Yadix Review

Overall Yadix is considered an average risk with an overall Trust Score of 71 out of 100. They are licensed by the Financial Services Authority (FSA) Seychelles. They offer Indonesians three retail trading accounts: a Classic Account, a Scalper Account, and a Pro Account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD / 1,554,800 IDR

Regulators

Seychelles FSA

Trading Desk

MT4, Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

Account Activation

Overview

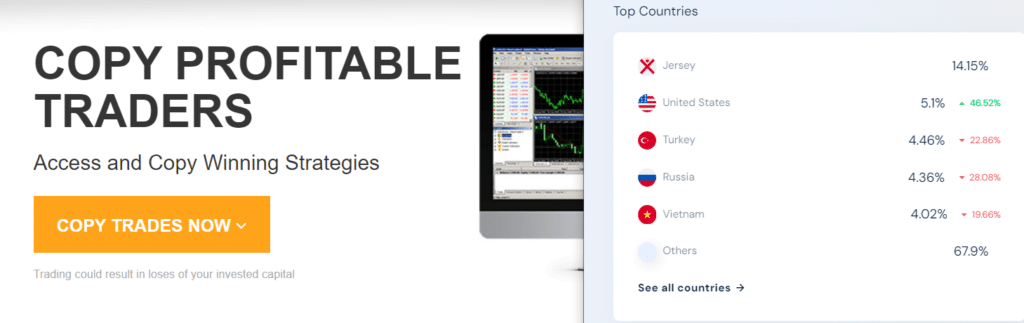

Yadix is a sophisticated Forex and CFD broker that caters to experienced traders by providing a variety of assets and features.

The company was founded in 2010 and is based in Seychelles. It aims to provide its clients with trading freedom and confidence through its unrivalled trading technology and liquidity depth.

The broker is a Seychelles Financial Services Authority (SFSA) regulated offshore Forex and CFD broker. While offshore regulation may not provide the same level of protection as other jurisdictions, Yadix has been in operation for over a decade, which may give potential clients some peace of mind.

They provide three types of trading accounts: Classic, Rebate, and Scalper. The Classic account caters to traders who prefer fixed spreads, whereas the Rebate and Scalper accounts cater to traders who prefer variable spreads.

The minimum deposit for a Classic Account is $100, $500 for a Scalper Account, and $5,000 for a Pro Account.

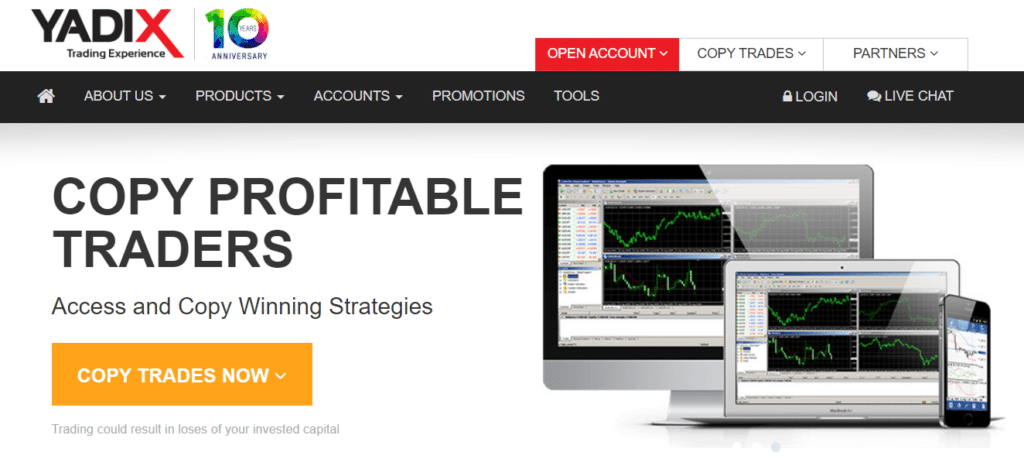

Distribution of Traders

The broker currently has the largest market share in these countries:

➡️️ Jersey – 14.15%

➡️️ United States – 5.1%

➡️️ Turkey – 4.46%

➡️️ Russia – 4.36%

➡️️ Vietnam – 4.02%

Popularity among Indonesian traders

Yadix is one of the Top 40 forex and CFD brokers for Indonesian traders.

Does Yadix offer services globally?

