Saxo Bank Review

Saxo Bank is a multi-regulated and multi-asset broker popular for its transparency and massive 71,000 product portfolio. Saxo Bank has been operating since 1992 and has established itself as a forex trading giant in forex.

- Louis Schoeman

Updated : May 09, 2024

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

0 IDR / 0 USD

Regulators

FSA, FCA, MAS, FINMA, CONSOB, JFSA, ASIC and more.

Trading Desk

SaxoTraderGO, SaxoTraderPRO

Crypto

Total Pairs

185+

Islamic Account

Trading Fees

Account Activation

Overview

Our journey into Saxo Bank’s beginnings takes us back to 1992 in Denmark when it was established to make trading and investment accessible to all.

Since then, it has become a leading presence in the online trading industry. With its global brokerage and banking license, Saxo Bank has made impressive advancements in innovation, technology, and service expansion, which Indonesian traders have highly appreciated.

We have been closely monitoring Saxo Bank’s impressive growth. The institution has always been a leader in digital trading solutions, as demonstrated by the launch of one of Europe’s first online trading platforms in 1998.

This innovative decision paved the way for several developments that have played a crucial role in shaping the trading environment we and our Indonesian counterparts enjoy.

Our research indicates that Saxo Bank’s growth trajectory aligns with its commitment to offering a wide range of tools and over 71,000 tradable instruments.

In addition, implementing user-friendly platforms such as SaxoTraderGO and SaxoTraderPRO demonstrates the broker’s dedication to making trading accessible and innovative. These platforms are designed to meet the needs of beginner and experienced traders in our community.

Indonesian traders have shown a strong interest in Saxo Bank’s comprehensive range of services. Our experiences have shown that customers value Saxo Bank’s robust regulatory framework, overseen by reputable international organizations.

We, as traders, find it essential to prioritize high regulatory standards to ensure a secure trading environment. The combination of security, technological expertise, and extensive market access has made Saxo Bank a favoured option among our trading community in Indonesia.

Saxo Bank continues to prioritize innovation, consistently updating its offerings to stay at the forefront of the industry. This commitment greatly benefits the ever-evolving Indonesian trading landscape.

Furthermore, as expert reviewers, we rely on the latest updates for the most up-to-date information regarding Saxo Bank’s operations to ensure our review is accurate and relevant.

Is Saxo Bank properly regulated?

Yes, Saxo Bank is overseen by fourteen Tier-1 regulators throughout the globe, assuring financial security and operational transparency for Indonesian traders.

Can Indonesian traders get customer help in their language?

Yes, Saxo Bank provides multilingual customer care via several channels, guaranteeing that Indonesian traders can get help in a variety of languages.

At a Glance

| 🗓 Established Year | 1992 |

| ⚖️ Regulation and Licenses | Danish FSA, Danish FSA in UAE, Danish FSA in Brazil, Danish FSA in Czech, FCA, MAS, FINMA, CONSOB, Japan JFSA, Hong Kong FSC, ASIC, Dutch Central Bank and Authority for Financial Markets in the Netherlands, National Bank of Belgium and Financial Services and Market Authority, Banque de France and Autorite Marche Financial |

| 🪪 Ease of Use Rating | 4/5 |

| 🚀 Bonuses | Yes, Saxo Rewards, Referral Program |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 💻 Account Types | Classic, Platinum, VIP |

| 💰 Base Currencies | 18 currencies |

| 📈 Spreads | From 0.4 pips |

| 📉 Leverage | 1:30 |

| 💸 Currency Pairs | 185+; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 0 IDR / 0 USD |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Danish, French, Thai, Chinese, Italian, Polish, Russian, Japanese, etc. |

| ✔️ Fees and Commissions | Spreads from 0.4 pips; commissions from $0 on Mutual Funds |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, CFDs, stocks, commodities, futures, FX options, listed options, ETFs, bonds, mutual funds |

| 🎉 Open an account | Open Account |

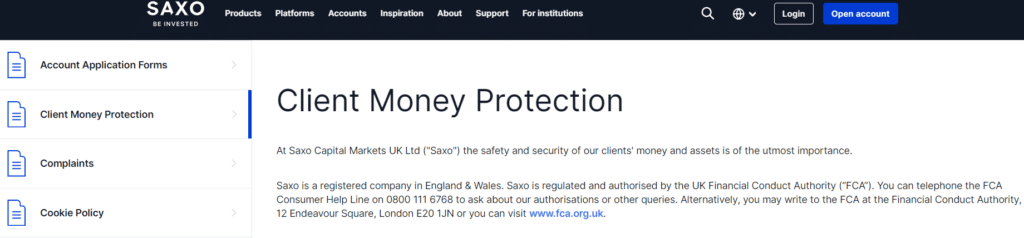

Regulation and Safety of Funds

When analyzing Saxo Bank’s security measures for Indonesian traders, it’s crucial to note that it is not regulated locally in Indonesia.

However, instead, we can examine the global regulatory framework and security protocols that Saxo Bank adheres to in safeguarding its clients worldwide, including those in Indonesia.

Saxo Bank is regulated by top-tier authorities, including the Danish FSA and the UK’s Financial Conduct Authority (FCA), among others. Therefore, strict regulatory standards are in place to ensure that Saxo Bank maintains the highest levels of financial security and operational integrity.

In addition to its strict and robust regulatory framework, Saxo Bank utilizes state-of-the-art security measures on its platforms and website to ensure the safety of its users.

SSL encryption ensures the protection of all transaction data and communications. Incorporating two-factor authentication (2FA) into login procedures enhances security by providing an additional layer of protection, minimizing the chances of unauthorized access.

