Pepperstone Review

Pepperstone is one of the largest Forex and CFD brokers that accepts Indonesian traders. Indonesians can access a world of CFDs with Pepperstone spread across several financial markets. Pepperstone has a trust score of 95%.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

200 USD / 3,209,990 IDR

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overview

Pepperstone joined the competitive world of online Forex and CFD trading with one clear purpose: to provide high-quality trading services to a worldwide audience.

Pepperstone was founded in 2010 by veteran traders Owen Kerr and Joe Davenport and began operations in Melbourne, Australia. Since the beginning, Pepperstone immediately gained traction and spread to cities such as London and Dubai, establishing a global presence within a decade.

Pepperstone bridges worldwide financial markets, allowing Indonesian traders to engage in global trading easily.

Furthermore, Pepperstone recognizes Indonesian traders’ demands and provides accounts denominated in currencies such as USD and GBP, with a minimum deposit of 2 million IDR (AU200).

This unique strategy, along with a wide choice of over 1,200 trading assets, caters to Indonesia’s diversified investing preferences, which include everything from Forex to cryptocurrency CFDs.

Pepperstone welcomes both experienced traders and beginners to the trading industry. Furthermore, Pepperstone’s support team is available in several languages 24 hours a day, 5 days a week, which is especially useful for Indonesian traders who may want assistance during peak trading hours.

Today, Pepperstone is known for its cutting-edge technology and customer-centric attitude. In addition, Pepperstone caters to Indonesian traders looking for user-friendly and efficient trading experiences, including platforms like MetaTrader 4 and 5, cTrader, and TradingView.

Furthermore, Pepperstone continues to gain its clients’ confidence and respect by combining low and competitive pricing, a range of educational materials, and a strong emphasis on transparency and customer care, which sets it apart from its rivals.

Is Pepperstone ideal for both new and experienced traders in Indonesia?

Yes, Pepperstone caters to both new and experienced traders by offering user-friendly platforms such as MetaTrader 4 and 5 and sophisticated tools for expert traders.

Does Pepperstone provide help in Bahasa Indonesia?

Yes, Pepperstone offers help in Bahasa Indonesia. Furthermore, traders can also select Indonesian as their language on the Pepperstone website.

At a Glance

| 🗓 Established Year | 2010 |

| ⚖️ Regulation and Licenses | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 🪪 Ease of Use Rating | 5/5 |

| 🚀 Bonuses | Yes, active trader program, referral bonus |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai |

| 💻 Account Types | Standard Account, Razor Account |

| 💰 Base Currencies | USD, GBP |

| 📈 Spreads | From 0.0 pips EUR/USD on the Razor Account |

| 📉 Leverage | 1:500 (Pro), 1:200 (Retail) |

| 💸 Currency Pairs | 70, minor, major, and exotic pairs |

| 💳 Minimum Deposit | 2 million IDR (AU$200) |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Spanish, Russian, Chinese, Vietnamese, Arabic, Indonesian, Italian, French, Laotian, German, Polish |

| ✔️ Fees and Commissions | Spreads from 0.0 pips, commissions from AU$7 |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States, Canada, Iran, Japan, Iraq, Zimbabwe, Yemen, and others |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, commodities, indices, currency indices, cryptocurrencies, shares, ETFs |

| 🎉 Open an account | Open Account |

Regulation and Safety of Funds

Pepperstone places the highest priority on the security of its Indonesian clients’ funds and personal information.

Although Pepperstone lacks local regulation in Indonesia, it is overseen by internationally recognized financial agencies such as the ASIC, CMA, FCA, CySEC, and BaFin, among others, guaranteeing compliance with stringent regulatory requirements.

To safeguard client funds, Pepperstone holds them in separate accounts with respected institutions from its operational funds.

All reputable and well-regulated brokers use this technique to ensure that funds are not used for business expenses or investments.

Furthermore, Pepperstone uses modern encryption technologies on its trading platforms and website, including SSL (Secure Socket Layer) encryption. This security safeguard prevents unwanted access to sensitive personal and financial information during transmission.

In addition to these robust measures, Pepperstone offers negative balance protection to Indonesian traders using retail accounts. This critical feature protects Indonesians from losing more money than they deposited into their accounts.

Is Pepperstone regulated and licensed to operate in Indonesia?