The broker provides services globally but is primarily governed by the Seychelles Financial Services Authority (SFSA).

Are there any countries where Yadix is restricted?

Yes, they do not cater to US traders.

At a Glance

| 🏛 Headquartered | Seychelles |

| ✅ Global Offices | Seychelles |

| 🗓 Year Founded | 2010 |

| 📞 Indonesia Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, X, LinkedIn |

| ⚖️ Regulation | Seychelles FSA |

| 🪪 License Number | Seychelles (Quantix FS Limited) – SD021 |

| ⚖️ BAPPEBTI Regulation | No |

| 🚫 Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 30% |

| ✅ Crypto trading offered? | No |

| 💰 Offers a IDR Account? | No |

| 👨💻 Dedicated Indonesia Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Indonesia? | No |

| 💰 Minimum Deposit | 100 USD / 1,554,800 IDR |

| ✅ IDR Deposits Allowed? | Yes |

| 📊 Active Indonesia Trader Stats | 200,000+ |

| 👥 Active Indonesia-based Yadix customers | Unknown |

| 💳 Indonesia Daily Forex Turnover | 13.1 billion USD |

| 💵 Deposit and Withdrawal Options | Skrill Neteller Credit/Debit Card SEPA Bank Wire SWIFT Bank Wire Perfect Money FasaPay BitWallet Bitcoin Ethereum Tether |

| 🏦 Segregated Accounts with Indonesian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4 |

| ✔️ Tradable Assets | Forex, Commodities, Indices |

| 💸 Offers USD/IDR currency pair? | No |

| 📈 USD/IDR Average Spread | None |

| 📉 Offers Indonesian Stocks and CFDs | No |

| 🗣 Languages supported on Website | Arabic, Chinese (Simplified), Filipino, Hindi, Indonesian, Italian, Japanese, Malay, Persian, Polish, Russian, Spanish, Urdu, Vietnamese, English |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Indonesia-based customer support? | No |

| ✅ Bonuses and Promotions for Indonesia Traders | Yes |

| 📚 Education for Indonesian beginners | No |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Trader in Indonesia | Several – Richest, Dadap Kuswoyo ($68,100 profit) |

| ✅ Is Yadix a safe broker for Indonesian traders? | Yes |

| 📊 Rating for Yadix Indonesia | 6/10 |

| 🤝 Trust score for Yadix Indonesia | 71% |

| 🎉 Open an account | Open Account |

Safety and Security

Regulation in Indonesia

The broker is not currently regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI/CoFTRA).

Regulatory Oversight

The Seychelles Financial Services Authority (FSA) regulates the broker . While this is an offshore regulatory body, it does provide a level of oversight that traders can rely on.

Offshore regulation, however, may not provide the same level of investor protection as other, more established financial jurisdictions.

Data Encryption

Although specific details must be verified, most brokers use high-level encryption technologies to safeguard traders’ personal and financial information. This is critical for ensuring transaction confidentiality and integrity.

Account Segregation

Regulated brokers typically keep Client funds separate from the company’s operational funds. This ensures that traders’ funds are not used for the broker’s commercial purposes and are available for withdrawal.

Risk Management Tools

The broker provides risk management features such as stop-loss orders, which can be especially useful for traders to manage their risks effectively. The ability to place stop-loss orders at any level gives traders more control over their trading activities.

Transparency

The broker appears to provide transparent pricing with no hidden fees, which indicates a broker’s honesty. Pricing transparency can help traders manage their costs more effectively.

Customer Support

Customer support that is prompt and efficient can be a critical aspect of security, especially when traders face issues that require immediate resolution. Rapid customer service response times can help to prevent potential problems from escalating.

Track Record

The broker has been in business for over a decade, which can provide traders with some peace of mind. A broker with a long track record is often regarded as more trustworthy than a trader in the market.

Limitations

While they provide several security features, Indonesian traders should be aware of the limitations, such as offshore regulation and the potential lack of investor protection compared to brokers regulated in more stringent jurisdictions.

Is my money safe with Yadix?

While the SFSA regulates them, it is important to note that this authority may not provide the same level of protection as other jurisdictions.

Is Yadix’s trading platform secure?

Yes, the broker employs the MetaTrader 4 platform, which is widely regarded as a secure and dependable trading platform.

Awards and Recognition

Yadix does not list any awards received in recent years.