In addition, Saxo Bank prioritizes risk management by implementing thorough margin rules and providing traders with tools to prevent negative balances. This ensures traders do not exceed their initial investment and protects them from potential losses.

In our experience, these practices are especially crucial for Indonesian traders, considering the lack of local regulatory protections. Saxo Bank also participates in client compensation schemes, offering a safety net in the event of the bank’s insolvency.

Therefore, while Saxo Bank is not currently regulated in Indonesia, several other robust tools and measures are implemented that give Indonesians the peace of mind they need.

Regulation in Indonesia

The Commodity Futures Trading Regulatory Agency (BAPPEBTI) does not regulate Saxo Bank. However, Saxo Bank’s global regulations are listed in the table below.

Global Regulations

⚖️ Registered Entity 🏦 Country of Registration 🪪 Company Reg. ✅ Regulatory Entity 🛍 Tier 🤝 License Number/Ref

Saxo Bank A/S Denmark 15731249 Danish FSA 1 1149

Saxo Capital Markets UK Limited United Kingdom 551422 FCA 1 551422

Saxo Capital Markets Pte. Ltd. Singapore 200601141M MAS 1 –

BG SAXO Società di Intermediazione

Mobiliare S.p.A. Italy 296 CONSOB 1 –

Saxo Bank Securities Ltd. Japan 0104 – 01 – 082810 JFSA 1 –

Saxo Capital Markets HK Limited Hong Kong 1395901 SFC Hong Kong 1 ADV061

Saxo Bank (Schweiz) AG Switzerland CHE-106.787.764 FINMA 1 –

Saxo Capital Markets (Australia) Limited Australia 32 110 128 ASIC 1 AFSL

BinckBank N.V. Netherlands 33162223 Dutch Central Bank and Authority for the Financial Markets 1 BO341

Protection of Client Funds

🚫 Security Measure 🪪 Information

Segregated Accounts Yes

Compensation Fund Member Yes

Compensation Amount 100,000 EUR

SSL Certificate Yes

2FA (Where Applicable) Yes

Privacy Policy in Place Yes

Risk Warning Provided Yes

Negative Balance Protection Yes

Guaranteed Stop-Loss Orders No

What type of financial monitoring does Saxo Bank provide for its activities in Indonesia?

Saxo Bank’s activities in Indonesia are subject to stringent oversight from several world-renowned regulators, who ensure the bank is honest and upfront with its customers.

What actions does Saxo Bank take to prevent money laundering through Indonesian accounts?

To keep an eye out for and stop any questionable activity in Indonesian accounts, Saxo Bank has strict anti-money laundering (AML) protocols in place.

Awards and Recognition

Our analysis of Saxo Bank’s achievements uncovered a multitude of prestigious accolades outlined on their website. Recent achievements include:

➡️Saxo Bank was awarded the top spot for the “#1 Desktop Platform” by ForexBrokers.com in 2024.

➡️In 2024, Saxo Bank was recognized as the “Best Forex Broker” by BrokerChooser.

➡️Received the prestigious “Best Trading Platform” award for 2024 from BrokerChooser.

➡️In 2023, Saxo Bank was recognized as the top CFD Broker and DMA/Professional Trading Account provider by Good Money Guide.

Saxo Bank Account Types

Saxo Bank is a reputable financial services provider that caters to global traders by offering three flexible trading and investment accounts. In the sections below, we provide an overview of each and discuss what we found while evaluating these account types.

The fact that Saxo Bank offers a variety of accounts for different needs in the Indonesian trading community is evidence of their dedication to providing a tailored trading experience.

Whether you’re just starting with a Demo Account or are an experienced trader looking to take your game to the next level with a VIP Account, Saxo Bank is here to help.

Classic Platinum VIP

✔️ Availability All; beginners and casual traders Experienced and professional traders Professional and Institutional traders

💵 Markets 71,000 71,000 71,000

💰 Commissions $1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds “$1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds ““$1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds “

💻 Platforms All All All

🔨 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots

📊 Leverage 1:30 1:30 1:30

💸 Minimum Deposit 0 IDR 3.1 billion IDR 15.4 billion IDR

👉 Open an account Open Account Open Account Open Account

Demo Account

The Saxo Bank demo is an important initial step that provides a secure learning environment using virtual funds that simulate real market conditions.

Using this account allows you to experiment with various strategies and become familiar with Saxo Bank’s trading platforms without any concerns about losing funds.

This demo account is particularly valuable if you’re interested in exploring trading. It provides a 20-day trial period with USD 100,000 in virtual funds. Registration is easy, and our demo account was approved within minutes of starting the registration.

Classic Account

Now, let’s discuss the Saxo Bank Classic Account, a popular choice among Indonesian traders. This account stands out due to its lack of minimum deposit requirement, demonstrating Saxo Bank’s dedication to inclusivity.

It provides access to diverse trading instruments, such as forex, stocks, and commodities, with over 71,000 options available.

While we tested this account, we found it is perfect for beginners and intermediate traders who value a straightforward, no-nonsense trading experience with dependable research tools and a user-friendly interface.

Platinum Account

As traders gain experience and expand their investments, they frequently seek more sophisticated trading conditions. This is where the Saxo Bank Platinum Account stands out.

Designed for seasoned traders who engage in larger trading volumes, this account provides more competitive commission rates and narrower spreads, resulting in substantial savings on trading expenses.

In addition, Saxo Bank’s priority customer support guarantees that they promptly address all your queries and trading needs.

Therefore, according to our analysis of this account type, s, the Platinum Account offers a more efficient and streamlined trading experience for Indonesians who are actively involved in the market.