While Pepperstone is not regulated locally in Indonesia, it is overseen by globally renowned financial agencies like ASIC, FCA, and CySEC, ensuring strict regulatory compliance to protect Indonesian traders’ interests.

How does Pepperstone prevent illegal access to trading accounts?

Pepperstone uses strong security methods, such as multi-factor authentication and secure login procedures, to prevent illegal access to trading accounts, increasing the safety of Indonesian traders’ accounts.

Pepperstone Account Types

Standard Account Razor Account

✔️ Availability All traders; suitable to all traders despite their skill or objectives All traders; more suited to scalpers, day traders, automatic traders

💵 Markets All All

💰 Commissions None From AU$7 per round turn, per standard lot

💻 Platforms MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai

🔨 Trade Size From 0.01 lots to 100 lots per trade From 0.01 lots to 100 lots per trade

📊 Leverage Australia – 1:30

Bahamas – 1:200

Cyprus – 1:30

Dubai – 1:30

Germany – 1:30

South Africa – 1:400

United Kingdom – 1:30Australia – 1:30

Bahamas – 1:200

Cyprus – 1:30

Dubai – 1:30

Germany – 1:30

South Africa – 1:400

United Kingdom – 1:30

💸 Minimum Deposit 200 USD / 3,209,990 IDR 200 USD / 3,209,990 IDR

👉 Open an account Open Account Open Account

Standard Account

The Pepperstone Standard Account is ideal for Indonesian traders starting or occasional traders. It offers a low minimum deposit in IDR, no commissions, and all trading costs in spreads starting from 1 pip, making it easy to trade across platforms without hidden fees.

Razor Account

The Pepperstone Razor Account is a commission-based trading platform in Indonesia that offers tighter spreads and a more intense trading atmosphere. It is suitable for high-volume trading and scalpers.

Furthermore, it offers fast and precise execution on multiple platforms, making it a valuable choice for traders in Indonesia.

Demo Account

The Pepperstone Demo Account provides Indonesian traders with a risk-free environment to test new strategies and improve their skills.

In addition, it offers access to all of Pepperstone’s trading platforms for 30 days, providing valuable market experience without financial risk. After the trial period, users can transition to a live account.

Islamic Account

The Pepperstone Islamic Account is a swap-free trading solution for Indonesian traders adhering to Islamic finance principles. It eliminates swap fees on overnight positions and charges a fixed administration fee for extended trades.

This account caters to traders who must adhere to Islamic financial regulations while accessing various instruments and platforms.

Professional Account

The Pepperstone Professional Account is designed for experienced Indonesian traders with high trading volume and experience. It offers higher leverage options, up to 1:500, and a dedicated account manager.

This account is tailored for those proficient in complex trading environments and those exposed to high-volume trading risks. Qualifying traders must meet specific criteria.

What’s the difference between Pepperstone’s Standard and Razor accounts?

The Standard Account allows for commission-free trading with wider spreads, making it ideal for all traders. In contrast, the Razor Account has narrower spreads but requires a commission cost, making it perfect for scalpers and day traders.

What is the minimum deposit amount for Pepperstone accounts?

Pepperstone’s Standard and Razor accounts need a minimum deposit of 2 million IDR (AU$200), making them accessible to Indonesian traders of all levels.

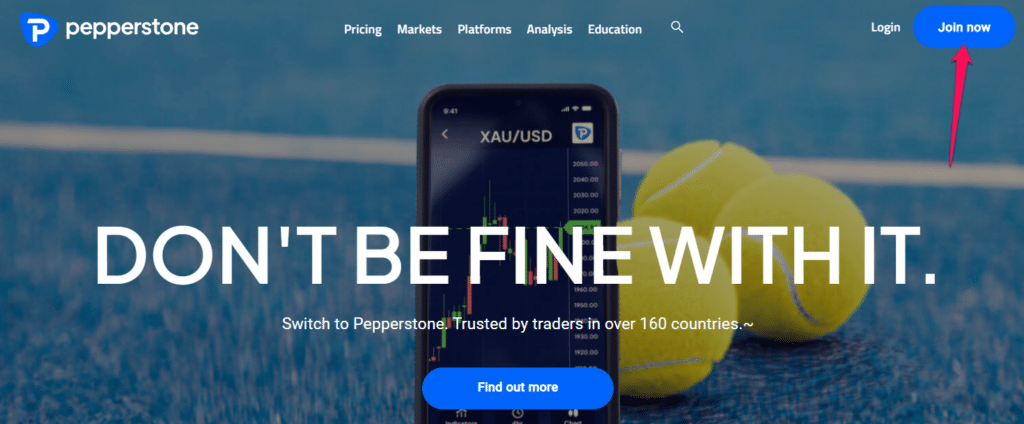

How To Open a Pepperstone Account

To register an account with Pepperstone, follow these steps:

Step 1 – Click on the Open Account button.