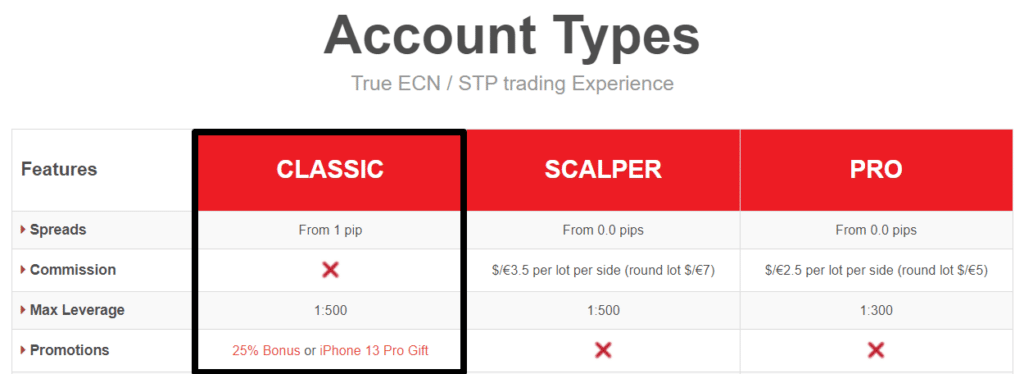

Yadix Account Types and Features

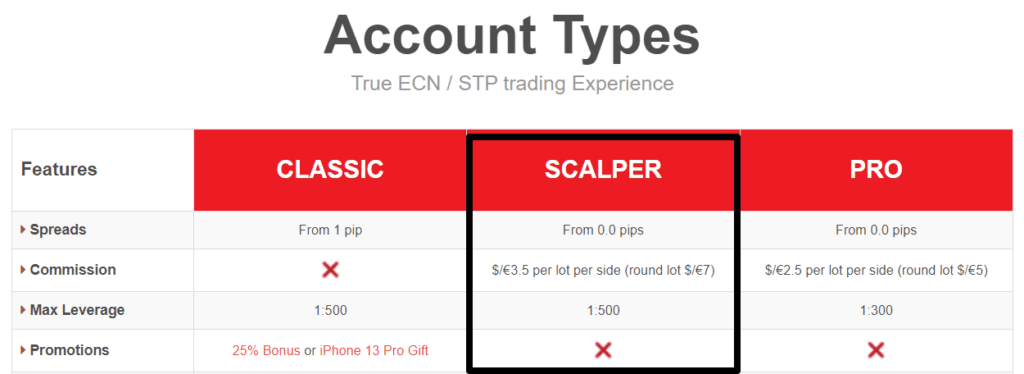

Classic Account

The Classic account is designed to provide superior execution quality, lightning-fast speeds, and low spreads without charging any trading commissions. As a result, it is an excellent choice for experienced and inexperienced traders.

When you open a Classic Account, you automatically become eligible for a 25% trading bonus on all deposits. This bonus protects you during drawdowns and is fully tradable, allowing you to lose the entire bonus amount without affecting your principal.

Furthermore, the account has spreads beginning at 1 pip and a stop-out level of 30%, allowing you to maximize your account’s equity before a stop-out is triggered.

Account Features Value

💰 Minimum Deposit Requirement 100 USD / 1,554,800 IDR

📊 Average Spreads From 1 pip

💳 Commission Fees None; only the spread is charged

🚀 Maximum Leverage 1:500

💸 Promotions specific to the account 25% Bonus, iPhone 14 Pro Gift

🛠️ Free Tools Available on Account Yes, Copy Trades

📈 Minimum Position Size 0.01 lots (micro-lot)