VIP Account

Finally, the Saxo Bank VIP Account is the top-tier option for experienced traders. We were impressed to find that it offers more than just an account; it provides a comprehensive service that comes with benefits such as

➡️A dedicated relationship manager.

➡️Direct access to global markets.

➡️Competitive transaction prices.

Furthermore, with the VIP account, you’ll enjoy exclusive privileges like invitations to special events and personalized insights from our team of financial experts. This account type caters to affluent individuals who seek a top-tier trading experience, both domestically and internationally.

Which account type is ideal for beginners?

The Classic Account. With the classic account, beginners have flexibility in terms of minimum deposit. Furthermore, the features cater to inexperienced traders and those who have traded before.

Can I register a demo account with Saxo Bank?

Yes, you can register a demo account with Saxo Bank. The demo offers ample funds and is available for 20 days.

How To Open a Saxo Bank Account

While Saxo Bank is a sophisticated broker and platform, we found that the application process is extremely simplified and straightforward, with an industry-standard KYC process to verify that we are who we claim to be.

Indonesians who want to join Saxo Bank can easily follow our detailed steps below to get started:

Step 1 – Click on the Register button.

Start the account setup process by visiting the official website of Saxo Bank. Find the “Open Account” link on the homepage.

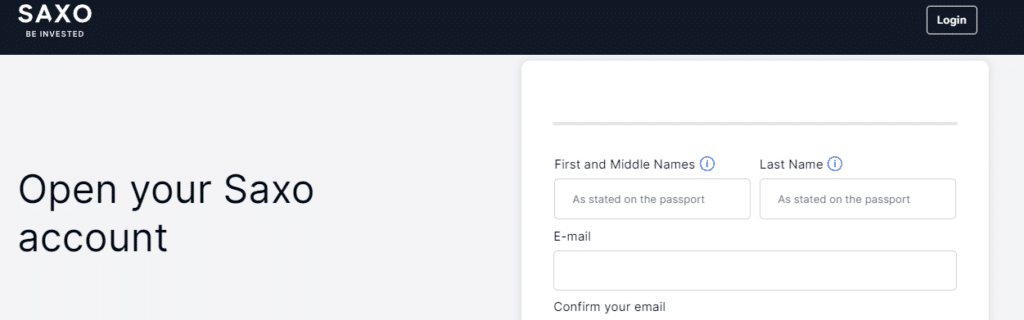

Step 2 – Complete the form.

Complete an electronic application form, and please provide correct personal information, including your full name, address, and tax residency details, as Saxo Bank needs these for the initial registration process.

Step 3 – Provide your identification documents.

Please provide the necessary identification documents as part of the Know Your Customer (KYC) requirements. It is important to provide a clear, legible copy of a government-issued ID or passport and a recent utility bill or bank statement for address verification.

Saxo Bank Vs JustMarkets Vs CPT Markets – Broker Comparison

| Saxo Bank | JustMarkets | CPT Markets | |

| ⚖️ Regulation | Danish FSA, Danish FSA in UAE, Danish FSA in Brazil, Danish FSA in Czech, FCA, MAS, FINMA, CONSOB, Japan JFSA, Hong Kong FSC, ASIC, Dutch Central Bank and Authority for Financial Markets in the Netherlands, National Bank of Belgium and Financial Services and Market Authority, Banque de France and Autorite Marche Financial | CySEC, FSCA, FSA, FSC | FCA, FSCA, IFSC |

| 📱Trading Platform | SaxoTraderGO SaxoTraderPRO | MetaTrader 4 MetaTrader 5 JustMarkets App | MetaTrader 4 MetaTrader 5 cTrader |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Min Deposit | 0 IDR ($0) | 162,000 IDR ($10) | 0 IDR ($0) |

| 📈 Leverage | 1:30 | Up to 1:3000 | 1:1000 (IFSC) 1:500 (FSCA) 1:30 (FCA) |

| 📊 Spread | From 0.4 pips | From 0.0 pips | From 0.0 pips |

| 💰 Commissions | From $0 on Mutual Funds | $6 per lot traded | From $4 |

| ✴️ Margin Call/Stop-Out | Flexible | 40%/20% | 100% – 50% (M) 50% – 30% (S/O) |

| ✴️ Order Execution | Market | Market | Instant |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | Classic Account Platinum Account VIP Account | MT4 Standard Cent Account MT4 Standard Account MT4 Pro Account MT4 Raw Spread Account MT5 Standard Account MT5 Pro Account MT5 Raw Spread Account | Classic Account Standard Account ECN Account Prime Account Platinum Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | No | No |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 7 | 5 |

| ☪️ Islamic Account | No | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Flexible | 100 lots | Unlimited |

| 💸 Minimum Withdrawal Time | Instant | 1 – 3 hours | Instant |

| 💰Maximum Estimated Withdrawal Time | Up to 5 days | 6 banking days | 3 – 7 days |

| 📞 Instant Deposits and Instant Withdrawals? | Yes, deposits | Yes, deposits | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

0 IDR / 0 USD

Regulators

FSA, FCA, MAS, FINMA, CONSOB, JFSA, ASIC and more.

Trading Desk

SaxoTraderGO, SaxoTraderPRO

Crypto

Total Pairs

185+

Islamic Account

Trading Fees

Account Activation

Trading Platforms and Software

Saxo Bank’s review highlights the broker and bank’s suitability to cater to Indonesian traders, and what better way to do this than with powerful trading platforms? We tested Saxo Bank’s offering and discussed some of the best features that Indonesians can use while trading with Saxo Bank.

Saxo Bank offers a variety of platforms that are designed for different types of traders. However, they all have the same goal of delivering a trading environment that is comprehensive, secure, and quick.

Traders in Indonesia can easily get a premium trading experience that is uniquely suited to their needs through these platforms, which provide a wide variety of financial products and extensive trading capabilities.