To open a new trading account, go to Pepperstone’s website and click the “Open Account” option on the homepage.

Step 2 – Fill out the form.

Choose the account option that aligns with your trading experience and goals: the commission-free Standard Account for beginners or the Razor Account for experienced traders looking for tighter spreads. Complete the registration form with your personal information, such as your complete name and contact information, as well as a summary of your trading history, to meet regulatory requirements.

Trading Platforms and Software

MetaTrader 4

Indonesian traders generally favour MetaTrader 4 because of its dependability, user-friendly interface, and overall usability.

Pepperstone’s use of MT4 assures traders that they get fast and reliable execution and that various analytical tools give them a competitive edge.

With support for many order types and a full collection of pre-installed technical indicators and charting tools, MT4 lets Indonesians tailor their trading environment to their objectives.

Furthermore, Pepperstone improves the MT4 experience by adding features such as one-click trading and comprehensive charting to meet the different demands of beginner and experienced traders in the Indonesian market.

cTrader

Pepperstone’s cTrader is known for its user-friendly design and extensive trading tools, making it a popular option among discriminating Indonesian traders.

Furthermore, Pepperstone provides this technology, incorporating Level II pricing for full market depth and increased trade transparency.

cTrader has sophisticated order types, greater charting tools, and algorithmic trading capabilities, making it perfect for more experienced Indonesian traders who use more complex trading methods.

With its comprehensive charts and in-depth back-testing environment, cTrader provides a strong platform for Pepperstone’s Indonesian clients, aligning with the broker’s dedication to providing advanced trading tools.

MetaTrader 5

Pepperstone’s MetaTrader 5 is the latest generation of trading platforms, providing the best functionality and a massive selection of trading products.

Pepperstone’s adoption of MT5 offers Indonesian traders additional technical indicators, timeframes, and graphical elements than its predecessor.

Furthermore, this robust platform contains an economic calendar, which provides real-time information on global economic events. This calendar helps Indonesians make more educated decisions when they trade global financial markets.

In addition, MT5’s comprehensive back-testing capabilities and support for all available order types, including market, pending, stop orders, and trailing stops, demonstrate Pepperstone’s commitment to providing tools for analytical and algorithmic traders in Indonesia.

TradingView

TradingView is offered through Pepperstone and provides Indonesian traders with an improved charting experience by including social networking capabilities for sharing trading ideas.

The platform’s rich analytical capabilities and diverse technical indicators appeal to technical analysis fans.

Furthermore, Pepperstone’s Indonesian clients benefit from TradingView’s browser-based execution, eliminating the need for downloads or installs while providing a flexible trading environment from any device.

Capitalise.ai

Capitalise.ai is an innovative and powerful platform that lets Indonesians automate their methods without having any previous coding knowledge or experience.

Pepperstone provides Indonesian traders with a sophisticated tool for converting their trading ideas into algorithms in basic English.

This integration demonstrates Pepperstone’s dedication to using cutting-edge technology by offering a platform where all traders can easily and quickly back-test and execute trading strategies regardless of their technical knowledge.

Is MetaTrader 4 accessible for trading at Pepperstone?

Yes, MetaTrader 4 is accessible at Pepperstone and is popular among many Indonesian traders due to its dependability, user-friendly interface, and comprehensive analytical tools, which provide a competitive advantage in the market.

Does Pepperstone provide demo accounts for testing trading platforms?

Yes, Pepperstone offers demo accounts for Indonesian traders to practice trading methods and become acquainted with various trading platforms, allowing them to acquire confidence before trading with real funds.