🏆 VPS Access? No

📡 Access to Trading Signals? No

💻 Hedging and Scalping Allowed? Yes

👥 Expert Advisors (EAs) Allowed? Yes

🌐 Execution STP

📱 Requotes? None

💲 Five Digit Pricing? Yes

🎉 Open an account Open Account

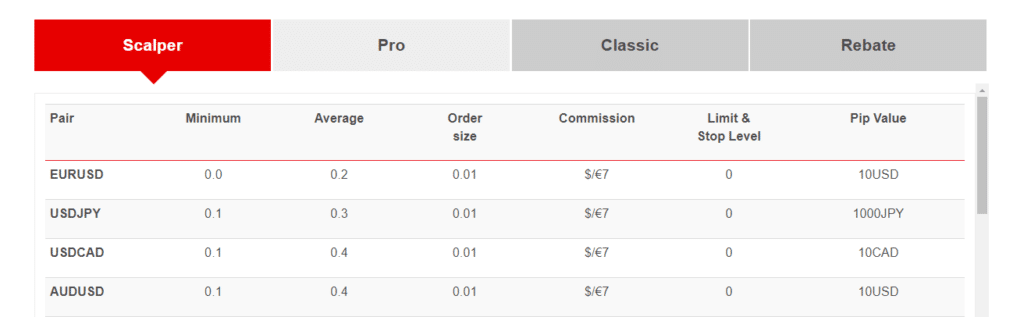

Scalper Account

Scalping, High-Frequency Trading (HFT), and other profitable trading systems are all supported by the Scalper account. It provides targeted liquidity to support these strategies effectively.

The cost structure of this account type is one of its distinguishing features; commissions are charged at $/€ 3.50 per 100,000 traded, providing traders with low-cost and dependable access to robust liquidity. This ensures a high level of trading accuracy and dependability.

Furthermore, traders with the Scalper ECN account have unrestricted access to institutional-level trading conditions. There are no restrictions or levels on stop-loss or take-profit orders, and there will be no re-quotes.

The account offers the best bid/ask pricing, making forex trading transparent, fair, and beneficial. This is consistent with Yadix’s commitment to providing its clients with true trading freedom.

The Scalper account is designed for speed and quality regarding execution statistics. The execution speeds are impressive, reaching as fast as 6 milliseconds.

Furthermore, 99.4% of trades are completed in 15 milliseconds or less, and 78% of orders are completed at the requested price or better. This high level of execution efficiency is especially advantageous for traders who use strategies that require quick and accurate order fulfilment.

Account Features Value

💰 Minimum Deposit Requirement 500 USD / 7,774,000 IDR

📊 Average Spreads From 0.0 pips

💳 Commission Fees $3.5 per side and $7 per round lot traded

🚀 Maximum Leverage 1:500

💸 Promotions specific to the account None

🛠️ Free Tools Available on Account Yes, Copy Trades

📈 Minimum Position Size 0.01 lots (micro-lot)

🏆 VPS Access? No

📡 Access to Trading Signals? No

💻 Hedging and Scalping Allowed? Yes

👥 Expert Advisors (EAs) Allowed? Yes

🌐 Execution ECN

📱 Requotes? None

💲 Five Digit Pricing? Yes

🎉 Open an account Open Account

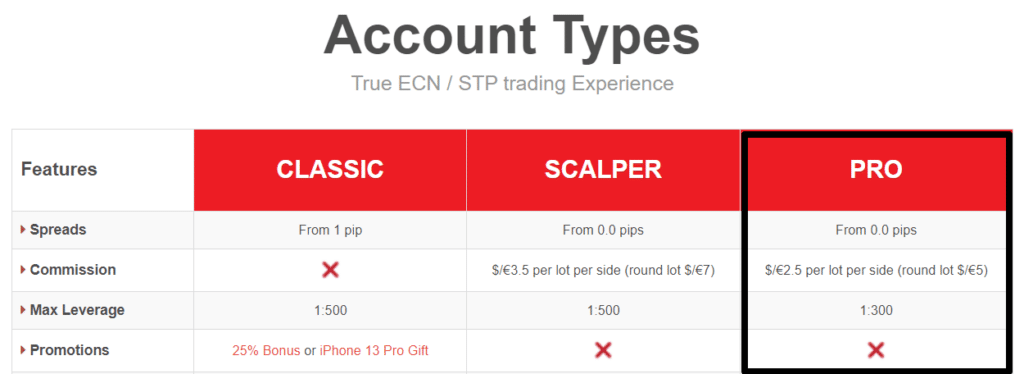

Pro Account

The Pro account offers traders unmanipulated “core” spreads sourced from over 14 liquidity providers, low ECN commissions and ultra-fast order filling, ensuring high-quality execution. This is especially advantageous for traders looking for low-cost, true ECN trading.

The Scalper ECN account, on the other hand, charges commissions of $/€ 2.50 per 100,000 traded, providing low-cost and dependable access to robust liquidity.

It also includes a free London VPS with an average ping time of just 2ms, which can significantly speed up trading and improve order execution accuracy.

The Pro ECN account further enhances the trading experience by providing unrestricted access to institutional-level conditions. No restrictions on stop-loss or take-profit orders give traders true trading freedom.