Keep reading to discover which platform suits your unique trading style, needs, and objectives in competitive markets in 2024.

Connectivity and APIs

As expert reviewers and traders who are consistently looking for ways to refine our trading, integration with third-party technologies is something that we appreciate, and Saxo Bank excels in this area.

The platform’s API enables integration with various analytical tools and algorithmic trading systems, critical for Indonesian traders designing their tactics.

Integrating Saxo Bank products with external charting and analysis software enables the use of bespoke indicators and automated techniques. This personalization provides Indonesian traders an advantage, allowing them to make improved and educated trading decisions.

SaxoInvestor

As we examined SaxoInvestor, we saw an emphasis on long-term investing, which is a good shift for Indonesian investors looking for sustainable development. This platform is designed for mobile use and appeals to modern investors who need accessibility without sacrificing functionality.

A feature that caught our attention is the ‘Explorer’ function. It curates investing topics to help find trending possibilities matched with global economic developments.

On SaxoInvestor we had access to a wide selection of stocks, bonds, mutual funds, and ETFs, allowing for a well-rounded investing portfolio. Furthermore, the ‘Portfolio Overview’ provides a thorough look at investment performance, allowing Indonesians to make educated decisions.

Overall, we like this platform because its simplicity and clarity make it suitable for Indonesian investors new to the market looking for a plain yet comprehensive platform.

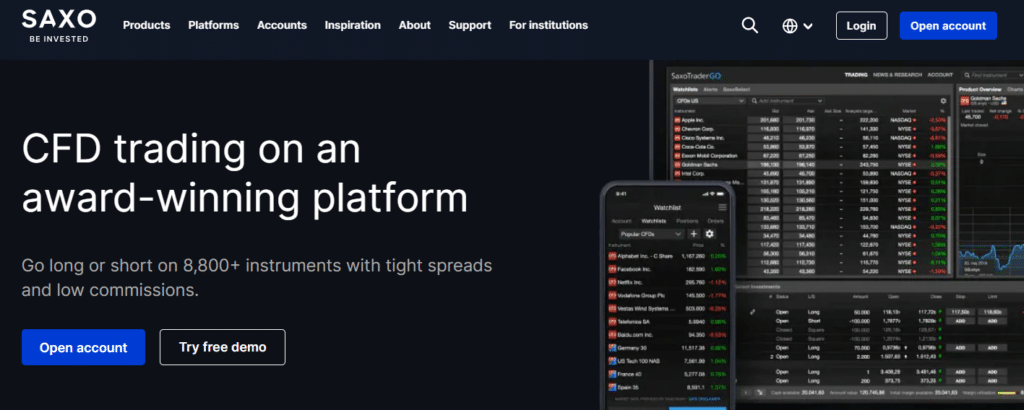

SaxoTraderGO

The first thing we noticed about SaxoTraderGO is that it is a versatile platform that excels in Indonesia’s trading landscape, offering over 71,000 instruments across several financial markets.

Its user-friendly interface makes navigation easy for us to move between different functions, and its advanced charting tools enable real-time market trend tracking.

A notable feature, the ‘Trade Ticket’ feature, provided deep market visibility for precise order placement, which will be especially useful in Indonesia’s volatile trading scene.

Furthermore, something that is always appreciated is when the mobile app mirrors the desktop experience, allowing traders to stay agile and respond promptly to market shifts.

SaxoTraderPRO

While we tested SaxoTraderPRO, we immediately saw a sophisticated platform designed for experienced traders in Indonesia. This innovative trading technology includes professional-grade tools, a wide range of order types, and control over trading preferences.

What impressed us the most is that the platform’s ability to manage numerous screens is critical for traders who must watch different markets simultaneously.

Furthermore, it featured detailed market depth and direct access to liquidity, which can improve trade execution. At the same time, advanced risk management tools give a clear picture of risk exposure and its impact on Indonesian traders.

This granular information is critical for Indonesian traders negotiating complicated market conditions, necessitating a strong foundation for successful trade management.

Third-Party Tools

Finally, Saxo Bank’s seamless integration with third-party applications satisfied our rigorous evaluation criteria, which is a factor that we consistently consider.

The platform’s API capability of establishing connections with additional algorithmic trading systems and analytical tools was superb.

Therefore, Indonesian traders whose strategies are customized using bespoke trading instruments will appreciate this integration.

While we tested this platform, we also discovered that by connecting external charting and analysis software to Saxo Bank’s extensive product line, we could easily use custom indicators and automated strategies commonly available in the native platform environment.

Experienced Indonesian traders will have an extremely large advantage due to this degree of customization, as they have access to intricate algorithms and comprehensive analytics, which can assist them in making more informed trading decisions.

Does Saxo Bank provide API access for automated trading solutions?

Yes, Saxo Bank provides connection and APIs to Indonesian traders, allowing for simple interaction with automated trading systems, high-frequency trading, and institutional client setup.

Are there any platform-specific educational sources accessible to Indonesian traders?

Yes, Saxo Bank offers platform video tutorials for Indonesian traders, which give step-by-step instructions on how to use Saxo Bank’s trading platforms effectively.

Trading Instruments & Products

Saxo Bank is one step ahead of the competition by providing one of the largest instrument product portfolios in the world. With Saxo Bank, Indonesians can access over 71,000 instruments divided into the following financial markets.

Mutual Funds

Saxo Bank offers Indonesian investors access to a wide range of mutual funds from top global providers, all without commissions, ensuring professional fund management without extra fees. The funds cater to different risk preferences, strengthening investment portfolios.

ETFs

Indonesian investors can access over 7,000 ETFs on 30 international exchanges, providing diversification opportunities.

