take advantage of attractive commission structures tied to the trading volume generated by their referred clients and access various marketing materials.

To optimize performance, affiliates can monitor referrals and earnings in real-time using an affiliate dashboard with advanced reporting tools for strategic decision-making based on data analysis.

Moreover, this program offers occasional bonuses and promotional opportunities suitable for financial bloggers, influencers, or anyone interested in promoting Vantage Markets – even those targeting the Indonesian market.

Can I customize the promotional materials provided?

Yes, they frequently offer affiliates promotional materials that can be tailored to their target audience.

Are there any restrictions on marketing methods or channels?

Although the broker supports a variety of marketing channels, affiliates must review the terms for any restrictions.

Customer Support

| ⏳ Operating Hours | 24/5 |

| 📚 Support Languages | Multilingual |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of JustMarkets Support | 4/5 |

Can I get support in languages other than English?

Yes, the broker provides multilingual support for its international clientele.

How responsive is the live chat feature?

The live chat is renowned for its prompt responses, ensuring clients receive timely support.

Verdict

Vantage Markets has made a commendable effort to provide a comprehensive trading platform. This demonstrates their dedication to providing traders with the best available tools.

While many traders find the support to be adequate there is a need for more consistent and individualized assistance.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: AvaTrade Review

you might also like: Exness Review

you might also like: FBS Review

you might also like: Octa Review

you might also like: JustMarkets Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| They are well-regulated in four regions | The broker does not offer an IDR-denominated account |

| There are flexible account types available to Indonesian traders | The demo account is not unlimited |

| Traders can expect prompt and dedicated customer support available 24/5 | Vantage Markets has several withdrawal limits and conditions |

| There are more than 1,000 instruments that can be traded across markets | |

| There is a transparent fee schedule available | |

| The broker applies negative balance protection to retail accounts | |

| There is a decent educational offering available on the Vantage Markets website |

Frequently Asked Questions

What is the minimum deposit amount?

$50 is the minimum required deposit to open a live trading account.

Is the broker regulated?

Yes, they are adequately regulated by ASIC in Australia, FSCA in South Africa, VFSC in Vanuatu, and CIMA in Cayman.

Do they charge deposit fees?

Yes, deposit fees apply to China UnionPay.

Does Vantage Markets have Nasdaq 100?

Yes, they, like most brokers, offer Nasdaq 100.

Does Vantage Markets allow scalping and hedging?

Yes, they permit all trading strategies, including scalping and hedging.

Can I use Expert Advisors (EAs) with Vantage Markets?

Yes, you may use any Expert Advisor (EA) compatible with your Vantage Markets trading style.

Does Vantage Markets have VIX 75?

Yes, the broker provides VIX 75 as an index CFD.

Is it easy to open an account?

Yes, opening an account is quick and simple.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

Vantage aims beyond just a financial trading platform and strives to achieve broader social and economic objectives. The company acknowledges its capacity to create significant positive changes. While profitability is crucial, Vantage Markets emphasizes benefiting all stakeholders, which can be seen through various initiatives and projects they have undertaken.

As part of their commitment towards environmental, social, and governance (ESG) principles:

Is there a fee associated with the VPS service?

Certain account types or trading volumes may be eligible for a free VPS, while others may incur a fee.

What are the benefits of using their VPS?

Using their VPS guarantees faster trade execution, decreased latency, and 24-hour trading capability.