This account also promises fast and high-quality execution, with order execution times as fast as 6ms and 78% of orders filled at or above the requested price.

Account Features Value

💰 Minimum Deposit Requirement 5,000 USD / 77,740,000 IDR

📊 Average Spreads From 0.0 pips

💳 Commission Fees $2.5 per side and $5 per round lot traded

🚀 Maximum Leverage 1:300

💸 Promotions specific to the account None

🛠️ Free Tools Available on Account Yes, Copy Trades, Signals, VPS

📈 Minimum Position Size 0.01 lots (micro-lot)

🏆 VPS Access? Yes

📡 Access to Trading Signals? Yes

💻 Hedging and Scalping Allowed? Yes

👥 Expert Advisors (EAs) Allowed? Yes

🌐 Execution ECN

📱 Requotes? None

💲 Five Digit Pricing? Yes

🎉 Open an account Open Account

Demo Account

The Demo Account is an invaluable resource for traders looking to evaluate their trading strategies, evaluate the performance of expert advisors (EAs), and become acquainted with the trading conditions provided by Yadix.

The demo account simulates a live trading environment with price feed and execution metrics, allowing traders to gain confidence in their trading strategies before investing real money.

The Demo Account, which comes with $100,000 in virtual trading funds, is especially useful for traders who want to practice trading without risking their money. It enables them to comprehend market dynamics and become acquainted with Yadix’s trading software.

Seasoned traders also benefit from the Demo Account because it allows them to examine the broker’s ECN/STP trading features, institutional-level trading conditions, and core spreads beginning at 0.0 pips without risking real money.

Although the Demo Account cannot completely replicate live trading results, traders can take several steps to make their simulated trading as realistic as possible.

Making reasonable assumptions, accounting for factors such as slippage and market volatility, and implementing sound risk management practices are all examples. This improves the Demo Account’s overall utility and effectiveness.

Islamic Account

The broker offers an Islamic account option for traders following Sharia law in their Forex and CFD trading. Swap-free accounts are designed to comply with Islamic principles prohibiting the accrual or interest payment.

Furthermore, the absence of interest charges or earnings is a key feature of Yadix’s Islamic account, allowing traders to participate in financial markets without jeopardizing their religious principles.

The swap-free accounts are all-inclusive and suitable for a wide range of traders. While they are intended for Muslim traders, they are also appropriate for those who prefer to avoid interest-based transactions for personal or ethical reasons.

Furthermore, the Islamic account has no restrictions on the base currency or the level of leverage, giving traders much freedom.

It is worth noting that Yadix is subject to the regulatory oversight of the Seychelles Financial Services Authority (SFSA). However, traders should be aware that the SFSA may not provide the same level of investor protection as other regulatory bodies.

This is an important factor for traders to consider when choosing a broker for their Islamic trading needs.

Do all the accounts support scalping?

Yes, however, while the broker’s trading strategies are generally adaptable, the Scalper Account is specifically designed for scalping.

What leverage can I get with an account?

Leverage varies by account type but can reach 1:500.

How to open a Yadix Account – A Step-by-Step Guide

To open an account, Indonesians can follow these steps:

To get to the account registration page, go to https://www.yadix.com/.

Choose the trading account that best meets your needs and fill out the form.

Min Deposit

100 USD / 1,554,800 IDR

Regulators

Seychelles FSA

Trading Desk

MT4, Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

Account Activation

Yadix Vs Vantage Markets Vs FBS – Broker Comparison

| Yadix | Vantage Markets | FBS | |

| ⚖️ Regulation | FSA | CIMA, VFSC, FSCA, ASIC | IFSC, CySEC, ASIC, FSCA |

| 📱 Trading Platform | MetaTrader 4 | MT4, MT5, ProTrader, Vantage App, Vantage Social trading, ZuluTrade, Myfxbook AutoTrade, DupliTrade | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade |

| 💰 Withdrawal Fee | None | Yes | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 100 USD / 1,554,800 IDR | 50 USD / 777,400 IDR | 5 USD / 77,740 IDR |

| 📈 Leverage | 1:500 | 1:500 | Up to 1:3000 |

| 📊 Spread | From 0.0 pips | From 0.0 pips | From 0.5 pips |

| 💰 Commissions | From $5 per lot | From $3 | $0 |

| ✴️ Margin Call/Stop-Out | 100%/30% | 80%/50% | 40%/ 20% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | Yes | Yes |

| 📈 Account Types | Classic Account Scalper Account Pro Account | Standard STP Account Raw ECN Account PRO ECN Account Cent Account | Cent Account Standard Account Pro Account |

| ⚖️ BAPPEBTI Regulation | No | No | No |

| 💳 IDR Deposits | No | Yes | Yes |

| 📊 IDR Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 3 | 4 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms

The broker offers Indonesian traders a choice between these trading platforms:

The broker provides the popular MetaTrader 4 (MT4) platform, a robust and user-friendly Forex trading platform with various features and tools designed to enhance the trading experience.

The MT4 platform allows for simple order execution and account management, with features such as market orders, pending orders, and the ability to set stop-loss and take-profit levels.

They provide access to the MT4 platform via desktop and mobile interfaces, allowing traders to manage their accounts and execute trades while on the go.

Mobile versions support Android, iPad, and iPhone devices. The platform allows traders to trade various financial instruments, including 57 major, minor, and exotic currency pairs, commodities, and indices.

MT4 traders can leverage up to 1:500 and benefit from raw spreads starting at 0.0 pips. This adaptability enables a wide range of trading strategies and may result in lower trading costs.

They are a broker operated by Quantix FS Limited and regulated by the Seychelles Financial Services Authority (SFSA). Still, it is worth noting that SFSA regulation may not provide the same level of investor protection as other regulatory bodies.

What trading platforms does the broker offer?

They provide the MetaTrader 4 (MT4) trading platform, which is widely recognized and trusted in the industry.

What instruments can I trade on the platform?

57 major, minor, and exotic currency pairs are available for trading and other financial instruments, such as commodities and indices, providing diverse trading opportunities.

Range of Markets

Indonesian traders can expect the following range of markets:

Can I trade commodities with Yadix?

Yes, commodities are among the financial instruments available for trading on Yadix’s platform, allowing you to diversify your portfolio.

Is social trading available for all markets?

Yes, social trading is generally available across all Yadix markets, allowing you to apply it to various asset classes.

Broker Comparison for a Range of Markets

| Yadix | Vantage Markets | FBS | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

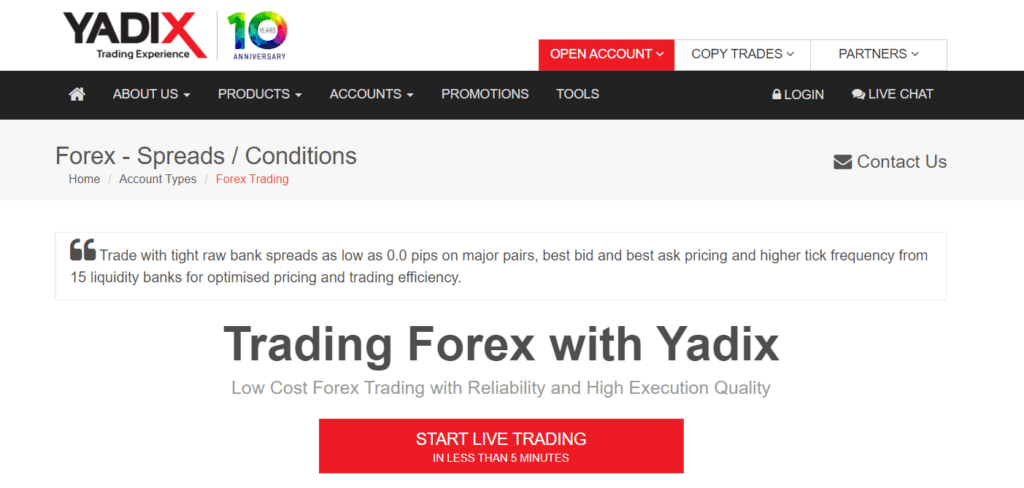

Yadix Fees, Spreads, and Commissions

Spreads

The broker charges floating spreads according to the account type, instrument, and market conditions.

Commissions

They offer commission-free trading on the Classic Account but charge the following commissions on the Scalper and Pro Accounts:

Overnight Fees

The broker charges overnight fees when traders hold positions for longer than 24 hours. However, Muslim traders who use the Islamic Account are exempted from such fees.

Deposit and Withdrawal Fees

They do not charge any deposit or withdrawal fees.