In our experience with this instrument, ETFs combine stock trading flexibility with mutual fund exposure, benefiting investors in various sectors, commodities, or global markets. Furthermore, Indonesians can expect real-time pricing and high liquidity with Saxo Bank’s ETFs.

Bonds

Saxo Bank provides Indonesian investors with a diverse range of government and corporate bonds from 26 countries and 21 currencies, allowing them to diversify into fixed-income instruments and maintain portfolio balance.

Forex

Indonesian traders can access a vast forex market with over 185 currency pairs, offering a leverage ratio of up to 1:30, allowing them to profit from currency fluctuations without significant capital commitment.

Stocks

Saxo Bank offers Indonesian investors access to global equity markets, with 23,500 equities across over 50 exchanges. This allows diversification beyond local markets and participation in global corporations’ growth, exposing them to various economic drivers.

Options

Indonesian traders can leverage over 3,200 listed options across 20 global exchanges for portfolio hedging or speculation in various sectors, equities, and indices, offering flexibility with predefined risk parameters for different market conditions.

Futures

Saxo Bank provides Indonesian traders with over 250 futures contracts, allowing them to hedge market exposure and speculate on future price movements in energy and agriculture markets, effectively managing risk.

Commodities

Indonesian traders can trade commodities like oil, gold, and agricultural products through Saxo Bank’s CFDs, futures, options, and spot pairs. This allows Indonesians to diversify their portfolios effectively against the risks posed by market volatility and leveraging market trends.

Forex Options (FX Options)

Saxo Bank offers 45 vanilla FX options for Indonesian traders to hedge currency exposure or express market views, offering strategic alternatives with varied strike prices and expiry dates.

CFDs

Saxo Bank provides Indonesian traders with over 8,800 CFDs on indices, commodities, and individual equities, letting them speculate on price movements without owning the underlying asset. In our experience, this can amplify the potential gains of Indonesians and increase the inherent risks.

Can Indonesian traders trade commodities like oil and gold on the Saxo Bank platform?

Yes, Saxo Bank allows Indonesian traders to trade a broad range of commodities, including oil, gold, and agricultural products, using a variety of trading instruments such as CFDs, futures contracts, and options.

Does Saxo Bank allow Indonesian traders to trade listed options?

Yes, Indonesian traders can hedge existing positions or speculate on future market events using Saxo Bank’s platform, which includes over 3,200 listed options on 20 global exchanges.

Saxo Bank Spreads and Fees

Therefore, Saxo Bank is licensed and must be transparent about all trading conditions, fees, and other expenses that traders might incur. After researching the fee schedule of Saxo, we can confidently say this broker is transparent and fair in its pricing.

In the sections below, we explain the fees that Indonesians will likely encounter when dealing with Saxo Bank.

Spreads

Saxo Bank offers competitive spreads for foreign exchange pairs like EUR/USD, starting at 0.4 pips.

This benefits Indonesian traders frequently engaging in high-volume transactions, as even minor fluctuations can impact profits. However, these spreads are subject to change based on market conditions, which can affect trading expenses and performance.

Commissions

Saxo Bank offers a transparent commission structure for commodities, equities, and other financial instruments, starting at a nominal amount on US Stocks.

This transparent approach benefits regular and infrequent traders, particularly Indonesian traders interested in expanding their investment portfolios with international stocks.

Overnight Fees

As is standard in forex trading, according to our experience, swap fees are another important consideration for traders who hold holdings overnight.

Saxo Bank calculates these costs using interbank rates plus a markup, as is normal procedure. These rates are prominently posted on Saxo’s trading platforms, letting Indonesian traders consider them while making deals, particularly in the forex market.

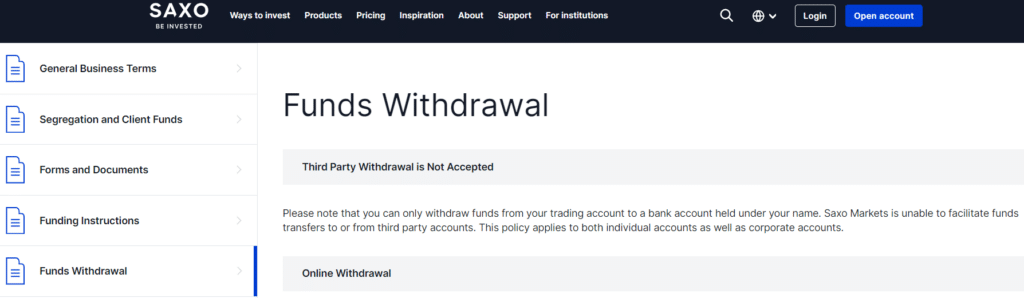

Deposit and Withdrawal Fees

Saxo Bank is known for its cost-effective processes for Indonesians, with most methods without fees.

Traders used to brokers charging fees for every transaction can find some relief in this. However, it’s important to be aware of any potential fees charged by local banks or payment service providers, especially for international transactions.

Inactivity Fees

Unlike many brokers, Saxo Bank does not charge inactivity fees. This is great news for Indonesian traders who do not trade frequently but still want to keep their accounts active without any extra (often hidden) costs.

Currency Conversion Fees

Saxo Bank charges a currency conversion fee to Indonesian traders who trade on markets denominated in other currencies.

While this price is unavoidable when trading foreign exchange, we found that Saxo Bank’s low markup on interbank rates helps mitigate its influence on transaction profitability.

Furthermore, currency conversion fees are an important factor for Indonesian traders working in global markets because these costs can accrue over time.

Can Indonesian traders negotiate costs with Saxo Bank?