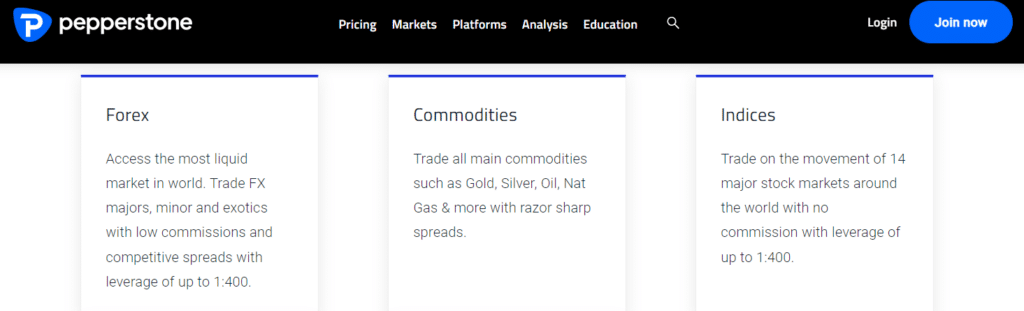

Trading Instruments & Products

Pepperstone offers the following trading instruments and products:

➡️Cryptocurrency – Pepperstone offers Indonesian traders a chance to dive into the dynamic world of cryptocurrencies with 19 digital currencies. This includes popular choices like Bitcoin, Ethereum, and Litecoin, giving traders diverse options to explore the ups and downs of the crypto market.

➡️ETFs – Pepperstone provides access to 100 ETFs, allowing Indonesian investors to spread their investments across various sectors, commodities, and indices. ETFs offer Indonesians the benefits of a diversified portfolio while being as easy to trade as a single stock.

➡️Forex – Traders in Indonesia can tap into a wide range of 70 currency pairs through Pepperstone, covering major, minor, and exotic pairs. This extensive selection caters to both beginners and seasoned professionals looking to navigate the global currency market.

➡️Commodities – Pepperstone allows Indonesians to trade in 17 commodities, including energy, metals, and agricultural products. This allows Indonesians to speculate on price movements and safeguard against inflation or currency fluctuations.

➡️Indices – For Indonesians interested in broader market trends, Pepperstone grants access to 28 indices representing top company stocks from global markets. This is ideal for Indonesian traders who invest in specific industries or economies without buying individual stocks.

➡️Currency Indices – Pepperstone’s currency indices track the value of a basket of currencies, providing Indonesians with a comprehensive overview of the forex market. Additionally, these indices help assess the strength or weakness of a currency group compared to others.

Does Pepperstone facilitate ETF trading?

Yes, Pepperstone offers 100 ETFs (Exchange-Traded Funds), allowing Indonesian traders to participate in a wide range of sectors, commodities, and indexes, resulting in the benefits of a diversified portfolio.

Are there any limits to trading indices with Pepperstone?

No, Pepperstone provides access to 28 indices that reflect the top firm stocks in worldwide marketplaces, allowing Indonesian traders to invest in certain industries or economies without purchasing individual companies.

Min Deposit

200 USD / 3,209,990 IDR

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

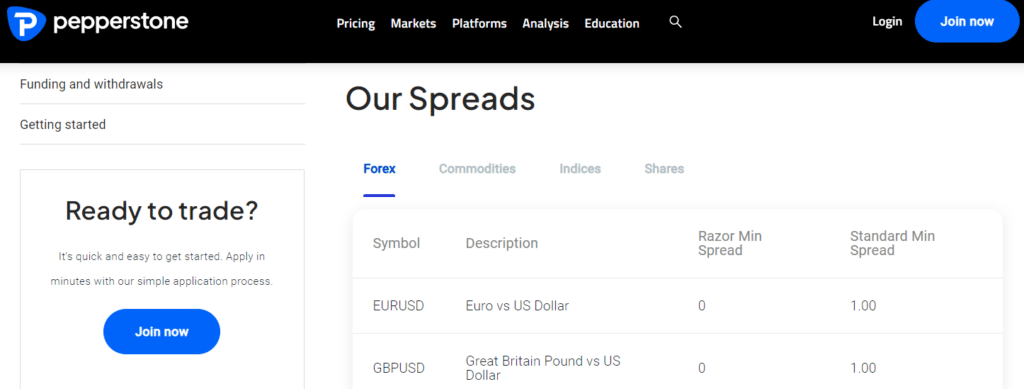

Pepperstone Spreads and Fees

Spreads

Pepperstone is well-known for its competitive spread offerings, making it a cost-effective choice for traders in Indonesia.

The Standard account typically starts with spreads ranging from 0.6 to 1.3 pips for major currency pairs. This setup allows traders to engage in forex trading without facing extra commission charges, which is great for beginners or those who prefer simple pricing.