Inactivity Fees

The broker charges inactivity fees of $20 to a dormant account which has not seen any activity for three consecutive months.

Currency Conversion Fees

Because they only accept USD and EUR as the base currencies for accounts, Indonesians depositing or withdrawing funds in IDR could face currency conversion fees.

Does Yadix charge commissions?

Yes, commissions vary depending on account type and can reach $7 per lot per side for the Scalper account.

Do different account types have different fee structures?

Yes, fees, spreads, and commissions differ depending on the account type you select, allowing you to choose an account that matches your trading preferences and budget.

Yadix Deposits and Withdrawals

The broker offers Indonesian traders the following deposit and withdrawal methods:

What is the minimum deposit requirement?

The minimum deposit varies by account type, ranging from $100 to $5,000, giving traders with varying capital levels flexibility.

Is there a maximum withdrawal limit?

No, the broker does not impose maximum withdrawal limits, allowing you to withdraw your funds per your trading results and preferences.

How to make a Deposit with Yadix

To deposit funds into an account, Indonesian traders can follow these steps:

Use your login information to access Yadix’s official website and sign in to your personal account management area.

After logging in, go to the “Deposit” section, usually in the account management dashboard or client portal.

Choose your preferred payment method from the list of available options. Yadix accepts various deposit methods, including Neteller, Skrill, and FasaPay.

How to Withdraw from Yadix

To withdraw funds from an account, Indonesian traders can follow these steps:

Access Yadix’s official website and sign in to your personal account management area using your login details.

Find Withdrawal Section Navigate to the “Withdrawal” section of the account management dashboard or client portal after logging in.

Select the payment method you used with your most recent deposit.

Min Deposit

100 USD / 1,554,800 IDR

Regulators

Seychelles FSA

Trading Desk

MT4, Mobile App

Crypto

No

Total Pairs

57

Islamic Account

Trading Fees

Account Activation

Education and Research

The broker does not offer any educational material or trading tools.

Does Yadix offer educational resources?

Aside from the demo account, they do not provide specific educational resources. Its primary mission is to provide a trading platform and services.

Is there a demo account for educational purposes?

The broker provides a demo account, which can be a valuable educational tool by allowing traders to practice and test strategies without risking real money. It is important to note, however, that Yadix does not provide structured educational content.

Bonus Offers and Promotions

The broker offers Indonesian traders the following bonuses and promotions:

Does the broker offer a no-deposit bonus?

No, they do not provide a no-deposit bonus, and all bonuses are usually associated with deposits or specific promotions.

Are there any promotions for new traders?

Yes, new traders can participate in promotions like the iPhone 14 Pro giveaway, adding value to their trading experience.

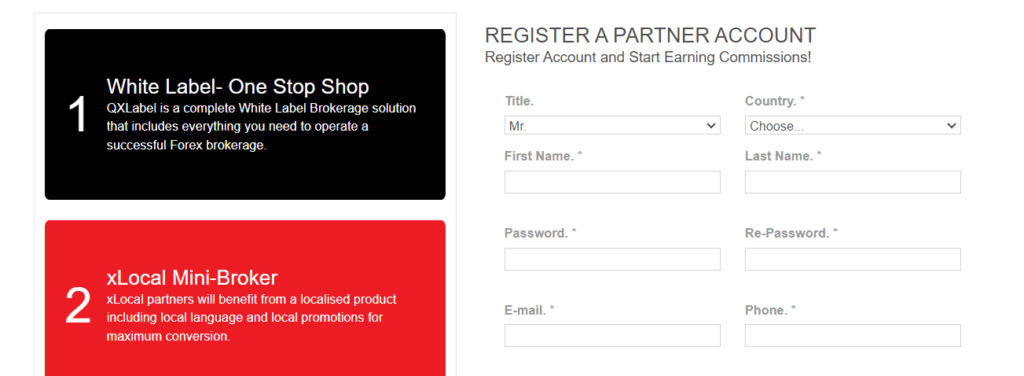

How to open an Affiliate Account

To register an Affiliate Account, Indonesian traders can follow these steps:

Locate the “Affiliate” section on the official Yadix website, typically in the main menu or the website footer.