No, they cannot. Saxo Bank provides clear and standardized charge structures and negotiating is not allowed.

Does Saxo Bank charge commissions?

Yes, Saxo Bank charges commission fees across several assets, starting from $0 on mutual funds and 0.05% on bonds.

Saxo Bank Deposit & Withdrawal Options

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

Electronic Direct Debit Authorization Singapore SGD Instant – 5 days

FAST Singapore SGD Instant – 5 days

PayNow Singapore SGD Instant – 5 days

MEPS Singapore SGD Instant – 5 days

TT Wire Transfer All Multi-currency Instant – 5 days

Onshore inter-bank transfer All Multi-currency Instant – 5 days

Credit/Debit Card All Multi-currency Instant – 5 days

Bank Transfers All Multi-currency Instant – 5 days

Deposits

How to Deposit using Bank Wire Step by Step

✅To deposit, simply access the SaxoTraderGO or SaxoTraderPRO platform and locate the ‘Deposit’ section.

✅Opt for the ‘Bank Transfer’ option when making your deposit.

✅Choose the Saxo account you want to deposit funds into.

✅Take note of the banking information on the platform, including the Saxo Bank account details customized for your particular currency and region.

✅Please use the banking details to initiate a wire transfer from your personal bank account. Ensure the bank account’s name matches the name registered with Saxo Bank to prevent any transfer discrepancies.

How to Deposit using Credit or Debit Card Step by Step

✅Access your trading platform and find the ‘Deposit Funds’ feature.

✅Choose the option to deposit funds using a credit or debit card.

✅Please enter the amount you would like to deposit.

✅Please provide your card details, such as the card number, expiration date, CVV code, and your name as it appears on the card.

✅Please review and confirm the payment details, then proceed to authorize the transaction to complete the deposit process.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅Please log in to your preferred Saxo trading platform.

✅Go to the ‘Withdraw Funds’ section located within the platform.

✅Select the specific Saxo account from which the withdrawal will be made.

✅Please provide the amount you wish to withdraw and indicate your preferred currency.

✅Choose the destination bank account previously added and verified to receive the funds.

✅Verify the withdrawal request by using an SMS code that will be sent to your registered mobile number.

Can Indonesian traders withdraw funds from their Saxo Bank accounts through wire transfers?

Yes. According to our research, Saxo Bank only accepts withdrawals using bank wire.

Can Indonesian traders withdraw money from their Saxo Bank accounts at any time?

Yes, Indonesian traders can withdraw cash from their Saxo Bank accounts anytime, with no limits or penalties.

Leverage and Margin

As part of our in-depth review process, no review is ever complete without investigating a broker’s terms, conditions, limits, and information regarding leverage and margin.

This is because these tools are of utmost importance to Indonesian traders, especially those with smaller investment amounts who still want to participate in global markets.

Saxo Bank, renowned for its commitment to regulatory compliance, provides leverage of up to 1:30 for major forex pairs. This limit demonstrates the worldwide shift towards more conservative leverage limits aimed at safeguarding traders from the potential dangers of excessive leverage.

While this might seem extremely restrictive to Indonesians, we urge traders to remember the massive risk associated with using leverage on volatile financial instruments, especially where the market can turn on a position at any given moment.

Furthermore, Saxo’s leverage can differ based on the specific financial instrument, with higher-risk instruments having lower leverage.

For example, the leverage for CFDs and other instruments is typically lower compared to forex. This structured method of leveraging encourages prudent trading, ensuring that traders do not take excessive risks in the market.

The margin requirements at Saxo Bank are reasonable, and Saxo’s client agreement provides clear definitions of the initial margin required to open a position and the maintenance margin needed to keep positions open.

Having a clear grasp of these margin requirements is essential for Indonesian traders, as they serve as a key indicator of the capital required to sustain positions in the market.

Having gone through Saxo’s information on margin and leverage, we can see that Saxo Bank’s margin and leverage framework strives to strike a balance between capitalizing on opportunities and effectively managing risk.

We appreciate Saxo’s efforts in ensuring Indonesian traders are well-informed by providing detailed margin tables and transparent margin policies directly through its trading platforms.

Does Saxo Bank issue margin calls?

Yes, Saxo Bank will issue margin calls to Indonesian traders if their account balance falls below the maintenance margin threshold.

Can I get educational material regarding leverage and margin on Saxo Bank?

Yes, Saxo Bank provides training tools and risk management recommendations to assist Indonesian traders in grasping leverage and margin principles and making more educated trading choices.

Educational Resources

Because Saxo Bank is well-established, reputable, and known for its transparency, we expected its educational tools and resources to be comprehensive, and we weren’t disappointed. Here’s the breakdown of the education with which Indonesians can kickstart their trading journey.

Podcasts

The SaxoStrats team produces financial podcasts for Indonesian traders, providing easy-to-understand analyses of complex market events.

These podcasts cover market trends and trading strategies, providing crucial information for Indonesian traders to stay competitive in the fast-paced trading world. Furthermore, listeners can benefit from these podcasts’ informative content.

SaxoStrats

SaxoStrats, Saxo Bank’s in-house strategy team, provides comprehensive analyses of global market events, economic forecasts, and asset class reviews, providing Indonesian traders with detailed insights to guide their trading decisions in both local and international financial contexts.

Courses covering the introduction to trading

Saxo Bank’s e-learning modules provide fundamental education for novice traders, covering financial markets, trading instruments, and trade execution, letting Indonesian traders navigate Saxo Bank’s trading environment easily and confidently.

Risk Management Rules and Tools

Saxo Bank emphasizes risk management through its comprehensive tools and guidelines, providing strategic approaches for Indonesian traders to safeguard their capital.