Indonesian traders who require even tighter spreads can use the Razor account, with spreads as low as 0.0 pips on major currency pairs. However, this account involves a commission fee.

Furthermore, the Razor account suits experienced traders, scalpers, or those using algorithmic trading strategies.

Commissions

Because Pepperstone only charges the spread on the Standard Account, Indonesians using the Razor Account can expect commission fees that start from $7 per standard lot (100,000 currency units) round turn.

Overnight Fees

Indonesians should note that overnight fees will apply to positions held overnight, calculated based on regional interest rates plus a fixed charge of 2.5%.

These fees are common for indices CFDs, stock CFDs, or commodities and can change based on market conditions and the assets traded.

Furthermore, because Pepperstone does not publish these swap fees, Indonesians can find the latest rates on Pepperstone’s trading platforms.

Deposit and Withdrawal Fees

Pepperstone offers fee-free deposits and withdrawals for most methods, which is advantageous for Indonesians who want to manage their funds efficiently. However, Indonesians must note that international bank wire transfers can incur fees from their banking institution.

Inactivity Fees

Pepperstone does not charge an inactivity fee, making it appealing for traders who do not trade regularly or want to take a break without worrying about extra costs. Furthermore, the lack of an inactivity fee can benefit Indonesians with long-term strategies.

Currency Conversion Fees

Indonesians must note that currency conversion fees apply when transacting in a currency different from their account’s base currency (this applies to IDR). These fees depend on the prevailing exchange rates at the time of the transaction.

Is there a currency conversion cost with Pepperstone?

Yes, currency conversion costs apply when trading in a currency other than the account’s base currency, including IDR, based on the current exchange rates at the time of the transaction.

Does Pepperstone provide spread and commission reduction?

Yes, Pepperstone offers an Active Trader program for fee reduction through forex cashback to active and high-volume traders.

Pepperstone Deposit & Withdrawal Options

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

Visa All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 3 to 5 days

Mastercard All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 3 to 5 days

Bank transfer All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 3 to 7 days

MPESA All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD Instant – 5 days

PayPal All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD Instant – 5 days

Bpay All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 3 to 5 days

Neteller All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD Instant – 5 days

POLi All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 1 to 3 days

Skrill All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD Instant – 5 days

China UnionPay All AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD 3 to 5 days

Deposit Methods:

How to Deposit using Bank Wire Step by Step

✅Access your protected client area via Pepperstone’s website.

✅Select “Fund Your Account” and “Bank Wire Transfer” from the deposit choices.

✅Select your preferred currency and input the transfer amount.

✅Download the bank wiring details from Pepperstone containing the receiving bank’s information.

✅Use the Pepperstone bank details to initiate a wire transfer from your local bank.

✅Notify Pepperstone of the successful transfer by sending the transfer information through your secure client area or by email.

How to Deposit using Credit or Debit Card Step by Step

✅Access your protected client area on the Pepperstone website.

✅Navigate to “Fund Your Account” and choose “Credit/Debit Card.”

✅Enter your card data, including the card number, expiration date, CVV, and deposit amount.

✅Authorize the transaction.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅Log in to Pepperstone’s protected client area.

✅Select “Fund Your Account” and then your e-wallet or payment gateway.

✅You must connect to your e-wallet account to complete the transaction.

✅Enter the transfer information, including the amount and any relevant reference numbers.

Withdrawal Methods:

How to Withdraw using Bank Wire Step by Step

✅Enter the secure client area and go to the ‘Withdraw Funds’ section.

✅Choose “Bank Wire” as your withdrawal method and enter your bank account information.

✅Submit the withdrawal request and wait for the withdrawal request to be processed, which could take 3 to 5 working days.

How to Withdraw using Credit or Debit Cards Step by Step

✅Go to your protected client area’s ‘Withdraw Funds’ section.

✅Choose the card withdrawal option and enter the withdrawal amount.

✅If needed, provide your credit card information for the withdrawal.

✅Confirm the withdrawal request.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Go to your protected client area’s ‘Withdraw Funds’ section.

✅Choose the e-wallet or payment gateway that you used to deposit.

✅Enter the withdrawal amount and validate your e-wallet account information.

✅Submit your request to Pepperstone and wait for it to be processed within 1 to 3 working days.

How long does it take for deposits to appear in my Pepperstone account?

Deposits made using most payment methods are often completed instantaneously or within a few hours, allowing Indonesian traders to begin trading immediately.