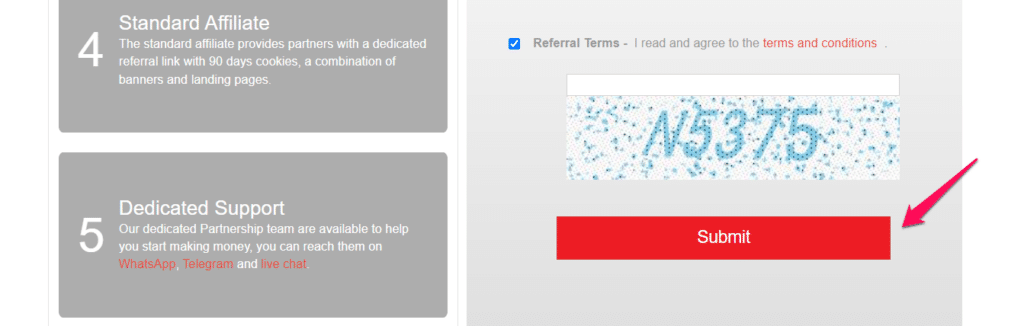

Fill out the registration form with your personal information, including your name and email address, and adhere to any other Yadix requirements. Ensure you read and agree to the terms and conditions of the affiliate program.

After completing the registration form, submit your Yadix Affiliate Program membership application. Your application will be evaluated, and you will be notified of your affiliate account’s status.

Affiliate Program Features

What kind of tracking capabilities are available?

Affiliates can track the performance of their promotional efforts across different channels and campaigns thanks to the affiliate program’s versatile tracking capabilities.

Is email marketing supported?

Yes, the affiliate program typically provides email marketing programs that allow affiliates to use email campaigns for targeted promotions.

Customer Support

| ⏳ Operating Hours | 24/5 |

| 📚 Support Languages | Multilingual |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️ The overall quality of JustMarkets Support | 3/5 |

Is Yadix’s customer support available 24/7?

No, the broker’s customer support is available during market hours, Monday through Friday, ensuring that traders can get help during active trading times.

How can I contact Yadix customer support?

Their customer service can be reached via email, phone, or live chat, providing multiple channels for assistance.

Verdict

In Conclusion Yadix is a comprehensive trading platform that caters to a wide range of traders.

One of its distinguishing characteristics is the variety of account types. This enables traders to select an account that closely corresponds to their trading strategies and financial capabilities.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

you might also like: Vantage Markets Review

you might also like: FBS Review

you might also like: Avatrade Review

you might also like: Exness Review

you might also like: FXTM Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders can choose from three flexible account types | There are only three asset classes that can be traded |

| Indonesian traders are not limited in the strategies they employ | The broker only offers one trading platform |

| There is a competitive rebate program | They are only regulated by one Tier-3 regulatory entity |

| The broker offers copy trading | There is no educational material for beginners |

| There are tight, zero-pip spreads | Yadix does not offer any trading tools or research |

| There is an industry-standard $100 minimum deposit on the Classic account | The website is outdated |

| Traders can use leverage up to 1:500 | |

| Yadix supports MetaTrader 4 | |

| There is a free, unlimited demo account available | |

| There is transparent pricing | |

| There are multiple portfolio options for investors |

Frequently Asked Questions

When was Yadix founded?

The broker was established in 2010.

Where is Yadix registered?

They are a Seychelles registered forex and CFD broker under Quantix FS Limited.

What instruments can I trade with at Yadix?

The broker allows you to trade 57 currency pairs with leverage of up to 1:500. You can also trade commodities and indices with Yadix.

How long does it take to withdraw from Yadix?

Withdrawals are processed within the same day they are made.

Does Yadix have VIX 75?

No, the broker does not have VIX 75 but offers 13 other popular indices that can be traded.

Does Yadix offer copy trading?

Yes, you can use their trading platforms to copy other people’s strategies or broadcast your own to other broker clients.

Does Yadix offer a bonus for new clients?

Yes, the broker provides bonuses to both new and returning customers.

Does Yadix have Nasdaq 100?

Yes, Yadix has Nasdaq 100 as an index CFD.

Is Yadix Safe or a Scam?

They are a safe broker. However, it is only regulated by one Tier-3 entity, which could concern some traders.

Does Yadix have a partnership program?

Yes, Yadix has a partnership program in which referees are paid a fee of up to $12 for each lot closed.

Best Forex Brokers in Indonesia

Best Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Scam Forex Brokers in Indonesia

Corporate Social Responsibility

The broker does not provide any information regarding CSR activities or projects.