We found that these resources explain the fundamentals of risk management and demonstrate how to apply them using Saxo Bank’s platforms.

Platform Guides (Videos)

Saxo Bank provides step-by-step tutorials on platform usage for Indonesian traders, enhancing their trading experience by demonstrating how to use the SaxoTraderGO and SaxoTraderPRO platforms effectively.

We went through a few of these resources and can confidently say that all trading levels will benefit from these videos and guides, whether to start using the platforms or get a refresher course.

Trade Inspiration

The Trade Inspiration section on Saxo Bank’s platform offers innovative trading ideas, articles, and videos that stimulate creative trade concepts and enhance market understanding. It is an excellent resource for Indonesian traders seeking diversification.

Events and Webinars

Saxo Bank’s events and webinars are crucial for Indonesian traders.

From what we have seen while exploring this section on Saxo Bank, these sessions offer Indonesian traders the opportunity to gain advanced market insights and seek clarification from experts on trading intricacies, making them a critical aspect of ongoing financial education.

Does Saxo Bank limit access to educational materials and resources?

No, all Saxo Bank account categories, including Classic, Platinum, and VIP, have access to the same instructional tools, giving Indonesian traders identical possibilities to improve their trading abilities.

Can I access Saxo Bank’s education using my phone?

Yes, Saxo Bank’s training tools are available on mobile devices via the SaxoInvestor mobile app, enabling Indonesian traders to learn and improve their trading abilities at any time and from any location.

Bonuses and Promotions

The Saxo Rewards program is crucial in Saxo Bank’s client engagement strategy in Indonesia. This loyalty program is designed to motivate traders by providing them with points as rewards for their investment activities.

These points are directly linked to various trading volumes determining the trader’s account tier.

From what we can see, according to the Saxo Bank website, when traders register an account with Saxo Bank, their initial deposit determines their placement in a particular tier. They can then strive to progress to higher tiers by earning points.

The program is structured so traders can accumulate points by trading specific volumes. For instance, a trade of EUR 10,000 in stocks, ETFs, or ETNs will earn them 250 points, whereas the same investment in bonds will secure 320 points.

Our research shows that the initial 30 days after opening an account offer significant benefits. Every Euro of net funding or securities transferred into the account during this period equals 0.6 points.

Traders can quickly advance to higher tiers, such as Platinum or VIP, based on the total value they transfer or deposit.

Once the initial 30-day period is over, the rewards system starts prioritizing the overall average AuM (Assets under Management). Traders receive 0.025 points for each Euro of average monthly AuM, calculated two trading days before the end of the month.

By consistently trading and investing, traders can continuously enhance their account status through an ongoing accumulation of points. This incentivizes them to stay active and engaged in the market.

How can Indonesian traders qualify for Saxo Bank promotional offers?

Trading activity, account type, and the completion of particular promotional conditions often determine eligibility for promotional offers at Saxo Bank.

Are there any loyalty awards for Saxo Bank’s long-term Indonesian traders?

Yes, loyalty perks and benefits are available to long-term Indonesian traders at Saxo Bank, especially those who trade often or have premium accounts.

Affiliate Programs

Features

Affiliate networks, lead generation experts, and influencers are just a few of the target audiences for Saxo Bank’s Indonesian affiliate program. According to our research, this program aims to help affiliates succeed by providing them with free promotional tools and expert support.

Affiliates can earn lucrative commissions through their referrals because their rewards are based on the account level of the clients they bring in.

To top it all off, affiliates can easily optimize their efforts with the program’s extensive reporting. Because of this, it is a good option for Indonesian affiliates who already have a following and provide quality material online.

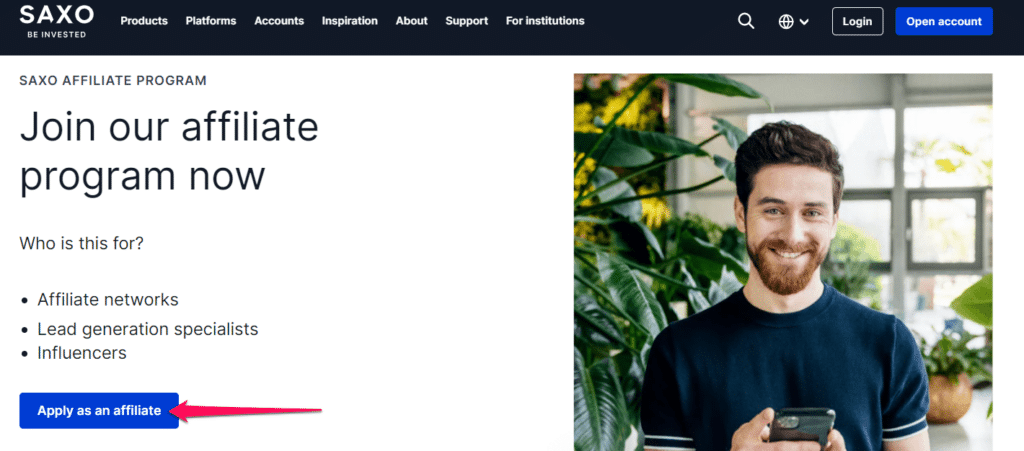

How to Register an Affiliate Account with Saxo Bank Step-by-Step

Step 1 – Go to the Affiliate section.

Go to the Saxo Bank website and select the “Partners” option from the main menu on the homepage once it loads. Next, click the “Apply as an Affiliate” link, and you will be redirected to the account registration page.

Step 2 – Send an email.

Please ensure that you fill out the registration form with the necessary personal and professional details. Saxo Bank could request URLs of your social profiles, website, blog, and others where you have a significant online presence.

Step 3 – Choose a commission method.