What is Pepperstone’s withdrawal processing time?

Pepperstone normally processes withdrawals within 24 hours. However, the time it takes for funds to reach Indonesian traders’ accounts varies based on the withdrawal method and the receiving bank’s processing time.

Leverage and Margin

Pepperstone offers numerous leverage ratios to Indonesian traders based on their trades and account types. The leverage in forex trading with Pepperstone can be extremely high, which might suit some Indonesian traders while being detrimental to others.

Furthermore, Indonesians must remember that while increased leverage might improve earnings, it raises the risk of larger losses.

Due to these risks, Indonesians should exercise caution when using leverage and consider risk management strategies such as stop-loss orders to protect themselves from unexpected market movements.

Indonesians can modify their leverage depending on their trading strategies, available funds, and the funds they are comfortable risking.

While Pepperstone’s retail traders are capped at a leverage of 1:200 on forex major pairs, professional clients can have up to 500:1 leverage, depending on the jurisdiction and regulatory entity through which they register an account.

Pepperstone’s margin refers to the minimum amount of money necessary to create and hold a leveraged position in a trader’s account. Furthermore, this margin is a security deposit, guaranteeing Indonesians enough funds to cover potential losses.

Pepperstone’s margin requirements vary depending on the financial instrument being traded, account type, and market conditions, and are often expressed as a percentage. Traders can view the margin requirements and maximum leverage per instrument on the Pepperstone website.

What is the purpose of leverage when trading with Pepperstone?

Leverage enables Indonesian traders to handle larger positions with a smaller investment, increasing possible profits and the risk of losses, necessitating appropriate risk management measures.

Is there a minimum margin required for Pepperstone?

Yes, Pepperstone has minimum margin requirements for opening and maintaining leveraged bets, ensuring Indonesian traders have enough funds to cover possible losses.

Educational Resources

Pepperstone offers the following educational resources:

➡️Webinars – Pepperstone hosts interactive webinars that cover a wide range of subjects. These live events offer real-time market updates, explore various trading tactics, and frequently include professional guest speakers. They provide a dynamic learning environment for Indonesians to keep up with the newest market trends and trading strategies.

➡️Educational Videos – Pepperstone’s videos include fundamental trading principles, platform training, and in-depth looks at more advanced trading tactics. Furthermore, Pepperstone’s educational videos are an excellent resource for visual learners and Indonesians who prefer self-directed learning.

➡️Learn to Trade Forex – For those Indonesians to the foreign exchange market, Pepperstone’s ‘Learn to Trade Forex’ tools cover the fundamentals of currency pairings, market analysis, and risk management. They are particularly developed to assist Indonesians in laying a firm foundation in forex trading.

➡️Learn to Trade Shares – Pepperstone’s ‘Learn to Trade Shares’ resources can help Indonesian traders learn about stock markets. These tools dive into the complexities of share CFD trading, covering market dynamics, corporate occurrences, and equity-specific technical analysis.

➡️Trading Guides – Pepperstone’s trading guidelines include many subjects, from basic trading basics to sophisticated strategies and trading plans. These tutorials are useful resources for new and seasoned Indonesian traders who want to improve their trading skills.

➡️Learn about Liquidity – Understanding how liquidity affects spreads and trade execution risks is essential for Indonesians to succeed in the Forex and CFD markets. Therefore, Pepperstone teaches Indonesians the importance of liquidity through several guides and articles.

➡️Learn to Trade CFDs is designed for Indonesians looking to learn more about CFDs to navigate the markets and trade without owning the underlying instrument. Furthermore, this educational resource typically covers leverage, the mechanics of CFDs, and numerous strategies for trading them efficiently while minimizing risks.

Does Pepperstone provide live webinars for Indonesian traders?

Yes, Pepperstone conducts live webinars with real-time market updates, trading methods, and insights from skilled guest speakers, giving Indonesian traders unique opportunities to improve their trading knowledge and abilities.

Are there any video lessons accessible on Pepperstone’s educational platform?

Yes, Pepperstone provides training videos on various topics, including platform tutorials, trading tactics, and advanced trading approaches, making learning materials more accessible for visual learners.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Conclusion

According to our in-depth analysis of Pepperstone, the broker stands out as a powerful player in the Indonesian Forex and CFD trading market, providing various benefits to different types of traders.

With over 1,200 available and tradable assets, including currency pairings, cryptocurrencies, indices, and commodities, Indonesians can diversify their investments.