Select the method that suits you best for receiving affiliate commissions. Saxo Bank provides a range of pay-out options to its customers. After finishing the application, submit it for review. Once you’ve submitted your request, watch your email for a response from Saxo Bank. This email will provide any additional steps or confirmation you may need.

To be eligible for Saxo Bank’s affiliate program, what conditions must Indonesian affiliates complete?

To keep working with Saxo Bank, Indonesian affiliates must meet specific performance goals, usually evaluated by how active and satisfied their clients are.

How does Saxo Bank ensure the fair tracking of referrals made by Indonesian affiliates?

Saxo Bank employs cutting-edge tracking tools to keep track of all the recommendations produced by affiliates in Indonesia and compensate them fairly.

Customer Support

Customer Support Saxo Bank Customer Support

⏰ Operating Hours 24/5

🗣 Support Languages Multilingual

👥 Live Chat No

📱 Email Address Yes

📞 Telephonic Support Yes

✅ The overall quality of FXView Support 4/5

Response Time

📞 Support Channel ⏰ Average Response Time 👥 User-based Response Time

Phone 5 – 8 minutes 6 minutes

Email 24 – 48 hours 24 – 48 hours

Live Chat No live chat No live chat

Social Media 6 minutes 4 – 6 minutes

Affiliate 24 – 48 hours 24 – 48 hours

Are there any self-help facilities for Indonesians with Saxo Bank?

Yes, on its website, Saxo Bank provides various self-help tools such as FAQs, troubleshooting guides, and instructional videos to assist Indonesian traders.

Can Indonesian traders request a callback from Saxo Bank’s customer support?

Yes, Indonesian traders can request a callback from customer support for assistance with more complex issues or detailed inquiries.

Saxo Bank User Comments and Reviews

Because of its long history as a forex broker and licensed bank, Saxo Bank has gathered thousands of user reviews across several reputable sites. Here are a few top ones:

➡️“Saxo’s website is a treasure trove of helpful info for investment decisions. It simplifies ongoing investments too, making it a breeze to manage.”

➡️“I think Saxo is a great broker, but sorting out ETF names can be a headache. The inconsistency and errors stand out, and unfortunately, reaching out for support didn’t help.”

➡️“While Saxo’s platform isn’t the easiest, it’s packed with features. With time, you gain experience navigating it. Their written responses may take a while, but they’re thorough and trustworthy.”

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Conclusion

Our detailed review of Saxo Bank’s services and products for Indonesian traders considers the bank’s superior infrastructure and local investors’ demands, along with any drawbacks that we found during our review.

In addition, the bank also protects traders’ financial and personal data with SSL encryption and two-factor authentication.

Our Insight

From what I’ve seen is Saxo Bank a good option for Indonesian Traders. They offer a very low minimum deposit, they are very secure and have a good reputation.

Our Recommendations on Saxo Bank

➡️Saxo Bank could create more interactive forums and seminars that will help build a more robust trader community.

➡️Saxo Bank can add more payment methods for deposits and withdrawals, especially more local methods for clients in regions like Indonesia.

➡️Provide more entry-level accounts with minimum deposits that are easier to pay, especially for beginners and those with limited funds.

➡️Simplify some trading interfaces or develop a more user-friendly platform that makes it easier for beginners to navigate the platform and start trading.

Saxo Bank Pros & Cons

| ✔️ Pros | ❌ Cons |

| Saxo Bank, unlike its rivals, does not charge inactivity fees | New traders might be confused and intimidated by the sophisticated Saxo Bank platforms |

| The spreads charged across instruments are competitive, starting from 0.4 pips EUR/USD | There are no IDR Accounts |

| Saxo Bank is highly secure and has a good reputation | There are no local e-wallet or mobile money solutions supported for deposits and withdrawals |

| Saxo Bank has a long history of superior trading solutions and financial services, giving Indonesians the peace of mind that they are dealing with a safe option | There are several withdrawal limitations, and bank wire is the only method supported |

| The trading platforms available are robust and offer a range of features for all types of traders | |

| Saxo Bank currently has the largest portfolio of instruments across markets | |

| Clients often praise customer support from Saxo Bank | |

| The broker ensures transparent and fair pricing without any hidden fees |

you might also like: PrimeXBT Review

you might also like: FP Markets Review

you might also like: FXGT Review

you might also like: FXView Review

you might also like: Pepperstone Review

Frequently Asked Questions

Is Saxo Bank accessible in Indonesia?

Yes, Saxo Bank provides services in Indonesia, allowing customers to create accounts and trade a variety of financial instruments.

Does Saxo Bank have any connections with Indonesian financial institutions?

Yes, with Sinar Mas Group. Saxo Bank cooperates with the Sinar Mas Group, a major Indonesian corporation. This alliance intends to improve financial services and investment prospects in Indonesia.

What types of accounts does Saxo Bank provide in Indonesia?

Classic, Platinum, and VIP. Each Saxo Bank account offers various benefits, and each has its minimum deposit, with the Classic Account not requiring a set minimum investment.

Can I trade stocks using Saxo Bank in Indonesia?

Yes, you can trade stocks, bonds, and ETFs across international exchanges and markets on Saxo Bank’s platforms from Indonesia.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Social Responsibility

After investigating the Saxo Bank website, we found that Saxo Bank shows it cares about sustainability by designing its business model with ESG (environmental, social, and governance) factors in mind.

Launched in 2022, their Sustainability Strategy highlights their commitment to ethical business practices. Saxo Bank gives its customers access to educational materials and a variety of sustainable investment options so that they may make well-informed decisions.

In addition, to lessen its influence on the environment, the bank is also cutting emissions and transitioning to renewable energy sources, which are part of broader sustainability initiatives.