Our Insight

Pepperstone is a good option for Indonesians, except they do not support IDR currency so traders will have to face currency conversion fees. They also only offer Islamic Accounts to certain regions.

Our Recommendations on IC Markets

We found that Pepperstone has a compelling offer for Indonesians. However, there is always some room for improvement even when a broker fits the bill perfectly, and here’s what we believe Pepperstone can aim to improve:

➡️Consider offering Islamic Account to more regions.

➡️Provide detailed breakdowns and examples of how fees are applied in different scenarios to help traders plan strategies more effectively and accurately.

➡️Expand the available payment methods for deposits and withdrawals to be country-specific, giving traders access to local payment methods and the ability to deposit and withdraw in local currency.

Pepperstone Pros & Cons

| ✔️ Pros | ❌ Cons |

| There are zero-pip spreads on the Razor Account, making it ideal for scalping | Pepperstone only offers Islamic accounts to certain regions |

| Indonesians can expect high liquidity, ensuring fast and reliable trade execution | IDR is not a supported deposit or withdrawal currency |

| Pepperstone offers a demo account that can be used to practice trading and testing strategies | Indonesian traders cannot register an IDR-denominated account |

| Traders can expect flexible leverage ratios, allowing them to boost their profit potential | Leverage ratios are limited according to traders’ trading experience |

| Indonesians can access several trading resources, tools, education, and more | Currency conversion fees apply to IDR deposits and withdrawals |

| Pepperstone is extremely well-regulated and prioritizes client safety and fund security | There are no local Indonesian deposit and withdrawal methods supported |

| Several markets can be traded, including global indices, forex, crypto CFDs, etc. | |

| Indonesians can choose from powerful trading platforms that are both user-friendly and sophisticated |

you might also like: FP Markets

you might also like: FXGT Review

you might also like: FXView Review

you might also like: IC Markets Review

you might also like: HFM Review

Frequently Asked Questions

Can I open a Pepperstone account from Indonesia?

Yes, Indonesian citizens can open Pepperstone trading accounts. The procedure is often conducted online.

What is Pepperstone’s minimum deposit?

Pepperstone needs a AU$200 minimum deposit (or equivalent in IDR).

Is Pepperstone an appropriate broker for beginners?

Yes, Pepperstone provides instructional resources and a demo account, which might benefit novices. However, Indonesian traders must realize that forex and CFD trading have inherent risks.

Does Pepperstone provide Islamic/swap-free accounts?

Yes, Pepperstone recognizes the religious needs of many traders. Therefore, swap-free accounts are accessible per Islamic financial principles.

Is Pepperstone a safe broker?

Yes, Pepperstone is deemed safe since many top-tier financial agencies license it and use robust security measures to secure traders and their funds.

Can I try Pepperstone using a demo account?

Yes, Pepperstone provides demo accounts. This is an excellent method for testing their systems and practicing trading without risking real money.

How long does Pepperstone’s withdrawal take?

Withdrawals with Pepperstone are normally handled within 24 hours. However, the precise time it takes for funds to reach your account will depend on the withdrawal method. For example, bank transfers often take 3-5 working days.

Can I make deposits and withdrawals in Indonesian Rupiah (IDR)?

No, you cannot. While Pepperstone accepts various base currencies, direct IDR deposits and withdrawals might not be available. Therefore, you must use a conversion service or an accepted intermediate currency.

What can I trade with Pepperstone?

Pepperstone provides Indonesians with significant market exposure by offering a diverse selection of products, including Forex, commodities, indices, cryptocurrency CFDs, and stocks.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

User Comments and Reviews

Reading user comments and reviews on trusted sites gave us an idea of the type of broker IC Markets is, and can be, for Indonesians. While this is a useful resource, we urge Indonesians to conduct their research instead of relying solely on the reviews or comments of others.

Here are a few top comments on IC Markets:

➡️“Excellent platform..ultra low spreads..What distinguishes pepperstone from others is the top notch customer support..Mr. Ayush is always a message away for any help.. Highly recommend.”

➡️“As a Pepperstone Pro account trader actively trading the markets, commissions can easily add up, but with their rebate tier system, rebates are paid daily back into your trading account. Cheers to Mitch Comben my premium account manager for putting me on this program.”

➡️“Really professional support and very nice and down to earth to talk to. Also they actually seem to care about their client´s.”